beglaubigt.de

Download working student contract now

Generate a legally reviewed working student contract as a PDF according to the latest standards in no time. The template is free and fully customizable.

DOWNLOAD PDF

+10 Tausend

Verträge erstellt

100%

Anpassbare Vorlagen

2 Minuten

Bis zur Fertigstellung

4 Stunden

Zeiteinsparung

In collaboration with top-notch lawyers for legal security

The contract template was created by a team of expert lawyers and is regularly reviewed for up-to-dateness. We continuously work to provide legally compliant and up-to-date contract templates.

And it's simple and digital. Do you have an exceptional case? We are happy to take on your case.

Peter MendelRechtsanwalt und Fachanwalt

Peter MendelRechtsanwalt und Fachanwalt für Arbeitsrecht

Individually customizable working student contract for download as a PDF or Word document.

Once completed, you will receive the contract for download in your desired file format for further editing or reuse. An encrypted link also ensures permanent accessibility.

This way, you remain flexible for future adjustments or modification requests.

Working Student Contract Template: PDF or Word Template

In addition to the working student template, we thoroughly cover all aspects of working student contracts. A template for your use can be found here: Working Student Template as PDF.

A working student contract provides students with the opportunity to gain valuable work experience while continuing their studies. But how does this contract differ from other types of contracts, and what should employers and working students be sure to consider?

In this comprehensive overview, we cover all aspects, from contract design content, salaries, taxes, to termination.

I. Introduction to Working Student Contracts

What is a Working Student Contract?

A working student contract is a special form of employment contract established between a company and a student.

In this agreement, the student commits to pursuing a professional activity in the company alongside their studies, while the company, in return, provides compensation and enables the student to gain practical experience in their respective field.

The uniqueness of a working student contract lies in the combination of studying and working, offering many advantages in terms of working hours, compensation, and social security. These aspects differ from other types of contracts, such as mini-job contracts or internship agreements.

What are the requirements for a working student contract?

Here’s a brief overview, as a working student contract cannot always be established directly. These are the requirements:

- Must be officially enrolled as a student at a university, college, or recognized technical institute

- May not have studied for more than 25 semesters

- Must not be in a leave of absence semester

- Has not yet completed all required exams (credits)

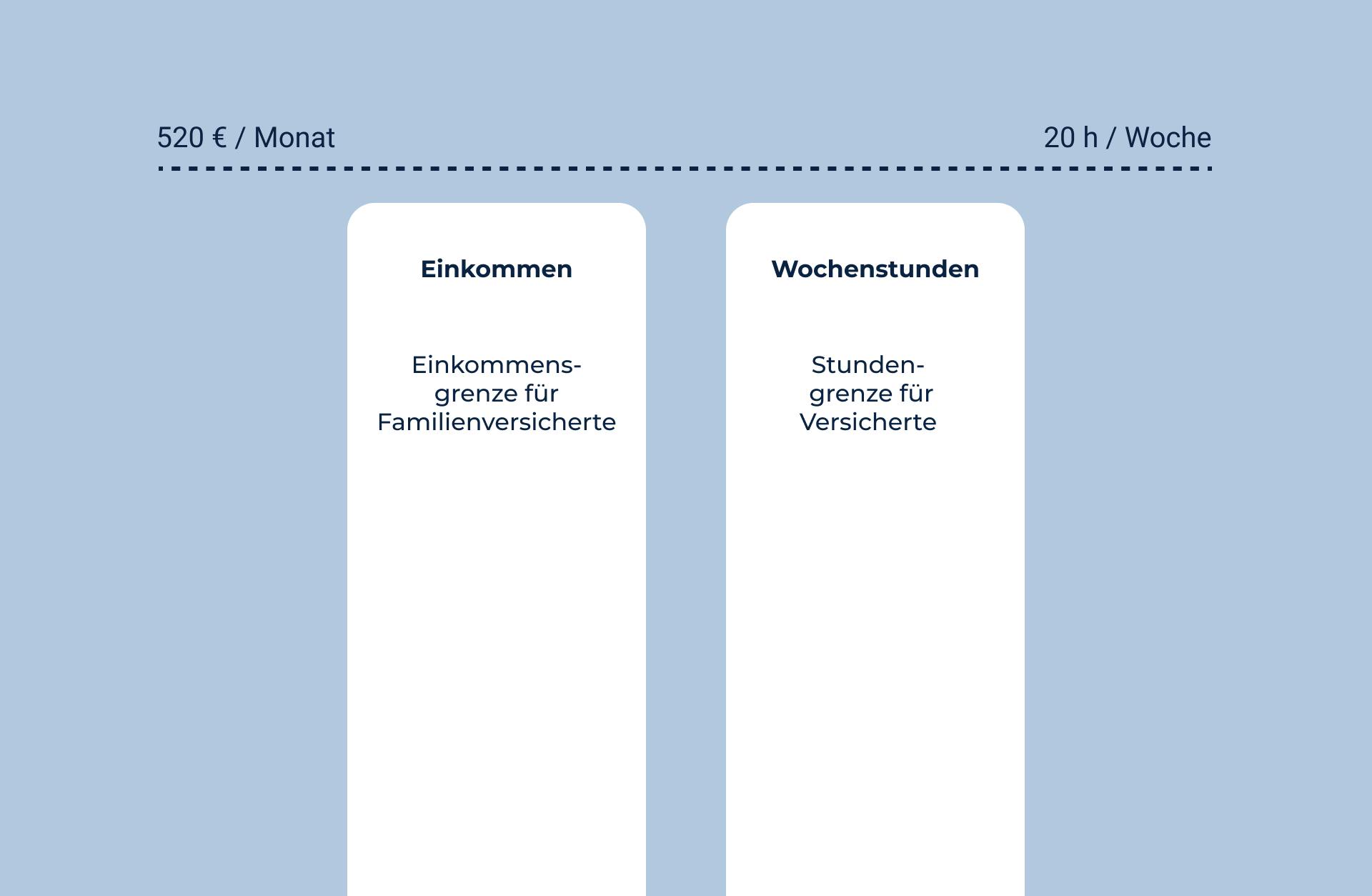

- During the lecture period, working hours must not exceed 20 hours per week (the primary focus remains on studies)

- May work more than 20 hours per week for a maximum of 26 weeks per year

A working student contract is typically used when a student is earning more than the maximum monthly limit of 520 euros, unlike a mini-job.

Important: Before employment, a student must provide proof of regular enrollment to the HR department and promptly inform HR if their student status changes.

Ready to create the working student contract? Use our contract assistant easily:

How does a working student contract differ from other types of contracts?

A working student contract differs from other types of contracts, such as internship contracts, mini-job contracts, or regular employment contracts, in several key aspects. Here are some of the main differences:

- Working hours: According to the working student privilege (§ 8 Abs. 1 Nr. 1 SGB IV), working students are allowed to work a maximum of 20 hours per week during the lecture period. This ensures that studies remain the priority and are not hindered by work. In other types of contracts, such as regular employment contracts, there are no such limitations on working hours.

- Social security: Working students benefit from special social security regulations. As long as they adhere to the 20-hour limit during the lecture period and prioritize their studies, they are exempt from health, nursing care, and unemployment insurance (§ 8 Abs. 1 Nr. 1 SGB IV). However, they must still contribute to pension insurance but can apply for an exemption (§ 6 Abs. 1 Nr. 1 SGB VI). In other types of contracts, employees are typically subject to contributions in all branches of social security.

- Compensation and taxes: Working students generally receive higher compensation than interns and mini-jobbers, as they perform more qualified tasks. They are subject to income tax but can benefit from an annual tax exemption allowance (§ 32a EStG). In contrast, mini-jobbers earning up to 520 euros per month do not have tax deductions, but they are not exempt from pension insurance either.

- Contract duration: Working student contracts are often temporary and tied to the duration of the student’s studies. Internship contracts are typically also temporary but are limited to the duration of the internship. Mini-job contracts and regular employment contracts can be either temporary or permanent, with the latter having no fixed end date.

Let’s assume a company needs support on a project for 20 hours per week. Two options are available: hiring a working student or a part-time employee under a regular employment contract.

Option 1: Working student

- Hourly wage: 15 euros

- Weekly working hours: 20 hours

- No pension insurance contributions (below the 20-hour limit)

Weekly cost: 15 euros/hour * 20 hours = 300 euros

Option 2: Part-time employee

- Hourly wage: 15 euros

- Weekly working hours: 20 hours

- Employer’s pension insurance contribution: approximately 9.3% of gross salary

Weekly cost: (15 euros/hour * 20 hours) + (15 euros/hour * 20 hours * 9.3%) = 327.9 euros

In this example, by hiring a working student, the company saves 27.9 euros per week or around 111.6 euros per month in pension insurance contributions. Additionally, the company benefits from great flexibility and the opportunity to nurture and retain qualified young professionals for future full-time positions while also having the flexibility to let them go if needed.

How is a working student contract structured?

Why are working student contracts important for companies and students?

Working student contracts are significant for both companies and students for several reasons:

- Flexibility: Working student contracts offer flexibility for both students and companies regarding working hours and workload. They allow students to balance their studies with practical work experience, while companies benefit from the opportunity to hire flexible workforce.

- Practical Experience: Through working student positions, students gain valuable practical experience and can apply their theoretical knowledge in real-world scenarios. This not only makes the transition into full-time work easier but also helps students in making informed decisions about their future career paths.

- Cost Efficiency: For companies, working students are often more cost-efficient than full-time employees, as they usually receive lower salaries and do not require full social benefits. However, working students can still make meaningful contributions to the company and may be groomed for full-time roles.

- Talent Acquisition:: Companies can view working students as potential future employees. By working closely with students, companies have the chance to identify and nurture talent early on, which can simplify the recruitment of qualified staff in the future.

II. Legal Foundations of Working Student Contracts

2.1. What labor law regulations are relevant for working student contracts?

From an objective standpoint, the following labor law regulations are relevant for working student contracts:

Social Security Law: Working students are subject to specific regulations under social security law.

They are generally exempt from pension insurance as long as they work no more than 20 hours per week and their studies remain the primary focus. During semester breaks, they may work more than 20 hours without losing their status as a working student.

Minimum wage:Working students are entitled to the statutory minimum wage, like all employees.

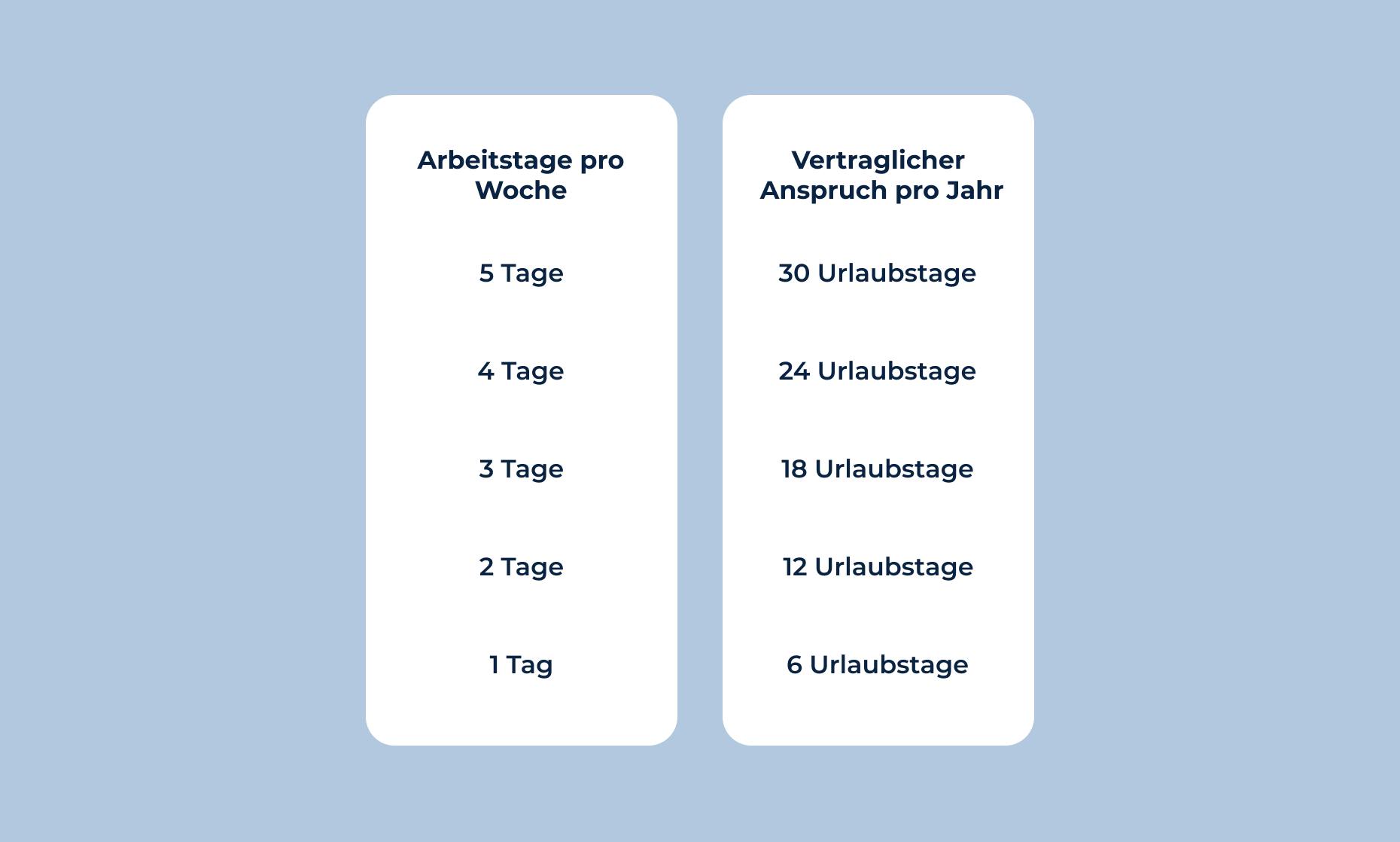

Vacation entitlement:Working students are entitled to paid vacation. The legal minimum is 20 vacation days per year based on a five-day work week. The vacation entitlement should be calculated proportionally if the working student works fewer days per week.

Job protection: Working students are subject to general job protection laws as outlined in the Employment Protection Act (KSchG), provided they work in a company with more than ten employees and their employment lasts longer than six months. This means that termination is only permissible under certain conditions, such as operational, personal, or behavioral reasons. Legal notice periods must also be observed.

2.2. How do social security aspects and contribution payments affect working student contracts?

Social security aspects and contribution payments have a significant impact on working student contracts since working students are typically subject to social security regulations. Here are some key points:

- Social security obligation:Working students are subject to social security contributions if they work more than 20 hours per week during the lecture period. In this case, both the employer and the working student must contribute to health, pension, unemployment, and nursing care insurance.

- Exemption from social security contributions:If the working student is already employed in another social security-obligated job, such as a mini-job, they can apply for an exemption from social security in the working student job. In this case, the employer does not need to pay social security contributions for the working student.

- Reduced contributions: If the working student works less than 20 hours per week during the semester, they can benefit from reduced contributions, particularly to the pension insurance.

- Reporting obligations:: The employer is required to register the working student with social security and pay the corresponding contributions. The working student must also report their employment to social security.

- Insurance protection: Through social security, working students are covered against various risks, such as disability or unemployment.

2.3. What tax implications and allowances need to be considered in working student contracts?

There are specific tax implications and allowances to consider in working student contracts. Here are some key points:

Tax liability:Working students are generally subject to tax if they exceed a certain income threshold. For the year 2023, the basic tax allowance is €10,908 per year, meaning that working students who earn less than this amount per year do not have to pay taxes.

Income tax deduction:If the working student earns more than €520 per month, the employer must deduct income tax and remit it to the tax office.

Flat-rate tax:Instead of income tax deduction, the employer can apply a flat tax rate of 2 percent on the working student's gross wages if they do not earn more than €520 per month.

Work-related expenses allowance:Working students can claim a work-related expenses allowance of €1,000 per year to reduce their tax burden. This can include costs for work materials, travel expenses to work, or professional literature.

Tax return:Even if the working student earns less than €10,908 per year, it may be worthwhile to file a tax return to receive possible tax refunds.

Impact on child benefits:If the working student earns more than €10,908 per year, this may affect the child benefits received by the parents. However, it is important to note that child benefits are only reduced if the child’s income exceeds a certain threshold.

How many deductions does a working student have?

The deductions for a working student depend on the individual situation and the working conditions. Generally, working students are subject to special social security rules, which result in fewer deductions compared to regular employees.

In summary:

- Health and nursing care insurance: approx. 14.6%

- Pension insurance: exempt

- Unemployment insurance: exempt

- Income or payroll tax: exempt up to €10,908/year

- Church tax: exempt up to €10,908/year

However, the following conditions and requirements should be considered:

- Health and nursing care insurance: Working students are generally required to be covered by statutory health and nursing care insurance. The contributions are shared between the employee and the employer. The statutory health insurance contribution rate is 14.6% in 2023 (plus the individual fund's additional contribution), with the employee and employer each paying half. The contribution rate for nursing care insurance is 3.4% (3.3% for those without children over 23), also shared between the employee and employer.

- Pension insurance: Working students are exempt from pension insurance obligations as long as they work no more than 20 hours per week during the lecture period.

- Unemployment insurance: Working students are generally exempt from unemployment insurance, meaning no contributions are required.

- Income tax: If a working student's income exceeds the basic tax allowance of €10,908 per year (in 2023), they are required to pay income tax. The amount of tax depends on the student's income and tax class.

Am I liable for church tax as a working student?

Whether a working student is liable for church tax depends on their religious affiliation and place of residence. In Germany, church tax is levied on income and payroll tax and amounts to 8% to 9%, depending on the federal state.

If a working student belongs to a tax-collecting religious community (e.g., Roman Catholic Church, Evangelical Church, or Jewish community) and lives in Germany, they are generally liable for church tax.

As a student, you are only required to pay church tax if you are liable to pay income tax.

However, church tax is only payable if the working student has to pay income tax. If their annual income is below the basic tax allowance (€10,908 in 2023), they will not be required to pay income tax, and therefore, no church tax will be due.

Intuitive Questions Without Complexity

Shareable Link

Reviewed by Lawyers

Documents Ready as PDF or Word

2.3 Working Student Benefits: What are the advantages of a working student contract?

A working student contract offers various advantages for both students and companies. Here are some of the key benefits of a working student contract:

Benefits for Students:

- Practical Experience: Working student positions allow students to gain practical experience in their field and apply the knowledge they’ve learned during their studies. This contributes to career orientation and the development of both technical and social skills.

- Financial Support: Working students receive compensation for their work, which can help finance their studies or improve their standard of living.

- Flexibility:Working student contracts usually offer flexible working hours that can be adjusted to fit around academic schedules. This makes it easier to balance study and work.

- Networking:As a working student, you have the opportunity to build connections within the industry and form valuable relationships that can benefit your future career.

- Career Opportunities:Working student positions can serve as a stepping stone to a full-time position in the company. Often, working students are hired by their employers after successfully completing their studies.

Benefits for Companies:

- Talent Acquisition:Working students bring fresh, up-to-date knowledge from their studies, offering valuable insights to the company. Additionally, companies can identify and nurture talent early on.

- Cost Efficiency:Compared to full-time employees, working students are often more cost-effective since they typically incur lower social security costs and receive lower salaries.

- Flexibility:Companies can employ working students flexibly to cover personnel shortages or seasonal fluctuations.

- Knowledge Transfer:Collaborating with working students promotes the transfer of knowledge between universities and companies, contributing to the development of industries and technologies.

Overall, a working student contract offers attractive advantages for both students and companies, contributing to personal and professional growth as well as economic development.

What are the Disadvantages of a Working Student Contract?

Despite the many advantages that working student contracts offer, there are some disadvantages that both students and companies should consider:

Disadvantages for Students:

- Time Management:Balancing studies and work can lead to increased stress, especially during exam periods. Students must effectively manage their time and set priorities.

- Limited Free Time:Combining studies and work can reduce leisure time and recovery periods, potentially negatively impacting work-life balance and overall well-being.

- Potential Overstepping of Legal Working Hours:To maintain the benefits of student health insurance and other social benefits, working students must adhere to legal limits regarding maximum working hours. Exceeding these limits can lead to financial and legal consequences.

Disadvantages for Companies:

- Limited Availability:Due to their academic commitments, working students have restricted availability, which can complicate staffing and personnel planning.

- Turnover:Since working students are typically employed only for the duration of their studies, there tends to be higher turnover compared to full-time employees. This can lead to repeated onboarding phases and an increased effort in recruiting.

- Lack of Experience:Working students often lack the professional experience of full-time employees. This may result in longer training periods or an increased need for supervision.

While there are some disadvantages, the benefits of a working student contract often outweigh them. However, both students and companies should consider potential challenges and develop proactive strategies to address them.

Beglaubigt.de also handles complex contract creations and inquiries

Our support team consists of a mix of certified notaries and trained German-speaking staff. The team is available throughout the process, especially for hassle-free contract processing.

Do you have an exceptional case? We are happy to take on your request.

III. Drafting and Contents of a Working Student Contract

3.1. Which contract terms are legally relevant in a working student contract?

A working student contract must include several legally relevant terms. Here are some important aspects:

Parties:The contract should clearly name the parties, i.e., the employer and the student.

Subject of the contract:The subject matter of the contract, meaning the specific tasks the working student will perform, should be described in detail.

Compensation:The contract should specify the compensation or salary of the working student, ensuring compliance with minimum wage regulations.

Working Hours:The weekly and daily working hours, as well as break times, should be outlined in the contract.

Vacation:The vacation policy, including the number of vacation days and the terms for taking vacation, should be clearly defined in the contract.

Probationary Period:It is common to include a probationary period in the contract. The duration and conditions of this period should be stated.

Termination:The conditions for terminating the contract by either party should be clearly outlined.

Confidentiality Clause:The contract should include a confidentiality clause to ensure that the working student does not disclose the employer’s confidential information.

Intellectual Property:The contract should specify who owns any intellectual property, such as patents or copyrights, created during the student’s employment.

Data Protection:The contract should also include data protection regulations to ensure compliance with privacy laws.

3.2. How should working hours and vacation be regulated in a working student contract?

Several aspects should be considered when drafting the working hours and vacation provisions in a working student contract:

- Working Hours:The weekly working hours should be specified. It is important to note that students are often limited in time due to their studies. A maximum of 20 hours per week is typical and should not be exceeded to prevent overloading the student.

- Work Hours and Breaks:The daily working hours and break times should be clearly defined, ensuring they do not conflict with the student’s class schedule. It should also be considered that students may need longer breaks to manage their study time effectively.

- Vacation:The contract should include provisions for vacation. The number of vacation days should be specified, usually in line with legal requirements. Vacation planning should take into account the student’s exam periods or plans for internships or study abroad during semester breaks.

- Flexible Working Models:Flexible working models, such as part-time options or remote work, may benefit students, allowing them to better balance work with their academic commitments.

- Work Time Tracking:The contract should also establish how working hours will be tracked. For instance, a timesheet or time-tracking system can be implemented to ensure adherence to working hour limits.

IV. Salary of Working Students

4. How much can a working student earn under a working student contract?

In principle, working students, like all employees in Germany, are entitled to the statutory minimum wage. As of October 1, 2023, the minimum wage is €12.00 per hour. This applies regardless of the industry in which the student is employed.

1. Salaries for Working Students in Different Industries

Depending on the industry and region, working students may earn significantly more than the statutory minimum wage. Here are some examples of average hourly wages in various fields:

- Engineering: €12-18

- IT/Software Development: €13-20

- Business Administration: €10-16

- Natural Sciences: €12-17

- Humanities: €10-14

It’s important to note that these figures are averages and can vary from company to company.

2. Factors Affecting a Working Student’s Salary

A working student’s salary can depend on several factors, such as:

- Work Experience:Working students with more experience can usually negotiate higher salaries.

- Company Size:Larger companies tend to offer higher salaries than smaller firms.

- Region:Salaries are often higher in regions with higher living costs, such as in large cities.

- Negotiation Skills:Strong negotiation skills can help secure a higher salary.

How much can a working student earn?

There is no fixed salary limit for working students, but income varies based on the industry, company, and the student’s qualifications. As mentioned earlier, working students, like all employees, are entitled to the statutory minimum wage.

There is no legal upper limit on a working student’s salary. Income depends on several factors, including industry, company, qualifications, experience, and location.

Higher salaries for working students are typically possible in industries and companies that require specialized knowledge and skills and are willing to pay for qualified labor.

While there is no salary cap, it is important to pay attention to the social security regulations for working students.

To maintain the working student status and benefit from social security advantages, students are generally not allowed to work more than 20 hours per week during the lecture period. However, during semester breaks, they can work more without losing their working student status.

Another aspect to consider with higher salaries is income tax. If a working student's income exceeds the tax-free allowance, their income becomes taxable, and they will have to pay income tax.

So, what does the salary for working students look like in practice? Here are a few examples:

Working student salary at SAP: Working students in roles such as "Software Development Working Student" or "Data Science Working Student" at SAP benefit from the company's renowned reputation. Hourly wages can range between €15 and €22, often at the higher end of that range or even higher. The exact salary depends on the student’s experience, location, and department.

Working student salary at Zalando: At Zalando, working students can be employed in various roles such as "Marketing Working Student," "IT Support Working Student," or "Logistics Coordination Working Student." Salaries vary by department. IT working students may earn between €13 and €20 per hour, while marketing working students might receive between €12 and €16. The actual salary depends on factors like department, experience, and location.

Working student salary at Personio: Personio, a growing HR software company, employs working students in several areas, including positions like "IT System Administration Working Student," "HR Working Student," or "Sales Support Working Student." Depending on the position, salaries can vary. IT working students can expect hourly wages between €13 and €20, while sales working students might earn between €12 and €16. Experience, location, and department all influence the final salary.

Working Student Contract Template

Beglaubigt.de offers a comprehensive template for your company to reuse. This is an interactive questionnaire that ultimately generates the final contract. You can start creating it here: Working Student Contract PDF

4.2. What compensation models and possible additional benefits can be agreed upon in a working student contract?

Several compensation models and additional benefits can be agreed upon in a working student contract. These may vary depending on the company, industry, and country. Here are some common compensation models and additional benefits:

- Hourly Wage:A common compensation model for working students is an hourly wage, where the student is paid for each hour worked. The hourly rate can vary based on the industry, qualifications, and experience of the student.

- Monthly Salary:In some cases, a fixed monthly salary may be agreed upon, especially if the working hours and workload of the student are relatively consistent throughout the month.

- Performance-Based Compensation:In some cases, performance-based compensation can be agreed upon, such as bonuses or incentives tied to specific performance goals or project successes.

- Additional Benefits:Depending on the company and legal regulations, working students may receive additional benefits beyond financial compensation. These may include:

a. Vacation Entitlement:In many countries, working students are entitled to a legally mandated minimum number of vacation days, which should be included in the contract.

b. Social Security Contributions:Depending on the legal framework and the student's working hours, the company may be required to pay social security contributions for the working student.

c. Professional Development:Companies may offer training or professional development programs to working students to enhance their knowledge and skills.

d. Company Pension Plan:In some countries and industries, a company pension plan may be provided for working students.

e. Employee Discounts or Benefits:Working students may be eligible for discounts or benefits on the company's products or services.

f. Travel Allowances or Job Tickets:Companies may provide allowances for public transport or job tickets to reduce commuting costs for working students.

V. Vacation Regulations in Working Student Contracts

How are vacation entitlements for working students regulated in their contract, and what legal foundations apply?

Vacation entitlements for working students are governed by their contract and are based on the legal provisions of the Federal Vacation Act (BUrlG) and the Part-Time and Fixed-Term Employment Act (TzBfG). The regulations for working students do not fundamentally differ from those for other employees.

According to § 3 BUrlG, every employee in Germany is entitled to a minimum of 24 working days of vacation per year based on a six-day workweek. For a five-day workweek, the minimum vacation entitlement is 20 working days. This also applies to working students, but their specific weekly working hours and number of workdays per week must be considered when calculating vacation entitlements.

For part-time employment, which is common for working students, the vacation entitlement is calculated proportionally. The following formula can be used to calculate a working student’s prorated vacation entitlement:

(Number of workdays per week / Number of regular company workdays) x statutory minimum vacation

Example:

A working student works three days per week at a company with a five-day workweek. The prorated vacation entitlement is calculated as follows:

(3 / 5) x 20 working days = 12 working days

It is important to note that this is the statutory minimum vacation. Employers may choose to offer their working students a higher vacation entitlement, which should be specified in the contract.

Additionally, for fixed-term contracts, which are typical for working students, the vacation entitlement can be calculated proportionally based on the contract's duration. According to § 5 BUrlG, vacation must generally be taken within the same calendar year.

If it is not taken by the end of the year, it may be carried over to the next year in exceptional cases, such as due to illness or urgent business needs.

How is vacation entitlement calculated for working students with part-time or varying working hours?

The calculation of vacation entitlement for working students with part-time or varying working hours is done proportionally based on the average number of workdays per week, taking into account the regular workdays at the company. Here are some examples to illustrate how the vacation entitlement is calculated in different situations:

Example 1: Fixed part-time employment

A working student regularly works 3 days per week at a company with a five-day workweek. The statutory minimum vacation is 20 working days per year. The prorated vacation entitlement is calculated as follows:

(Workdays per week / Regular workdays) x statutory minimum vacation

(3 / 5) x 20 working days = 12 working days

Example 2: Varying working hours A working student works under a flexible working hours model, working different days over a 4-week cycle. In the four weeks, they work 5, 3, 4, and 2 days. To calculate the average vacation entitlement, we first determine the average number of workdays per week:

(5 + 3 + 4 + 2) / 4 = 3.5 workdays per week

Now, we calculate the prorated vacation entitlement:

(3.5 / 5) x 20 working days = 14 working days

Example 3: Working student with variable weekly hours

A working student is employed by a company with a five-day workweek and has a contract for a monthly working time of 60 hours. The distribution of hours across the weeks is flexible and varies month by month. To calculate the vacation entitlement, the average number of workdays per week must first be determined. Assuming an average of 15 working hours per week (60 hours / 4 weeks), and if the working student works 5 hours on 3 days per week, the average number of workdays per week is 3. The prorated vacation entitlement is calculated as follows:

(3 / 5) x 20 working days = 12 working days

In all cases, it is important to clearly and transparently outline the vacation entitlement in the working student contract and regularly review the calculation of entitlement for varying working hours to ensure the student receives the vacation they are entitled to.

What specific considerations should companies keep in mind when planning and approving vacation for working students?

When planning and approving vacation for working students, companies should consider several specific factors to ensure smooth operations and compliance with legal requirements:

- Consideration of Exam and Lecture Periods: Working students need to balance their studies and work simultaneously. Companies should take into account the exam and lecture periods of working students, allowing them sufficient time to prepare for exams and attend classes.

- Flexibility in Vacation Planning: Working students may have more flexible vacation requests than full-time employees. Be open to flexible solutions when planning and approving vacation requests, such as allowing part-time working students to take their vacation in smaller increments or adjusting their working hours during the semester.

- Proportional Vacation Entitlement: Since working students typically work part-time, their vacation entitlement is prorated. Ensure that this is correctly calculated and factored in when planning and approving vacation time.

- Clear Communication of Vacation Policies: Inform working students about the company’s vacation policies and procedures. Make sure they understand how to apply for and receive approval for their vacation entitlement.

- Timely Vacation Approval: To provide working students with planning certainty, vacation requests should be processed and approved in a timely manner. This allows students to better align their vacation with their academic commitments.

- Coverage During Vacation: Ensure that a coverage plan is in place during the working student’s vacation to maintain workflow continuity. Clarify early on which tasks can be taken over by other employees and whether any training is required.

By considering these aspects when planning and approving vacation for working students, companies can foster a successful working relationship and allow students to balance their academic and work commitments effectively.

How can working students and employers structure flexible vacation policies in the contract to meet both parties' needs?

Flexible vacation policies in a working student contract can benefit both the student and the employer. To create policies that suit both parties, the following steps can be taken:

- Open Communication:Engage in open communication about the vacation needs and preferences of both the working student and the employer. Discuss potential flexibility in vacation planning to find a fair and balanced solution.

- Flexible Vacation Entitlement:Allow working students to take their vacation in smaller increments or even on an hourly basis, rather than requiring them to take longer continuous vacation periods. This can help better manage workload alongside academic requirements.

- Adjustable Working Hours: Agree on flexible working hours in the contract, allowing the working student to adjust their hours during the semester or exam periods. This can include flexible hours (e.g., flextime) or reducing hours during exam periods.

- Individualized Vacation Planning: Consider individual needs and circumstances when planning vacation time, such as exams, lectures, or other academic obligations. Jointly set a period during which vacation can be taken and document this in the contract.

- Provisions for Short-Term Vacation Requests: Create provisions for short-term vacation requests to account for unforeseen needs or academic obligations. Include a reasonable notice period for such requests in the contract, and outline how they will be processed.

- Coverage During Vacation: Ensure that a coverage plan is in place during the working student’s vacation to maintain the continuity of operations. This will help alleviate concerns about disruptions in work.

- Clear Communication of Vacation Policies: Make sure that the vacation agreements in the working student contract are clear and understandable. Both parties should be aware of their rights and obligations regarding vacation time.

By addressing these aspects in the design of flexible vacation policies within the working student contract, both students and employers can ensure that their respective needs are met and a successful working relationship is maintained.

Example Vacation Clause in a Working Student Contract:

§ X Vacation Regulation (1)The working student is entitled to paid vacation. The number of vacation days is based on legal requirements and is calculated proportionally according to the individual's weekly working hours. For example, with an average of 20 hours per week, the vacation entitlement amounts to 50% of the statutory vacation entitlement of a full-time employee. (2)Vacation may be taken in smaller increments of at least half a day or on an hourly basis. The working student should take their academic commitments, such as lecture times and exam periods, into consideration when applying for vacation. (3)Vacation requests must generally be submitted in writing and are subject to the employer's approval. For long-term planned vacations, the request should be submitted at least four weeks in advance. Short-term vacation requests may be made in exceptional cases with one week's notice after consultation with the employer. (4)A substitution arrangement will be made during the working student’s vacation to ensure continuity of work processes. The working student must ensure that all pending tasks and projects are properly handed over to the substitute before the vacation starts. (5)Any unused vacation will generally expire at the end of the calendar year. A carryover to the following year is only permitted if justified by urgent business or personal reasons. In such cases, the vacation must be taken by March 31 of the following year. (6)Upon termination of the employment relationship, any unused vacation will be compensated financially if it is no longer possible to take the vacation due to business reasons.

This sample clause can be used as a template for structuring the vacation clause in a working student contract. It can be adjusted according to the specific needs and requirements of the employer and the working student.

The contract assistant from Beglaubigt.de is a useful tool that automates and simplifies the creation of legally compliant working student contracts, including the vacation clause.

Using the contract assistant saves time and effort for both employers and working students during the contract drafting process. The tool ensures that the contract always meets current legal requirements and allows for individual adjustments. Take advantage of the contract assistant from Beglaubigt.de to quickly and easily create legally compliant working student contracts.

IV. Termination of Working Student Contracts

What termination options and notice periods apply to working student contracts?

The same termination options and notice periods apply to working student contracts as to other employment contracts. Below are the key aspects:

- Ordinary Termination: Both the employer and the working student can terminate the contract by observing the statutory notice periods. According to § 622 BGB (German Civil Code), the notice period during the first six months of employment is two weeks to the end or the middle of a calendar month. After the probationary period (if agreed), the notice period extends to four weeks to the 15th or the end of a calendar month.

- Extraordinary Termination: Extraordinary termination is possible under certain conditions if there is a significant reason that makes the continuation of the employment relationship unreasonable (§ 626 BGB). In such cases, the employment relationship can be terminated without notice. Examples include serious breaches of contract or criminal behavior.

- Fixed-Term Contracts: For fixed-term working student contracts, the employment relationship automatically ends at the agreed end date, unless the contract is terminated early or extended. Termination options during the fixed term can be contractually excluded or restricted.

- Probationary Period: If a probationary period is agreed upon in the working student contract, shortened notice periods apply during this time. According to § 622(3) BGB, the notice period during the probationary period (up to six months) is two weeks.

How can a working student be terminated during the probationary period?

Working students can be terminated during the probationary period by adhering to specific notice periods and rules. The probationary period allows both the employer and the working student to evaluate the employment relationship.

According to § 622(3) BGB, the notice period during the probationary period (maximum of six months) is two weeks. Within this period, either the employer or the working student can terminate the employment without providing reasons. The termination must be in writing and delivered to the other party in a timely manner.

It is advisable to clearly state in the working student contract whether a probationary period is agreed upon and what the conditions are. This includes the length of the probationary period and the notice period during that time. Both parties can ensure that legal requirements are met and that the employment relationship can be terminated if necessary during the probationary period.

4.2. What should be considered in a termination agreement or mutual resolution regarding working student contracts?

What are the specific conditions regarding fixed-term contracts and probationary periods in relation to working student contracts?

Working student contracts can be either fixed-term or open-ended. Fixed-term contracts and probationary periods have some particularities that are important for both employers and working students:

- Fixed-Term Contracts: According to § 14 of the Part-Time and Fixed-Term Employment Act (TzBfG), a fixed-term contract without a substantive reason can be valid for a maximum of two years. Within this period, the contract can be extended up to three times. If a substantive reason exists (e.g., covering for a sick employee or a project duration), there is no maximum duration for the fixed term. However, the reason for the fixed term should be clearly stated in the contract.

- Probationary Period: A probationary period of up to six months can be agreed upon in working student contracts (§ 622(3) BGB). During this period, the notice period is shortened to two weeks. The probationary period allows both parties to assess the employment relationship. The probationary period, including its duration and the shortened notice period, should be included in the contract.

- Combination of Fixed-Term and Probationary Period: It is possible to include a probationary period within a fixed-term contract. In this case, the probationary period ends when the agreed duration expires, and the employment continues based on the fixed term.

- Transition to Regular Employment: After graduation, a fixed-term working student contract can be transitioned into regular employment. This should be discussed in advance between the employer and the working student and documented in the contract.

IV. Working Student Contract: Health Insurance

How are working students covered in terms of health insurance?

Health insurance coverage for working students depends on national regulations and the student's individual circumstances. In Germany, where the term "working student" is commonly used, health insurance for working students is regulated as follows:

Family Insurance: If the student is under 25 years old, they can often remain covered by their parents’ statutory health insurance (GKV) at no additional cost. This applies as long as the student’s regular monthly income does not exceed a certain threshold (usually €450).

Student Health Insurance: If the student is no longer eligible for family insurance or exceeds the income limit, they can be covered by student health insurance. This is a special rate within statutory health insurance, available for students up to a certain age (typically until the age of 30 or up to the 14th semester). Contributions for student health insurance are generally lower than those for regular GKV members.

Voluntary Statutory Health Insurance: If the student exceeds the age or semester limits for student health insurance, or for other reasons is no longer eligible, they can opt for voluntary statutory health insurance. Contributions are generally higher than those for student health insurance and are based on the student’s income.

Private Health Insurance: In some cases, working students may choose or be required to opt for private health insurance. This may apply if the student does not wish to be covered by GKV or is ineligible due to their income or employment status. Private health insurance premiums vary based on the student’s individual circumstances.

For a detailed contribution, see:

Working Student Contract Health Insurance.

Are there differences between statutory and private health insurance for working students?

Yes, there are key differences between statutory (GKV) and private health insurance (PKV) for working students. Here are some of the main distinctions:

- Contribution Calculation: GKV contributions are based on a fixed percentage of income (within certain limits). For students in the student health insurance scheme, contributions are uniform regardless of income.

- PKV contributions, however, are calculated based on individual risk factors such as age, gender, and health status. Many students can benefit from lower premiums in PKV due to their younger age and good health.

- Scope of Benefits: GKV offers standardized benefits as determined by law. PKV, on the other hand, provides more customizable plans, with benefits varying depending on the insurer and plan. Working students considering PKV should carefully review the options and assess which benefits best meet their needs.

- Choice of Doctors and Treatment: GKV allows free choice of all doctors who accept statutory health insurance, while PKV offers the possibility of receiving treatment from non-GKV doctors or in private clinics. PKV may also provide faster appointments and shorter waiting times.

- Premium Refunds: Some private health insurers offer premium refunds if no or few services are used over a certain period. This can be an attractive option for working students, who typically have fewer health issues.

It is essential to weigh individual needs and financial capabilities to make the best decision regarding health insurance. It is advisable to compare both statutory and private insurance options and seek professional advice if necessary.

What conditions must be met for working students to remain in student health insurance?

To remain covered under student health insurance (KVdS) as a working student, the following conditions must be met:

- Enrollment: The Student must be enrolled at a German university. The primary focus of their activity should be on their studies.

- Age Limit: Generally, students must not have exceeded the age limit of 30 years. In certain cases, this age limit may be extended due to specific circumstances, such as extended schooling or vocational training, prior professional employment, or childcare responsibilities.

- Regular Study Period: Student health insurance (KVdS) usually applies until the end of the 14th semester. If the student exceeds this period, or if they are in their 15th semester or beyond, they may be required to voluntarily join statutory or private health insurance.

- Working Hours: During the semester, working students are not allowed to work more than 20 hours per week to maintain their working student status and stay in student health insurance. However, they can work more hours during semester breaks without jeopardizing their working student status or KVdS membership.

- Income Limits: For student health insurance, there is no explicit income limit. However, it is essential to note that if the 20-hour weekly limit is exceeded during the semester, KVdS membership might be at risk.

As long as these conditions are met, working students can remain in student health insurance and benefit from its standard contributions and services.

How does the income of a working student affect their health insurance status?

A working student's income can affect their health insurance status, particularly if it exceeds certain limits. Below are key points regarding a working student’s income and its impact on health insurance:

- Working Hours and Income Limit: During the semester, working students must not work more than 20 hours per week to maintain their working student status and stay in student health insurance (KVdS). Exceeding this limit may result in the working student being classified as a regular employee, requiring them to switch to statutory or private health insurance.

- Social Security Exemption: Working students are exempt from contributions to health, nursing care, and unemployment insurance as long as they do not exceed the 20-hour limit per week during the semester. However, they must contribute to pension insurance, where a reduced contribution rate applies.

- Exceeding the Annual Earnings Threshold (JAEG): If a working student's income exceeds the annual earnings threshold (JAEG), they may have the option to switch to private health insurance. The JAEG is adjusted annually and was €64,350 in 2021. It’s essential to weigh the pros and cons before opting for private health insurance, as this decision has long-term implications.

In general, a working student’s income should remain within the legal limits to maintain student health insurance and its associated benefits.

What regulations apply to international students working as working students concerning health insurance in Germany?

For international students working as working students in Germany, specific regulations apply regarding health insurance. Here are some important points:

- Statutory Health Insurance (GKV): International students from countries without a social security agreement with Germany are generally required to obtain statutory health insurance if they are working as a working student. They can enroll in student health insurance (KVdS) as long as they meet the requirements (e.g., the 20-hour rule during the semester).

- European Health Insurance Card (EHIC): Students from EU member states, Iceland, Liechtenstein, Norway, and Switzerland can use their EHIC to be covered for health insurance during their stay in Germany. However, they must check with their home country’s health insurance provider to see if the EHIC also covers working student jobs.

- Private Health Insurance (PKV): In some cases, international students may opt for private health insurance in Germany, depending on factors such as age, study duration, and home country. Private insurers often offer special rates for students.

- Social Security Agreements: Students from countries that have a social security agreement with Germany (e.g., Turkey, Serbia, Montenegro) may remain insured in their home country under certain conditions, without needing to obtain additional health insurance in Germany. It is crucial to review the relevant provisions of the social security agreement and ensure that insurance coverage is valid before starting work as a working student.

V. Jurisprudence and Working Student Contracts

5.1. What recent rulings and their impact on contract drafting are relevant to working student contracts?

Here are two or three relevant rulings that should be considered when drafting working student contracts, along with the resulting recommendations:

- Maximum Working Hours: In Germany, working students are allowed to work a maximum of 20 hours per week during the semester. This rule is based on a decision by the Federal Social Court (BSG) in 2004 (Az. B 12 KR 25/03 R). When drafting contracts, it is essential to ensure that the working hour restrictions are adhered to in order to avoid social security contributions for both the working student and the company.

- Vacation Entitlement: The Federal Labor Court (BAG) ruled in 2012 (Az. 9 AZR 353/10) that working students, like other employees, are entitled to paid vacation. When drafting contracts, it is important to account for the statutory minimum vacation entitlement of 20 working days per year (for a five-day workweek) and to include provisions regarding the granting and compensation of vacation time.

- Anti-Discrimination Law: According to the General Equal Treatment Act (AGG), working students cannot be discriminated against based on characteristics such as gender, age, or ethnic origin. In a ruling by the BAG in 2013 (Az. 8 AZR 838/12), it was determined that the anti-discrimination law also applies to compensation. Companies should ensure that the compensation and working conditions for working students are fair and reasonable when drafting contracts.

5.2. How do important precedents influence practice in working student contracts?

VI. Beglaubigt.de and Working Student Contracts

6.1. How does the document creator from Beglaubigt.de work, and what advantages does it offer in creating working student contracts?

6.2. How does Beglaubigt.de ensure the legal security and up-to-dateness of its contract templates for working student contracts?

6.3. How can the working student contract from Beglaubigt.de be effectively integrated into everyday work?

Frequently Asked Questions

from our Users