A working student contract is an employment agreement between a student and an employer. Under a working student contract, the student works for a company and receives remuneration in return.

This type of employment is very popular among many students, as it allows them to gain valuable work experience while earning money at the same time. But what about health insurance for working students? In this article, we will address this topic.

Health insurance for working students

Working students are generally required to have health insurance. This means that they must be insured either through the statutory health insurance system or through private health insurance. Health insurance is an important part of the working student contract, as it can account for a significant portion of the student's monthly income.

Insurance obligation for working students

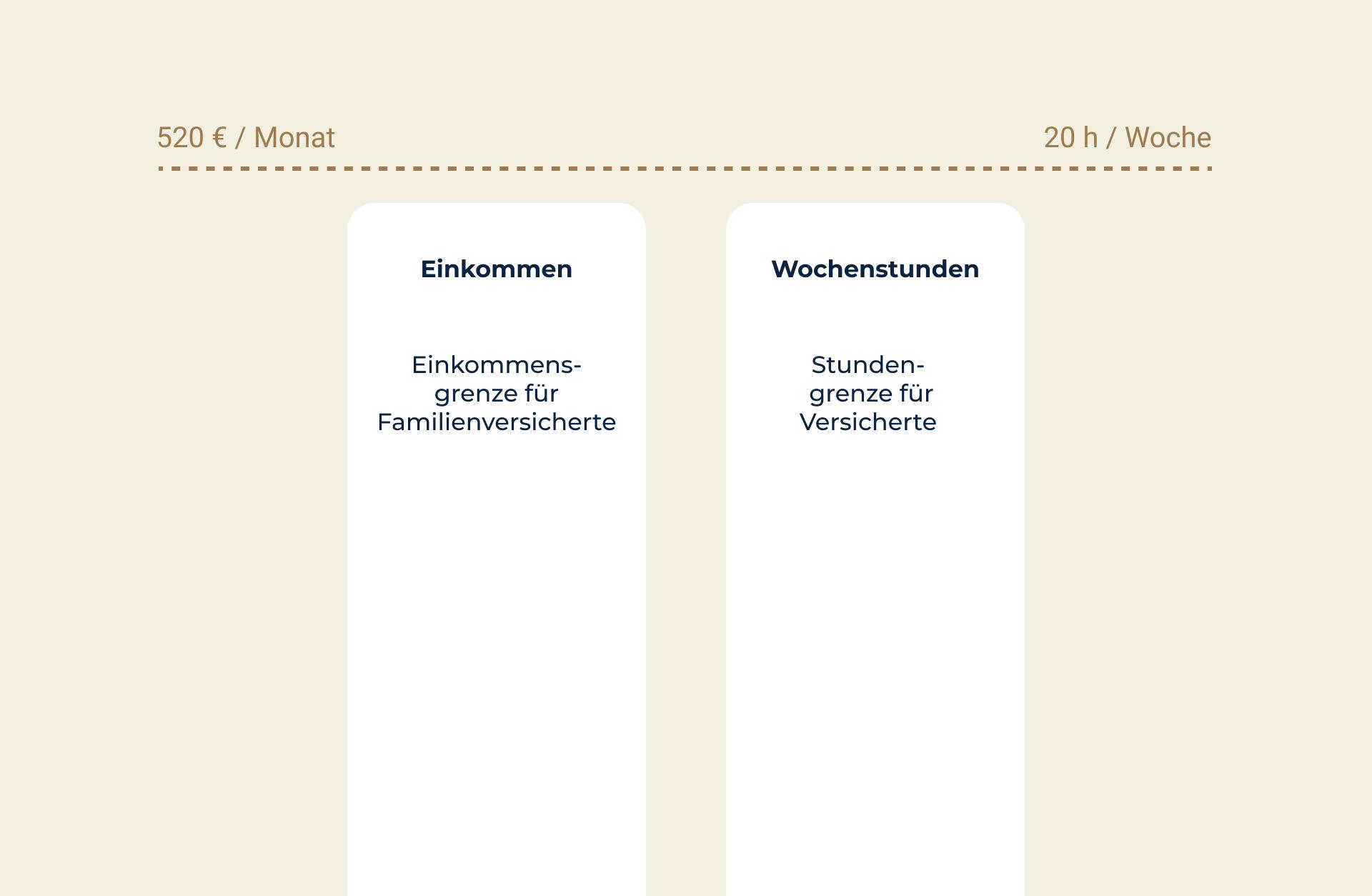

The obligation to take out health insurance for working students depends on their income. If a working student's gross monthly income regularly exceeds the threshold of €520, they are required to take out statutory health insurance.

The income limit of €520 is a guideline and not an absolute limit. The decisive factor is whether the student regularly earns more than €520 per month. Occasional exceedances of this limit are generally not taken into account.

However, there are exceptions to the obligation to take out statutory health insurance. Working students who already have health insurance elsewhere are exempt from the obligation to take out insurance. Working students who are in a specific stage of their studies or in a special training situation may also be exempt from the obligation to take out insurance under certain circumstances.

What is student health insurance?

Student health insurance is a special form of statutory health insurance for students. Under certain conditions, students can take out student health insurance and thus benefit from comparatively low premiums.

The requirements for student health insurance are:

- This refers to a student enrolled at a state or state-recognized university.

- The student is not older than 30 years of age, unless he or she had statutory health insurance before beginning his or her studies.

- The course requires a minimum of 20 hours per week or at least 800 hours per year.

Students can remain insured under the student health insurance scheme until the end of their 14th semester, but no later than their 30th birthday. Those who do not meet these requirements can take out voluntary membership in the statutory health insurance scheme or take out private health insurance.

Health insurance options for working students

Working students generally have the choice between statutory or private health insurance. Statutory health insurance is usually the first choice, as it offers comprehensive insurance coverage at comparatively low premiums. With private health insurance, on the other hand, premiums can be significantly higher due to individual insurance coverage and the insured person's state of health.

Health insurance contributions for working students: How much does health insurance cost for working students?

Health insurance contributions for working students are calculated differently depending on whether the student is covered by statutory or private health insurance.

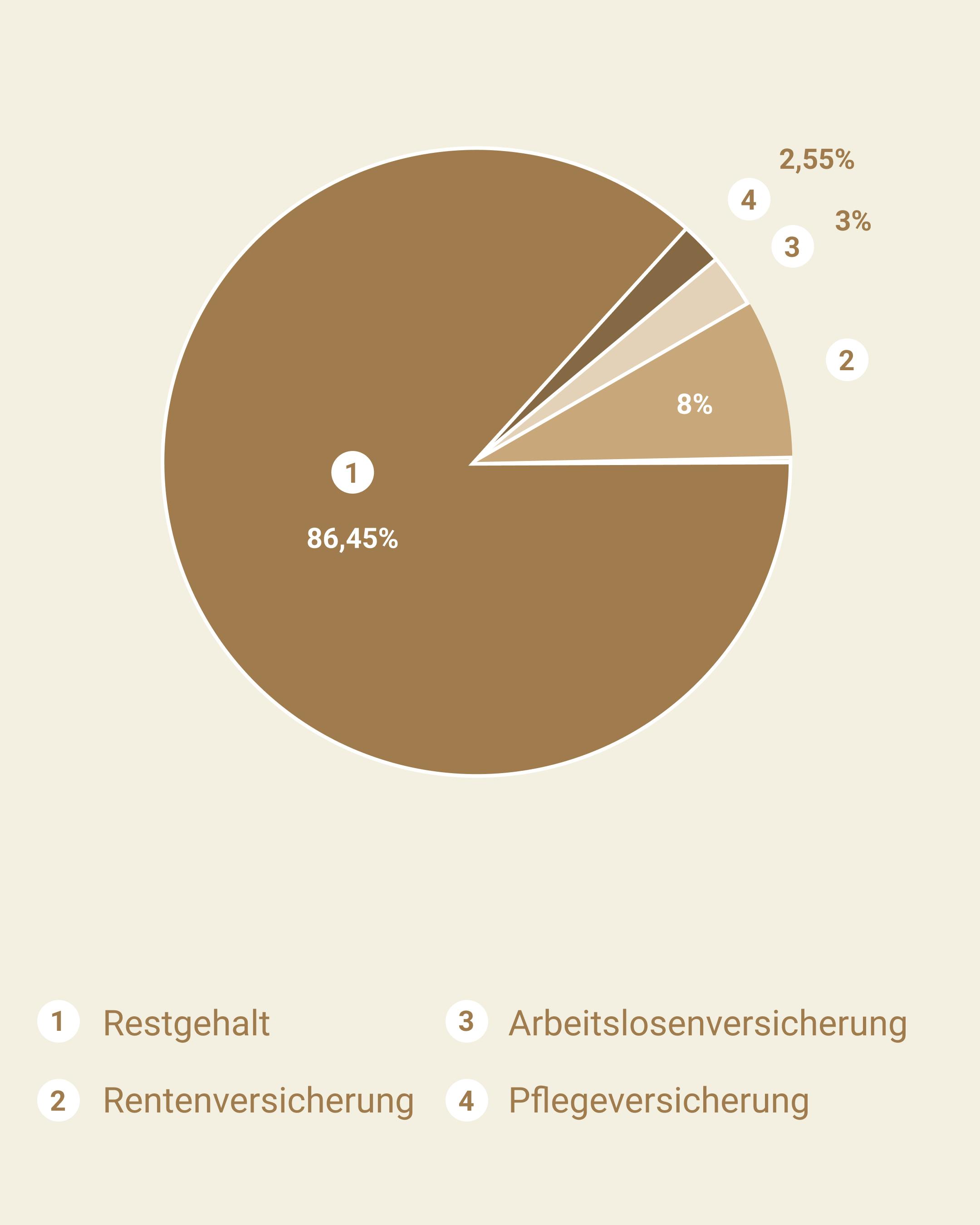

In statutory health insurance, contributions are based on the working student's income. There is a contribution assessment ceiling up to which maximum contributions must be paid. This ceiling is adjusted each year and amounts to €4,837.50 per month in 2021. The contribution rate is currently 14.6 percent, with employers and employees each paying half of the contribution. The working student's contribution is therefore based on their income, with the employer paying at least half of the contribution.

In private health insurance, premiums depend on various factors, such as age, gender, state of health, and the chosen insurance coverage. For working students, premiums can be comparatively low due to their generally young age and lower overall risk compared to other policyholders.

The taxation of working students should also not be overlooked before entering into a working student contract. As an employer, you should also keep an eye on the notice period for working students.

Registering for health insurance for working students

Working students are required to register with a statutory health insurance fund within three months of starting work. This is stipulated in Section 5 (1) No. 13 of Book V of the Social Code (SGB V). Failure to register working students within this period may result in penalties.

Registering for health insurance for working students is usually straightforward and is done through the employer. The employer must register the student with the health insurance company and issue an insurance certificate. Half of the health insurance contribution is paid by the employer and half by the working student. The exact costs depend on the student's income, which is subject to contributions up to the contribution assessment ceiling.

An example: A working student earns €800 per month. The contribution assessment ceiling for 2021 is €4,837.50. The health insurance contribution is 14.6 percent of income, half of which is paid by the employer. The student must therefore pay €58.48 per month for statutory health insurance, while the employer contributes the same amount.

Who pays for health insurance for working students?

The question of who pays for health insurance for working students is usually quickly resolved. Employers and employees share the costs of statutory health insurance equally, with the working student's contribution being income-dependent. The employer must pay at least half of the contribution.

The exact rules are set out in Book V of the Social Security Code (SGB V), which regulates statutory health insurance. According to Section 249 SGB V, employers and employees must each pay half of the contribution to statutory health insurance. For working students, this means that their employer must pay at least half of the contribution.

Income plays a decisive role in determining the amount of the contribution. Working students who are insured under the statutory health insurance scheme pay contributions on their income up to the contribution assessment ceiling. In 2021, this ceiling is €4,837.50 per month. The contribution rate is 14.6 percent, with employers and employees each paying half of the contribution.

In private health insurance, however, the premium is based on various factors, such as the age, gender, and health status of the policyholder, as well as the selected insurance coverage. Here, premiums for working students can be comparatively low due to their generally young age and lower overall risk compared to other policyholders.

In any case, it is important that working students register with a health insurance company within three months of starting their employment and obtain an insurance certificate from their employer.

Can I remain on my family's insurance as a working student?

Yes, as a working student, you can remain on your family's insurance under certain conditions. The conditions are as follows:

- Under 25 years of age

- A monthly income of no more than €520 in 2023

- Parents must have statutory health insurance themselves.

- Not having a family of one's own

- Proof that the person cannot support themselves and is dependent on parental support.

If you meet these requirements, you can be covered by your parents' family insurance without having to pay health insurance contributions yourself. However, you should make sure that you continue to meet the requirements. For example, if you are older than 25 or earn more than €520 per month, you will have to insure yourself.

When registering for family insurance, it is important that you provide all the necessary documents and evidence to prove your eligibility for co-insurance. These include your employment contract, proof of income, and, if applicable, a certificate of enrollment at a college or university.

When does a student lose their family insurance coverage?

A student is no longer covered by family insurance if they no longer meet the requirements for co-insurance. The main requirements are that they must be under 25 years of age and have a maximum monthly income of €520 in 2023. If the student no longer meets these requirements, they must take out their own health insurance.

An example: A student has taken out family insurance with a health insurance company because he is not yet 25 years old and has not exceeded the income limit. After completing his studies, he starts full-time employment and now earns more than €520 per month. In this case, he is no longer covered by family insurance and must take out his own health insurance. He can then either take out statutory health insurance or private health insurance.

How much can I earn as a working student in terms of health insurance?

As a working student, there is a special rule for calculating health insurance contributions. Working students are usually covered by their parents' family insurance or by their own student health insurance. If the requirements for family insurance are not met or student health insurance is not an option, working students can also be compulsorily insured under the statutory health insurance system.

For the calculation of health insurance contributions, a monthly income limit of €520 applies to working students. If working students do not earn more than €520 per month, they only have to pay a reduced health insurance contribution. Contributions to pension, unemployment, and long-term care insurance are also reduced for working students.

If a working student earns more than €520 per month, they are no longer considered a working student for health insurance purposes and must pay the full health insurance contribution. All income, including from other jobs or sources, is taken into account for the calculation.

What is the working student privilege?

The working student privilege is a regulation in Germany that allows students to work in regular employment alongside their studies without having to pay high social security contributions. Here are some important facts about the working student privilege:

- The working student privilege exempts students who work as working students from the obligation to pay social security contributions in full.

- Working students are currently subject to an earnings limit of €450 per month. As long as this limit is not exceeded, working students only have to pay a reduced health insurance contribution.

- The working student privilege is only intended for students who are in regular employment. Other forms of employment, such as marginal employment ("mini-jobs"), are not covered by the working student privilege.

- The working student privilege is an advantageous arrangement for students, as it allows them to earn money alongside their studies without having to pay high social security contributions. However, students should pay close attention to the earnings limit of €450 per month and other regulations to avoid having to pay unexpectedly high contributions.

- The working student privilege is also attractive to employers, as they can save costs due to reduced social security contributions. In addition, they can benefit from the work experience and knowledge of working students thanks to the regulations governing the working student privilege.

- Students have normal vacation regulations and vacation entitlements. More detailed calculations regarding the statutory vacation entitlement for working student contracts can be found in the following article: Working student contract vacation.

Additional insurance for working students

In addition to health insurance, there are other types of insurance that may be relevant for working students. These include, in particular, pension insurance, unemployment insurance, and accident insurance.

Pension insurance for working students

Working students are generally subject to pension insurance contributions if they earn more than €520 per month or if their employment lasts longer than three months. In this case, both the employer and the working student must pay pension insurance contributions. Pension insurance contributions are already deducted from the salary in statutory health insurance.

Unemployment insurance for working students

Working students are not usually covered by unemployment insurance, as they generally do not have to worry about becoming unemployed during their studies. However, if working students become unemployed after completing their studies and meet the requirements for receiving unemployment benefits, they can take out voluntary unemployment insurance.

Term life insurance for working students

Term life insurance for working students can be useful in certain situations. If a working student has financial obligations that would remain unfulfilled in the event of their death, term life insurance can help to secure these obligations and protect their surviving dependents. Further information on term life insurance.

Some reasons why a working student might take out term life insurance are:

- Debts: If the working student has debts, term life insurance can help ensure that these debts are paid off in the event of his or her death.

- Family support: If the working student is married or has children, term life insurance can help ensure that his family is financially secure even after his death.

- Tuition fees: If the working student still has student debt or has to pay tuition fees, term life insurance can help ensure that these obligations can be met even in the event of their death.

Accident insurance for working students

Working students are generally covered by statutory accident insurance as part of their employment. Statutory accident insurance covers accidents at work and occupational illnesses and covers, among other things, the costs of medical treatment, rehabilitation, and a possible pension in the event of permanent health damage. The insurance coverage applies regardless of whether the working student is covered by statutory or private health insurance.

Five tips for students regarding working student contracts and health insurance

- Find out in good time: Before signing a working student contract, you should find out about health insurance. Clarify whether you are covered by family insurance or student health insurance and what impact the working student job will have on your health insurance.

- Stay within the earnings limit: As a working student, you can earn a maximum of €450 per month to benefit from reduced health insurance contributions. Make sure you stay within this earnings limit to avoid having to make additional payments.

- Please note the registration requirement: Even as a working student, you must register with health insurance if you are not covered by family insurance or student health insurance. Find out in good time about the registration requirement and the necessary documents.

- Inform your employer: Notify your employer in good time if you are not covered by family insurance or student health insurance and need to register with a health insurance provider. Your employer is obliged to register you and pay the contributions.

- Check out other employment opportunities: If you want to earn more than €450 per month, you should check whether marginal employment (also known as a "mini-job") is an option for you. Different rules apply here with regard to health insurance and social security contributions. Find out more from your health insurance provider and your employer.

Three tips for employers who hire working students and need to consider health insurance in this context

- Check the insurance situation: As an employer, you should ensure that the working student has adequate health insurance. If necessary, ask the working student whether they are covered by family insurance or student health insurance. If this is not the case, you must register them with a health insurance company.

- Inform the working student: Explain to the working student that they must take care of their own health insurance if they do not have coverage and inform them of the income limit. Also provide them with the necessary documents they need to register with the health insurance company.

- Check social security obligations: Before hiring a working student, check whether they are subject to social security contributions or whether the so-called working student privilege applies. Make sure that the working student does not work more than 20 hours per week in order to be eligible for the working student privilege. Otherwise, employers and working students will have to pay higher social security contributions.

More Articles: