What is a gift contract?

A gift contract is an agreement where one person (the donor) gives an item or a right to another person (the recipient) without expecting anything in return. The gift is made out of pure generosity.

The gift contract constitutes a form of bilateral legal transaction because it requires two matching declarations of intent (offer and acceptance). The donor declares their intention to give a gift, and the recipient declares their intention to accept the gift.

It is important to note that in many countries, including Germany, certain types of gifts, such as real estate or cars, legally require notarization of the gift contract. This ensures legal certainty and prevents misuse.

A gift may also contain conditions or stipulations that the recipient must fulfill. Such conditions must be clearly laid out in the gift contract.

Despite its apparent simplicity, gift contracts can raise a number of complex legal issues in practice, especially concerning taxes (gift contract taxes), compulsory portions, and the validity of the gift.

Is a gift contract valid without a notary?

Starting with the legal basis for the necessity of notarization in gift contracts, § 518 Section 1 of the German Civil Code (BGB) states that a gift, unless executed among those present through delivery, must be made via a notarially recorded contract. This paragraph clarifies that notarization is essential if the gift is not executed among those present.

However, there are situations where notarization is mandatory regardless of the type of gift. Examples include:

- Gifting of real estate

- Gifting of company shares that require a written partnership agreement

- Gifting with stipulations or conditions

Special rules apply when gifting real estate. § 311b BGB stipulates that contracts in which one party commits to transferring ownership of real estate must be notarized. This provision explicitly underscores the necessity of notarization in real estate gifts.

It should also be noted that for certain types of gifts, exceptions to the requirement of notarial certification apply.For example, the gifting of movable items (e.g., vehicles, jewelry) is also valid without notarization as long as it is executed through delivery among those present.

Overall, it can be concluded that for the question, "When is a gift contract valid?" notarization plays a central role, particularly when it comes to real estate gifts or gifts with stipulations. It is therefore advisable to seek legal advice when gifting assets to ensure compliance with legal requirements in accordance with §§ 518 and 311b BGB.

When is a gift contract invalid?

There are several typical reasons that can lead to the invalidity of a gift contract.

Typical reasons for invalidity include:

- Form defects: As previously explained, certain gifts require notarial certification according to § 518 BGB. If this is missing, the contract is invalid. (More on formal requirements: Gift contract what to consider)

- Incapacity or limited capacity of a party: According to § 104 BGB, a person who is incapable of conducting business cannot make valid legal declarations. This also applies to gift contracts.

- Immorality or illegality of the gift: A gift contract that violates good morals (§ 138 BGB) or statutory prohibitions is invalid.

- Rescission: If a gift contract was concluded due to error, duress, or fraudulent misrepresentation, it can be rescinded and thus become invalid in accordance with §§ 119 et seq. BGB.

The consequences of the invalidity of a gift contract can be significant. Generally, it means that the gift is considered not to have been made. The donor then has the right to demand the return of the gifted item, while the recipient may be able to claim damages.

Regarding the jurisprudence on the invalidity of gift contracts, there are some notable decisions. For instance, the Federal Court of Justice (BGH) ruled on November 18, 2014 (Case No. X ZR 163/12) that a gift is invalid if the donor did not have the required capacity of insight due to a mental illness when the contract was concluded.

Another example is a ruling by the Higher Regional Court of Cologne (Case No. 3 U 191/11), which determined that the gift of a property was invalid because the notarial certification was missing.

When is a real estate gift legally binding?

The gift of real estate and properties requires compliance with certain legal requirements to be legally binding. The following steps are crucial:

- Notarial certification: According to § 311b BGB, contracts involving the transfer of ownership of real estate must be notarized. This also applies to gift contracts for real estate.

- Registration in the land register: A gift of real estate becomes legally binding only with registration in the land register. According to § 873 BGB, a registration procedure in the land register is required for the transfer of ownership of a property. The notary applies for the registration and confirms the validity of the gift document.

- Approvals: In certain cases, the gift of real estate may require official approvals, such as for agricultural or forestry land.

- Burdens and third-party rights: Prior to the gift, potential burdens in the land register, such as mortgages or rights of way, should be checked and possibly removed to avoid future disputes.

Relevant jurisprudence on the legal validity of real estate gifts emphasizes the necessity of notarization and land registry entry. In a judgment dated February 7, 2014 (Ref. V ZR 26/13), the Federal Court of Justice (BGH) clarified that a real estate gift is only effective if all required formalities, including land registry entry, are met.

In summary, the legal validity of a real estate gift requires compliance with several statutory requirements, including notarization and entry in the land register in accordance with § 873 BGB. It is advisable to seek legal support when making a real estate gift to ensure that all requirements are met and the gift becomes legally valid.

When is a gift no longer part of the estate?

Gifts are relevant in the context of inheritance law and, in particular, compulsory share law. It may happen that gifts made before the death of the testator need to be considered in the calculation of the compulsory share.

Gifts in the context of inheritance law and compulsory share law:

- If a testator makes gifts during their lifetime, these can potentially affect the compulsory share. The compulsory share is the portion of the inheritance to which close relatives such as children and spouses are legally entitled (§ 2303 BGB).

- Gifts made by the testator within the last 10 years before their death can, under certain circumstances, be considered in the calculation of the compulsory share (§ 2325 BGB).

The reclaiming of gifts according to §§ 2325 ff. BGB:

- According to § 2325 BGB, a gift is included in the estate if it was made within the last 10 years before the death of the testator. The gift is then treated as a so-called "fictive component" of the estate and can increase the compulsory share.

- However, according to § 2325 para. 3 BGB, the consideration share of the gift decreases for each year that has passed since the gift was made.

Examples and case law on the treatment of gifts in inheritance law:

- A typical example is when a parent gives a property to a child and then dies within 10 years. In this case, the gift can affect the compulsory share of other heirs.

- In a judgment of the Federal Court of Justice (BGH) dated June 29, 2011 (Ref. IV ZR 308/09), it was decided that a gift made more than 10 years ago is no longer considered in the calculation of the compulsory share.

When does a gift contract become time-barred?

The question of the statute of limitations on a gift contract can be viewed in various contexts, such as in relation to the reclaiming of a gift or the assertion of claims from a gift contract.

- Reclaiming due to impoverishment of the donor: According to § 528 BGB, the donor can reclaim a gift if they are no longer able to maintain their reasonable living standard after the gift. The limitation period for this claim is three years from the knowledge of the circumstances that justify the reclaiming (§ 195 BGB).

- Reclaiming due to gross ingratitude: If the recipient of the gift is guilty of gross ingratitude towards the donor, the donor can revoke the gift according to § 530 BGB. Here, too, the limitation period is three years (§ 195 BGB).

- Mandatory Supplementary Share Claim: In inheritance cases, heirs can under certain circumstances assert a mandatory supplementary share claim if the testator made donations before their death. Here, the limitation period according to Section 2325 of the German Civil Code (BGB) is ten years from the time of the donation.

What conclusions can be drawn regarding the validity of a gift contract?

After thoroughly examining the various aspects that concern the validity of a gift contract, some key points and recommendations can be noted.

Summary of criteria for the validity of a gift contract

- Notarial Certification: A gift contract requires notarial certification in certain cases, particularly when gifting real estate, in accordance with Section 518 BGB and Section 311b BGB.

- Land Register Entry: When gifting real estate, an entry in the land register is required in accordance with Section 873 BGB.

- Effectiveness of the Contract: The gift contract must comply with legal requirements and must not contain any circumstances that make it ineffective, such as immorality.

- Revocation of Gifts and Estate: Gifts can under certain circumstances fall into the estate and influence the mandatory portion, in accordance with Sections 2325 ff. BGB.

Recommendation to use Beglaubigt.de for creating legally secure gift contracts

It is essential that a gift contract is carefully prepared and in compliance with legal regulations. Beglaubigt.de offers a platform that allows you to quickly and easily generate legally secure gift contracts as PDF or Word documents (Gift contract as PDF).

Using professional document creators like Beglaubigt.de can help avoid potential legal disputes and ensure that all aspects of the gift contract are legally protected.

Final thoughts and recommendations

It is evident that the validity of a gift contract depends on various factors and that careful attention to legal regulations is required. It is advisable to seek legal support when creating a gift contract or to rely on reliable platforms like Beglaubigt.de.

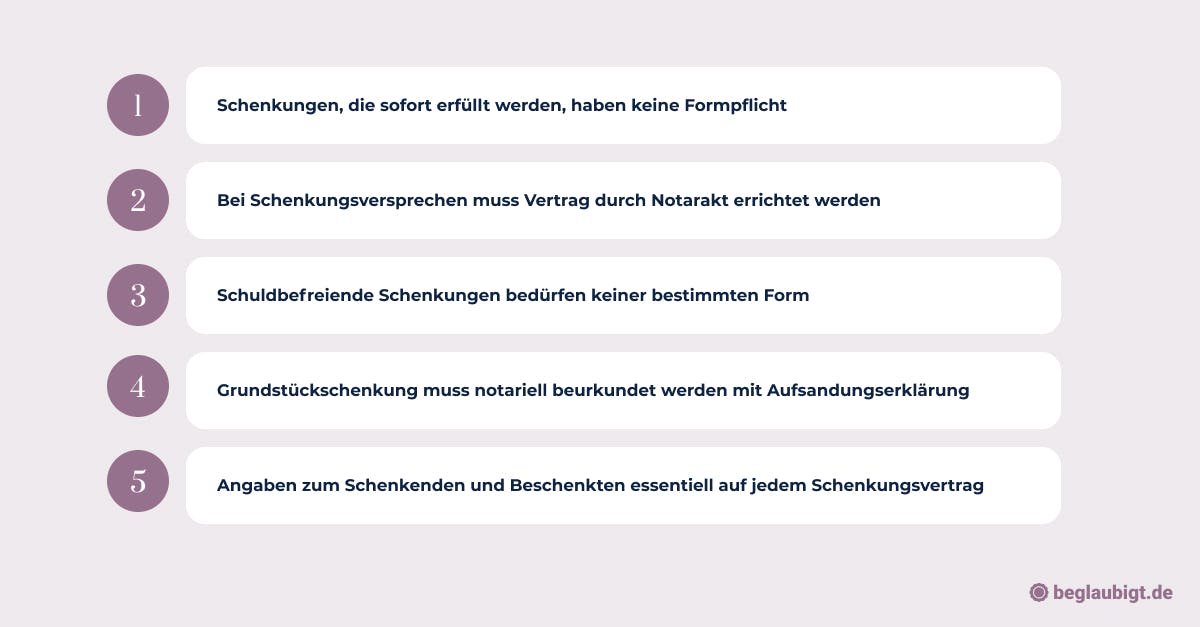

In summary, the validity of gift contracts can be broken down into a few key points:

- Voluntary transfer of assets

- Clear contractual intention

- Fulfillment of legal requirements

- No grounds for revocation

- Acceptance of the gift by the recipient

In any case, utmost care should be taken when drafting a gift contract to ensure that all legal requirements are met and the rights of all involved parties are protected.

At beglaubigt.de we offer digital solutions for your notary problems. Find out more here.

More Articles:

Certify Land Register Eexcerpt