What do I need to do to leave the church?

Leaving the church is a formal legal act that expresses a church member's desire to no longer be part of the church community and, accordingly, to no longer pay church taxes.

This process is defined by legal regulations and by the administrative practices of the federal states and the churches themselves. To make this step as smooth as possible, it is essential to find out in advance about the necessary steps, documents, and possible costs.

Step-by-step guide on how to leave the church

- Find out which authority is responsible: In Germany, leaving the church is a matter for the state, but the process varies from state to state depending on which authority is responsible—in some states it is the registry office, in others it is the local court.

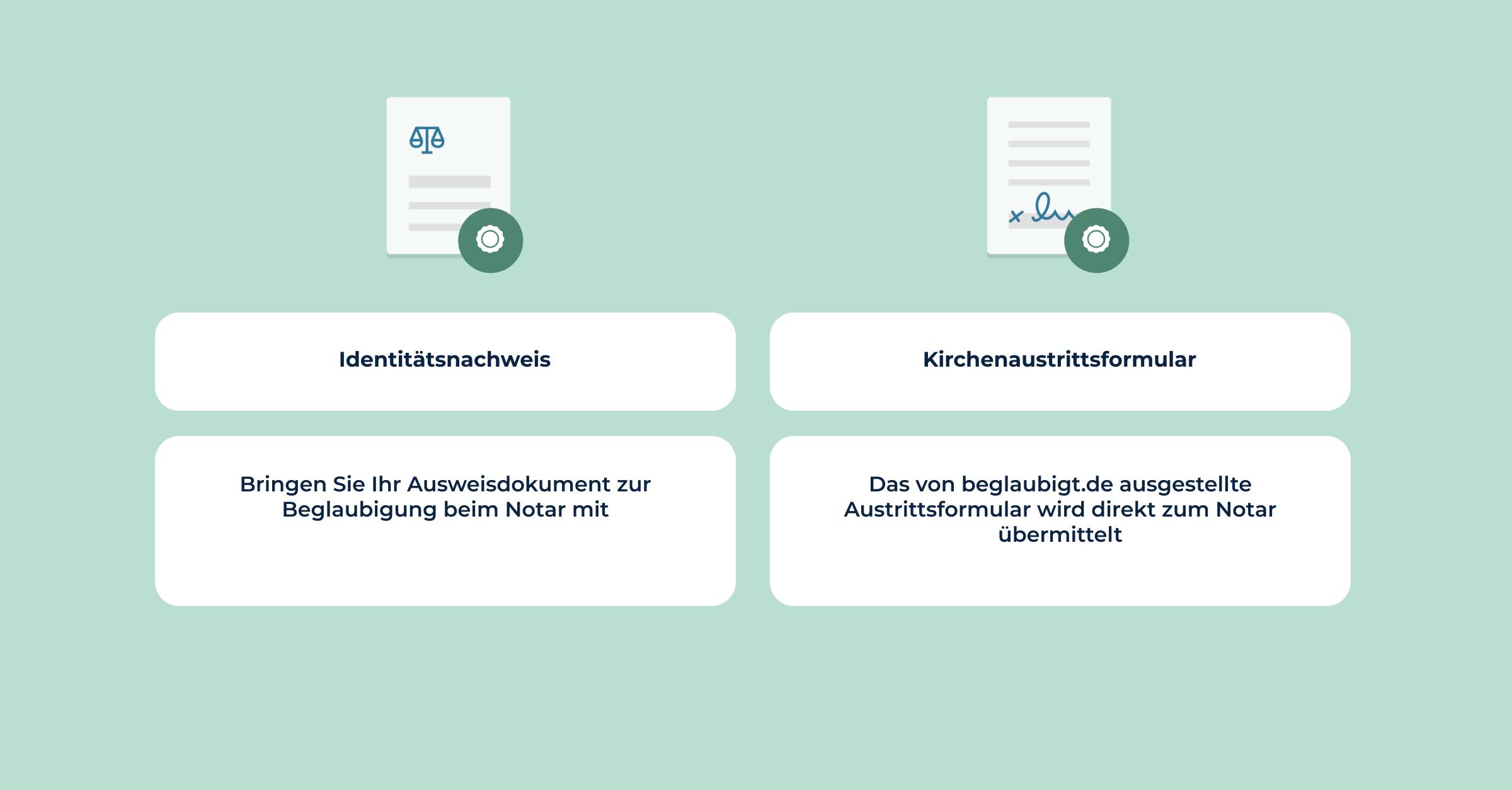

- Prepare the necessary documents: To leave the church, you will usually need a valid identity card or passport. Depending on the state, a baptism certificate or other proof of church membership may also be required.

- Write a letter of resignation: Although not always required, it is helpful to write a formal letter stating your desire to resign. This should include your personal details and a statement that you wish to leave the church.

- Submit the documents and pay the fee: Formal withdrawal is effected by submitting the required documents to the competent authority. A fee may be charged for this, the amount of which varies depending on the state.

Documents and proof of identity

The following documents are generally required to identify and prove your church membership:

- Valid identity card or passport

- Possibly baptism certificate or proof of church membership

Differences in the exit processes by state and denomination

The process of leaving the church can vary in detail depending on the state and denomination. While the basic steps are largely similar, the required documents, the amount of fees, and the responsible authority may differ. It is therefore advisable to obtain detailed information in advance to avoid unexpected obstacles.

Leaving the church in Germany is a formal process that requires thorough preparation and an understanding of the specific requirements. By finding out about the relevant authorities, preparing the necessary documents, and taking the necessary steps, you can leave the church efficiently and in accordance with your personal wishes.

By following these instructions, potential obstacles in the withdrawal process can be minimized and the transition to church tax-exempt status can be made smooth.

To learn more about the process of leaving the church, please also read this article: What do I need to do if I want to leave the church?

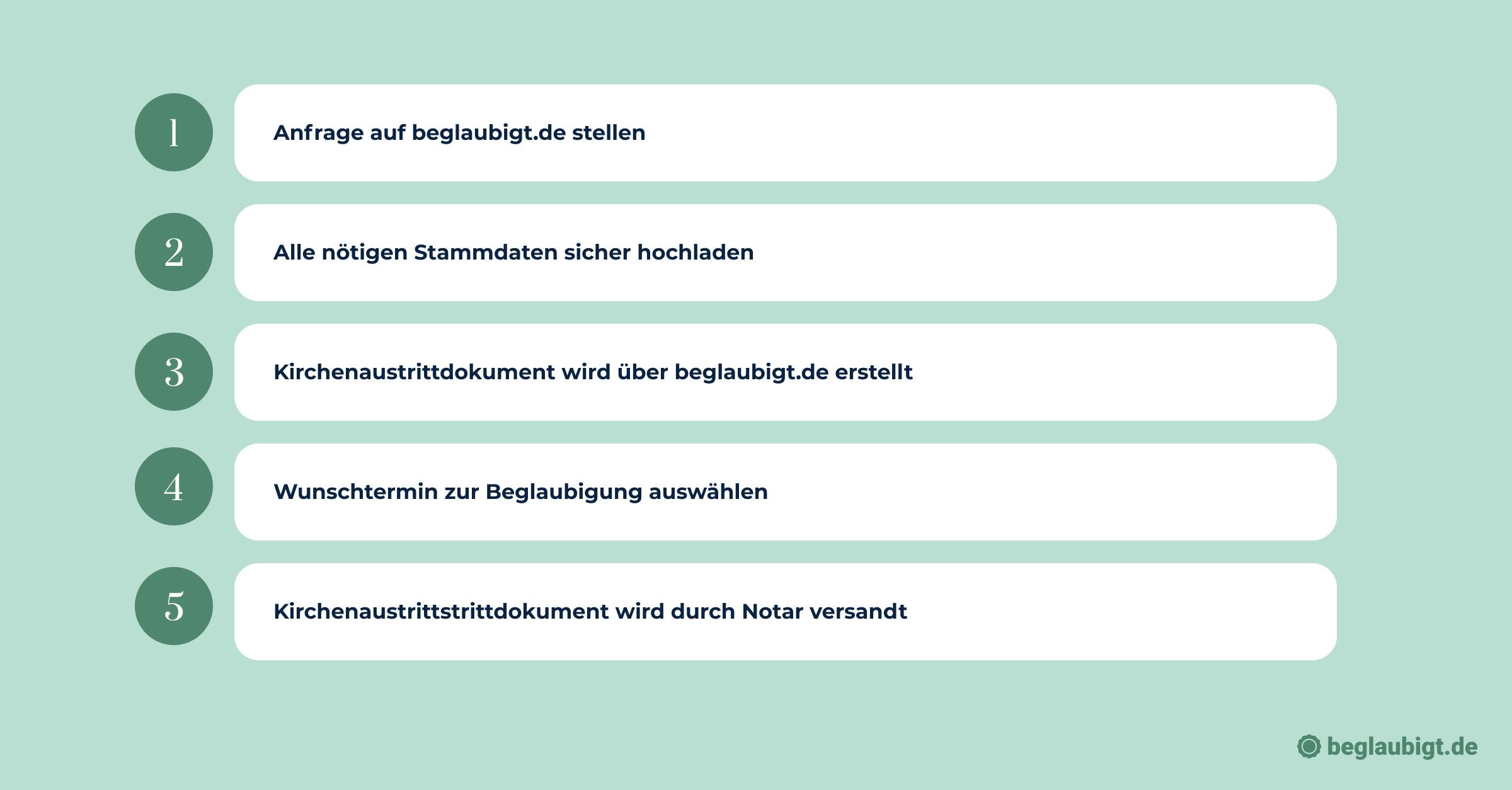

How can a notary help with leaving the church?

At first glance, it may seem unusual to consult a notary when leaving the church, as the process can usually be carried out directly at the relevant authority. However, there are situations in which notarial services are not only helpful, but also recommended or necessary. For anyone who would like to seek advice from a notary, beglaubigt.de is a good place to start.

There you can easily find a notary in your area and complete the entire process online. This section highlights the role of the notary in the process of leaving the church and explains how this legal support can make the process efficient and legally secure.

You may also be interested in the following articles:

- Leaving the church: what to bring

- Leaving the church – how does it work?

- Leaving the church Disadvantages

Role and duties of a notary

A notary serves as an impartial, state-appointed lawyer who certifies legal documents and ensures that legal transactions comply with legal requirements. In the context of leaving the church, a notary can perform the following tasks:

- Advice: A notary can provide information and advice on the legal consequences of leaving the church, particularly with regard to family law or inheritance law implications.

- Document creation and certification: The notary can draw up and certify the declaration of withdrawal in the proper form to ensure its legal validity.

- Transmission of documents: In some cases, the notary can send the certified withdrawal documents directly to the relevant authority, which simplifies the process for the applicant.

Advantages of using notarial services

The main advantages of involving a notary in the process of leaving the church include:

- Legal certainty: Notarization of the declaration of withdrawal ensures the legal validity of the document and avoids potential queries or problems during processing.

- Convenience: Comprehensive advice and support from a notary can greatly simplify and speed up the withdrawal process.

- Clarification of complex issues: In cases where special legal issues or international aspects play a role, a notary can provide valuable support.

Possible costs

The use of notary services incurs costs that can vary depending on the scope of the services provided. These fees are regulated by law and are based on the fee schedule for notaries. It is advisable to obtain a cost estimate in advance to avoid financial surprises. Please feel free to contact us to find out more about the costs of leaving the church with beglaubigt.de.

What to consider when choosing a notary

When choosing a notary, you should consider their experience and expertise in similar matters. Good communication and transparency regarding the costs involved are also important. Recommendations from friends or researching reviews can be helpful in making your decision. We would be happy to refer you to one of our notaries. To do so, simply send us a request at any time and explain your situation in more detail.

If you would like to learn more about the role of a notary in leaving the church, you may find this article interesting: Leaving the church with a notary

What do you call it when you leave the church?

Once a person has officially left the church, their religious and legal status with regard to church membership changes. This change in status is often described using specific terms that characterize the person's new position in a social and religious context. This terminology can be used in general communication as well as in official documents and legal texts.

Non-denominational

The most common term for people who have left the church is "non-denominational." This term implies that the person does not belong to any specific denomination or religious community. Non-denominational status primarily refers to formal membership in a religious community and says nothing about personal beliefs.

Non-religious

Another term that is sometimes used is "non-religious." This expression can indicate that a person has not only distanced themselves from a specific church or denomination, but does not belong to any religion in general or rejects religious beliefs. However, it is important to note that "non-religious" and "non-denominational" do not necessarily mean the same thing, as a non-denominational person may well have religious or spiritual beliefs without belonging to a particular church.

Not subject to church tax

In a narrower, tax law context, leaving the church also means achieving the status of "not liable for church tax." This means that the person is no longer obliged to pay church taxes due to their departure from the church. This status has direct financial implications and is one of the most common reasons for leaving the church.

The terms "non-denominational," "non-religious," and "not subject to church tax" reflect different aspects of a person's status after leaving the church.

While "non-denominational" describes the lack of affiliation with a religious community, "irreligious" can imply a general distancing from religion. The term "not liable for church tax" refers specifically to the tax consequences of leaving the church. These distinctions are important in order to fully understand and correctly communicate the social, religious, and financial implications of leaving the church.

If you would like to learn more about leaving the church, you may also be interested in this article: When does leaving the church take effect?

Consequences of leaving the church

Leaving the Church means that you are no longer considered a full member of the ecclesiastical community. This not only affects your ability to take on ecclesiastical offices or certain sacramental roles, such as that of a godparent, but also excludes you from participating in certain ecclesiastical activities. As a rule, people who have left the Church are excluded from taking on any godparent roles within the sacraments.

How much does it cost to leave the church in Bavaria?

The decision to leave the church can involve financial considerations as well as personal ones. In this context, the costs associated with leaving the church are of particular interest. Bavaria, like other federal states in Germany, charges a fee for the administrative act of leaving the church. This fee covers the processing costs associated with the formal change of church membership status.

Current fee schedule for leaving the church

In Bavaria, the fee for leaving the church is around €30 to €60. This fee may vary depending on the relevant authority and specific circumstances. It is important to check the exact amount of the fee in advance with the relevant authority, usually the local court.

Comparison of costs in different federal states

The costs of leaving the church in Germany are not uniformly regulated and vary from state to state. While a fee is charged in Bavaria, the costs in other states may be lower or even waived entirely. These differences reflect Germany's federal structure and are the result of the states' autonomous decision-making powers in this matter.

Information on possible exemptions or reductions in fees

In certain cases, it may be possible to obtain a reduction in fees or a complete exemption. Such arrangements are intended to accommodate individuals with low incomes or financial difficulties. To apply for a reduction or exemption, it is necessary to provide appropriate evidence of financial circumstances and to contact the relevant exit office.

The exact requirements for a fee reduction or exemption may vary, so it is recommended that you contact the authorities directly.

If you would like to know more about the financial aspects of leaving the church, please read this article: Is leaving the church financially worthwhile?

How does leaving the church work: Legal basis for leaving the church

Leaving the church in Germany is governed by a series of legal regulations that apply at both federal and state level. These legal foundations define the framework within which individuals can declare their withdrawal from a church or religious community.

The key laws and paragraphs provide guidance and security for both the person leaving and the church institution concerned.

Key laws and sections relating to leaving the church

- Church tax laws of the federal states: In Germany, church tax is regulated at the state level. Each federal state has its own church tax law, which, among other things, specifies the legal conditions for leaving the church. These laws determine which authority the departure must be declared to and which procedures must be followed.

- Civil Code (BGB): Section 26 of the BGB regulates the right to leave an association, which indirectly also applies to leaving the church, as churches in Germany are treated in some respects similarly to associations. This section emphasizes the fundamental right to freedom of religion and the possibility of leaving a religious community.

- Basic Law (GG): Article 4 of the Basic Law guarantees freedom of belief, conscience, and religion. This also includes the right to leave a religious community at any time. The Basic Law thus forms the highest legal basis for leaving the church.

Significance of legal regulations

The legal regulations governing withdrawal from the church protect individual religious freedom and ensure that withdrawal from a religious community

can take place within a regulated and legally secure framework. They ensure that individuals are free to make their decision to leave and can do so without unreasonable obstacles. The clear definition of responsibilities and procedures in laws and regulations also helps to ensure that the process is transparent and comprehensible for all involved.

The legal basis also reflects the principle of separation of church and state in Germany. Although church tax is an example of the close connection between state institutions and church institutions, the legal regulations allow for a clear distinction between individual rights and these institutions.

Find a notary near you who can assist you with leaving the church:

Summary of How to leave the church

The legal basis for leaving the church in Germany is anchored in a combination of federal and state laws as well as fundamental constitutional principles. They provide a legally secure framework that protects and supports the freedom of individuals to leave a church or religious community. For more information on the topic of leaving the church, please visit our blog.

These laws and provisions are essential for safeguarding individual freedom of belief and conscience and ensure that leaving the church is carried out in a regulated and fair manner.