Leaving the Church in Germany: Statistical Overview and Trends

In 2021, 639,205 people left the church in Germany. This remarkable figure reflects a striking trend in German society: an increasing number of people are deciding to officially leave the church.

This development is not only a clear sign of changing religious and ideological attitudes among the population, but also raises an important practical question: How much does it actually cost to leave the church?

In this article, we will take a detailed look at the costs of leaving the church in the various federal states and provide an overview of what this decision means financially for those affected.

New: Beglaubigt.de now offers church withdrawal: https://beglaubigt.de/kirchenaustritt

What does leaving the church cost: Legal framework for leaving the church

Fundamental right to freedom of religion (Art. 4 GG) and leaving the church

Leaving the church in Germany is protected by the fundamental right to freedom of religion, which is set out in Article 4 of the Basic Law (GG). This article guarantees every citizen:

- Freedom of religious practice.

- The right to leave a religious community at any time.

This regulation forms the legal basis for leaving the church and ensures that no citizen is held in a religious community against their will.

Different responsibilities: Registry office vs. local court

The responsibilities of registry offices and local courts in Germany are clearly defined and differ significantly.

- Registry office: The registry office is primarily responsible for civil status matters. This includes the registration of births, marriages, civil partnerships, and deaths. Registry offices are also responsible for issuing civil status documents such as birth, marriage, and death certificates. In addition, they process name changes that are not of a legal nature and perform marriages.

- Local court: Local courts, on the other hand, deal with a wide range of legal matters. They are the court of first instance in civil, family, and criminal cases. Their responsibilities include handling inheritance matters, conducting foreclosure sales, ruling on maintenance disputes, and dealing with guardianship and custody matters. Local courts are also responsible for name changes resulting from gender reassignment procedures.

Costs of leaving the church: Costs in different federal states

The costs for leaving the church in Germany vary depending on the federal state. These fees usually cover the administrative costs associated with processing the withdrawal. Below is a complete list of the fees for leaving the church in the various federal states:

- Baden-Württemberg: approx. 31–35 euros

- Bavaria: approx. 31 - 35 euros

- Berlin: approx. 30 euros

- Brandenburg: no fee

- Bremen: approx. 25 euros

- Hamburg: approx. 31 euros

- Hesse: approx. 25 - 30 euros

- Mecklenburg-Western Pomerania: approx. 10–15 euros

- Lower Saxony: approx. 25 euros

- North Rhine-Westphalia: approx. 30 euros

- Rhineland-Palatinate: approx. 30 euros

- Saarland: approx. 32 euros

- Saxony: no fee

- Saxony-Anhalt: no fee

- Schleswig-Holstein: approx. 25 - 30 euros

- Thuringia: approx. 25 euros

The fees mentioned may vary and should be checked with the relevant authority, usually the registry office or local court, to be on the safe side.

An interesting article for further reading: Is leaving the church financially worthwhile?

Fee structure: Why does it cost money to leave the church?

Leaving the church in Germany involves costs, which are mainly due to administrative reasons. These fees cover various aspects of the withdrawal process:

- Administrative effort: The process of leaving the church requires certain administrative steps. These include processing the application to leave, registering the departure in official records, and notifying the relevant parish. These procedures require working time and resources from the responsible authorities.

- Personnel costs: The processing of withdrawal applications is carried out by public administration employees, usually at registry offices or local courts. The fees help to cover the personnel costs incurred for these services.

- Administrative fees: In Germany, administrative fees are a common means of covering the costs of public services. Leaving the church falls under this category, which is why fees are charged.

- Federal structure: The different fees in the federal states also reflect Germany's federal structure. Since the federal states can make their own regulations in certain areas, this leads to variations in administrative fees.

What do I have to pay if I leave the church?

When leaving the church in Germany, various fees must be paid. These fees can vary depending on the federal state. They typically range between €30 and €60. The exact amount of the fee depends on the local court or registry office where the leaving of the church is declared.

- In some federal states, such as Bavaria and North Rhine-Westphalia, the fee is €30.

- In other federal states, such as Hamburg or Bremen, the fee can be as high as 60 euros.

- It is important to note that these fees are subject to change at any time, so it is advisable to check the latest information or contact the relevant office directly.

Apart from the one-time fee for leaving the church, there are no other direct costs associated with leaving the church. However, leaving the church can have financial implications in other areas, particularly through the elimination of church tax. This tax, which is paid by church members in Germany, is no longer applicable after leaving the church, resulting in a reduction in monthly expenses.

You can find more detailed information in the following article: What do I have to do if I want to leave the church?

Do you have more money if you leave the church?

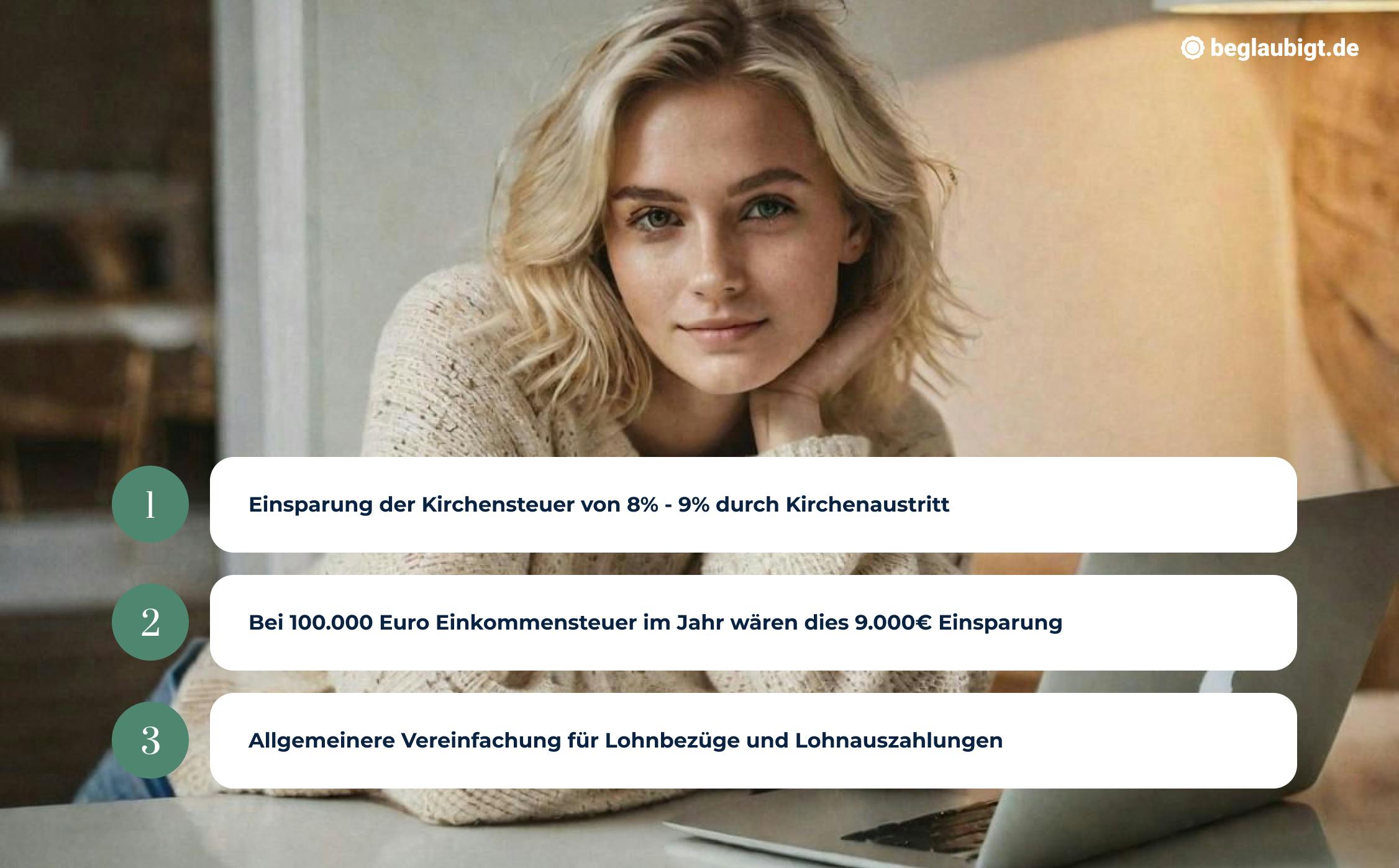

Leaving the church can have financial implications, particularly with regard to church tax. In Germany, church tax is a significant financial obligation for members of certain religious communities. It usually amounts to 8 to 9 percent of income tax and is collected directly by the tax authorities and forwarded to the relevant churches.

- Financial savings: By leaving the church, you are no longer required to pay church tax. This can lead to a noticeable reduction in monthly payments and thus to more disposable income.

- Long-term view: The amount of savings depends on individual income. Higher incomes result in higher church tax amounts, which means that people in higher income brackets can save more by leaving the church.

However, it is important to consider non-financial aspects as well. Leaving the church also has an impact on participation in church rituals and ceremonies. Many churches restrict participation in certain sacraments and church activities to non-members. This can play a significant role for people who value their religious life.

Differences and variations in fees for leaving the church

The variability in fees can be explained by various factors:

Local legislation: The fee rates are determined individually by the federal states.

Administrative costs: Differences in administrative costs may result in different fees.

Legal requirements: Changes in legislation may affect the amount of fees charged.

Hardship provisions and reductions

In Germany, there are certain hardship provisions and reductions for leaving the church that apply in the following situations:

- Low income and social benefits: People on low incomes or receiving social benefits can often apply for reductions or exemptions from exit fees.

- School pupils, students, and trainees: Under certain conditions, these groups may also benefit from reduced fees or exemptions.

The exact provisions vary depending on the federal state and usually require appropriate proof of financial circumstances.

Impact on specific groups (e.g., Hartz IV recipients)

Special regulations apply to specific groups such as Hartz IV recipients in some federal states:

- Exemption from fees: In some federal states, Hartz IV recipients can be exempted from paying exit fees.

- Application procedure: As a rule, this exemption must be applied for at the relevant registry office or local court, whereby appropriate proof of receipt of Hartz IV benefits must be provided.

These regulations are intended to ensure that leaving the church is also possible for financially disadvantaged individuals.

Practical examples and implementation of the regulations

In practice, it has been shown that the implementation of these regulations can vary depending on the region and authority. Some examples:

- Berlin: Here, recipients of social benefits can apply for a fee exemption by presenting their benefit notices.

- Bavaria: In Bavaria, a reduction in fees is possible, but the requirements and process are more strictly defined.

These examples illustrate how local authorities interpret and apply hardship provisions. It is advisable for those affected to contact the relevant authority in advance to understand the specific requirements and procedures for a possible fee exemption or reduction.

More Articles: