Working as a working student can be beneficial for both the employer and the employee. While the employee gains valuable practical experience and earns an income, the employer benefits from the support of a motivated and dedicated student.

However, it’s important to understand that working as a student also has tax implications. In this article, we will explore the taxation related to working student contracts and address key questions such as how working students are taxed, what the tax-free income limits are for students, and what deductions apply for working students.

I. Taxation of Working Students

How is a working student taxed?

In Germany, working students are taxed similarly to other employees. Since a working student position is a form of employment, the income earned must be taxed. However, due to their typically lower income, the income tax for working students is often lower than that of other employees.

In Germany, employees who earn more than €10,908 per calendar year are required to file an income tax return. This translates to a monthly salary of approximately €909.

The amount of income tax a working student pays depends on their gross income and is calculated according to the applicable tax regulations.

In addition to income tax, the solidarity surcharge (Solidaritätszuschlag) may also be applied to the earned income. However, this surcharge is only imposed on income above a certain threshold and is currently set at 5.5% of the applicable income.

It's important to note that employers are required to automatically deduct both income tax and the solidarity surcharge from the employee's gross salary and transfer these amounts to the tax office. The employee then receives a payslip detailing the gross salary, net salary, and the taxes deducted.

Church Tax as a Working Student

If you belong to the Catholic or Protestant church in Germany, you are required to pay church tax, regardless of whether you are working as a student or in any other role. The church tax is calculated as a percentage of your income tax and typically amounts to 8-9% of the income tax you pay. For example, if you pay €10 in income tax per month, your church tax would be around €0.80 to €0.90.

It’s important to note that this is only a rough estimate, and the actual amount may vary based on several factors. If you are non-religious or do not owe income tax, you are exempt from paying church tax.

Working Student Taxes: What’s Left at the End?

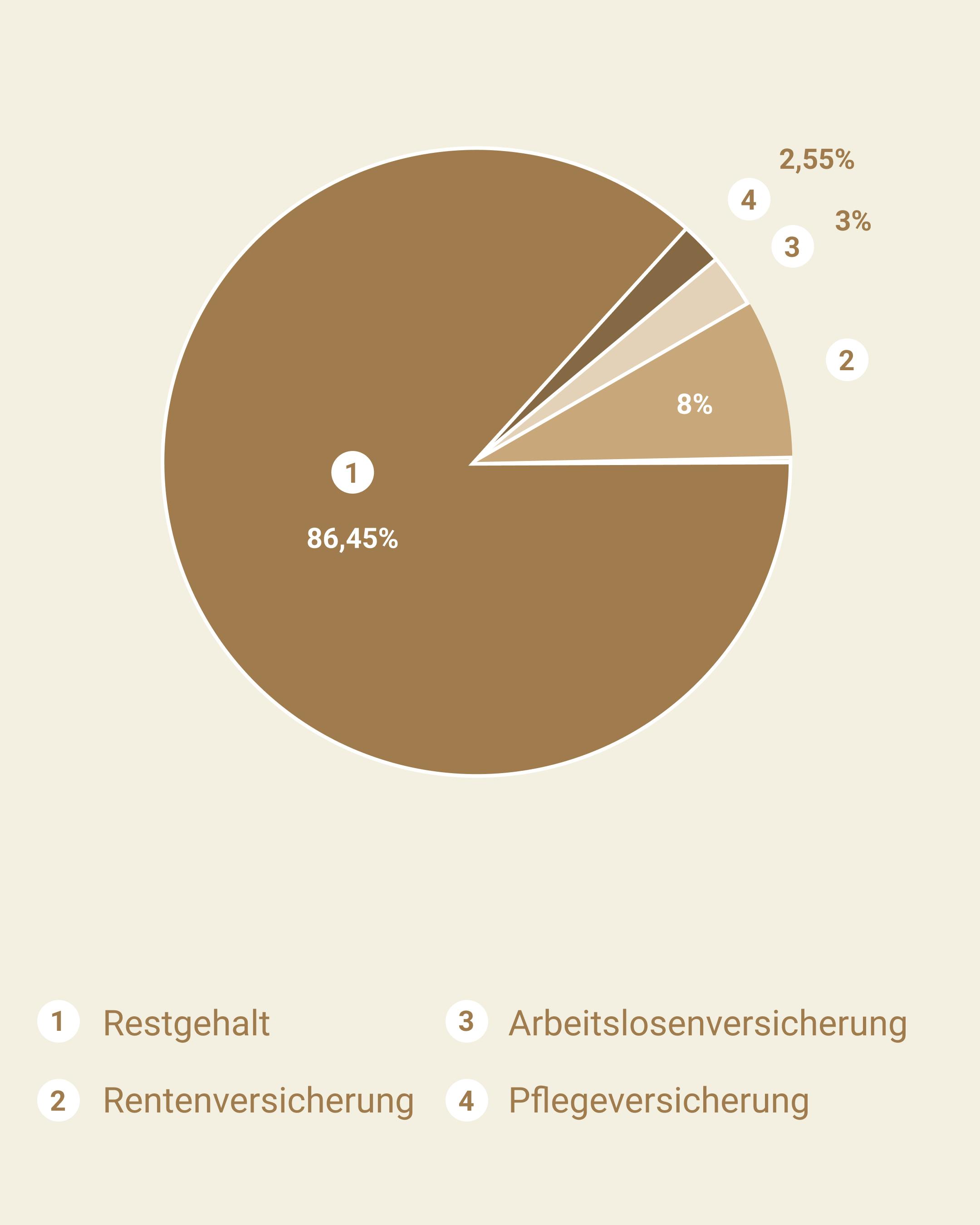

Let’s assume you earn an hourly wage of €12 and work the full 20 hours per week, totaling 80 hours per month. Your monthly earnings would therefore be €960 (80 * €12).

Since in this example, you earn more than €520 but less than €2,000, a part of your income will be deducted for pension insurance (see also Working Student Contract Insurance). For €960, the deduction is approximately 8%.

At the end of the month, you would be left with around €880.

"Taxes are like a puzzle where you must always ensure that all the pieces fit in the right place. As a working student, it is especially important to have an understanding of the applicable laws and regulations to ensure you handle your taxes correctly and take advantage of all the benefits available to you." – beglaubigt.de Team

How Much Can a Working Student Earn Tax-Free in 2023?

In Germany, working students have a tax-free income threshold, which is set at €10,908 for the calendar year 2023. This means that working students do not have to pay income tax on earnings up to this limit. This annual threshold is adjusted by tax authorities to account for inflation and rising living costs.

It is important to note that this tax-free threshold should not be confused with full wage tax exemption. Even if the income is below the tax-free limit, social security contributions may still apply to working students. Therefore, even with earnings below the threshold, contributions such as pension insurance may be deducted.

If a working student earns more than the tax-free income limit, they are subject to income tax on the portion that exceeds the threshold. The amount of income tax depends on various factors such as income level, number of children, and marital status.

Additionally, for incomes exceeding the tax-free limit, deductions for social security contributions and income tax will be necessary. These deductions can significantly reduce the net income of the working student.

How Much Can a Working Student Earn?

There is no set income limit for how much a working student can earn, meaning that, in theory, you can earn an unlimited amount. However, a higher income can affect your social security and tax obligations. (See also our article on Working Student Contract Insurance)

If a working student’s income exceeds the annual tax-free income limit of €10,908, that income will generally be taxed at the full rate. Additionally, social security contributions must be paid on the entire income, even if it exceeds the tax-free threshold.

For higher earnings, it is advisable to carefully calculate your potential taxes and contributions to understand how much of your income is actually tax-free and what your tax obligations are. Consulting with a tax advisor or tax office can be very helpful in this case.

A working student works 20 hours per week while studying and earns €1,000 per month.This results in an annual income of €12,000 (€1,000 x 12 months).Since this income exceeds the tax-free threshold of €10,908, the student would need to pay income tax and social security contributions on the amount exceeding the limit.

Regardless of income, working students are entitled to paid vacation. For more information on vacation calculations, refer to Working Student Contract Vacation.

What is Deducted from a Working Student's Income?

When a working student earns taxable income, taxes and social security contributions are automatically deducted.

Employers are required to deduct a portion of the salary as income tax and transfer it to the tax office (Finanzamt). The amount of income tax depends on several factors, including income level, number of children, and other deductible amounts.

A portion of the income is also deducted for social security contributions, including health insurance, pension insurance, and unemployment insurance. These contributions are shared between the employee and the employer.

Example:

A working student earns €1,000 per month.

From this, approximately €180 is deducted as income tax.

Around €140 is deducted for social security contributions.

In the end, the working student receives a net salary of €680.

What Happens If a Working Student Earns More Than €10,908?

If a working student earns more than €10,908 in a year, they are required to report this income in their annual income tax return. This means they may need to adjust the taxes already deducted by the employer and possibly pay additional taxes.

A working student who earns more than €10,908 falls into the progressive income tax bracket, meaning that the higher the income, the higher the tax rate applied to that income.

It’s important to note that a working student's taxable income isn't limited to wages from employment but can also include other sources of income, such as rental income, the sale of assets, or capital gains.

What Happens if a Student Works More Than 20 Hours a Week?

Working more than a certain number of hours can impact study support programs like BAföG. Many of these programs have limits on how much students can work while studying. If these limits are exceeded, students may face a reduction or even loss of financial support.

It's important to note that the type of work matters. Working student positions (Werkstudententätigkeiten) are generally exempt from strict working hour regulations since they are designed to be undertaken alongside studies. However, other types of jobs, such as minijobs or internships, may be subject to stricter limits on working hours, which could affect eligibility for financial aid.

6 Tips for Employers Regarding Working Student Contracts & Taxes

- Monitor Working Hours Regularly: Employers should regularly track and document the working hours of their working students to ensure compliance with labor laws.

- Understand Tax Obligations for Working Students: Employers need to be aware of their working students' tax obligations and ensure that the appropriate deductions are made on the payroll.

- Choose the Correct Tax Class: Selecting the right tax class for working students is crucial to ensure that the correct amount of taxes is calculated and withheld.

- Review Wages Regularly: Since working students have a tax-free income limit, it’s important to periodically review their wages to ensure they stay within the allowable range.

- Make all necessary deductions correctly: To ensure that tax obligations are properly fulfilled, all necessary deductions such as social security and church taxes (see also leaving the church) should be accurately calculated and withheld.

- Employers should keep notice periods for working student contracts in mind when drafting the contract.

When Does It Make Sense for Students to Accept a Working Student Contract from a Tax Perspective?

Whether it makes sense for students to take on a working student contract depends on several factors, including expected income, monthly financial needs, and any other sources of income.

A key factor is the tax-free income limit for students, which is €10,908 per year (as of January 2023). If a student's expected income is below this limit, accepting a working student contract can be tax-efficient, as little to no income tax will be due. In this case, the student can maximize their earnings without facing significant tax deductions.

If the expected income exceeds the tax-free limit, income tax will need to be paid. In this scenario, students should carefully calculate whether it still makes financial sense to take on a working student contract or if another type of job might be more tax-efficient.

Social Security Contributions, Another important factor to consider is social security contributions, which are mandatory for working students who earn above certain thresholds. These contributions are split between the employer and the student and go towards systems like pension insurance, health insurance, unemployment insurance, and long-term care insurance.

Example:

A working student earns €1,000 per month.

The employer must contribute approximately 15% of the student's gross salary to social security funds. In this case, the employer would pay around €150.

The working student also contributes to social security, which reduces their net income.