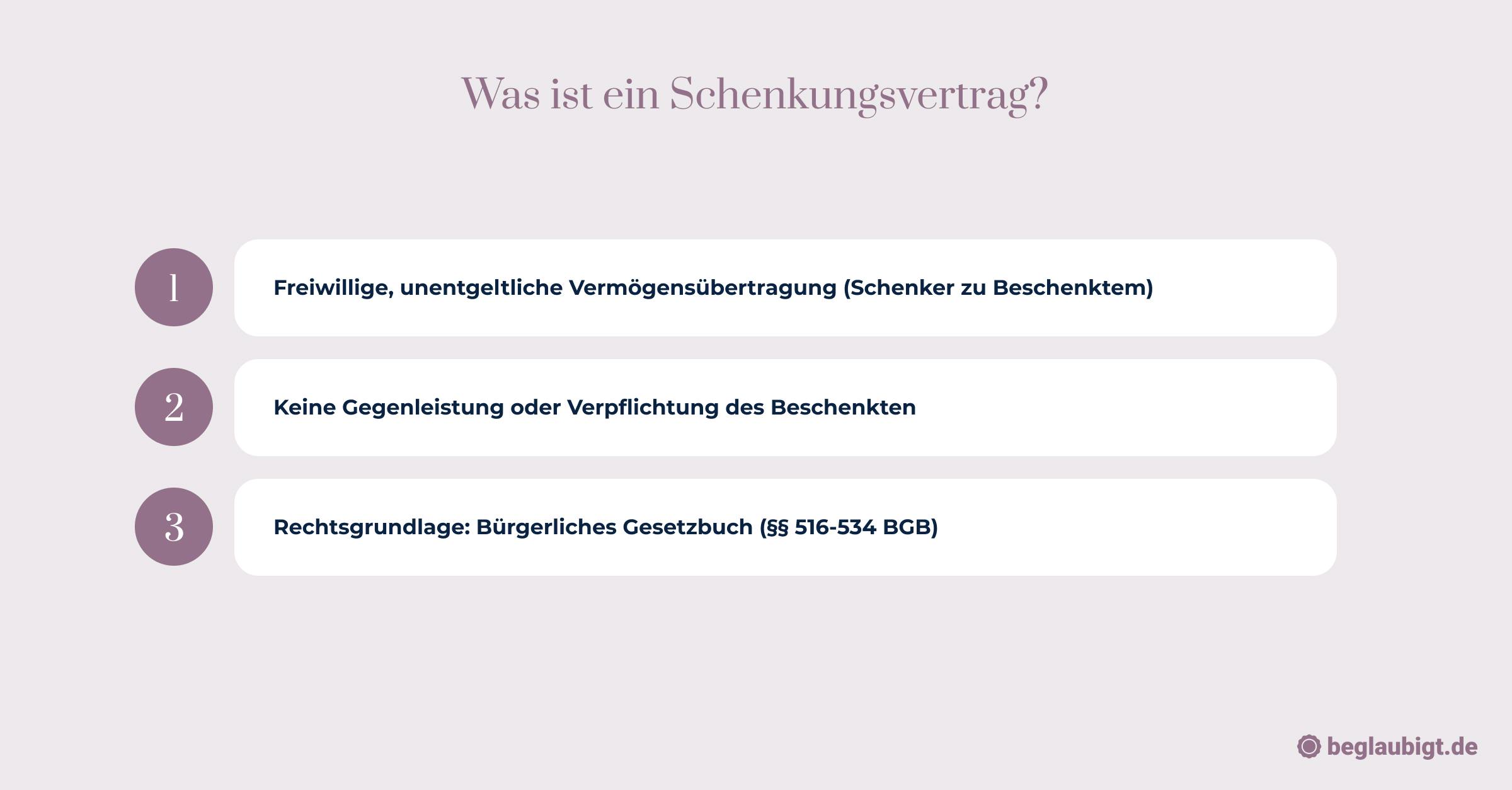

In the legal world, a gift agreement is a special instrument whereby one party, the donor, voluntarily and gratuitously transfers an object or a right to another party, the recipient. The basis for this contractual relationship is Section 516 of the German Civil Code (BGB), which states:

A gift is when someone transfers an asset from their estate to another person and both parties agree that the transfer should be made free of charge.

Within the German legal system, both movable and immovable property can be transferred by means of gift agreements.

For example, a gift may be a

- Car (Car donation agreement)

- Dogs (Dog donation agreement)

- Real estate (Real estate gift agreement)

- or even horses (Horse donation agreement)

act. Careful preparation and precise knowledge of what must be included in a gift agreement are crucial for its legal validity.

For those looking for a legally compliant, fast, and accurate way to draw up a gift agreement, the document generator from Beglaubigt.de offers an excellent solution. This online tool supports both laypeople and professionals in creating contracts in PDF or Word format, ensuring that the gifting process runs smoothly and is legally sound.

What must a gift agreement contain?

A gift agreement is a legal document that confirms the intention of one party (the donor) to transfer an item or right to another party (the recipient) free of charge. The legal basis for this is laid down in the German Civil Code (BGB), in particular in Section 516 BGB.

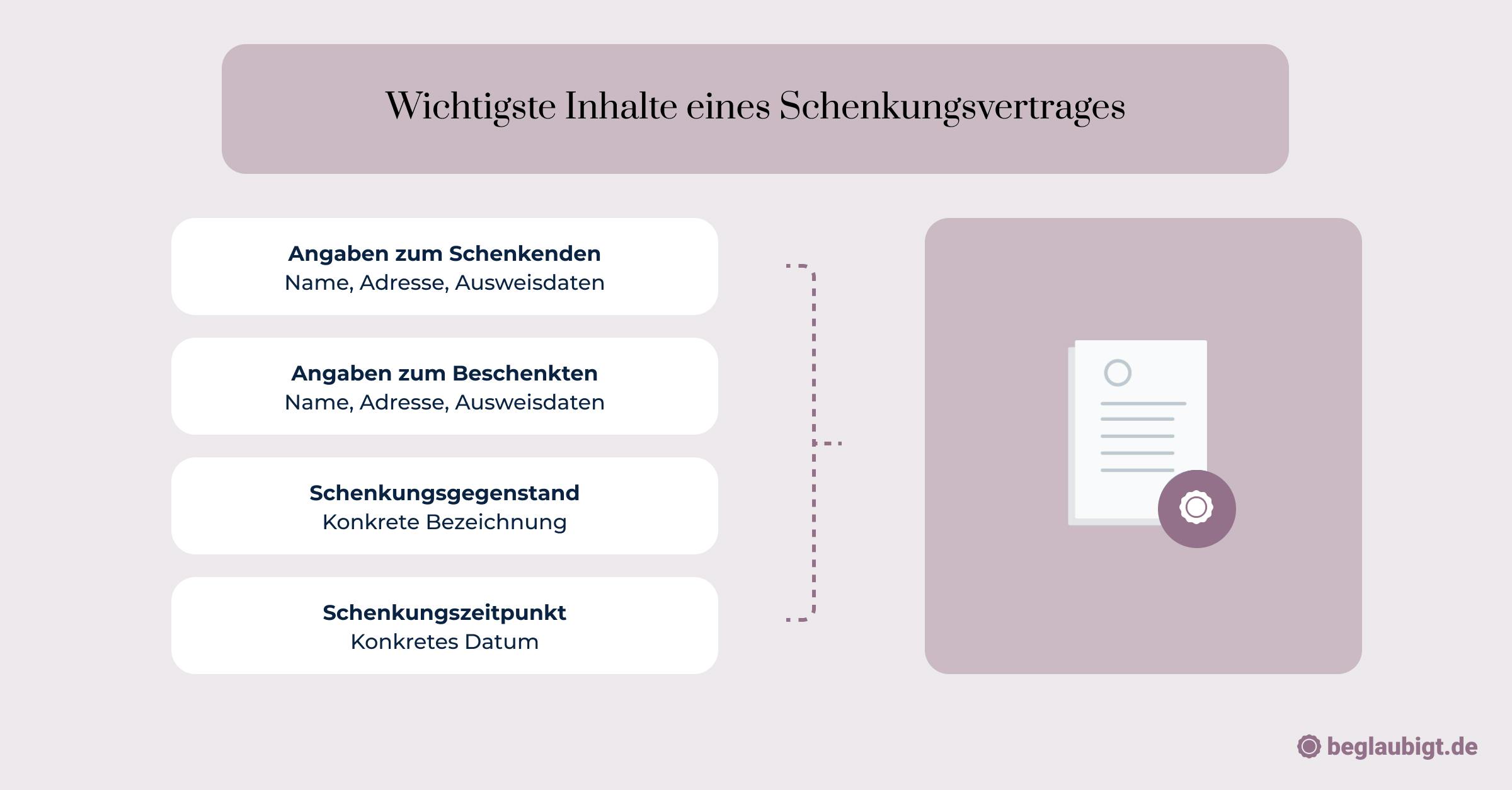

A valid gift agreement should contain the following key elements:

- Parties to the contract: These are the donor and the recipient. Both parties should be listed in the contract with their full names and addresses.

- Subject of the gift: This section should clearly and unambiguously describe what is being gifted. This can range from sums of money to movable objects to real estate.

- Clear intention to make a gift: It must be clearly stated that the transfer is being made without any consideration in return. In this respect, a gift agreement differs clearly from a purchase agreement.

- Signature of both parties: The contract is not concluded without the signatures of the donor and the recipient.

To simplify the contract creation process and ensure that all relevant information is included, the document creator from Beglaubigt.de offers a user-friendly and legally compliant platform. Here, users can create customized gift agreements in PDF or Word format that meet current legal requirements with just a few clicks.

You can use our digital tool for this: Create a gift agreement here.

Description of the parties in the gift agreement

The correct naming and description of the parties in a gift agreement is essential in order to create legal clarity and avoid subsequent ambiguities or disputes. There are certain basic elements that must be included.

Elements describing the parties:

- Full names: The exact and full names of the sender and recipient must be stated in the contract. Abbreviations or nicknames should be avoided.

- Addresses: The current residential addresses of both parties should be listed. This facilitates identification and can be important in the event of legal disputes.

- Date of birth: The date of birth can be provided in addition to more precisely identify the parties, especially in the case of common names.

- Nationality: In the case of international gifts or if one of the parties has a different nationality, it may be useful to specify the nationality.

- Legal capacity: It should be made clear that both parties have legal capacity. This means that they are able to enter into legally binding contracts. Special provisions may apply in the case of minor recipients.

- Legal representative: If one of the parties is represented by a legal representative, such as a guardian, this should be explicitly stated and the representative described accordingly.

What you can't do without:

- Clear distinction between donor and recipient: It must be clear who is the donor and who is the recipient in the gift agreement.

- Data accuracy: The parties' data should be up to date and correct. An outdated place of residence or incorrect names can call the validity of the contract into question.

- Possible representation relationships: If one of the parties acts through an authorized representative or legal representative, this must be clearly stated in the contract and the power of attorney must be attached or described accordingly.

An accurate and comprehensive description of the parties contributes significantly to the legal certainty of the gift agreement. In case of uncertainty or special circumstances, it may be advisable to seek legal advice or use professional templates, such as those provided by the document generator at Beglaubigt.de. (Gift agreement template)

Clear intention to make a gift in the gift agreement

A key aspect that distinguishes a gift from other types of contracts is the so-called "clear intention to make a gift." The contract must make it unambiguously clear that the transfer of the object or right is made without any expectation of consideration or remuneration. The gift contract should contain clear wording that excludes any appearance of hidden consideration.

Examples of clearly stating the intention to make a gift:

- Transfer of car: Mr. Müller transfers his car, a BMW Model X, to Ms. Schneider. The gift agreement could be worded as follows: "Mr. Müller hereby transfers the vehicle specified in the appendix to Ms. Schneider without any expectation of financial or material consideration in return."

- Real estate transfer: Ms. Becker gifts her daughter a house in Berlin. The contract could state: "Ms. Becker transfers the house registered in the Berlin land register, page 1234, to her daughter without expecting any remuneration or compensation of any kind."

- Jewelry transfer: Mr. Schmidt gives his niece a valuable diamond ring as a gift. The contract could include: "Mr. Schmidt gives his niece the diamond ring described in the appendix as a pure gift, without any conditions or expectations of consideration."

In all three examples, it is clear that the transfer is made without expectation of consideration. Such clear and unambiguous wording helps to avoid potential future legal ambiguities or disputes.

It is always advisable to have such formulations drawn up by experts or with the help of tools such as the document generator from Beglaubigt.de to ensure that the intention to make a gift is clearly and legally documented.

Sample gift agreement

Donation agreement

Between

Mr. Max Mustermann

Musterstraße 123

12345 Musterstadt

Date of birth: 01.01.1980

Nationality: German

hereinafter referred to as the "Donor" -

and

Mrs. Anna Beispiel

Beispielweg 456

67890 Beispieldorf

Date of birth: 02.02.1990

Nationality: German

hereinafter referred to as the "Recipient" -

the following gift agreement is concluded:

§1 Object of the gift

The donor hereby transfers to the donee a motor vehicle of the make Volkswagen, model Golf, year of manufacture 2020, with the vehicle identification number XYZ12345678901234 and the registration number MU-XY 1234, without expectation of any consideration.

§2 Handover

The said motor vehicle is handed over when this contract is signed. Ownership of the vehicle is transferred to the donee upon handover.

§3 Exclusion of liability

The donor transfers the vehicle in its current condition and excludes any liability for hidden defects.

§4 Final provisions

Should any provision of this contract be or become invalid or unenforceable, this shall not affect the validity of the remainder of the contract.

Place, date

Signature of donor Signature of donee

For individual and legally compliant gift agreements and other contractual matters, we recommend the free gift agreement document generator from Beglaubigt.de.

Is a gift agreement valid without a notary?

The question of whether a gift agreement must be notarized depends on the type of item being gifted. In principle, gift agreements in Germany can be concluded without any formal requirements, which means that they can also be valid when made verbally. However, there are certain exceptions where notarization is mandatory.

Basic rule and exceptions according to the BGB (German Civil Code):

- Informal gift agreements: For movable property such as cars, furniture, or money, notarization is not usually required. In such cases, a verbal agreement or a written contract without notarization is sufficient.

- Notarization: When donating real estate, in accordance with Section 311b (1) of the German Civil Code (BGB), notarization is mandatory. This also applies to other rights that are entered in the public register, such as land charges.

Examples of cases in which notarization is required:

- Property transfer: Mr. Fischer would like to gift a piece of land to his granddaughter. For this gift to be valid, a notary must certify the gift agreement.

- Transfer of company shares: Ms. Lehmann owns shares in a limited liability company (GmbH) and would like to transfer them to her nephew. Depending on the provisions in the articles of association, notarization may also be required in this case.

- Granting of residential rights: If someone is granted lifelong residential rights in a property, this must also be notarized.

Furthermore, it should be noted that visiting a notary involves costs, which we have listed here: How much does a gift agreement at a notary cost?

Legal consequences of disregarding formal requirements: If you violate the formal requirements, for example by gifting a property without notarization, the gift agreement is invalid. This can result in significant legal and financial disadvantages.

When is a gift agreement invalid?

A gift agreement, like any other contract, may be considered invalid under certain circumstances. The invalidity of a contract means that it has no legal validity from the outset. It is therefore essential to understand under what circumstances a gift agreement could lose its legal validity.

Reasons for the invalidity of gift agreements:

- Formal defects: As already mentioned, certain gifts, in particular those involving real estate, require notarization in accordance with Section 311b (1) of the German Civil Code (BGB). Any violation of this formal requirement will render the contract invalid.

- Deception or threat: If a party is induced to sign a gift agreement through deception or threat, this agreement is contestable in accordance with Sections 123 and 142 of the German Civil Code (BGB) and is therefore invalid.

- Unconscionability: A gift agreement that violates public policy is void under Section 138 of the German Civil Code (BGB). An example of this could be an agreement drawn up to circumvent compulsory portions.

Examples of case law on the invalidity of gift agreements:

- Federal Court of Justice, ruling of February 7, 2001 – XII ZR 244/98: A gift agreement in which the donor gave the recipient a large sum of money on the condition that the recipient invest it in shares of a specific company was declared null and void on the grounds of immoral damage to third parties.

- Federal Court of Justice, ruling of January 19, 1994 – IV ZR 219/92: A gift agreement was declared invalid because it was signed under considerable pressure and in an emotionally stressful situation, which exploited a predicament.

The invalidity of a gift agreement has far-reaching legal consequences. According to Section 812 (1) of the German Civil Code (BGB), the recipient is obliged to return the item or right received to the donor.

This reversal serves to restore the original situation prior to the gift being made. In addition, there may be additional legal and financial disadvantages for the parties involved. These may include claims for damages or the need to rearrange ownership structures.

When drafting a gift agreement, legal requirements must be strictly observed. Section 516 (1) of the German Civil Code (BGB) defines a gift as a transfer of assets by one person to another for the purpose of enriching the latter, provided that both parties agree that the transfer is made free of charge.

It is essential to formulate the subject matter of the gift and the associated intentions and conditions precisely and unambiguously. This serves to avoid misunderstandings and legal ambiguities that could jeopardize the validity of the contract.

The following aspects should be clearly defined in the gift agreement:

- Identity of the contracting parties: The full names and addresses of the sender and recipient must be clearly stated.

- Subject of the gift: A precise description of the object or right to be gifted is required in order to identify it unambiguously.

- Transfer: The terms and conditions for transferring the donated item should be specified in order to document the fulfillment of the donation.

- Voluntary nature: The declaration that the gift is voluntary and without consideration emphasizes the gratuitous nature of the gift.

General rules and tips for wording:

- Precise description: The object of the gift should be described precisely. Vague or general descriptions can lead to problems of interpretation.

- Exclusion of conditions: Since this is a gift, it should be made clear that no consideration is expected in return. Any conditions or expectations should be expressly excluded or clearly stated in the contract.

- Information about the parties: Full names, addresses, and any other relevant information should be included in the contract in order to clearly identify both the donor and the recipient.

Typical wording and clauses:

- Transfer of ownership: "The donor hereby transfers the property described in detail in the appendix to the recipient without any consideration."

- Disclaimer: "The donor transfers ownership in the current condition and excludes any liability for hidden defects or faults."

- Rights of recovery: "If the recipient dies before the donor, the gifted property shall revert to the donor or their heirs."

Legal pitfalls and how to avoid them:

- Unclear wording: Avoid vague terms or unclear descriptions. If you are unsure, you should consider seeking legal advice.

- Forgotten provisions: A common mistake is to omit important provisions such as rights of recovery or provisions in the event of death.

- Failure to comply with legal requirements: Particular care must be taken to ensure that all legal requirements are met when donating real estate or other special assets.

In summary: What must be included in a gift agreement

The most important points in brief - A gift agreement must contain the following essential information in order to be legally valid:

- Precise details of the contracting parties: Full names, addresses, dates of birth, nationalities, and, where applicable, details of legal representatives, in order to clearly identify the parties and ensure legal clarity.

- Detailed description of the object of the gift: A precise definition of the object or right to be gifted in order to avoid misunderstandings and to clearly regulate the transfer.

- Agreement on the gratuitous nature of the gift: The explicit statement that the gift is made without any consideration in return, supported by clear communication of the intentions and conditions associated with the gift.

To ensure that the gift agreement covers all relevant points and is legally correct, the document generator from Beglaubigt.de offers a reliable platform. With its help, both laypeople and experts can create customized and legally sound gift agreements.

More Articles:

Working Student Contract Vacation

Digitale Gmbh Gruendung Durch Das Elektronische Notariatsform Gruendungsgesetz Eng