beglaubigt.de

Gift contract template as PDF & Word.

Create a legally reviewed gift contract quickly and easily in PDF format according to the latest standards. The template is free and fully customizable.

CREATE PDF NOW

+10 Tausend

Verträge erstellt

100%

Anpassbare Vorlagen

2 Minuten

Bis zur Fertigstellung

4 Stunden

Zeiteinsparung

In collaboration with top-tier lawyers for legal security

All contract templates have been created by an expert team of lawyers and are continuously reviewed for their relevance. Our goal is to provide legally compliant and up-to-date contract templates in a simple and digital way. If you have a special case, we are ready to address it.

Get started now easily. Peter MendelRechtsanwalt und Fachanwalt

Peter MendelRechtsanwalt und Fachanwalt für Arbeitsrecht

Individually customizable gift contract for download as a PDF or Word document.

After creation, you will receive the gift contract in your chosen file format for download, allowing you to further edit or use it as needed. A secure, encrypted link also ensures continuous access, giving you flexibility for future adjustments or desired changes.

In our modern and legally complex world, a solid understanding and correct application of legal principles are essential. This is particularly true in the area of gifts, where careful attention to legal details is crucial to avoid unwanted legal consequences.

A gift contract serves as a key tool to ensure that gifts are made legally sound and transparent. In this article, we provide a detailed insight into the topic of gift contracts and explain how you can efficiently and effortlessly create legally compliant contracts as PDF or Word documents using the document creator from Beglaubigt.de.

With the document creator from Beglaubigt.de, you can effortlessly and instantly generate legally compliant contracts as PDF or Word documents.

General information about the gift contract

1.1 What is a gift contract and why is it relevant?

he donor and the recipient, where one person (the donor) voluntarily and without compensation transfers assets or items to another person (the recipient). The gift is made without any return obligation, meaning the recipient is not required to give anything in exchange for the gift.

The gift contract serves to legally regulate the gift and to document the rights and obligations of the parties involved in writing.

The relevance of a gift contract lies in its function to make the gift legally secure and to prevent potential misunderstandings or disputes between the parties involved.

Gift contracts are particularly useful for the transfer of real estate, vehicles, or larger sums of money, in order to clearly document the intent of the parties and ensure compliance with legal requirements.

Under German law, gifts are regulated by §§ 516-534 of the Civil Code (BGB). According to § 516 BGB, a gift is defined as "a contract by which one person (the donor) grants another person (the recipient) a financial benefit without demanding anything in return." This paragraph clarifies the basic principles of gifting and emphasizes the gratuitous nature of the transfer.

A gift contract can also be notarized under German law. You can submit a non-binding request with us digitally or find a partner notary locally.

Our notary for immediate appointments:

Alternatively, you can of course also submit a fully digital request.: Digital notary beglaubigt.de

Another important aspect is the evidentiary function of a gift contract. In the event of disputes, such as in the context of inheritance settlements, the gift contract can serve as proof of the gift and its scope.

Thus, the gift contract significantly contributes to legal security and protects the interests of the parties involved.

Additionally, gift contracts can help take into account tax aspects and allowances that are relevant in the case of gifts. In this context, the Inheritance Tax and Gift Tax Act (ErbStG) is relevant, which regulates the taxation of gifts. A well-drafted gift contract can allow both parties to benefit from the legally established allowances and tax rates, minimizing potential tax burdens.

1.2. What legal regulations apply to the gift contract?

The legal regulations for the gift contract in Germany are set out in the Civil Code (BGB). The most important paragraphs concerning the gift contract can be found in §§ 516-534 BGB. Below is a brief explanation of the key provisions from these paragraphs:

- § 516 BGB (Gift): This defines the gift as a contract by which one person (the donor) grants another person (the recipient) a financial benefit without demanding anything in return. This paragraph highlights the fundamental principles of gifting and emphasizes the gratuitous nature of the transfer.

- § 518 BGB (Gift Promise): This regulates the gift promise, which establishes the donor's obligation to give the gift. Such a promise requires notarization to be legally binding.

- § 519 BGB (Revocation of the Gift Promise): This paragraph governs the donor's right to revoke the gift promise before the gift is executed if the recipient commits gross ingratitude.

- § 521 BGB (Condition of the Gifted Item): This states that the donor is generally not liable for defects in the gifted item, except in cases where the donor has fraudulently concealed the defect.

- § 522 BGB (Obligation to Transfer): This paragraph specifies that the donor is obliged to transfer the gifted item to the recipient. For real estate and similar rights, the transfer requires notarization and registration in the land register.

- § 523 BGB (Revocation of the Gift Due to Gross Ingratitude): This allows the donor to revoke the gift if the recipient is guilty of gross ingratitude. The revocation must occur within one year of the donor becoming aware of the gross ingratitude.

- § 528 BGB (Reclaiming the Gift Due to Donor’s Impoverishment): This paragraph allows the donor to reclaim the gift if, after executing the gift, they become so impoverished that they can no longer provide for their own reasonable support.

- § 530 BGB (Exclusion of Reclamation): This sets the conditions under which the donor may be prevented from reclaiming the gift, for example, if the recipient has consumed or sold the gifted item.

- § 531 BGB (Reclamation Claim): This paragraph outlines the scope and conditions of the donor's right to reclaim the gift, including deadlines within which the donor must assert their rights.

- § 532 BGB (Limitation Period for Reclamation Claims): This establishes that the donor's reclamation claim generally expires after ten years, with the limitation period starting from the date the gift is executed.

- § 534 BGB (Limited Personal Servitudes): This paragraph concerns limited personal servitudes that may arise in connection with a gift. It regulates the conditions under which such a servitude may transfer to the recipient.

In addition to the regulations in the BGB, tax aspects are also relevant under the Inheritance and Gift Tax Act (ErbStG). This law governs the taxation of gifts and determines, among other things, the tax classes, allowances, and tax rates that apply to gifts.

1.3. In which situations is a gift contract necessary or recommended?

A gift contract is an important tool in various situations to ensure legal certainty for all parties involved and to address tax implications. Below are examples of situations where a gift contract is advantageous or even essential:

- Transfer of real estate: Gifts involving real estate or equivalent rights require a gift contract by law. This must be notarized and recorded in the land register, in accordance with § 313 BGB and § 873 BGB.

- Transfer of vehicles: When transferring vehicles, it is recommended to create a written gift contract. This clarifies the transfer of ownership and the associated obligations (such as re-registration) and helps avoid potential misunderstandings.

- Large sums of money or valuable objects: For significant monetary gifts or the transfer of valuable items, it is advisable to use a gift contract. This serves to record the details of the gift as well as the rights and obligations of all parties, and it can act as proof in case of tax or legal uncertainties.

- Gifts within the family: Gifts are often used within families as a means of wealth transfer or reorganization. A gift contract can help prevent future family disputes and establish clear rules for all parties involved.

- Tax considerations: A gift contract can help optimize the use of tax exemptions and allowances. By solidifying the details of the gift, the contract can reduce the tax burdens for both the donor and the recipient.

- Conditional gifts: If a gift is subject to certain conditions or requirements (e.g., a property may only be used for specific purposes), a gift contract is essential to make these conditions legally enforceable.

You can find more information in our detailed article: Gift contract - when is it necessary?

2.1 How to create a gift contract?

Using Beglaubigt.de, you benefit from a legally secure and efficient method that offers numerous advantages over traditional approaches.

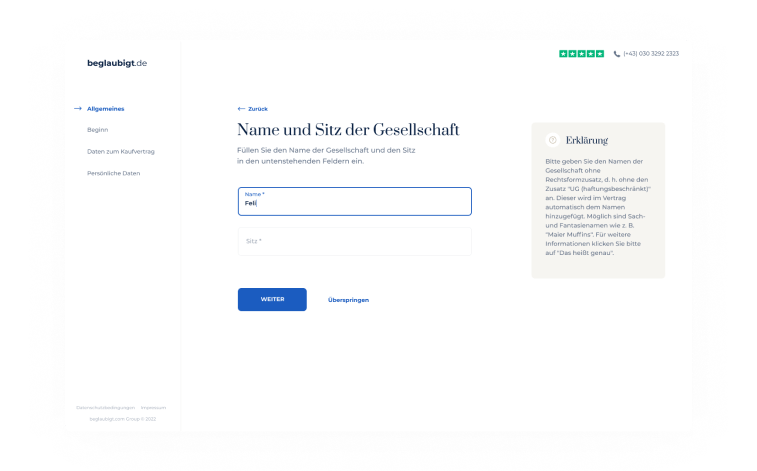

- Select a template: On Beglaubigt.de, choose an appropriate gift contract template tailored to your individual needs. The templates are created and reviewed by experts to ensure legal security and quality.

- Enter contract details: Fill in the necessary information in the contract, such as the names and addresses of the parties, the object of the gift, and any conditions or stipulations. Beglaubigt.de offers a user-friendly interface and clear instructions to help you complete the contract correctly.

- Follow legal formalities: Make sure to comply with the required formalities (see 2.2). Beglaubigt.de provides guidance on the necessary steps and supports you in meeting legal requirements.

- Finalize the contract: Once all information has been entered and reviewed, the donor and recipient can sign the gift contract. If needed, the contract can be notarized to ensure its legal validity in specific cases.

- Documentation and storage: Keep the signed gift contract in a secure place, so you can reference it in case of legal disputes or tax-related questions.

Using Beglaubigt.de to create a gift contract offers numerous benefits, including time and cost efficiency, flexibility, legal security, ease of use, and versatile application options. By using the platform, you ensure that your gift contract is legally sound and professionally drafted, without needing to undergo time-consuming and expensive consultations with lawyers or notaries.

Legally secure gift contract

Easily create online

Beglaubigt.de assists you in creating a legally secure gift contract with immediate validity.

The user-friendly and intuitively designed document assistant captures all necessary details to create a comprehensive yet straightforward gift contract.

2.2What formal requirements must be observed for a gift contract?

Basic written form and signature: Compliance with formal requirements is essential for the legal validity of a gift contract. Generally, a gift contract should be written. The signatures of both parties, the donor and the recipient, are required to document their consent and agreement with the contract terms.

Notarization for real estate and property: For certain gifts, especially in the case of real estate or land, notarization of the gift contract is legally required. During notarization, the notary ensures that all legal requirements are met and provides the parties with comprehensive information about their rights and obligations.

Land register entry: In the case of gifting real estate or land, an entry of the gift contract in the land register is also required. This entry finalizes the legally binding transfer of ownership and also requires notarization.

Special requirements for vehicle gifting: When gifting a vehicle, it is advisable to document the gift contract in writing. Additionally, the vehicle documents, including the registration certificate (Part I and II), must be transferred to the new owner, and the gift must be registered with the relevant vehicle registration authority.

Support from Beglaubigt.de: The Beglaubigt.de platform simplifies the compliance with formal requirements. It offers legally compliant templates that meet statutory requirements and can be customized. Furthermore, Beglaubigt.de provides guidance on the necessary steps to ensure adherence to the formalities and offers support in creating a legally secure gift contract.

2.3 What should a gift contract include?

A gift contract should include all relevant information and agreements between the donor and the recipient to avoid legal disputes and misunderstandings. Below are the key contents of a gift contract:

- Contracting parties: Full names, addresses, and, if applicable, birthdates of the donor and the recipient.

- Object of the gift: A precise description of the gifted item or service, such as details of real estate, vehicles, or sums of money. For real estate and land, the exact location, size, and land registry number should be provided.

- Transfer and transfer date: Details regarding the transfer of the gifted item, for example, whether the transfer will occur immediately or at a specific time. For real estate and land, the date of entry in the land register should be specified.

- Formal requirements: If notarization or other formal requirements are necessary, these should be noted in the contract.

- Conditions and stipulations: Any conditions or stipulations attached to the gift should be included in the contract. For instance, the gift may be contingent upon specific behavior, services, or events.

- Right of reclamation: A clause that allows the donor to reclaim the gift under certain circumstances, such as in cases of gross ingratitude or the donor’s financial hardship.

- Exclusion of liability: A liability exclusion for possible defects or damages to the gifted item can be included in the contract to protect the donor from future claims.

- Tax regulations: Information on the tax treatment of the gift, such as allowances, tax rates, and reporting obligations.

- Signatures: The gift contract should be signed by both parties to document their consent and ensure legal validity.

Create a legally secure gift contract as a PDF

By using Beglaubigt.de, you ensure that all relevant content is included in your gift contract. The platform offers legally compliant templates tailored to your individual needs and reviewed by experts.

2.4 Is a gift contract valid without a notary?

Whether a gift contract is valid without a notary depends on the type of gift and legal requirements. In general, under German law, notarization is not strictly required for gifts (§ 516 of the German Civil Code – BGB). However, there are exceptions where notarization is mandatory.

- Real estate: For the gifting of land or real estate, notarization is mandatory, as these must be registered in the land registry (§ 311b Paragraph 1 Sentence 1 BGB). The gift only becomes legally effective with the entry in the land register.

- Company shares: In some cases, the gifting of company shares may also require notarization, such as with shares in a GmbH (§ 15 Paragraph 3 GmbH Law) or shares in a stock corporation (§ 68 Stock Corporation Act).

- Contract in favor of third parties: If a gift contract is made in favor of a third party who is not a contracting party, notarization may also be required (§ 331 Paragraph 1 B

In most other cases, a gift contract is valid without a notary. However, it is still advisable to have a written contract to prevent any ambiguities or legal disputes. Using an online service like Beglaubigt.de can help create legally compliant contracts without a notary, ensuring they meet legal requirements and avoid potential legal issues.

2.5 How do I write a gift contract?

A gift contract should be clearly and understandably written to avoid misunderstandings and legal disputes. Here are some steps to help you create a gift contract:

- Title: Start the contract with a clear title such as "Gift Contract."

- Parties: List the full names and addresses of the donor and the recipient.

- Object of the gift: Provide a detailed description of the gift, for example, the exact location and size of a property, the vehicle identification number of a car, or the amount of money.

- Transfer: Specify the time of transfer of the gift, whether it’s immediate or at a later date.

- Formal requirements: Note any necessary formalities, such as notarization, and include them in the contract.

- Conditions and stipulations: Add any conditions or stipulations tied to the gift, if applicable.

- Right of reclamation: Define any right of reclamation the donor may have under certain circumstances, such as in cases of gross ingratitude or financial hardship.

- Exclusion of liability: Include a liability exclusion for possible defects or damages to the gifted item to protect the donor from future claims.

- Tax regulations: Provide information about the tax treatment of the gift, such as exemptions, tax rates, and reporting obligations.

- Signatures: Have both parties sign the contract to document their consent and ensure the legal validity of the agreement.

To ensure that your gift contract is legally secure, it is recommended to use an online service like Beglaubigt.de. Beglaubigt.de offers verified templates for gift contracts tailored to your individual needs and compliant with all legal requirements. The process is simple and saves time compared to drafting a contract from scratch or consulting a lawyer.

Steuerliche Aspekte beim Schenkungsvertrag

3.1 What tax aspects should be considered in a gift contract?

When drafting a gift contract, various tax aspects should be taken into account, which may be relevant for both the donor and the recipient. The key tax aspects related to gifts are regulated by the Inheritance and Gift Tax Act (ErbStG). Here are some important points to consider in a gift contract:

- Gift tax: Gifts are generally subject to gift tax (§ 1 Abs. 1 Nr. 2 ErbStG). The amount of gift tax depends on the value of the gifted asset, the degree of kinship between the donor and the recipient, and the tax class.

example

A father gifts his daughter a property worth 200,000 euros. The gift tax is calculated based on the value, the degree of kinship (tax class I), and the corresponding tax rate.

- Exemptions: For gifts, there are certain exemptions up to which no gift tax is incurred (§ 16 Inheritance Tax Act). These exemptions depend on the degree of relationship and apply for a period of ten years.

example

A spouse can gift their partner up to 500,000 euros tax-free within ten years. Parents can make tax-free gifts of up to 400,000 euros to their children within ten years.

- Tax Rates: The tax rates for gifts are regulated in §§ 19 and 20 of the Inheritance Tax Act and vary depending on the tax class and the value of the gifted assets.

example

If a brother gifts his sister an amount of 100,000 euros, the gift falls into Tax Class II. The tax rate in this case ranges from 15% to 43%, depending on the value of the gift.

- Tax Reporting Obligation: Gifts generally must be reported to the tax office (§ 30 Inheritance Tax Act). This applies to both the giver and the recipient. The report must be made within three months after becoming aware of the gift.

example

An aunt gifts her nephew a car worth 30,000 euros. Both the aunt and the nephew are required to report this gift to the relevant tax office within three months.

When creating a gift contract, these and other tax aspects must be considered to avoid potential tax disadvantages or penalties and to make optimal use of tax benefits, such as exemptions

3.2 How are gifts treated for tax purposes?

Gifts are generally subject to gift tax according to the Inheritance and Gift Tax Act (ErbStG). The tax treatment of gifts depends on various factors, such as the value of the gift, the degree of relationship between the giver and the recipient, and the applicable tax class. The following outlines the key aspects of the tax treatment of gifts:

- Tax Classes: Gifts are classified into different tax classes based on the degree of relationship between the giver and the recipient (§ 15 Inheritance Tax Act). For example, Tax Class I includes spouses, registered partners, and children, while siblings and their children fall into Tax Class II. Tax Class III covers all other recipients.

- Exemptions: Different exemptions apply to gifts depending on the tax class (§ 16 Inheritance Tax Act). These exemptions can be utilized within a period of ten years. For example, spouses and registered partners can gift up to 500,000 euros tax-free, while parents can gift up to 400,000 euros tax-free to their children.

- Tax Rates: The tax rates for gifts vary depending on the tax class and the amount of the gifted assets (§ 19 Inheritance Tax Act). They range from 7% to 50% for Tax Class I, 15% to 43% for Tax Class II, and 30% to 50% for Tax Class III.

- Reporting Obligation: Gifts must generally be reported to the relevant tax office (§ 30 Inheritance Tax Act). Both the giver and the recipient are required to report the gift. The reporting deadline is three months after becoming aware of the gift.

An example of case law related to gift tax is the ruling of the Federal Fiscal Court (BFH) dated May 10, 2017 (Az. II R 25/15).

In this case, the BFH ruled that gift tax on a mixed gift—where the recipient provides something in return—is only applicable to the gratuitous portion of the gift. This means that for a mixed gift, the value of the consideration provided is subtracted from the total value of the gift to determine the taxable gift amount

3.3 What exemptions and tax rates apply to gifts?

For gifts, different exemptions and tax rates apply depending on the degree of relationship and the applicable tax class. The exemptions and tax rates are regulated by the Inheritance and Gift Tax Act (ErbStG). Below is an overview of the most common exemptions and tax rates:

Exemptions (§ 16 Inheritance Tax Act):

- Spouses and registered partners: 500,000 euros

- Children and stepchildren: 400,000 euros

- Grandchildren: 200,000 euros

- Parents and grandparents (for gifts made upon death): 100,000 euros

- Siblings, nieces, nephews, and other persons in Tax Class II: 20,000 euros

- Persons in Tax Class III: 20,000 euros

The exemptions apply for a period of ten years. If additional gifts are made within this period, they will be counted towards the respective exemption amount.

Tax Rates (§§ 19 and 20 Inheritance Tax Act):

The tax rates for gifts vary depending on the tax class and the value of the gifted assets.

- Tax Class I (spouses, registered partners, children, stepchildren, grandchildren, etc.):

- Tax Class II (siblings, nieces, nephews, in-laws, parents-in-law, etc.):

- Tax Class III (all other persons):

The exact exemptions and tax rates are crucial for correctly calculating gift tax and optimizing potential tax benefits. It is important to consider these aspects when planning and executing gifts.

In some cases, additional benefits or regulations may apply. For example, under certain circumstances, gifts of business assets, agricultural or forestry assets, or shares in corporations may be exempt from or favorably treated in gift tax (§§ 13a and 13b Inheritance Tax Act).

3.4 Is a gift subject to reporting requirements?

Yes, gifts are indeed subject to reporting requirements. According to the Inheritance and Gift Tax Act (ErbStG), both the giver and the recipient are responsible for reporting the gift to the relevant tax office.

According to § 30 of the Inheritance and Gift Tax Act (ErbStG), the gift must be reported to the tax office within three months of becoming aware of it. This ensures the correct calculation of gift tax and the verification that all legal requirements have been observed

It is essential to understand that the reporting obligation exists regardless of the value of the gift and the applicable exemptions. Even if the gift does not exceed the exemption amount and therefore no gift tax is due, the gift must still be reported.

All relevant details must be provided in the report, such as the exact value of the gift, the degree of relationship between the parties, and, if applicable, the use of exemptions.

Failure to meet the reporting obligation can lead to serious consequences, including fines or additional gift tax liabilities. Therefore, it is of utmost importance to take this reporting obligation seriously and to carry out all necessary actions in a timely manner.

Moreover, case law has emphasized the importance of the reporting obligation in several rulings. A well-known ruling by the Federal Fiscal Court (BFH) confirmed, for example, the strict handling of the reporting obligation and the potential sanctions for non-compliance. It is advisable to stay informed about current rulings and decisions to be up-to-date with the latest legal developments.

3.5How does the tax office learn about a gift?

The tax office can become aware of a gift through various means. One of the main sources is the statutory reporting obligation, which applies to both the giver and the recipient (§ 30 Inheritance and Gift Tax Act). As previously mentioned, gifts must be reported to the tax office within three months of becoming aware of them.

Here are some additional ways the tax office might learn about a gift:

- Notarial Certification: If a gift agreement is notarized, the tax office may become aware of the gift through the notary or the land registry office. Notaries are required to report certain legal transactions, such as property transfers, to the tax office.

- Banks and Financial Institutions: In cases of large transfers or unusual transactions, banks and financial institutions may be required to report these to the tax office. This reporting is part of anti-money laundering efforts and helps detect tax evasion and other illegal activities.

- Control Reports: The tax office may receive information about gifts through control reports from other authorities or offices, such as youth welfare offices or social services.

- Self-Disclosure or Tax Return: Gifts may also be disclosed in a self-disclosure or tax return. For example, if the recipient reports interest income from the gift in their income tax return.

- Audits and Investigations: The tax office may learn about gifts through audits, investigations, or reports from third parties (e.g., whistleblowers).

Since the tax office can become aware of gifts through various channels and there is a reporting obligation for gifts, it is advisable to report gifts to the relevant tax office in a timely and accurate manner. Failure to comply with the reporting obligation can lead to sanctions and should therefore be avoided.

3.6 What happens if a gift is not reported to the tax office?

If a gift is not reported to the tax office despite the reporting obligation, various consequences and sanctions may arise. Here are some possible outcomes:

- Late Fees: If the gift is not reported within the three-month period specified in § 30 Inheritance and Gift Tax Act (ErbStG), the tax office may impose late fees. These can amount to up to 10% of the assessed gift tax.

- Fines: In cases of intentional or negligent failure to meet the reporting obligation, fines may be imposed under § 50 ErbStG. These fines can reach up to 50,000 euros.

- Payment of Gift Tax: If the tax office learns about the gift, it may demand payment of the gift tax due on the unreported gift. Additionally, interest may accrue for the period of non-reporting.

- Extension of Assessment Period: The assessment period for gift tax is generally four years (§ 169 Abs. 1 Sentence 2 Fiscal Code). However, for unreported gifts, this period can be extended to up to ten years (§ 169 Abs. 2 Fiscal Code).

- Criminal Consequences: In particularly severe cases, such as when failure to report is considered tax evasion, criminal consequences may arise. Penalties for tax evasion can include fines or imprisonment for up to five years (§ 370 Fiscal Code).

To avoid these negative consequences, it is crucial to report gifts to the relevant tax office in a timely and accurate manner.

3.7 Which gifts are not subject to reporting requirements?

Although most gifts are subject to reporting requirements, there are some exceptions. These exceptions generally apply to gifts that fall below certain exemptions or value limits. Here are some examples of gifts that are not subject to reporting requirements:

- Minor Gifts: Gifts that are considered "occasional generous contributions" are not subject to reporting requirements. These include gifts given on special occasions (e.g., birthdays, weddings) that fall within the usual range of such gifts. An example is monetary gifts from relatives or friends on birthdays.

- Personal Exemptions: Gifts that fall below the personal exemptions according to § 16 Inheritance and Gift Tax Act (ErbStG) are generally subject to reporting requirements. However, in practice, gifts below these exemptions are often not reported since no gift tax is due. It is important to emphasize that the reporting obligation still exists even if no tax needs to be paid.

- Gifts Between Spouses:Gifts between spouses or registered partners are generally subject to reporting requirements. However, gifts that serve daily cohabitation (e.g., gifts for special occasions like anniversaries or Valentine's Day) are usually not subject to reporting requirements, provided they remain within the usual .

It is important to emphasize that the reporting obligation for gifts generally exists, even if no gift tax is due.

3.8 Until when is a gift tax-free?

A gift is tax-free as long as it does not exceed the personal exemptions specified in gift tax law. According to § 16 Inheritance and Gift Tax Act (ErbStG), different exemptions apply depending on the degree of relationship between the giver and the recipient. These exemptions apply over a period of ten years. This means that within ten years, the total value of all gifts from the same person to the same recipient must not exceed the respective exemption amount to remain tax-free.

Here are the exemptions by degree of relationship:

- Spouses and registered partners: 500,000 euros

- Children and stepchildren: 400,000 euros

- Grandchildren: 200,000 euros

- Spouses and registered partners: 500,000 euros

- Children and stepchildren: 400,000 euros

- Grandchildren: 200,000 euros

- Alle anderen Personen: 20.000 Euro

If the total value of gifts within ten years exceeds the respective exemption amount, only the amount above the exemption is taxed. In such cases, it is advisable to spread the gifts over a longer period to optimize the exemptions and minimize gift tax.

It is important to note that despite the tax exemption for gifts below the exemption amounts, there is a reporting obligation to the tax office (§ 30 ErbStG). Therefore, gifts should be reported in a timely and accurate manner to avoid potential sanctions.

Special Considerations in Gift Agreements

4.1 What legal peculiarities are there in a gift agreement?

A gift agreement has some legal peculiarities that distinguish it from other types of contracts. Some of these peculiarities are:

- One-sided Obligation: Unlike most types of contracts that involve mutual obligations between the parties, a gift agreement is one-sided. This means that only the giver must perform (the gift), while the recipient does not have to provide anything in return.

- Formal Requirements: Gift agreements are subject to certain formal requirements. Generally, a gift agreement can be made informally (§ 516 Abs. 1 BGB). However, for specific cases, such as the gift of real estate or property-like rights, notarization is required (§ 311b Abs. 1 BGB).

- Revocation and Recovery: Gifts can be revoked or reclaimed under certain conditions. For example, the giver can reclaim the gift under § 528 BGB due to severe ingratitude if the recipient commits a serious wrongdoing against the giver or someone close to them. Another possibility is the recovery of the gift due to the giver's impoverishment (§ 529 BGB).

- Limited Liability: In a gift, the giver’s liability is limited under § 521 BGB for defects in the property or rights. Liability is restricted to cases where the giver has fraudulently concealed the defect or has provided a warranty for the condition of the item.

- Mandatory Share Supplement Claim: If a testator made gifts during their lifetime, this may lead to a mandatory share supplement claim (§ 2325 BGB). The value of the gift is added to the estate to calculate the compulsory share for statutory heirs. The claim for supplementing the mandatory share expires after ten years.

4.2 How does a gift agreement differ from other types of contracts?

The gift agreement differs in several aspects from other types of contracts, such as sales contracts, rental agreements, or loan agreements. Here are some of these differences:

- One-sided Obligation: While most types of contracts involve mutual obligations of the parties, a gift agreement is one-sided. This means that only the giver has to perform (make the gift), while the recipient does not have to provide anything in return.

- Non-Compensation: The main difference between a gift agreement and other types of contracts is the non-compensation nature of the gift. In a gift agreement, the recipient is not obligated to provide any compensation to the giver, whereas in other contracts like sales or rental agreements, compensation is agreed upon.

- Formal Requirements: Gift agreements may have different formal requirements compared to other types of contracts. For example, gifts of real estate or similar rights require notarization (§ 311b Abs. 1 BGB), while a sales contract for movable items does not have such a requirement.

- Revocation and Recourse: Gifts can be revoked or recouped under certain conditions, which is generally not possible with other types of contracts. Examples include the recourse of a gift due to gross ingratitude (§ 528 BGB) or the impoverishment of the giver (§ 529 BGB).

- Liability for Defects: In a gift agreement, the giver is only limitedly liable for defects according to § 521 BGB. Liability is restricted to cases where the giver fraudulently concealed the defect or provided a warranty on the condition of the item. In other types of contracts, such as sales contracts, there is generally more extensive liability for defects.

4.3 What rights and obligations do the donor and recipient have?

In the context of a gift agreement, the donor and recipient have specific rights and obligations:

Rights and Obligations of the Donor:

- Transfer of the Gift: The donor is obligated to transfer the gifted item or right to the recipient. This may involve different forms depending on the type of gift, such as handing over a movable item or registering a property in the land register for real estate.

- Limited Liability for Defects: According to § 521 BGB, the donor's liability for defects in the gift is limited. The liability is confined to cases where the donor has fraudulently concealed the defect or provided a warranty for the condition of the item.

- Claims for Return: In certain cases, the donor can reclaim the gift, such as in instances of gross ingratitude from the recipient (§ 528 BGB) or if the donor becomes impoverished (§ 529 BGB).

Rights and Duties of the Recipient:

- Right to Transfer: The recipient has the right to demand the transfer of the gift from the donor.

- Acceptance of the Gift: The recipient is obligated to accept the gift and take possession of it unless they explicitly decline the gift.

- Consideration for the Donor: The recipient should consider the donor's interests within reasonable limits to avoid the conditions that might lead to a claim for return due to gross ingratitude.

- Participation in the Transfer: The recipient is required to cooperate in the transfer of the gift, such as by signing the necessary documents or assisting with registration in the land register.

4.4 Disadvantages of a Gift?

Although gifts are often viewed as a generous gesture and a way to save on taxes, there are also several disadvantages that both the giver and the recipient should consider:

- Irrevocability: Once a gift has been effectively completed, it generally cannot be reversed, except under certain conditions such as gross ingratitude or the insolvency of the giver (§§ 528, 529 BGB).

- Gift Tax: Despite the allowances and tax rates applicable to gifts, gifts may still lead to gift tax liability, especially if the value of the gift exceeds the allowances.

- Risk of Insolvency: If the giver becomes insolvent within ten years after the gift, the insolvency administrator may challenge the gift and demand the return of the gifted assets (§ 134 InsO).

- Limited Control: By giving a gift, the giver relinquishes control over the gifted asset or right. This can be problematic, especially if the giver later needs the asset or if the recipient does not manage the gift in line with the giver’s intentions.

- Liability Risks: The recipient may be liable for certain obligations related to the gift, such as property taxes or public charges if the gift involves real estate.

- Legal Risks: Gifts can pose legal risks for both givers and recipients if not carefully planned and executed. These risks include violations of formal requirements, invalidity of the gift, or infringement of third-party claims to a mandatory share.

Revocation of a Gift Contract

5.1 How Can a Gift Contract Be Revoked or Contested?

A gift contract can be revoked or contested under certain circumstances. Here are some of the most common reasons:

Revocation:

- Gross ingratitude of the recipient (§ 528 BGB): The donor can reclaim the gift if the recipient acts with gross ingratitude, such as by severe mistreatment or insults towards the donor or their family members.

- Poverty of the donor (§ 529 BGB): If the donor becomes impoverished after the gift and can no longer support themselves adequately, they can reclaim the gift.

Contestations:

- Mistake, Threat, or Deception (§§ 119, 123 BGB): The gift contract can be contested if it was made based on a mistake, threat, or deception. For example, if the donor was misled by false statements from the recipient or third parties about the gift.

- Violation of Statutory Share Claims (§ 2305 BGB): If the gift results in a violation of statutory share claims of other heirs, the gift contract can potentially be contested.

Key Points:

- Revocation for Gross Ingratitude (§ 528 BGB)

- Revocation for Donor's Insolvency (§ 529 BGB)

- Contest for Mistake (§ 119 BGB)

- Contest for Threat or Deception (§ 123 BGB)

- Contest for Violation of Statutory Share Claims (§ 2305 BGB)

5.2 In which cases is a revocation or challenge possible?

A revocation or challenge of a gift contract is possible under certain circumstances. Here is an overview of the various situations:

Revocation options:

- Gross Ingratitude of the Recipient (§ 528 BGB): The donor can reclaim the gift if the recipient shows gross ingratitude, such as through severe physical or emotional harm, insults, or slander against the donor or the donor's close family members.

- Poverty of the Donor (§ 529 BGB): If the donor becomes impoverished after the gift and can no longer support themselves adequately, they have the right to reclaim the gift.

Challenge options:

- Mistake (§ 119 BGB): The gift contract can be challenged if it was based on a mistake. This could involve a mistake about the subject of the gift or about essential characteristics of the recipient.

- Threat or Deception (§ 123 BGB): The gift contract can be challenged if it was entered into under threat or deception. For example, if the donor was misled by false statements from the recipient or others about the gift or was pressured into making the gift.

- Violation of Forced Share Claims (§ 2305 BGB): If the gift leads to a violation of the forced share claims of other heirs, the gift contract can be challenged.

5.3 What are the legal consequences of a revocation or challenge?

The legal consequences of a revocation or challenge of a gift contract can be significant. Here are some possible outcomes:

Consequences of Revocation:

- Reversal of the Gift: If a revocation is effective, the gift must be reversed. This means the recipient must return the received item or assets to the giver.

- Compensation for Depreciation: If the returned item or asset has depreciated in value, the recipient may need to provide compensation.

- No Recovery of Consumed or Disposed Goods: If the recipient has already consumed or disposed of the received items or assets, the giver generally cannot reclaim them. However, there may be a claim for compensation for the value.

Consequences of Challenge:

- Nullity of the Gift Contract: If the gift contract is successfully challenged, it is deemed void retroactively. This means the gift is treated as if it never occurred.

- Reversal of the Gift: As with revocation, if a challenge is successful, the gift must be reversed. The recipient must return the received item or assets to the giver.

- Compensation for Depreciation: The recipient may also be required to provide compensation for any depreciation of the returned item or asset.

- No Recovery of Consumed or Disposed Goods: Similar to revocation, the giver generally cannot reclaim consumed or disposed of items or assets. However, a claim for compensation may exist.

Dokumentation und Kosten von Schenkungsverträgen

6.1 Is a transfer considered a gift?

A transfer can be considered a gift if it meets certain criteria. A gift is a gratuitous transfer of assets or items where the giver intends to enrich the recipient at their own expense.

A transfer is considered a gift if the following conditions are met:

- Gratuitousness: The giver does not demand any consideration for the transfer, and there is no legal obligation for the recipient to repay the amount.

- Intent to Enrich: The giver intends to enrich the recipient at their own expense. This means the giver wants the recipient to keep the transferred amount without any obligation of repayment or

- consideration. Acceptance of the Gift: The recipient of the transfer must accept the gift for it to be legally effective. Usually, acceptance is indicated by the recipient's consent to the gift and receipt of the transferred amount.

6.2 How should a gift be documented?

The documentation of a gift depends on the type of gift and legal requirements. Here are some general guidelines for documenting gifts:

- Gift Contract: A written gift contract is not always required but can be useful in many cases. For certain gifts, such as the transfer of real estate or rights to real estate, a notarized gift contract is legally required (§ 518 Abs. 1 BGB). In other cases, a written contract can help avoid misunderstandings and clarify the intention of the gift.

- Documentation of the Gift: Regardless of whether a written contract exists or not, it is advisable to keep evidence of the gift. This can include transfer confirmations, receipts, bank statements, or a confirmation from the recipient acknowledging receipt of the gift. These documents can serve as proof of the gift if needed, for example, in tax or legal matters.

- Tax Documentation: For gifts that are taxable or exceed exemption limits, it is important to report the gift to the tax office and submit the required documents. This typically includes gift tax returns and, if necessary, appraisals for asset valuation. The exact requirements may vary depending on the country and type of gift.

6.3 How much does a gift cost at the notary?

The costs for notarizing a gift vary depending on the value of the gift, the extent of the notarial services, and the individual fee rates of the notary. In Germany, notarial fees are governed by the Court and Notary Fees Act (GNotKG), which prescribes a standard fee schedule for notaries. The fees are based on the transaction value, which is the value of the gift.

An example for illustration:

Suppose the value of the gift is €100,000. According to the fee schedule in the GNotKG, this results in a notarization fee of about 1.0 fee units. One fee unit is approximately €747 for this transaction value (as of 2021). Therefore, the notarization fee would be about €747. In addition, there is the statutory VAT (19%) of around €142 and any additional fees for extra services provided by the notary.

Some examples of cost factors for a notarized gift are:

- Notarization Fee: This is the fee for creating the gift contract and the notarization. It is based on the value of the gift and is calculated according to legal fee tables.

- Consultation Fee: If the notary provides additional consultation services before or after the notarization, extra fees may apply.

- Fees for Certifications and Copies: Separate fees may be charged if the notary certifies documents or makes copies of the gift contract.

- Value Added Tax (VAT): Notary fees are generally subject to the statutory VAT (currently 19% in Germany).

Gifts in Everyday Life: Specifics and Questions

7.1 What to Consider When Gifting to Children?

When giving a gift to children, various aspects should be considered to avoid legal and tax issues. Here are some important points to consider:

- Gift Agreement: To ensure legal protection and avoid misunderstandings, it is advisable to draft a gift agreement detailing the specifics of the gift. For larger gifts or real estate, notarization is legally required.

- Gift Tax: Gifts to children are subject to gift tax. However, there are exemptions that can be used every ten years. For children, the exemption is currently €400,000. Gifts up to this amount are tax-free.

- Supplementary Inheritance Claims: If a child benefiting from a gift later claims a statutory share from the donor's estate, other heirs may assert a supplementary inheritance claim. To minimize this risk, the gift should be made at least ten years before the donor's death, as claims expire after this period.

- Right of Revocation: In certain cases, the donor can reclaim the gift, for example, if they face financial hardship or if the gifted child treats the donor with gross ingratitude. To address such situations, a revocation clause should be included in the gift agreement.

Example and Case Law: In a ruling by the Federal Court of Justice (BGH, Az. X ZR 107/16), it was decided that parents who gift a property to their child can, under certain circumstances, grant themselves a lifelong right to reside, even if this was not explicitly stated in the gift agreement. In the case, a mother gifted her daughter a house without securing a right to live there for herself. Later, a dispute arose, and the mother was evicted. The BGH ruled that the mother was entitled to a right of residence due to the special trust relationship between parents and children.

7.2 How Does a Monetary Gift Process Work?

A monetary gift can be made in different ways, depending on the amount, the wishes of the parties involved, and legal requirements. Here are the steps for carrying out a monetary gift:

- ntent of the Gift: First, it should be clear that the donor intends to give the recipient a sum of money without expecting anything in return.

- Gift Agreement: Although a written contract is generally not required for a monetary gift, a gift agreement can help clarify the intentions and terms of the gift and avoid potential disputes. For larger amounts or when tax aspects need to be considered, a written agreement is recommended.

- Transfer or Cash Payment: The monetary gift can be made either through a bank transfer to the recipient's account or as a cash payment. For a transfer, the term "gift" should be included in the reference to make the transaction traceable. For cash payments, a receipt or confirmation in the gift agreement can document the money transfer.

- Notification to the Tax Office: Depending on the amount and the relationship between the donor and the recipient, the gift may be subject to gift tax. In such cases, it is necessary to report the gift to the tax office within a certain period (usually three months). The notification should include details about the amount of the gift, the parties involved, and possibly the gift agreement.

- Gift Tax: Depending on the amount of the gift and the relationship between the donor and recipient, gift tax may be due. However, there are exemptions that can be used every ten years. For gifts to children, the exemption is currently €400,000. Gifts up to this amount are tax-free. If the gift exceeds the exemption, gift tax must be paid according to the applicable tax rates.

By following these steps, a monetary gift can be made smoothly and in compliance with legal requirements.

Intuitive Questions Without Complexity

Shareable Link

Reviewed by lawyers

Document ready as PDF or Word

7.3 Are high-value transfers reported to the tax authorities?

Banks and other financial institutions in Germany are subject to anti-money laundering regulations, which require them to report certain transactions to the relevant authorities. This includes unusual or suspicious transactions, as well as those that exceed a certain threshold.

According to the Money Laundering Act (GwG), banks are required to report suspicious activities to the Financial Intelligence Unit (FIU) if they have reasons to suspect money laundering, terrorism financing, or other criminal activities. This can include high-value transfers.

Additionally, banks are required to report unusual or suspicious transactions as part of their due diligence obligations, regardless of their amount. In such cases, the bank may request further information about the background and purpose of the transaction.

It is important to note that gifts to close relatives must be reported to the tax authorities if they exceed the applicable exemption limits. However, this reporting obligation falls on the donor and the recipient, not the bank.

In summary, high-value transfers are not automatically reported to the tax authorities, but banks are required to report certain transactions to the relevant authorities as part of their due diligence and legal obligations.

7.4 Can I transfer 10,000 euros to my son?

Yes, you can transfer 10,000 euros to your son. Such a transfer is generally permissible and constitutes a gift. There are no legal restrictions on transferring such amounts within the family, as long as the transaction is lawful and not related to illegal activities.

However, note that gifts to close relatives may be subject to gift tax under certain circumstances. In Germany, there are exemptions that can be used every ten years. The exemption for gifts to children is currently 400,000 euros. Since the gift of 10,000 euros is well below this exemption, no gift tax would be incurred in this case.

Even if no gift tax applies in this case, it may still be advisable to document the gift in writing. This can be helpful to track the utilized exemption and clarify any potential tax obligations. When making the transfer, you should indicate "gift" in the reference field to make the transaction clear and traceable for all parties involved.

To carry out the transfer, you should indicate the term "gift" in the purpose field of the transfer to make the transaction clear and traceable for all parties involved. This also facilitates the allocation of the payment for tax purposes or in case of any future inquiries.

Use of the document creator from Beglaubigt.de for gift contracts

8.1 How can Beglaubigt.de assist in the creation of a gift contract?

Beglaubigt.de is an online platform that helps you create legally compliant contracts, including gift contracts, quickly and easily. The platform offers the following support in drafting a gift contract:

- Templates and Samples: Beglaubigt.de provides legally reviewed templates and samples for gift contracts. These templates are designed to meet legal requirements while being easily adaptable to the individual needs of the parties involved.

- Custom Adaptation: The platform allows you to tailor the contract templates to your specific needs. You can adjust the templates based on the agreed conditions, the type of gift, and the parties involved.

- Legal Review: The contract templates from Beglaubigt.de are created and reviewed by experienced legal experts. This ensures that the templates comply with current legal standards.

- Time and Cost Savings: Using Beglaubigt.de templates saves you time and costs that would typically be incurred when creating a contract through a lawyer or notary. The platform offers a quick and cost-effective alternative to traditional contract creation.

- PDF and Word Export: Beglaubigt.de allows you to download your completed gift contract as a PDF or Word document. This makes it easy to share, print, or digitally store the contract.

By using Beglaubigt.de for creating a gift contract, you benefit from the platform’s expertise and receive a legally secure document tailored to your individual needs.

8.2 What advantages does the document creator from Beglaubigt.de offer compared to traditional methods?

The document creator from Beglaubigt.de offers several advantages compared to traditional methods of creating contracts, such as gift agreements:

- Time Savings: Using Beglaubigt.de allows you to create contracts quickly and efficiently without the need for time-consuming consultations with lawyers or notaries.

- Cost Efficiency: Compared to hiring a lawyer or notary to draft a gift agreement, Beglaubigt.de offers substantial cost savings as the platform provides legally sound templates at a fraction of the usual fees.

- Flexibility: Beglaubigt.de enables you to create and edit the contract anytime and from anywhere, allowing you to customize your contracts according to your needs and at your own pace.

- Legal Security: The contract templates on Beglaubigt.de are created and reviewed by experts to ensure they meet current legal requirements, giving you the assurance of a legally valid document.

- Ease of Use: The platform is user-friendly and allows even those without legal knowledge to create and adjust contracts. The templates are clearly structured and include explanations to help you complete the contract correctly.

- Versatility: Beglaubigt.de offers not only gift agreements but also a variety of other contract templates, making the platform a useful tool for a wide range of legal questions and needs.

Overall, the document creator from Beglaubigt.de provides a faster, more cost-effective, and user-friendly approach to creating contracts, without compromising the legal security and quality of the documents.

Frequently Asked Questions

from Our Users