Working student contracts are an important way for many students to finance their studies while gaining valuable professional experience.

However, working student contracts offer many advantages not only for students, but also for employers. This is because they can hire suitable employees for a specific period of time without entering into a long-term commitment.

In this article, we will take a detailed look at working student contracts and explain everything you need to know about them.

From the advantages for students and employers to the legal aspects and the process of drafting contracts—all this and more will be discussed in this article.

In addition, we will also show how beglaubigt.de can assist in the creation of a working student contract (use our contract assistant for a legally compliant working student contract).

What exactly is a working student contract?

A working student contract is a special employment contract between a student and an employer. It allows students to work while studying, with working hours generally limited to a maximum of 20 hours per week, as stipulated in Section 8 (3) of the Student Social Security Act (SGB IV).

The advantage of such a contract is that students can effectively combine work and study without neglecting their studies. For employers, it offers the opportunity to recruit qualified employees for a limited period of time without making a long-term commitment.

What are the requirements for employment under a working student contract?

Employment under a working student contract is a special form of employment relationship that requires specific conditions to be met. In order to be employed as a working student, a student must fulfill certain criteria.

According to current legislation, students must meet the following requirements:

- Be enrolled as a regular student at a college, university, or recognized technical college

- Have not studied for more than 25 semesters

- Not be on a semester break

- Have not yet completed all the required tests

- During the lecture period, work no more than 20 hours per week (the focus must be on your studies).

- May work more than 20 hours per week for a maximum of 26 weeks per year

It is important to note that a working student contract should not be confused with a mini-job, which has a maximum earnings limit of €520 per month. A working student contract is more suitable for students who want to earn more through their employment.

Before being hired, students must provide proof of their regular studies to the employer and inform the human resources department immediately if their student status changes.

It is also important that working students are assigned to tasks that are relevant to their field of study in order to create added value for both sides. In some cases, working students can also have their work credited as a mandatory internship, provided that it fits in with the content of their studies. A fundamental issue in this context is taxation for working student contracts.

What are the advantages for employers when hiring working students?

Employers enjoy a number of advantages when hiring working students. Here are some of the most important ones:

- Flexibility: Work-study contracts enable employers to hire suitable employees for a specific period of time without entering into a long-term commitment. This gives employers the flexibility to adjust their workforce as needed.

- Cost savings: Since working students study while they work, employers do not incur any costs for training and further education. In addition, working students are generally cheaper than other employees.

- Fresh perspectives: Working students often bring new ideas and energy that employers can use to improve their business.

- Future talent: Working students are usually future talent that employers can get to know early on and recruit for their company.

- Compliance with legal regulations: Employers must comply with certain legal regulations when hiring working students to ensure that the working conditions for students are fair. Beglaubigt.de can help employers comply with these regulations and draw up a legally compliant working student contract.

A detailed list can be found here: Working student contract advantages

What are the most important components of a working student contract?

A working student contract should always include all important aspects of an employment relationship, including:

- Identification of employer and working student, including names, addresses, and dates of birth.

- Description of the work performed by the working student, including working hours and type of work.

- Description of remuneration, including wages or salary and any allowances or supplements.

- Vacation regulations, including the number of days that working students are entitled to each year, as well as regulations governing vacation approval.

- Clauses regarding termination of employment, including notice periods and conditions for termination with notice. (see Terminating a working student contract)

- Regulations governing working conditions, including responsibilities, working hours, and the provision of necessary work equipment.

- Confidentiality clauses governing the use of confidential information.

- Regulations governing labor law obligations and rights, including the obligation of working students not to compete with their employer, and regulations governing social security obligations. (see Insurance for working students)

It is important to note that a working student contract is legally binding and that applicable labor law regulations must be observed.

What are the remuneration and social security provisions for working student contracts?

Remuneration: Remuneration for working students must be at least equal to the statutory minimum wage, unless there is a collective agreement in place. However, remuneration may also be higher, depending on the industry and the specific tasks performed by the working student. Any changes will have an impact on the taxes payable under a working student contract.

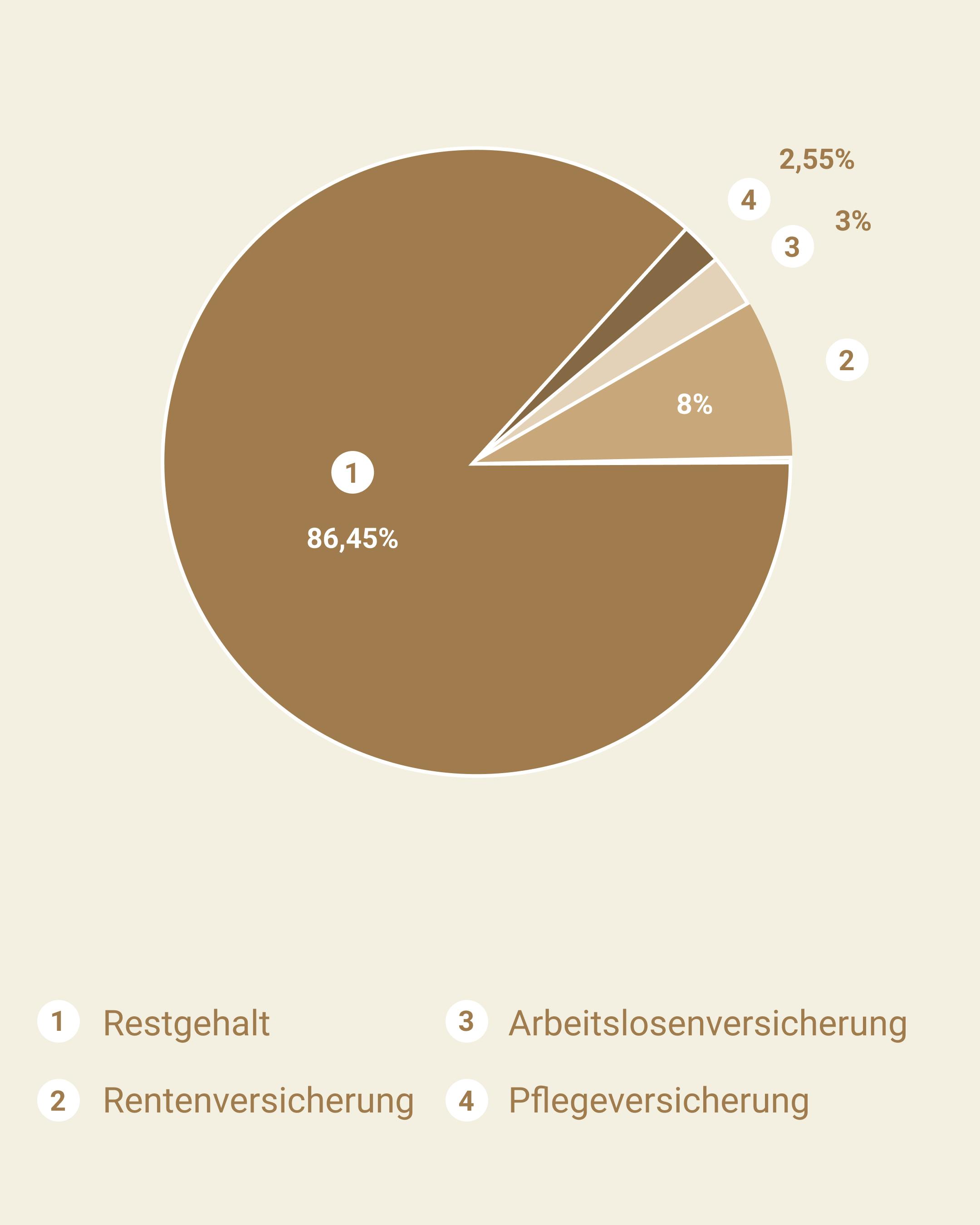

Social security: Working students fall under the category of student employment and are therefore exempt from social security contributions if they work less than 20 hours per week. If they work more than 20 hours per week, they are required to have health insurance.

It is important to note that social security contributions are still payable even if a working student already has private insurance. Employers should cover the contributions for health insurance and, if applicable, pension insurance from their budget.

In addition, it is recommended that working student contracts also include provisions on vacation, overtime, termination, and other labor law issues. It is essential to comply with labor law requirements in order to avoid potential legal disputes.

Working student contract: working hours, sick leave, and vacation entitlement

In Germany, the Working Hours Act (ArbZG) governs the working hours of working students. According to this law, working students may not work more than 20 hours per week during the lecture period and may only work more than 20 hours for a maximum of 26 weeks per year. However, it is also possible for employers and working students to agree to amend these regulations in an individual working student contract.

If a working student falls ill, he or she is entitled to continued payment of remuneration in accordance with the provisions of the Continued Remuneration Act (EFZG). However, employers and working students must note that this only applies to the period during which regular studies are suspended, i.e. during the lecture period. During the semester break, however, no continued payment of remuneration is provided for.

With regard to vacation entitlement, working students are subject to the Federal Vacation Act (BUrlG).

According to this, every employee is entitled to at least 24 working days of paid vacation per calendar year.

In some cases, however, employers and working students may agree on different arrangements in an individual working student contract. It is important to note that the provisions of the BUrlG represent a statutory minimum entitlement and may not be undercut.

How is vacation entitlement calculated?

The vacation entitlement of a working student is calculated in accordance with the Federal Vacation Act (BUrlG). This law stipulates that every employee is entitled to at least 24 working days of vacation per calendar year. This regulation also applies to working students.

Vacation entitlement is calculated based on actual working hours. This means that the more a working student works, the higher their vacation entitlement. Here is an example: A working student works 20 hours per week over a period of 50 weeks. This results in a total of 1,000 hours worked. Accordingly, the working student is entitled to 20 days of vacation (1,000 hours / 50 weeks * 5 working days per week = 20 vacation days).

However, it is important to note that this is only a rough guide and the calculation of vacation entitlement may vary from company to company. In any case, vacation entitlement should be clarified and set out in writing in the working student contract.

How much can I earn as a working student?

There is no legal upper limit on the income of working students in Germany. However, due to their student status, working students are usually not allowed to work more than 20 hours per week so as not to interfere with their academic performance.

However, it depends on individual circumstances, as it is sometimes possible for a working student to work more than 20 hours per week as long as it does not interfere with their studies. It is therefore important to check the regulations at the university and in the respective state law.

What is the average salary for a working student in Germany?

The average salary for a working student in Germany varies depending on the industry and size of the company. On average, however, working students earn between 12 and 15 euros per hour.

However, some companies pay higher hourly rates, while others may offer lower rates. It should also be noted that some companies employ their working students as part-time staff, who are paid a fixed monthly salary.

How much can a working student earn in 2023?

According to the Federal Ministry of Labor and Social Affairs, there is no legal upper limit on the income of working students. It can therefore vary and depends on many factors, such as industry, company size, and workload.

On average, working students in Germany earn between €12 and €25 per hour. However, it is important to note that actual income depends on a variety of factors, such as working hours, area of responsibility, and company policies.

What is the minimum wage for working students?

Since October 1, 2022, the general minimum wage in Germany has been €12.00 per hour. Although temporary workers and working students are also covered by this minimum wage, there are no specific legal regulations for them.

Instead, many employers follow the recommendations of the collective bargaining partners. In some industries and regions, working students may therefore receive an hourly wage that is above the minimum wage.

However, it should be noted that working students often work part-time and their working hours are limited due to their studies. In some cases, this may justify lower pay, but it should not be below the general minimum wage.

What about pension insurance?

In Germany, working students who work more than 20 hours per week are entitled to pension insurance. This means that part of their salary is paid into a statutory pension insurance scheme. This is compulsory insurance, with half of the cost borne by the employee and half by the employer. The pension insurance scheme is responsible for securing part of the salary as provision for retirement.

Therefore, only the pension insurance contribution of 18.6% is payable, which is shared between the employer and the employee.

Working students who work less than 20 hours per week are not entitled to statutory pension insurance. However, private pension insurance can be taken out to provide additional cover.

What does a typical working student contract look like?

A typical working student contract is a special type of employment contract designed specifically for students. It regulates the rights and obligations of both the employer and the working student. Such contracts usually specify the following points:

- Working hours: This section describes the maximum weekly working hours for students, working hours, and any changes to working hours.

- Remuneration: This is where the monthly salary amount is specified and whether it is a gross or net amount, for example.

- Social security: This section describes whether the student is covered by statutory health and pension insurance and what contributions must be paid by the employer or the student.

- Vacation entitlement: This describes the number of vacation days that students are entitled to per year and when these can be taken.

- Illness: This section describes the procedure in the event of illness, for example, whether a doctor's note must be submitted or whether vacation days will be deducted.

It is important to note that all provisions in the working student contract must comply with legal requirements, such as the provisions of the Part-Time and Fixed-Term Employment Act (TzBfG). Otherwise, problems with the labor authorities may arise.

Legal validity of a working student contract

A working student contract must comply with certain legal requirements in order to be legally valid. Here are some important requirements:

- Working Hours Act (ArbZG): The Working Hours Act regulates daily working hours, breaks, and overtime. It stipulates that the daily working hours of a working student may not exceed 8 hours.

- Continued Remuneration Act (EFZG): The Continued Remuneration Act stipulates that employees are entitled to continued remuneration in the event of illness. Working students are also entitled to continued remuneration if they are ill.

- Federal Leave Act (BUrlG): The Federal Leave Act regulates entitlement to annual leave. Working students are also entitled to at least 24 working days of paid annual leave.

- General Equal Treatment Act (AGG): The General Equal Treatment Act prohibits discrimination on the basis of gender, race, religion, sexual orientation, age, or disability. This must also be taken into account in a working student contract.

- Unfair Dismissal Protection Act (KSchG): The Unfair Dismissal Protection Act protects employees from unfair dismissal. Working students are also entitled to protection against unfair dismissal. Detailed information on this topic: Working student contracts and notice periods & Terminating a working student contract properly

It is important to note that a working student contract must also take into account the applicable collective agreements and company regulations.

What is the difference between a student assistant and a working student?

The difference between a student assistant and a working student lies in the requirements that a student must meet in order to be employed as either one.

A student can work as a student assistant if they:

- Enrolled at a college, university, or recognized technical college is

- No special requirements regarding the duration of studies or examinations need to be met.

A student can work as a working student if, in addition to the above requirements, they:

- A student is considered to be properly enrolled if

- Has not studied for more than 25 semesters

- Not currently on a semester break

- Has not yet completed all the required tests

- Does not work more than 20 hours per week during the lecture period

An important difference between the two forms of employment is that working students generally earn more than student assistants, as they are not considered mini-jobbers and are therefore not subject to the maximum earnings limit of €450 per month. In addition, working students can have their work credited as a mandatory internship, provided that it is relevant to their studies.

How can beglaubigt.de help with drawing up a working student contract?

beglaubigt.de is an online platform that enables companies to create legally binding contracts with just a few clicks. beglaubigt.de also offers the creation of working student contracts that contain all important regulations and legal requirements.

With beglaubigt.de, companies can conveniently and securely create their working student contract online. The platform offers a simple and intuitive process in which the required information is requested and automatically inserted into the contract. This ensures that the contract contains all relevant provisions to be legally binding for both the company and the working student.

In addition, beglaubigt.de offers a wide range of templates that comply with legal requirements and are specially optimized for working student contracts. Companies can choose from these templates and adapt them to their individual needs.

What are the possible consequences if a working student contract is not legally binding?

A work-study contract that is not legally secure can have significant legal and financial consequences for both parties—the employer and the employee.

For employers:

- Legal consequences: Violations of labor law or relevant collective agreements may result in fines or penalties. For example, failure to comply with the Minimum Wage Act (MiLoG) can lead to substantial fines.

- Reputational damage: A company that enters into legally questionable contracts can damage its reputation, which in turn can make it more difficult to recruit qualified employees.

- Unclear working conditions: An uncertain contract can lead to misunderstandings regarding working hours, remuneration, or tasks, which can affect morale and productivity.

For the employee:

- Loss of employment rights: An insecure contract can result in the employee not being entitled to benefits such as unemployment benefits, vacation pay, or overtime pay.

- Uncertainty in the event of illness: If there are no or unclear regulations regarding sick leave, problems may arise with regard to continued payment of wages in the event of illness.

- Payment issues: Without clear rules on remuneration, discrepancies or delays in salary payments may occur.

Example: A working student works more than the legally permitted 20 hours per week during the lecture period due to a contract that is not legally binding. This could result in him losing his status as a working student and becoming fully liable for social security contributions. This could result in the employer having to pay retroactive social security contributions.

It is therefore extremely important that working student contracts are drawn up carefully and in accordance with all relevant legal provisions. If you are unsure about anything, it is advisable to seek legal advice to ensure that all aspects of the contract are legally sound.

What would be the disadvantages of a working student contract for employers or employees?

Disadvantages for employers with a working student contract can include:

- Limited flexibility in terms of working hours and availability of working students, as they often work alongside their studies and may therefore have appointments or exams.

- Lower work productivity than that of a regular employee, as studies take priority and the working student's focus is on them.

- More administrative tasks, such as organizing working hours and vacation time.

Disadvantages for working students with a working student contract can include:

- Limited working hours and lower pay compared to a regular employment relationship.

- No entitlement to full social security benefits, such as vacation or sick pay.

- No entitlement to unemployment insurance, which can lead to financial disadvantages in the event of job loss.

- No entitlement to a company pension, which can lead to disadvantages in terms of financial security in old age in the long term.

6 final tips for employers when drawing up working student contracts

- Clear rules and responsibilities: It is important that the employer and the working student are clear about their respective duties and responsibilities from the outset. The working student contract should provide detailed information on this.

- Remuneration and social security: Employers must ensure that the remuneration of working students is at least equal to the applicable minimum wage and that working students have adequate social security coverage.

- Working hours and vacation entitlement: It is important that the working hours of working students are clearly defined and that they are granted an appropriate vacation entitlement.

- Legal requirements: Employers must ensure that the working student contract complies with the applicable legal requirements. It is advisable to consult an expert in this regard.

- Clear communication: Employers should maintain open communication with working students in order to identify and resolve problems at an early stage. Regular feedback meetings can also help to ensure that both sides are satisfied with the arrangement.

- If necessary, discuss the notice periods in the working student contract, as this will be an essential part of the farewell.

In summary, a working student contract can offer many advantages for both sides—employers and employees (Advantages of a working student contract). Employers have the opportunity to hire temporary and flexible workers, while working students can gain practical work experience and finance their studies. However, it is important that the working student contract is legally binding and includes all relevant provisions, such as remuneration, social security, working hours, and vacation entitlement. A contract that is not legally binding can have negative consequences for both parties.

If you want to conclude a working student contract, you should therefore take care to draft it carefully and watch out for any potential pitfalls. Our online platform, such as beglaubigt.de, can help you with this by quickly and easily creating a legally binding contract: Create a working student contract now.

More Articles:

How Much does it Cost to Set up a Limited Liability Company GMBH