Entrepreneurs active in the real estate sector often choose the legal form of an Unternehmergesellschaft (UG) for their businesses. The UG stands out due to numerous advantages, including limited shareholder liability and significant tax savings, which can amount to hundreds of thousands of euros.

This article provides a comprehensive overview of the asset-managing company (VV), a form also known as a holding company, and its essential characteristics.

At Beglaubigt.de, over 1,000 customers have successfully founded new companies. Feel free to submit your request; we support you even in complex cases. https://start.beglaubigt.de/anfrage

The formation of an asset-managing company occurs for various reasons, the most relevant of which are presented here:

Tax Optimization: A VV enables more efficient tax planning. In many jurisdictions, including Germany, profits from subsidiaries can be tax-efficiently received by the holding company, while losses can be offset within the group.

Risk Diversification: Dividing the risk across multiple business units through a VV minimizes the financial risk to the overall company. This way, the holding‘s assets remain protected even if a subsidiary faces financial difficulties.

Asset Protection: By establishing a VV, private assets can be separated from business assets, providing significant protection of personal wealth from business risks.

Increased Efficiency in Asset Management: A VV can take over the central coordination and control of subsidiaries, leading to enhanced efficiency and effectiveness in corporate management.

These aspects underscore the strategic importance of an asset-managing company for entrepreneurs in the real estate sector, offering not only tax and financial benefits but also a robust framework for risk management and asset protection.

What is a real estate UG and how does it differ from other company forms?

A real estate UG (Unternehmergesellschaft) is a particular type of company formation mainly used for starting real estate businesses or managing real estate.

The real estate UG differs from other company forms mainly due to its special tax structure. While GmbHs and AGs as corporations are subject to corporate tax, income tax, and trade tax, the real estate UG is only subject to income tax and corporate tax - not trade tax. This can be attractive for founders looking to optimize their tax burden by up to 30%.

Another distinctive feature of the Real Estate UG (Unternehmergesellschaft) is its flexible share capital structure. Unlike other legal forms, such as the GmbH, which requires a minimum share capital of €25,000 to be fully paid before establishment, the share capital of a Real Estate UG can be structured flexibly. There are no strict minimum capital requirements, allowing founders to adjust the capital amount according to their specific needs.

Another distinction from other company forms is the administrative effort of the real estate UG. While GmbHs and AGs regularly need to prepare an annual balance sheet and hold an annual general meeting, these are not necessary for the real estate UG. Shareholders are only required to submit an income tax return and, if applicable, a tax return for the real estate UG.

Founding a Real Estate UG - Advantages of the Real Estate UG

The decision to establish a real estate UG (entrepreneurial company) offers numerous advantages, particularly supported by tax incentives and corporate law flexibility. A detailed examination of the tax and corporate law framework in Germany reveals why a real estate UG can be attractive to entrepreneurs and investors.

Tax Advantages:

- Income Tax Aspects: Profits from the rental and leasing of real estate are treated as income from renting and leasing according to § 21 of the Income Tax Act (EStG). These incomes can, under certain circumstances, benefit from allowances that directly reduce the tax burden. The real estate UG can significantly reduce its taxable income through the depreciation of real estate (AfA), i.e., the depreciation of buildings over time. An example of this is the linear depreciation for residential buildings, which is generally 2% per year.

- VAT Option: When selling real estate, the option for VAT can be chosen under certain conditions, which can be particularly advantageous when selling to other entrepreneurs who are entitled to deduct input tax. This can make the property more attractive to the buyer and thus increase the sales value.

- Trade Tax: A real estate UG that exclusively conducts asset management and is not considered to be of a commercial nature may, under certain circumstances, be exempt from trade tax. This depends on the specific design of the business activity. The distinction from commercial activity is crucial here, as commercial income is subject to trade tax.

Corporate Law Flexibility:

- Limited Liability: The UG (limited liability) offers, like the GmbH, the advantage of liability limited to the company's assets. This is particularly relevant for real estate investments, where the financial risk can be considerable. Shareholders are thus protected from personal liability for the company's obligations.

- Low Share Capital: Compared to the GmbH, the UG can be founded with a minimum share capital of only one euro. This makes the establishment of a real estate UG attractive even for smaller investors or start-ups in the real estate sector.

- Flexibility in Corporate Management: The UG allows for flexible structures in corporate management and organization. This makes it possible to tailor the company optimally to the specific needs of the real estate market and investors.

Practical Example:

Assume a real estate UG buys a multi-family house for 500,000 euros and uses linear depreciation of 2% per year. This results in annual depreciation of 10,000 euros, which can be deducted from the income from renting and leasing, effectively reducing the UG's tax burden. Additionally, if the property is sold after renovation measures, a VAT option can be utilized under certain conditions to increase the sales value.

The correct purpose in the partnership agreement of a real estate UG

The object of the company of an asset-managing UG (entrepreneurial company) is exclusively the management of assets. These assets can be diverse, such as real estate, stocks, funds, or other securities. In this case, the asset-managing UG acts as a trustee and manages the assets in the interest of the shareholders.

This includes, for example, the monitoring of assets, carrying out repairs or modernizations, and managing rental or lease contracts. The asset-managing UG receives a management fee for this, which serves as its income and is usually subject to trade tax.

It is important to note that the asset-managing UG (Unternehmergesellschaft) is not allowed to engage in its own economic activities, but is solely responsible for managing the assets on behalf of the shareholders.

An example of the purpose of an asset-managing UG in the shareholder agreement could be as follows:

"The company's purpose is to manage and oversee the shareholders' assets. This specifically includes the management of real estate, stocks, funds, and other assets. In this case, the company acts as a trustee and manages the assets in the interest of the shareholders."

The company may not engage in its own economic activities but is solely designated for the management of the shareholders' assets.

Through this shareholder agreement, it is established that the asset-managing UG acts solely as a management company and does not engage in its own economic activities. At the same time, the purpose of the company, which is the management of the shareholders' assets, is clearly defined.

Income Tax Act for Real Estate UGs

The Income Tax Act (EStG) regulates the taxation of income and profits in Germany. For companies involved in the rental and leasing of real estate, there are special regulations in the EStG. According to these regulations, profits from the rental and leasing of real estate are classified as income from rental and leasing.

These incomes are tax-free in Germany as long as they do not exceed a certain threshold. The amount of this threshold depends on various factors, such as the age of the landlord and the relationship to the tenants. There are also special regulations for companies specializing in the rental of commercial properties.

It is also important that profits from the rental and leasing of real estate are tax-free not only if they are actually achieved but also if they could potentially be achieved. This means that losses from the rental and leasing of real estate can also be claimed for tax purposes.

Property UG with a tax rate of 15.83%

As already mentioned, corporations have a lower effective tax rate, which consists of the corporate tax (KSt) of 15% and the solidarity surcharge of 5.5%. This means that the rental income of a real estate UG is subject to a tax rate of 15.83%.

Compared to the top tax rate of 45% that applies to private rental income, significant tax savings can be achieved.

In addition to income tax, there is also a trade tax levied on commercial income. However, with regard to real estate UGs, there is an opportunity to bypass this tax because the activity as a landlord or lessor is considered asset management and thus not perceived as a taxable commercial activity.

According to § 9 GewStG No. 1 Sentence 2 trade taxes do not apply "on the commercial income that accrues from the management and use of one's own real estate." It is therefore important that the property UG does not engage in commercial activities but strictly confines itself to the management and use of its own real estate to benefit from this tax saving.

Establishing a real estate UG: What steps are necessary?

Establishing a real estate UG involves several steps described in detail below:

- Choice of shareholders: First, the shareholders of the real estate UG must be determined. These can be natural or legal persons. It is important that all shareholders are of legal age and competent, and that the number of shareholders is at least two. These are listed in the shareholders' list.

- Drafting the articles of association: The articles of association are the fundamental legal regulation of the real estate UG and set out all important rules such as the composition of the shareholders, the distribution of profits and losses, the management of the company, and the dissolution of the company. It is advisable to have the articles of association drafted by a lawyer.

- Registration in the Commercial Register: The real estate UG must be registered with the relevant district court. The following documents must be submitted for this purpose: the notarized articles of association, a declaration of the shareholders' legal capacity, a declaration of the adequacy of the share capital, a list of shareholders, and an extract from the civil register of the shareholders. (Beglaubigt.de now offers this process entirely remote and digital, more details at: Commercial Register Registration)

- Opening a Business Account: After registration in the Commercial Register, it is necessary to open a business account for the real estate UG. All business transactions will be conducted through this account.

- Applying for a Tax Number and VAT ID: A tax number must be applied for at the tax office for the real estate UG. If the real estate UG is subject to VAT, a VAT ID is also required.

- Taking Out Insurance: It is advisable to take out appropriate insurance for the real estate UG to cover risks. This may include, for example, business liability insurance or professional liability insurance.

Costs of a Real Estate UG:

To establish a real estate UG, a minimum share capital of 1 euro is required. However, it is advisable to choose a higher share capital since the UG typically generates little to no profit in the first few years, and the share capital serves as a liability reserve.

In addition to the share capital, there are also formation costs to consider, such as notary fees and registration fees for the commercial register. The exact costs can vary depending on the effort and location and should be determined on a case-by-case basis.

Furthermore, ongoing costs for the real estate UG should be taken into account, such as rent for office or business premises, employee salaries, and insurance premiums.

Formation Costs

When founding a real estate UG, several fees and costs are typically incurred. The key formation costs include:

- Notary Fees: The formation of a UG must be notarized. Fees for this service are typically around 2% of the company’s share capital.

- Commercial Register Fees: Registering the UG in the commercial register is necessary to be legally recognized. Fees for this usually range between 100 and 200 euros.

- Founding Documents: Various documents are needed to establish a UG, such as the articles of association and the notary contract. The costs for preparing these documents depend on the size and complexity of the company and can range from a few hundred to several thousand euros.

Operating Costs

After establishment, ongoing costs for running a real estate UG regularly arise. The main operating costs include:

- Personnel: If the UG employs staff, wages and salaries must be paid.

- Rent: If the UG rents an office or other premises, regular rental costs will be incurred.

- Insurance: To mitigate risks, it may be sensible to take out various insurances, such as business liability insurance or real estate liability insurance.

Loss Calculation for Further Optimization

The income tax rate for an asset-managing UG focused on real estate in Germany is generally the same as for other legal entities. This means that the UG typically has to pay an income tax rate of 15% on its profits. However, there are some exceptions and special regulations that may apply to asset-managing UGs.

First and foremost, it is essential to note that the UG only has to pay income taxes if it actually generates profits. Losses can typically be carried forward and offset against profits in future years, meaning taxes are only owed when the UG actually turns a profit.

First of all, it is important to note that the UG only has to pay income taxes if it actually makes profits. Losses can usually be offset against profits in future years, so that taxes are only incurred when the UG actually makes profits.

An asset-managing UG focused on real estate can benefit from a special rule known as "loss offsetting." This rule allows losses incurred through the purchase, sale, or management of real estate to be offset against other income of the UG. In this way, the income taxes for an asset-managing UG focused on real estate can be significantly reduced.

However, there are also limits to the loss offsetting. For example, losses can only be offset against other income within ten years. In addition, the UG must be able to prove that it is actually active in the real estate industry and not merely generating passive income.

Comparison of tax burden Real Estate UG and private purchase

Example 1: Real estate purchase through a real estate UG

- A real estate UG is founded by a person who owns private real estate and would like to rent it out to take advantage of tax benefits.

- The real estate UG now buys a condominium for 200,000 euros.

- The real estate UG rents the apartment to tenants and generates rental income of 1,000 euros per month.

- The real estate UG now pays corporate income tax (KSt) of 15% and solidarity surcharge of 5.5% on the rental income, resulting in a tax rate of 15.83%.

- Thus, the real estate UG has to pay KSt of 183.30 euros per month.

Example 2: Private real estate purchase

- A person already owns private real estate and wants to buy another condominium for 200,000 euros.

- The person rents the apartment to tenants and generates rental income of 1,000 euros per month.

- The person must now tax their rental income at the personal income tax rate, which is up to 45%.

- Thus, the person has to pay income tax of 450 euros per month.

In this example, purchasing through a real estate UG would be beneficial for the owner in terms of taxes, as the tax rates are lower and therefore less tax has to be paid.

However, it should be noted that there are certain requirements that must be met for a real estate UG and that there are also disadvantages such as higher administrative and accounting costs. Furthermore, the unchanging property tax for real estate owners is also of interest here.

Minimum share capital of a real estate UG

The minimum share capital of a real estate UG is specified in § 5 Abs. 1 sentence 2 of the law on the entrepreneurial company (UG) and amounts to 1 euro. This minimum share capital must be fully contributed when the UG is founded and serves as security for the company's creditors. However, it is not used to finance the company but is merely a legally required minimum amount that must be reached.

The share capital can also be higher if the founders wish. In this case, the higher share capital must also be fully contributed. The share capital can be contributed in cash or in kind and can also be transferred through the transfer of business shares. However, it should be noted that business shares contributing to the minimum share capital can only be fully transferred after the UG has been entered into the commercial register.

It is common to set a share capital of at least 300-500 euros to directly cover the founding costs.

When must a real estate UG be converted to a GmbH?

There is no legal obligation to convert a UG into a GmbH (limited liability company). A UG can therefore, in principle, remain as such indefinitely. However, there are some reasons why entrepreneurs might decide to convert their UG into a GmbH:

- Increase of share capital: A GmbH must have a minimum share capital of 25,000 euros, whereas the minimum share capital of a UG is only 1 euro. For companies that want higher financial security or need a larger amount of equity, a conversion to a GmbH can therefore make sense.

- Improvement of credibility: GmbHs often enjoy a higher reputation than UGs in the public, as the higher minimum share capital is considered an indicator of solid financing. Conversion to a GmbH can therefore help build the trust of customers, suppliers, and banks.

Holding structure: Parent company & real estate UGs - here's how it works

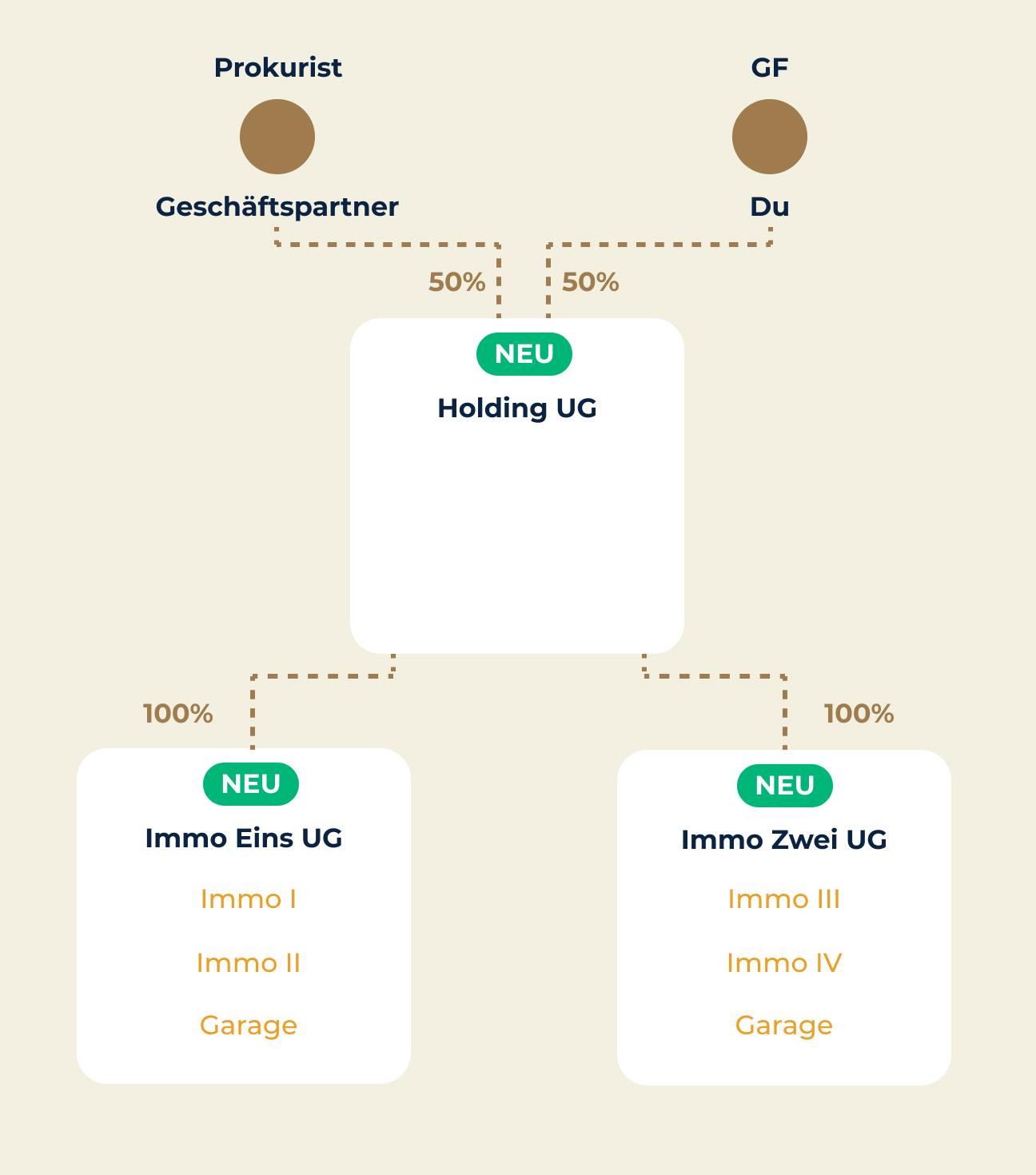

A holding structure with two asset-managing UGs that hold real estate could look like this:

- Holding company: The holding company is a company that serves as a parent company and owns one or more subsidiaries. In this case, the holding company would be the top company in the structure and would own the two UGs.

- Asset-managing UG 1: This UG would act as a subsidiary of the holding company and would be responsible for acquiring, managing, and selling real estate. It would specialize in acquiring and managing certain types of real estate.

- Asset-managing UG 2: This UG would also be a subsidiary of the holding company and would focus on acquiring, managing, and selling real estate, but possibly on different types of real estate than UG 1.

In this structure, the holding company would own both UGs and could serve as the parent company to coordinate various business activities and direct the strategic decisions of the two UGs.

This structure also offers the advantage that the assets of the two UGs are kept separate, which means that the risk of asset loss is limited to one of the UGs and does not affect the entire assets of the holding company.

It is important to note that the exact structure and organization of a holding company and its subsidiaries depend on many factors, such as specific business objectives, company size, tax structure, and other factors.

What are the advantages of a real estate holding company?

The advantages of a holding company can be manifold, especially from a tax and legal perspective. Here are some of the main advantages of a holding company:

- Tax benefits: A holding company can offer various tax advantages. In particular, profits and losses can be offset between the various subsidiaries, which can help minimize the tax burden. In addition, holding companies can benefit from tax incentives, such as a lower tax rate for corporations.

- Limitation of liability: A holding company can help minimize the risk for the subsidiaries and shareholders by keeping assets and liabilities separate. If a subsidiary becomes insolvent or is involved in legal disputes, this does not affect the assets of the holding company.

- Efficient Management: A holding company can also help simplify the management and control of subsidiaries. A central holding company can use resources and expertise more efficiently, thus saving costs. In addition, a holding company can establish uniform standards and strategies for all subsidiaries.

- Flexibility in Corporate Structure: Holding companies can also offer greater flexibility in corporate structure. They can have various subsidiaries specializing in different business areas or industries and thus diversify into different business sectors.

- Tax Optimization: A holding company can also provide an optimal tax structure by utilizing tax advantages and reductions and by locating subsidiaries in different countries or regions to benefit from lower tax rates.

Overall, holding companies can offer many advantages, particularly from a tax and legal perspective.

Conclusion: Is it worth setting up a real estate UG for you?

Whether setting up a real estate UG is worthwhile for you depends on various factors. A UG can be attractive for entrepreneurs who want to build and manage an extensive real estate portfolio in the long term. The corporate structure of the UG allows managers and shareholders to minimize their liability risks and benefit from tax advantages.

However, it is important to note that the establishment and operation of a UG come with various costs and obligations. These include notary fees, registration fees in the commercial register, and the costs for founding documents. Regular operating costs such as personnel, rents, insurance, taxes, and loans must also be considered.

Before deciding to establish a real estate UG, you should carefully weigh whether this corporate form is suitable for your purposes and whether you have the necessary resources and financial means to operate the UG successfully. It may be advisable to consult a tax advisor or lawyer who can help you make a decision and highlight the advantages and disadvantages of the UG compared to other corporate forms.