Introduction to gift agreements: What should you bear in mind?

A gift agreement is a legal agreement whereby one person (the donor) voluntarily and gratuitously transfers an item or right to another person (the recipient). This agreement is subject to certain legal requirements and conditions that must be met in order to ensure the validity of the gift.

This introduction explains the key aspects of a gift agreement and the factors that need to be taken into account when drawing up such an agreement. It refers to current laws, paragraphs, and court rulings in order to provide a sound and detailed basis for understanding the subject matter.

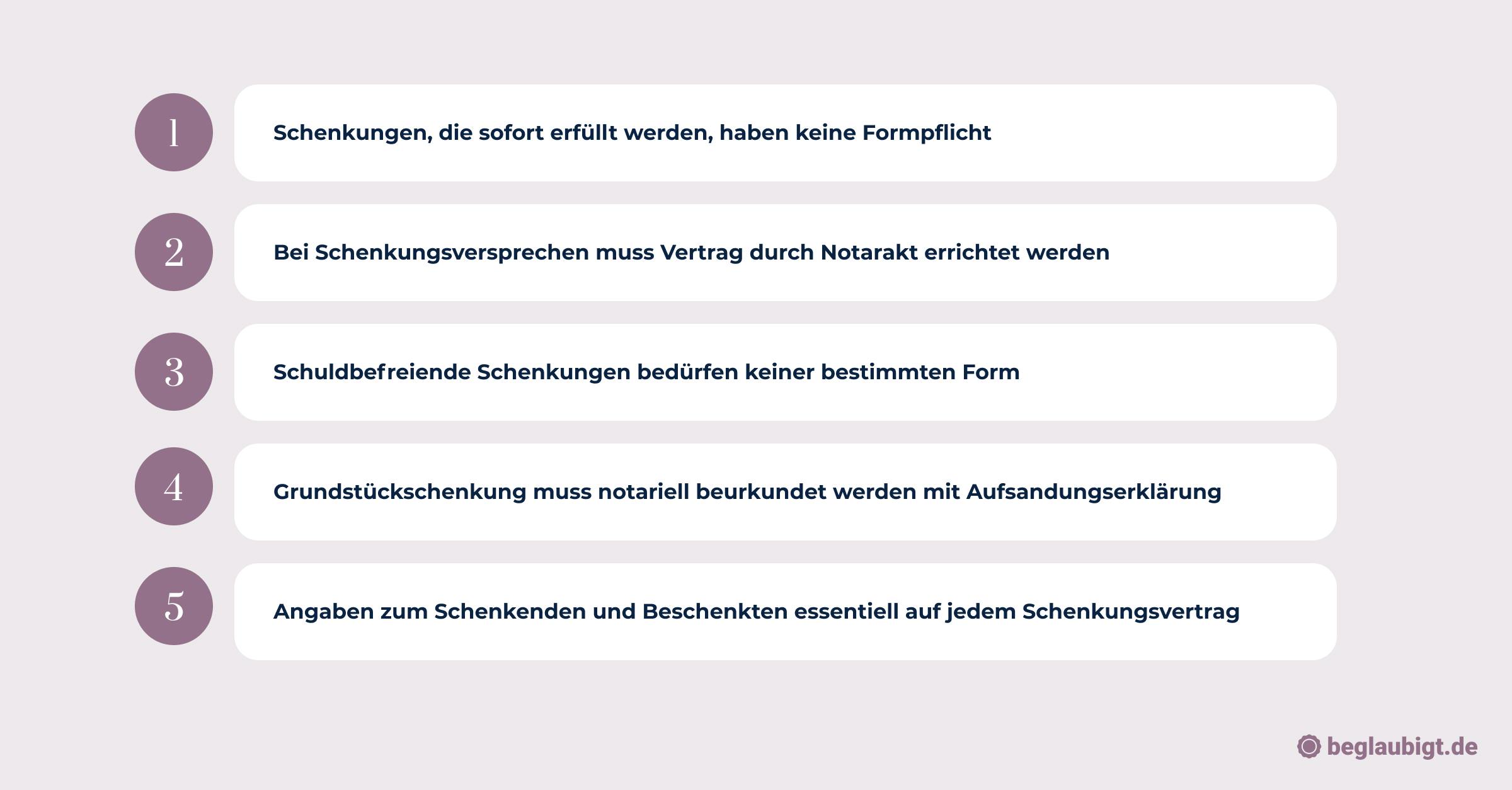

The following points in particular should be noted:

- Formal requirements: Gift agreements must always be made in writing (Section 516 (1) BGB). In certain cases, such as property transfers, notarization is also required (Section 311b (1) BGB).

- Consent of the recipient: The gift is only valid if the recipient expressly or implicitly accepts the gift (Section 516 (2) BGB).

- Execution of the gift: The gift must actually be executed, i.e., the donor must actually hand over or transfer the item or right to the recipient.

When drawing up a gift agreement, it is advisable to seek professional help in order to avoid potential errors and ambiguities. The document generator from Beglaubigt.de offers an excellent way to quickly generate legally binding contracts as PDF or Word documents.

For a transparent overview for further reading: How much does a notarized gift agreement cost?

Donation agreement: requirements and conditions

For a gift agreement to be valid, certain requirements and conditions must be met. The following points provide an overview of the key aspects to consider when drawing up a gift agreement:

1. Formal requirements and written form

- Principle of written form: According to Section 516 (1) of the German Civil Code (BGB), a gift agreement must be in writing.

- Notarization: In certain cases, such as the donation of real estate, notarization of the contract is required (Section 311b (1) BGB).

2. Consent of the recipient

- Express or implied acceptance: The recipient must expressly or implicitly accept the gift for it to become effective (Section 516 (2) BGB).

3. Execution of the gift

- Transfer or conveyance: The gift must actually be executed by the donor actually transferring or conveying the item or right to the recipient.

4. Free of charge

- No consideration: The gift must be made without consideration, otherwise it would be classified as a transaction for consideration, e.g., a purchase agreement.

5. Capacity to act of the contracting parties

- Legal age: Both parties to the contract, the donor and the recipient, must be of legal age and thus have full legal capacity.

- Exceptions: In the case of minor recipients, the consent of their legal representative is required. If the donor is a minor, the gift agreement can only be concluded with the consent of their legal representative.

We recommend further information on the contracting parties: Gift agreement Contracting parties

6. Legal consequences of the gift

- Transfer of ownership: With a gift, ownership of the item or right is transferred from the donor to the recipient.

- Liability for defects: The donor is not liable for material defects or defects of title in the gifted item, unless he has fraudulently concealed such defects (§ 523 BGB).

To ensure that all requirements and conditions for an effective gift agreement are met, it may be helpful to use professional services such as the document generator from Beglaubigt.de. This service enables the legally compliant and quick creation of contracts as PDF or Word documents. Our service is available for gift agreements involving money, for example.

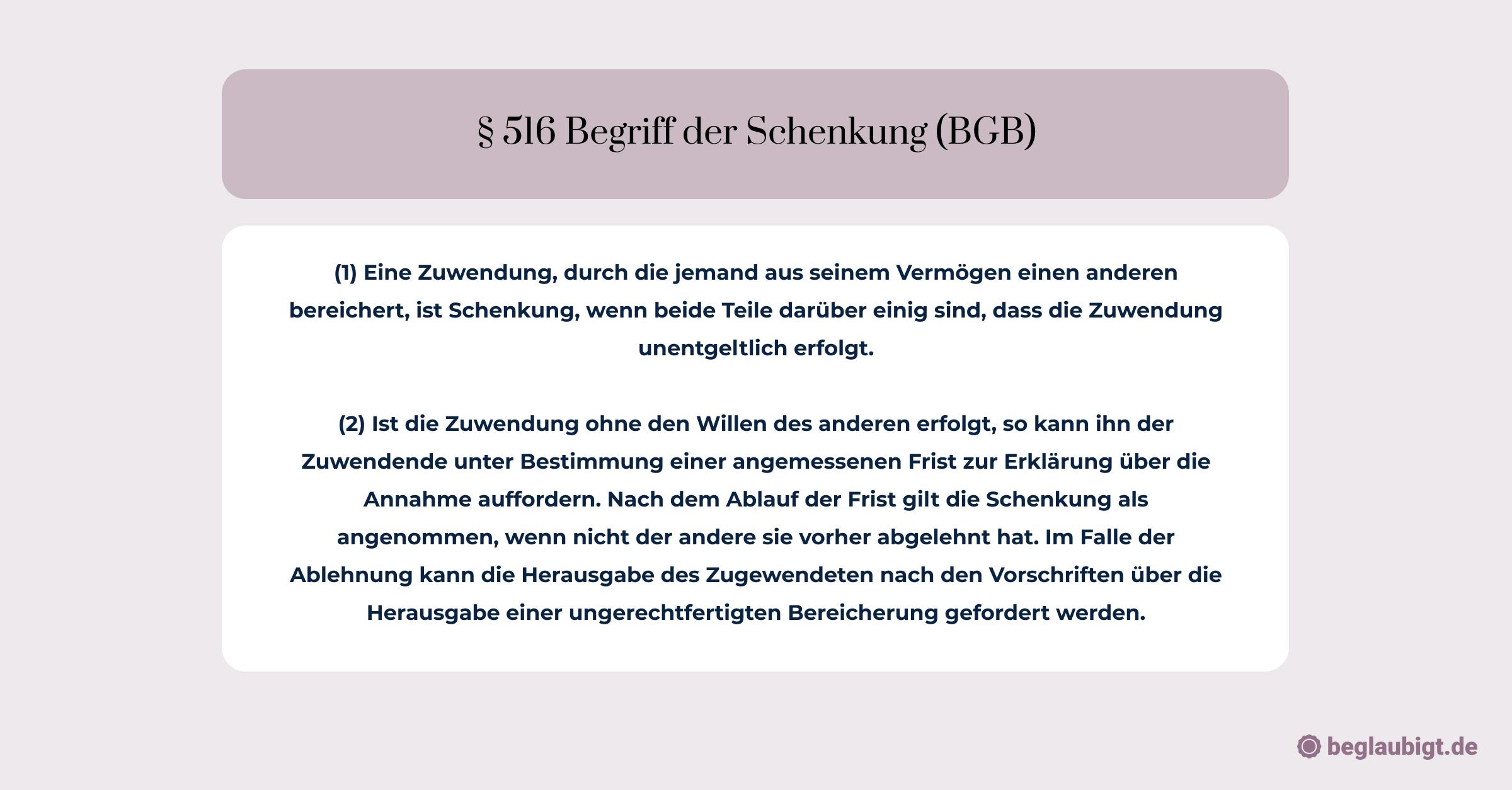

Donation agreement: Legal basis

The legal basis for gift agreements is laid down in the German Civil Code (BGB). The following section outlines the key sections and provisions that are important for understanding this topic.

1. Legal regulations and paragraphs

- Section 516 BGB (Gift): Defines a gift as a gratuitous transfer of property and regulates the formal requirements and acceptance of gifts.

- Section 518 BGB (Promise of gift): Stipulates that a contract whereby the donor undertakes to make a gift must be notarized.

- Section 519 BGB (Revocation of a promise of gift): Explains the reasons and conditions for revoking a promise of gift.

- Section 521 BGB (Reclaiming a gift due to the donor's impoverishment): Regulates the possibility of reclaiming a gift if the donor has become impoverished after making the gift.

- Section 522 BGB (Exclusion of reclamation): Describes the cases in which reclamation of the gift is excluded.

- Section 311b (1) BGB (Formal requirements for property transfers): Specifies that notarization is required for the donation of real estate.

We have also listed all the facts about the content of a gift agreement here: What must be included in a gift agreement

2. Court rulings and their significance

Case law plays an important role in the interpretation and application of legal regulations relating to gift agreements. Courts decide on disputes on the basis of the law and clarify ambiguities in the interpretation of the law. Some examples of relevant decisions are:

- Federal Court of Justice (BGH), ruling of September 29, 2017, ref. V ZR 49/17: In this ruling, the BGH confirmed that a gift agreement for a piece of land is valid even if it was initially concluded in text form only and later notarized.

- Federal Court of Justice (BGH), judgment of June 19, 2015, ref. V ZR 110/14: The judgment deals with the question of under what circumstances the donor can revoke his gift if the recipient makes serious accusations against the donor.

Overall, it is important to take into account the legal basis and relevant case law when drawing up a gift agreement to ensure that all requirements are met and potential disputes are avoided.

Using professional services such as the document generator from Beglaubigt.de can help you create legally binding contracts quickly as PDF or Word documents.

Donation agreement without a notary: validity and options

In principle, a gift agreement is valid even without notarization, provided that there are no special formal requirements. However, there are certain cases in which notarization is mandatory. The possibilities and limitations of a gift agreement without a notary are explained below.

1. Validity without a notary

- Gifts of movable property: Gifts of movable property, such as vehicles, jewelry, or furniture, do not require notarization. In such cases, written form in accordance with Section 516(1) of the German Civil Code (BGB) is sufficient.

- Promise of donation: A promise of donation in which the donor merely undertakes to make the donation without actually executing it requires notarization in accordance with Section 518 of the German Civil Code (BGB). Nevertheless, a gift agreement without notarization can be valid if the donor makes the gift immediately by handing over or transferring the item or right to the recipient.

2. Notarization required

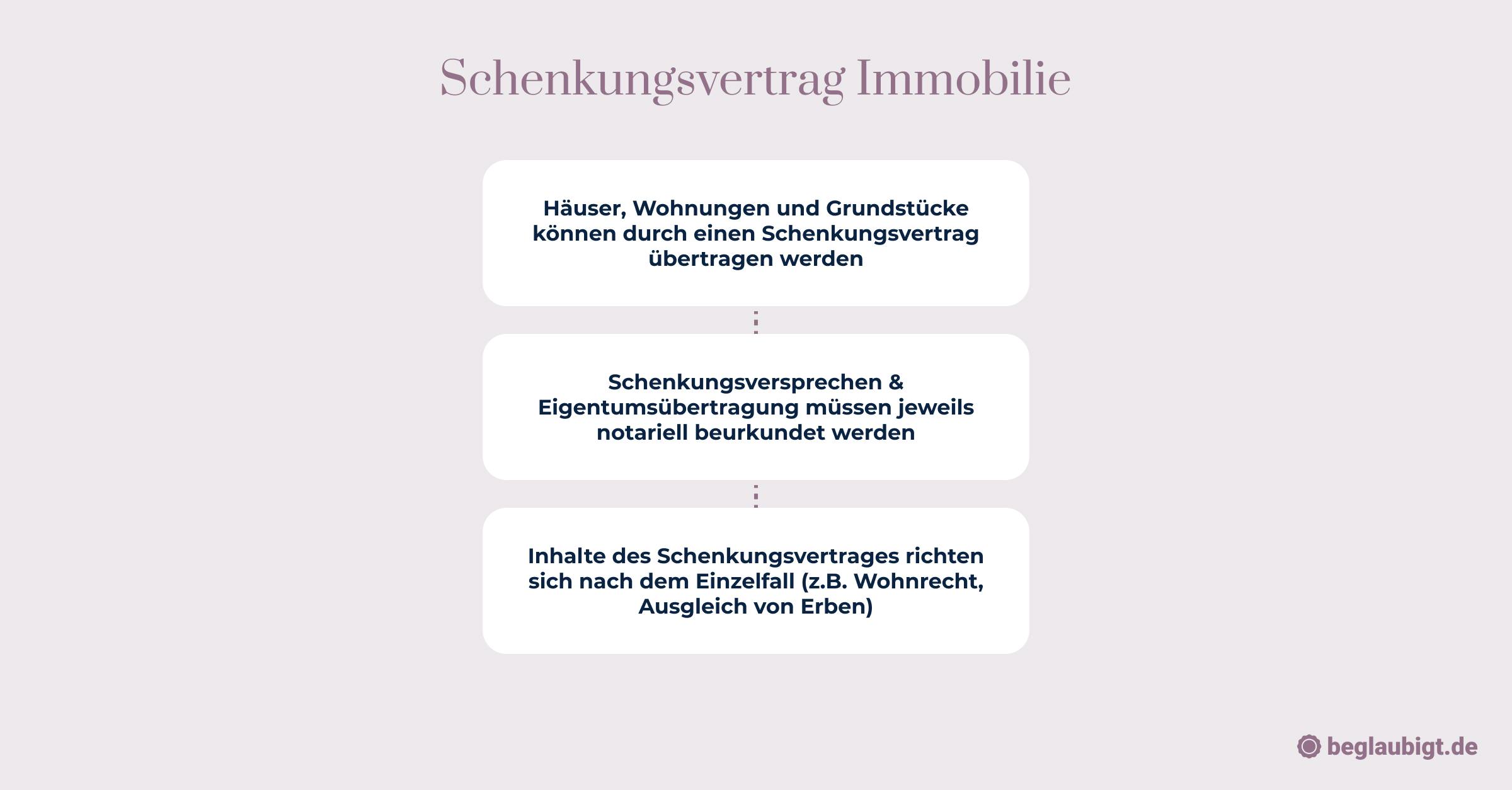

- Donation of real estate: When donating real estate or rights equivalent to real estate, notarization is mandatory in accordance with Section 311b (1) of the German Civil Code (BGB).

- Donation of company shares: In some cases, the donation of company shares, such as shares in a limited liability company (GmbH), may also require notarization.

3. Advantages of notarization

- Legal certainty: Notarization offers greater legal certainty, as the notary verifies the identity of the contracting parties, checks the contract for possible legal problems, and informs the contracting parties of their rights and obligations.

- Evidential value: A notarized gift agreement has greater evidential value in the event of a dispute, as the notary certifies compliance with the formal requirements and certifies the content of the agreement.

In summary, a gift agreement without a notary is generally valid, provided that there are no special formal requirements. In certain cases, such as gifts of real estate, however, notarization is required.

To ensure legal certainty and compliance with legal requirements, it may be advisable to use professional services such as the document generator from Beglaubigt.de, which creates contracts quickly and in a legally compliant manner as PDF or Word documents.

Gifts to children: special considerations and precautions

When making gifts to children, there are a number of special considerations and precautions to bear in mind to ensure that the gift is legally compliant and in the best interests of the child. The following points provide an overview of the relevant aspects of gifts to children:

1. Consent of the legal representative

In the case of minor children, the consent of the legal representative (usually the parents) is required for the gift to be valid (Section 110 BGB). Without this consent, the contract is provisionally invalid.

The consent of the legal representative is required both for the acceptance of the gift and for the conclusion of a promise of gift.

Precautions when donating land and real estate

- Notarization: When donating real estate or rights equivalent to real estate to minor children, notarization is mandatory in accordance with Section 311b (1) of the German Civil Code (BGB).

- Parental responsibility: When donating real estate or land to their minor children, parents or legal guardians should ensure that the donation is in the best interests of the child and does not entail any disadvantages, such as high maintenance costs or taxes.

Related articles:

- Real estate donation agreement: Legally compliant transfer and tax optimization

- House donation agreement: Template, Word & PDF

- Horse donation agreement: Correct application and process

2. Gifts within the scope of family assets

- Tax considerations: When making gifts to children, it should be noted that the Inheritance and Gift Tax Act (ErbStG) provides for tax allowances that can be claimed every ten years (Sections 16 and 17 ErbStG). These allowances vary depending on the degree of kinship.

- For children, the tax-free allowance for gifts and inheritances is €400,000. Gifts exceeding this allowance may be subject to gift tax. To save on taxes, gifts should therefore be carefully planned and structured.

More information on this can be found under Gift agreement taxes.

3. Reserved usufruct and right of residence

- In order to enable parents or donors to continue using the gifted assets (e.g., real estate) despite the gift, a reserved usufruct or right of residence can be agreed upon in the gift agreement. This right allows the donor to continue using the gifted assets while the child is already registered as the owner.

In order to comply with all legal and tax requirements when making gifts to children and to ensure that the gift is in the best interests of the child, it can be helpful to use professional services such as the document generator from Beglaubigt.de. This service enables the legally compliant and rapid creation of

Disadvantages of a gift: risks and pitfalls

In many cases, a gift can be a sensible way to transfer assets and potentially save on taxes. However, there are also disadvantages and risks that should be considered when making a gift. Here are some of the potential pitfalls and risks:

1. Right of the donor to reclaim the gift

- Revocation of a gift: In certain cases, the donor may revoke the gift in accordance with Section 528 of the German Civil Code (BGB), for example if the recipient is grossly ungrateful toward the donor. This can lead to legal disputes.

- Claim to a compulsory portion supplement: If the donor dies within ten years of making the gift, the claim to a compulsory portion supplement may apply (Section 2325 of the German Civil Code (BGB)). In this case, the value of the gift is taken into account when calculating the compulsory portion of the heirs.

2. Gift tax

- Exceeding tax allowances: If the gift exceeds the respective tax allowance under the Inheritance and Gift Tax Act (ErbStG), gift taxes may apply. It is therefore important to take tax allowances and tax rates into account and plan gifts accordingly.

3. Loss of social benefits

- Impact on social security benefits: Recipients of social security benefits, such as unemployment benefit II, must declare gifts as assets. The gift may result in social security benefits being reduced or canceled.

4. Insolvency of the recipient

- Contestation in the event of insolvency: If the recipient becomes insolvent within four years of receiving the gift, the insolvency administrator may contest the gift in accordance with Section 134 of the Insolvency Code (InsO). In this case, the recipient must return the gifted assets so that they can be used to satisfy the creditors.

5. Gifts between spouses

- Divorce: In the case of gifts between spouses, the question may arise in the event of divorce as to whether the gift must be taken into account in the context of equalization of accrued gains or pension rights equalization. It is advisable to seek legal advice before making a gift in order to clarify the possible consequences in the event of divorce.

In order to minimize the potential disadvantages and risks of a gift, it is important to plan carefully and possibly seek professional help. The document generator at Beglaubigt.de can help you create legally binding gift agreements as PDF or Word documents.

Gift agreement and the tax office: reporting and tax liability

When making gifts, it is important to observe tax obligations and reporting procedures in order to avoid potential disadvantages or penalties. Below you will find information on reporting and tax liability for gift agreements:

1. Reporting the gift to the tax office

- In accordance with Section 30 of the German Inheritance and Gift Tax Act (ErbStG), the gift must be reported to the relevant tax office by the recipient or their legal representative. This reporting obligation applies regardless of whether gift tax is actually payable.

- The deadline for notification is three months from the date on which the gift became known (Section 30 (1) ErbStG). If this deadline is missed, the tax office may impose a late filing penalty.

2. Gift tax

- Gift tax is payable if the value of the gift exceeds the applicable tax-free allowances. The tax-free allowances and tax rates depend on the degree of kinship between the donor and the recipient (Sections 16 and 19 of the German Gift Tax Act (ErbStG)). For example, the tax-free allowance for gifts to children is €400,000.

- Gift tax is calculated on the basis of the taxable acquisition, which is derived from the value of the gift minus the respective allowance (Section 10 ErbStG).

- The gift tax is payable by the recipient of the gift. In some cases, the donor may pay the tax, but this should be specified in the gift agreement.

3. Tax planning options

- Take advantage of tax allowances: By making clever use of tax allowances, which can be claimed again every ten years, you can save on gift tax.

- Distribute gifts among multiple recipients: By distributing the gift among multiple recipients, you can make better use of the respective allowances and reduce gift taxes.

- Agree on usufruct or right of residence: By agreeing on usufruct or right of residence in the gift agreement, the donor can continue to benefit from the gifted assets, while the recipient is registered as the new owner. This can offer tax advantages.

In order to correctly fulfill the reporting and tax obligations for gift agreements, it is advisable to seek professional assistance. The document generator from Beglaubigt.de can help you create legally compliant gift agreements as PDF or Word documents and take the relevant tax aspects into account.

Conclusion: Gift agreement – what to consider for a legally secure gift

A gift agreement can be an effective way to transfer assets and save on taxes. However, in order to ensure that the gift is legally valid, it is essential to take various aspects into account:

- Legal basis and requirements: Ensure that the gift complies with legal provisions, in particular the German Civil Code (BGB), and that the necessary requirements are met.

- Gift agreement: Use a written gift agreement to record the details of the gift and prevent potential disputes. In some cases, such as with real estate, notarization is required by law. (More on this: How much does a gift agreement at a notary cost?)

- Gifts to children: Be aware of the special rules and precautions that apply to gifts to children in order to protect their interests and avoid unexpected tax consequences.

- Tax aspects: Find out about gift tax, allowances, and tax rates so that you can optimize your gift for tax purposes. Remember to report the gift to the relevant tax office.

- Risks and pitfalls: Be aware of the potential disadvantages and risks of making a gift, such as claims for repayment, loss of social security benefits, or contestation in the event of insolvency, and plan accordingly.

- Professional help: If necessary, seek the help of experts such as lawyers, tax advisors, or notaries to ensure that your gift is legally compliant and tax-optimized.

- Using Beglaubigt.de: The document generator from Beglaubigt.de can help you create legally compliant gift agreements as PDF or Word documents, taking into account all relevant legal and tax aspects.

More Articles: