Contents of gift agreements: What should be included?

A gift agreement is a legal document that regulates the transfer of property without consideration. It is very important that such an agreement contains clear and precise relevant information in order to avoid legal disputes and to be legally binding. This section explains the basic information that must be included in a gift agreement.

A gift agreement should first contain the personal details of the parties involved, i.e. the donor and the donee. This includes full names, addresses and, if applicable, dates of birth. This ensures that the contracting parties can be clearly identified.

In addition, it is essential to describe the gift in detail. This could be real estate, a vehicle, a bank account, or another asset. The description should be as detailed as possible to avoid misunderstandings or legal disputes.

For example, for real estate, the exact address, property number, and size should be specified. For a vehicle, the make, model, chassis number, and registration date are relevant.

Furthermore, the conditions and clauses under which the gift is made should be set out in the gift agreement. These include, among other things:

- The fulfillment of certain requirements or conditions by the recipient

- Provisions regarding liability for any taxes or fees that may be incurred

- Provisions for reclaiming the gift under certain circumstances, such as gross ingratitude on the part of the recipient (Section 530 BGB) or if the donor becomes needy after making the gift (Section 528 BGB)

Even though the gift agreement is generally not subject to any formal requirements, it is advisable to draw it up in writing so that it can serve as evidence in the event of a dispute. For certain gifts, such as real estate, the written form is even required by law (Section 518 (1) BGB). (see: Gift agreement for real estate)

What basic information must be included in a gift agreement?

Basic information that must be included in a gift agreement includes:

- Personal data of the contracting parties: The full names, addresses, and, if applicable, dates of birth of the sender and recipient to ensure clear identification of the persons involved.

- Detailed description of the donated item: The donated item should be described in detail to avoid misunderstandings or legal disputes. Examples of such details include the address, property number, and size of a real estate property, or the make, model, chassis number, and registration date of a vehicle.

- Terms and conditions of the gift: The contract should contain the terms and conditions under which the gift is made. These include, for example, any conditions imposed on the recipient, provisions regarding liability for taxes or fees, and rights of recovery or revocation clauses in certain cases (e.g., gross ingratitude on the part of the recipient or neediness on the part of the donor).

Although a gift agreement does not generally require any specific form, it is advisable to draw it up in writing so that it can serve as evidence in the event of a dispute. For certain gifts, such as real estate, the written form is even required by law (Section 518 (1) of the German Civil Code (BGB)).

Why is it crucial to describe the donated item in detail?

The exact description of the donated item is crucial for several reasons:

- Clear identification of the gifted item: A detailed description ensures that all parties involved clearly understand which item or asset is the subject of the gift. This minimizes the likelihood of misunderstandings and ambiguities that could lead to legal disputes.

- Legal binding force: A precise description contributes to the legal certainty of the gift agreement by clarifying the obligations of the donor and the recipient. In the worst case, the absence of a precise description can lead to the agreement being considered invalid or incomplete and the gift not being legally effective.

- Tax stuff: For the tax treatment of gifts, it's important to know exactly what's being gifted. How the gift is valued can affect how much gift tax is owed. A detailed description helps to figure out the value of the gift correctly and calculate the tax burden accordingly.

- Rights of recovery and revocation clauses: In the event of recovery claims or revocation clauses specified in the gift agreement, it is crucial to describe the gifted item in detail. This makes it possible to clearly identify the originally gifted item or asset if necessary and, if applicable, to reclaim it.

A precise description of the object of the gift thus contributes significantly to the legal certainty and clarity of the gift agreement and helps to avoid potential conflicts or disputes between the parties involved.

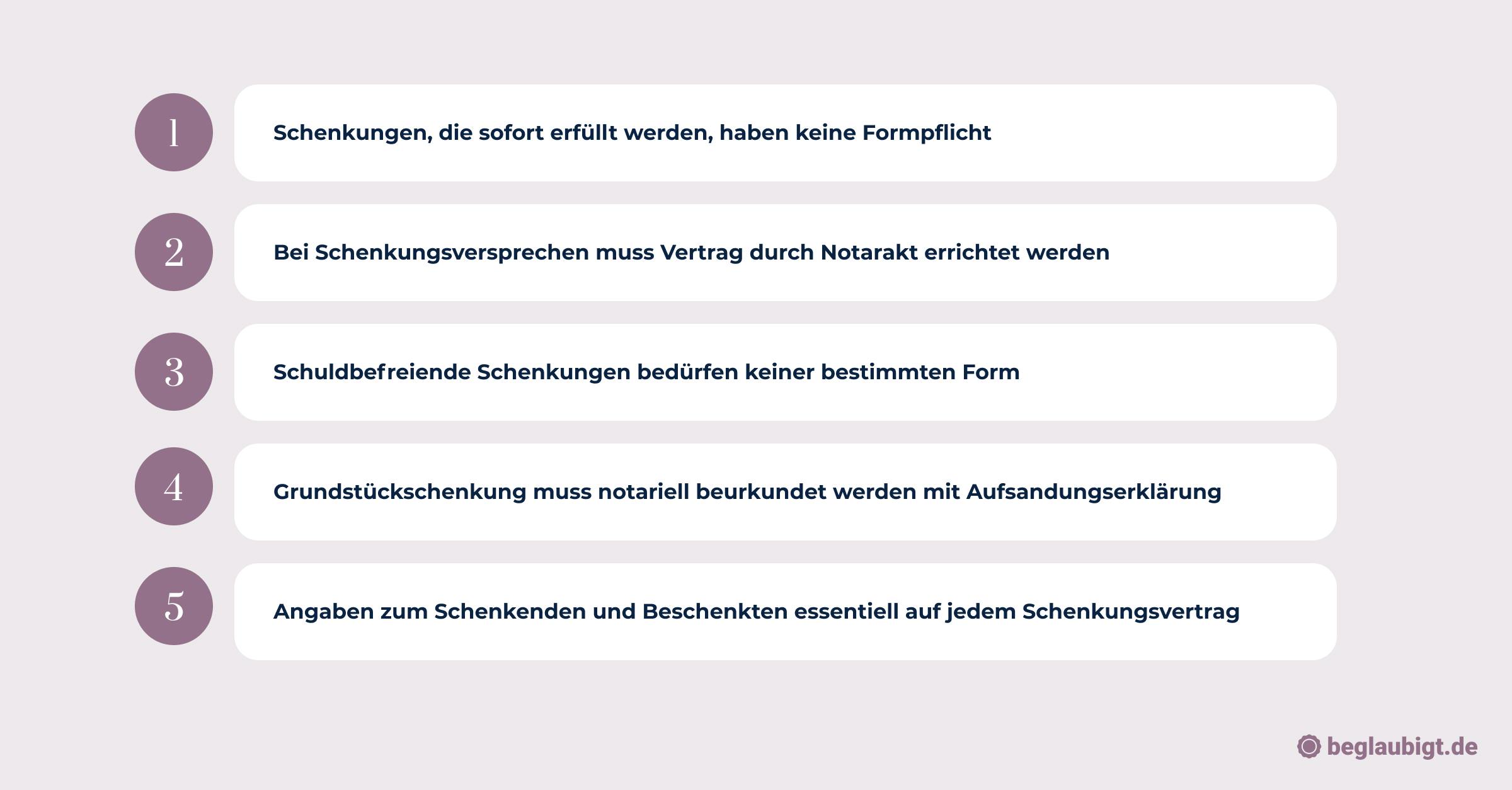

Form of gift agreements: What are the legal requirements?

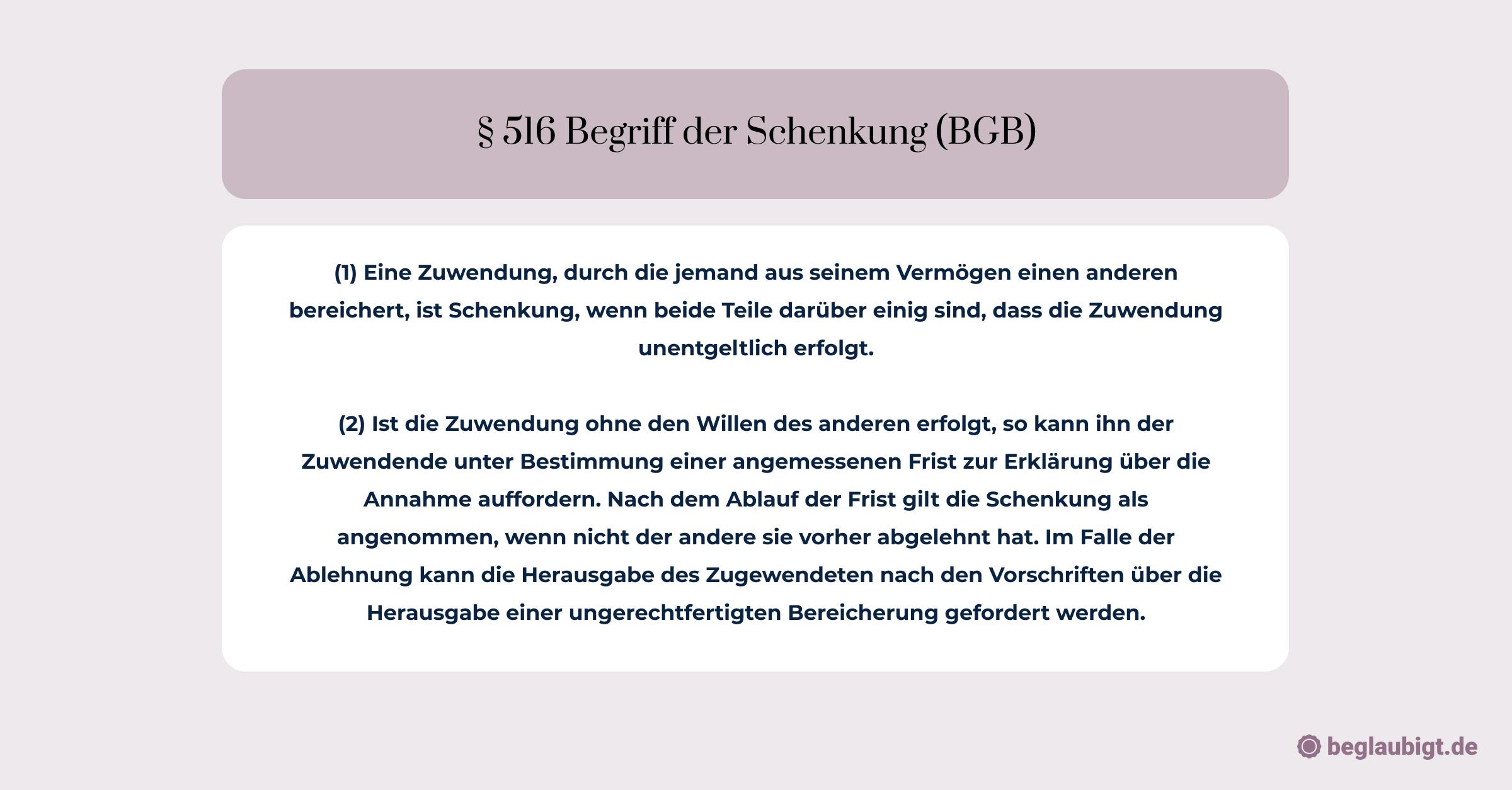

When drawing up a gift agreement, various legal requirements must be taken into account to ensure its validity. In Germany, the legal framework for gifts is regulated by the Civil Code (BGB). Here are some basic legal requirements for the form of gift agreements:

- Written form (Section 518 BGB): In principle, a gift agreement can be concluded verbally. However, the BGB stipulates that certain gifts must be made in writing. This applies in particular to gifts where the donor wishes to reserve a right (e.g., revocation or reclamation). In such cases, the agreement must be made in writing and signed by both parties (donor and recipient).

- Notarization (§ 311b BGB): Notarization is required for gifts of real estate or rights equivalent to real estate (e.g., hereditary building rights). The contract must be notarized by a notary and signed by both parties in the notary's presence. Without notarization, the gift contract is invalid.

- Agreement (Section 516 BGB): A gift agreement requires agreement between the donor and the recipient regarding the object of the gift and the transfer of ownership free of charge. This agreement (also referred to as "transfer of ownership") must be clearly stated in the agreement.

- Specificity of the gift: The gift must be described in detail in the contract so that it is clear which assets or rights are being transferred. Vague or unclear gifts can jeopardize the validity of the contract.

- Compliance with legal requirements: Gift agreements must comply with legal requirements, e.g., with regard to formal requirements or tax reporting obligations. Violations of legal requirements can lead to the invalidity of the agreement or to sanctions.

When is a written gift agreement required?

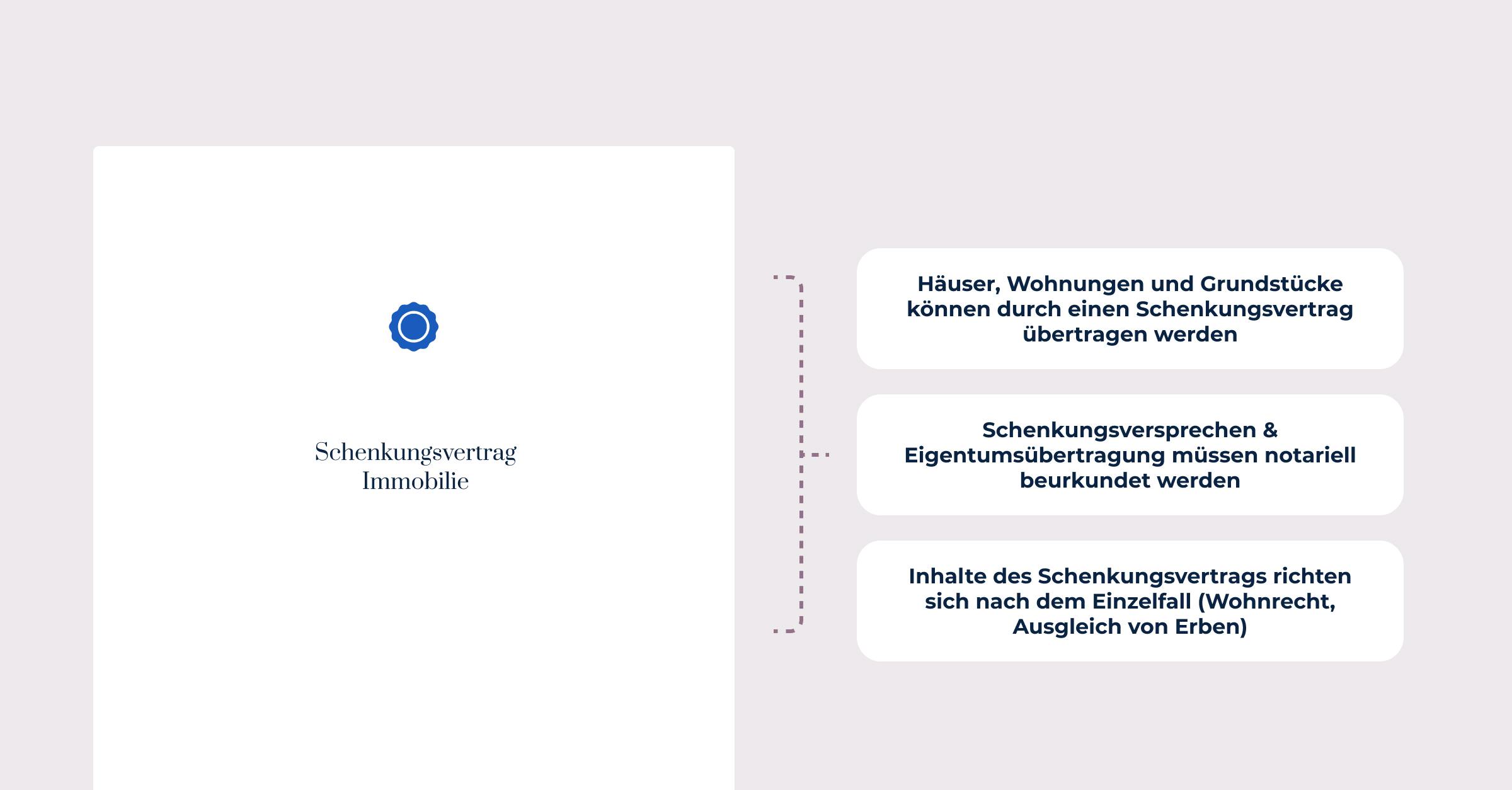

In certain cases, a gift agreement must be in writing, particularly when it concerns the gift of real estate. According to Section 518 (1) of the German Civil Code (BGB), the written form is required for gifts of land or rights equivalent to land. In such cases, the gift agreement must be signed by both parties, the donor and the recipient.

It is important to note that the donation of real estate requires not only written form but also notarization (§ 311b (1) BGB) and entry in the land register in order to be legally valid. Without these additional steps, the donation of real estate is not complete. (For more information, see: Real estate donation agreement)

In other cases involving the donation of movable objects or assets, a donation agreement is generally not subject to any formal requirements.

This means that it can be concluded verbally, in writing or even by conclusive action (implied).

Nevertheless, it is advisable to conclude a written contract in these cases as well in order to have clear proof of the agreements made in the event of a dispute and to avoid legal disputes.

What elements are essential for a gift agreement to be valid?

Several elements are essential for a gift agreement to be valid.

First of all, there must be an agreement between the parties involved, the donor and the recipient, regarding the gift and the transfer of ownership free of charge. This agreement, also known as transfer of ownership, should be clearly stated in the contract.

Furthermore, the gift agreement should describe the object of the gift in detail. The description should be so precise that there is no doubt about the assets or rights to be transferred. Indeterminate or unclear objects of gifts can jeopardize the validity of the agreement.

Depending on the type of gift, different formal requirements must be observed.

While many gifts can be agreed upon verbally, there are cases in which a written agreement or even notarization is required. Compliance with the relevant formal requirements is crucial for the validity of the gift agreement.

In addition, legal requirements, such as tax reporting obligations, must be complied with. Violations of such requirements can not only render the contract invalid, but also result in sanctions or penalties for the parties involved.

Overall, the validity of a gift agreement depends on the transfer of ownership, the precise description of the gift, compliance with formal requirements, and observance of legal provisions. Taking these components into account helps to ensure the legal certainty and effectiveness of the gift agreement.

Related articles:

- The meaning and definition of gift agreements: What does gift agreement mean?

- Special features of real estate gifts: Real estate gift agreement

How can you ensure that your gift agreement complies with legal requirements?

The following elements are essential for a gift agreement to be valid:

- Mutual declarations of intent: Both parties, the donor and the recipient, must express their intention to make a gift by issuing a mutual declaration of intent. This declaration of intent can take the form of verbal, written, or implied consent, depending on the form of the gift agreement.

- Agreement on the object of the gift: The contracting parties must agree on the object of the gift. This requires a precise description of the asset or object that is the subject of the gift.

- Capacity of the contracting parties: Both the donor and the recipient must be legally capable of entering into a contract. This includes legal capacity (at least limited legal capacity) and the age of majority of the parties involved, unless legal representatives are acting on behalf of minors.

- Compliance with legal formal requirements: If a specific form is required for the gift agreement, such as the written form for gifts of real estate (Section 518 (1) BGB), this form must be complied with in order to ensure the validity of the agreement.

- Notarization and land registry entry for real estate gifts: When gifting real estate, in addition to the written form, notarization (§ 311b (1) BGB) and entry in the land registry are also required in order for the gift to be legally effective.

- No violations of legal provisions or public policy: The gift agreement must not contain any provisions that violate applicable law or public policy. Otherwise, the agreement may be considered null and void.

By observing these fundamental components, the validity of a gift agreement can be ensured. It is advisable to seek the assistance of a lawyer or notary when drawing up a gift agreement in order to avoid legal errors and ensure the legal certainty of the agreement.

Types of gift agreements: Different types of agreements and their areas of application

What are the different types of gift agreements and how do they differ?

There are various types of gift agreements, which differ in terms of the object of the gift, the conditions, and the form. The following list shows some common types of agreements and their areas of application:

- Simple gift: A simple gift is the most basic type of gift agreement, in which an item or asset is transferred from the donor to the recipient free of charge and without conditions. This type of agreement is often used for the donation of movable items such as vehicles, household items, or sums of money.

- Gift with conditions: A gift with conditions imposes certain conditions or requirements on the recipient that must be fulfilled for the gift to be legally valid. For example, the donor may require the recipient to complete a specific course of education or to use a property for a specific purpose only.

- Gift with right of recovery: This is a gift agreement in which the donor has the right to reclaim the gift under certain circumstances. This may be the case, for example, if the donor becomes needy after making the gift (Section 528 of the German Civil Code (BGB)) or if the recipient shows gross ingratitude (Section 530 BGB).

- Gift upon death: This type of gift agreement stipulates that the gift will only be transferred to the recipient after the death of the donor. This is essentially a disposition of property upon death, but it is subject to the formal requirements of a gift agreement.

- Real estate donation: When donating real estate or rights equivalent to real estate, a special type of contract is required that complies with the legal formal requirements (Section 518 (1) BGB). This contract must be in writing, notarized (§ 311b (1) BGB) and entered in the land register in order to be legally valid. (Read more: Real estate gift contract)

The choice of the appropriate type of contract depends on various factors, such as the object of the gift, the wishes and intentions of the contracting parties, and the legal requirements. It is advisable to seek advice from a lawyer or notary when selecting and drafting a gift contract to ensure that all requirements are met and that the gift is legally valid.

In which situations is a specific type of gift agreement appropriate?

The choice of the appropriate type of gift agreement depends on the individual situation, the intentions of the contracting parties, and the object of the gift. Here are some examples of situations in which a particular type of gift agreement is appropriate:

- Simple gift: This type of gift agreement is appropriate when the donor wishes to transfer an asset to the recipient without any conditions or requirements. Examples include gifts of small amounts of money, vehicles, or household items to friends or family members.

- Gift with conditions: This type of contract is appropriate if the donor wishes to attach certain conditions to the gift. For example, a parent may gift a property to their child on the condition that the child completes a certain education or uses the property for a specific purpose.

- Gift with right of recovery: This type of contract is appropriate in situations where the donor wishes to have the option of recovering the gift under certain circumstances. This may be the case, for example, if the donor wishes to ensure financial security for the future or wants to be sure that the recipient will handle the gift responsibly.

- Gift upon death: This type of contract is appropriate if the donor wishes to transfer their assets to the recipient only after their death. This may be the case, for example, if the donor wishes to retain control over the assets until they die.

- Real estate donation: This special type of contract is required for the donation of real estate or rights equivalent to real estate. It is important to observe the legal formal requirements, such as the written form, notarization, and entry in the land register.

How can the document creator at Beglaubigt.de help you choose the right type of gift agreement?

The document generator from Beglaubigt.de is a helpful resource that can assist you in selecting the right type of gift agreement. By using this platform, users have a legally compliant, fast, and convenient way to generate contracts as PDF or Word documents. Here are some advantages and features of the document generator that are helpful in selecting the right type of gift agreement:

- Templates and customization options: Beglaubigt.de offers various templates for gift agreements that are tailored to the most common types of agreements. Users can customize the templates according to their individual needs and be sure that they are legally correct and up to date.

- User-friendly interface: The platform is simple and intuitive to use, allowing users without prior legal knowledge to select and create the appropriate type of gift agreement.

- Helpful tips and explanations: During the creation process, Beglaubigt.de provides useful tips and explanations on the various types of contracts, formal requirements, and legal requirements. This makes it easier to select the appropriate type of gift agreement and ensures the legal validity of the document.

- Time and cost savings: By using the document generator from Beglaubigt.de, users save time and money that would otherwise be spent on consulting a lawyer or notary. Since the platform generates contracts quickly and easily, users can conclude their gift agreements in a timely manner.

- Up-to-date and legally compliant: Beglaubigt.de ensures that the contract templates are always up to date and comply with current laws, regulations, and case law. This means that users can be confident that their gift agreements are legally correct and secure.

Overall, the document generator from Beglaubigt.de offers an effective and user-friendly way to select and create the appropriate type of gift agreement. By using this platform, users can ensure that their gift agreements comply with legal requirements and meet their individual needs.

What are the tax implications and obligations associated with gifts?

The tax aspects and obligations relating to gifts are regulated in Germany by the Inheritance and Gift Tax Act (ErbStG). Gift tax is a form of property transfer tax that is levied on gratuitous transfers of property between living persons. Here are some important aspects and obligations to consider when making gifts:

- Exemptions: Certain exemptions apply to gifts, up to which no gift tax is payable. These exemptions depend on the degree of kinship between the donor and the recipient (Section 16 ErbStG). For example, the allowance for gifts to spouses or registered partners is €500,000, for children €400,000, and for grandchildren €200,000. The allowances are lower for more distant relatives or unrelated persons.

- Tax rates: Gift tax is levied in various tax classes, which also depend on the degree of kinship between the donor and the recipient (Section 15 ErbStG). Tax rates range from 7% to 50% and may vary depending on the amount of assets transferred.

- Tax reporting obligation: Gifts must generally be reported to the relevant tax office (Section 30 ErbStG). Both the donor and the recipient are required to report the gift. It is important to comply with the statutory deadlines in order to avoid possible sanctions or penalties.

- Valuation of the gifted asset: The value of the gifted asset is decisive for the calculation of gift tax. Real estate, businesses, and other assets are valued in accordance with the provisions of the Valuation Act (BewG). In some cases, it may be advisable to obtain an appraisal or estimate from an independent expert in order to determine the correct value.

One example from case law is the ruling of the Federal Fiscal Court (BFH) of May 23, 2012 (II R 45/10), which dealt with the valuation of a property for gift tax purposes. The BFH ruled that when valuing a developed property for gift tax purposes, the actual circumstances on the valuation date are decisive, not the originally planned construction costs.

What advantages does the document creator from Beglaubigt.de offer compared to conventional methods?

The document generator from Beglaubigt.de offers a number of advantages over traditional methods of creating contracts and legal documents. These advantages include:

- Time savings: The platform enables users to create legal documents such as gift agreements quickly and efficiently. Compared to manual creation or consulting a lawyer or notary, this can save a considerable amount of time.

- Cost efficiency: The document generator from Beglaubigt.de is a more cost-effective solution than hiring lawyers or notaries to draw up contracts. Users can save money without compromising on legal certainty and quality.

- Legal certainty and up-to-date information: The contract templates on Beglaubigt.de are up to date with the latest legislation and case law. The platform ensures that the templates are always up to date and legally compliant, so that users can be confident that their documents meet current legal requirements.

- User-friendliness: The platform is intuitive and easy to use, even for users without prior legal knowledge. Thanks to the user-friendly interface, even laypeople can create legal documents without having to familiarize themselves with complex legal matters.

- Adaptability: Beglaubigt.de offers a wide selection of templates for various types of contracts and legal documents. Users can adapt the templates to their individual needs, which increases the flexibility and practicality of the documents created.

- Digital storage and accessibility: Documents created on Beglaubigt.de can be saved as PDF or Word documents and accessed at any time. This makes it easier to organize and manage documents and allows quick access when needed.

- Helpful tips and explanations: During the creation process, users receive helpful information and explanations about the various contract types, formal requirements, and legal requirements. This makes it easier to create legally compliant documents and reduces the risk of errors or ambiguities.

More Articles:

Working Student Contract Vacation

Digitale Gmbh Gruendung Durch Das Elektronische Notariatsform Gruendungsgesetz Eng