Why is a gift agreement with a notary a relevant topic?

A gift agreement with a notary is a relevant topic because a gift is a significant legal act that often requires notarial certification. The costs associated with a gift agreement at the notary can represent a substantial financial burden for the parties involved.

Therefore, it is essential for all parties to be informed about the fees, legal requirements, and possible alternatives.

This article provides a detailed explanation of the costs of a gift agreement at a notary, as well as the reasons for requiring notarial certification.

(Alternatively, at beglaubigt.de, we have also developed a tool that clearly calculates notary costs, for example, for real estate purchases: Notary Cost Calculator).

Costs for a Gift Agreement with a Notary: What Are the Usual Fees?

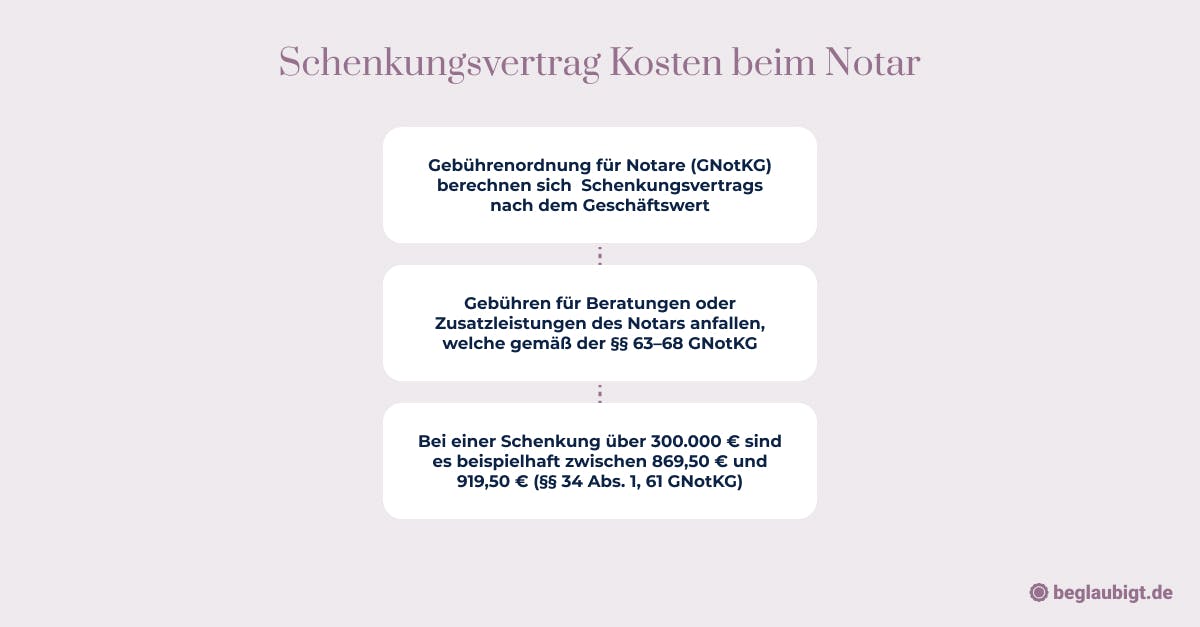

The notarization of a gift agreement by a notary in Germany follows a detailed fee structure based on the value of the assets being gifted. These fees are calculated according to the guidelines of the Court and Notary Costs Act (GNotKG), which provides a comprehensive fee schedule for notarial services. Fees are set in tiers based on the financial value of the gift.

This cost calculation is based on the guidelines of the Court and Notary Costs Act (GNotKG), which provides a detailed fee schedule for notarial services. Within this schedule, the fees are scaled according to the financial value of the gift.

When notarizing a gift agreement, a base fee generally applies, with potential additional costs for specific services. These services may include the drafting of the contract, expert legal advice provided by the notary, and the necessary registration of the gift in public registries, if required for the lawful transfer of the gifted assets.

The amount of notary fees varies significantly depending on the value of the gifted asset.

For lower-value gifts, such as personal items or cash in the range of a few thousand euros, the fees can be in the low hundreds. In contrast, the costs for notarizing high-value assets, such as real estate or company shares, can rise significantly, reaching the four- or even five-figure range.

It is important to recognize that fees for notarial services are regulated by the GNotKG (German Law on Court and Notary Fees), meaning that uniform fees apply for comparable services at all notaries in Germany.

In addition, other services might be required when notarizing a gift agreement, such as reporting the gift to the tax office, which could lead to additional costs.

Fee Schedule for Notaries: What Regulations Apply?

The fees for a gift agreement with a notary in Germany are governed by the Court and Notary Costs Act (GNotKG). According to § 36 Abs. 1 GNotKG, the fees for notarizing a gift agreement are based on the transaction value, meaning the value of the gift.

The exact amounts can be found in the fee schedule of the GNotKG, which is outlined in Annex 1 to the law. In addition to the notarization, further fees may be incurred for consultations or additional notary services, as calculated in §§ 63–68 GNotKG.

Example Calculation: How Are Notary Fees for a Gift Agreement Structured?

To better understand the costs of a gift agreement with a notary, let's look at a hypothetical case: A property valued at €300,000 is to be gifted.

The fees for notarizing the gift agreement are based on the fee schedule of the GNotKG. According to KV 14100, the fee for notarizing a gift agreement for a transaction value of €300,000 is 0.5 fees (§§ 36 Abs. 1, 44 Abs. 1 GNotKG). Based on a 1.0 fee amounting to €1,639.00 (§§ 34 Abs. 1, 61 GNotKG), the notarization fee would be €819.50 (0.5 × €1,639.00).

Additional fees may apply for certifying copies and potentially for a consultation. For certifying a copy, KV 32000 sets a fee of €10.00 per page. For three pages, this would amount to €30.00. If a consultation is necessary, KV 25000 allows for a consultation fee ranging from €20.00 to €70.00.

Total Costs Breakdown for the Example:

- €20.00 to €70.00

- Notarization fee: €819.50

- Certification of copies: €30.00

- Consultation (optional):

Thus, the total cost for the gift agreement with the notary in this example would be between €869.50 and €919.50, depending on whether a consultation is required.

It should be noted that fees can vary depending on the individual case and the value of the transaction. For a precise cost estimate, a notary should always be consulted.

Reasons for Notarizing a Gift Agreement: Why Should You Consult a Notary?

Legal Requirements: When Is Notarial Certification Mandatory?

In certain cases, the notarization of a gift agreement is legally required. Specifically, for gifts involving real estate, § 311b Abs. 1 Sentence 1 of the German Civil Code (BGB) mandates that the agreement must be notarized.

Additionally, for gifts that come with conditions or requirements, notarial certification should be considered to prevent potential legal disputes. It is important to be aware that if legal formalities are not followed, the gift agreement may be considered invalid (§ 125 BGB).

Legal Certainty and Risk Minimization: Benefits of Notarial Certification for Contracting Parties

Even when notarial certification is not legally required, it offers significant advantages for the involved parties, particularly:

Legal Certainty:

The notary ensures that the contract complies with legal requirements and accurately reflects the intent of both parties. This reduces the risk of challenges or contract invalidity.

Duty to Provide Information:

The notary is obligated to inform the parties about the legal consequences and risks of the contract (§ 17 Abs. 1 BeurkG). This ensures that both parties are better informed and can make well-founded decisions.

Neutrality:

The notary must remain neutral and safeguard the interests of both parties equally (§ 14 Abs. 1 BeurkG). This fosters trust and ensures a fair contract drafting process.

Evidentiary Power:

A notarized contract holds greater evidentiary value. In case of a dispute, it can provide proof of the contract's content and the authenticity of the signatures.

Overall, notarial certification helps minimize potential disputes and legal uncertainties, providing both the donor and the recipient with enhanced legal security.

How Can Beglaubigt.de Assist in Creating Gift Agreements?

Beglaubigt.de offers an innovative solution for the digital creation and processing of legal documents, including gift agreements. Their online platform simplifies the contract creation process and ensures that documents comply with current legal requirements through two main services:

Templates for Gift Agreements:

Beglaubigt.de provides access to standardized templates that meet the legal requirements in Germany. These templates serve as a solid foundation, ensuring that all legally relevant aspects are covered. Users can be confident that their gift agreement is based on a sound legal framework. These templates are particularly useful for clearly defining the legal context of a gift and serve as a starting point for further individual adjustments.

Contract Personalization:

A key advantage of the platform is the ability to personalize the contract templates. Users can insert specific information and conditions to tailor the agreement to their individual needs. This includes detailed descriptions of the gifted asset, the identification of the donor and recipient, and the specification of any conditions or restrictions. This personalization feature allows for a high degree of flexibility, ensuring that the specific circumstances and wishes of the parties involved are fully addressed.

Through these services, Beglaubigt.de significantly simplifies the process of creating legally compliant gift agreements and helps reduce the administrative burden for the parties involved.

Try it now: Create a digital gift agreement easily!

Features and Benefits: What Does Beglaubigt.de's Document Creator Offer?

The document creator from Beglaubigt.de is an online tool designed to assist in the creation of gift agreements. The key features and advantages of the document creator include:

- Templates:Beglaubigt.de provides legally secure templates for gift agreements, created and reviewed by experts. This offers users a reliable foundation for their contracts, which can be easily tailored to their individual needs.

- Flexibility:The document creator allows you to customize the gift agreement according to your specific requirements. Adjustments and additions can be made easily to fit the individual situation, ensuring the contract is suitable for each unique case.

- Speed: Creating a gift agreement with Beglaubigt.de’s document creator is time-saving. The template can be quickly filled out and adjusted, speeding up the entire process from start to finish.

- Export Function: Once completed, the gift agreement can be exported in PDF or Word format, allowing for easy processing and archiving of the document.

Our simple contract assistant helps you create a legally valid gift agreement for free within minutes: Download the gift agreement as a PDF.

Application and Integration: How is the Document Creator Integrated into the Contract Creation Process?

Using Beglaubigt.de's document creator for gift agreements is straightforward and user-friendly. The process for creating a gift agreement with the tool consists of the following steps:

- Complete the Template with the Individual Data and Requirements of the Gift Agreement:

After selecting the template, fill in all necessary details, such as the donor and recipient information, description of the gifted assets, and any other essential information specific to the agreement. - Add Additional Clauses or Adjustments as Needed:

Customize the contract by adding any extra clauses or adjustments to tailor it to your individual situation, such as conditions or restrictions related to the gift. - Export the Final Gift Agreement in PDF or Word Format:

Once the document is completed and reviewed, you can export it in either PDF or Word format for printing or digital storage. - Present the Agreement to a Notary if Notarization is Required:

In cases where notarial certification is legally required (e.g., real estate gifts), the completed and customized gift agreement should be submitted to a notary. The notary will conduct the necessary legal checks and notarize the agreement.

In cases where notarial certification is required, the completed and customized gift agreement should be presented to a notary, who will conduct the necessary legal checks and certify the agreement. Beglaubigt.de's document creator facilitates the contract creation process but does not replace notarial certification when it is legally mandated.

How much can be gifted tax-free?

In Germany, the Inheritance and Gift Tax Act (ErbStG) regulates the tax exemptions for gifts. The law provides allowances (Freibeträge) based on the relationship between the donor and the recipient. These allowances determine how much can be gifted tax-free.

- Spouses and registered partners: €500,000.

- Children, including stepchildren, adopted children, and grandchildren (if their parents are deceased): €400,000.

- Grandchildren (if their parents are still alive): €200,000.

- Great-grandchildren and parents (if gifted by their children): €100,000.

- Siblings, nieces, nephews, in-laws, former spouses: €20,000.

These allowances can be used once every ten years, meaning that after this period, the donor can gift up to the allowance amount tax-free again.

Any gifts exceeding these allowances are subject to gift tax. The amount of gift tax owed depends on the value of the gifted assets, the relationship between the donor and recipient, and the applicable tax rate, which increases progressively.

Additionally, there are special exemptions and valuation discounts for certain types of assets, such as business assets, agricultural and forestry property, and shares in corporations. These rules are complex and should be reviewed on a case-by-case basis.

Gift Tax and Allowances: What Are the Legal Regulations?

The gift tax in Germany is regulated by the Gift Tax Act (SchenkStG). The amount that can be gifted tax-free depends on the relationship between the donor and the recipient, with different allowances that apply over a ten-year period. These allowances are set in § 16 Abs. 1 SchenkStG and are as follows:

- Spouses and registered partners: €500,000

- Children and stepchildren: €400,000

- Grandchildren: €200,000

- Parents and grandparents (for gifts from children to parents): €100,000

- Siblings, nieces, nephews, and other individuals: €20,000

Exceeding the Allowances: How Is Gift Tax Calculated?

Gift tax is calculated once the allowances defined by the Inheritance and Gift Tax Act (ErbStG) are exceeded. The tax owed depends on several factors: the relationship between the donor and the recipient (which determines the tax class), the value of the gift after the allowance is subtracted, and the applicable tax rate.

Tax Classes

The ErbStG distinguishes between three tax classes, which reflect the degree of kinship between the parties:

- Tax Class I: Includes close relatives such as spouses, children, and grandchildren.

- Tax Class II: Applies to siblings, nephews, nieces, parents-in-law, and children-in-law.

- Tax Class III: Includes all other recipients, including non-relatives

Tax Rates

Progressive tax rates are applied within each tax class, and these rates increase as the value of the gift rises:

- Tax Class I: Rates start at 7% and can go up to 30% for very large gifts.

- Tax Class II: Rates range from 15% to 43%.

- Tax Class III: Rates range from 30% to 50%.

Calculation of Gift Tax

The exact calculation is done in two steps:

- Determining the Taxable Acquisition:

First, the total value of the gift is determined. From this, the respective personal allowance is subtracted, which varies depending on the relationship between the donor and the recipient. The remaining amount represents the taxable acquisition. - Applying the Tax Rate:

The tax rate, based on the tax class and the amount of the acquisition, is then applied to the taxable amount. - Example:

A parent gifts their child real estate valued at €600,000. The allowance for children is €400,000. The difference of €200,000 represents the taxable acquisition. For this amount, a tax rate within Tax Class I is applied, based on the size of the gift.

Utilizing Allowances for Multiple Gifts: How Can Allowances Be Optimally Used?

Since the allowances apply over a ten-year period, they can be fully utilized through multiple gifts within that time frame. It is recommended to plan gifts in such a way that the allowances are optimally used, minimizing the gift tax.

In conclusion, the statutory allowances in the Gift Tax Act enable the tax-free transfer of assets within certain limits. Careful planning and consideration of the allowances can help minimize gift tax and transfer wealth to the next generation tax-free.

Saving Costs on Gift Agreements: How to Reduce Notary Fees?

The creation of a gift agreement, particularly when notarial certification is required, can involve significant costs. However, platforms like Beglaubigt.de offer ways to make this process more efficient and cost-effective.

- Online Tool for Contract Creation: Beglaubigt.de provides an online tool that allows users to create their gift agreements themselves. By using pre-defined templates that meet legal requirements, users can develop a legally secure contract without the need for costly legal consultations.

- 2. Transparent Costs: The platform offers a clear overview of the costs associated with creating and notarizing the gift agreement. This allows users to better plan and control the financial aspects of the gift.

- 3. Preparation for Notarial Certification: By using Beglaubigt.de’s tool, users can prepare the gift agreementgift agreement before visiting a notary. This saves both time and money, as the notary only needs to review and certify the already-prepared contract.

- 4. Reducing Consultation Fees: Beglaubigt.de’s tool provides guidelines and explanations about various aspects of a gift agreement, allowing users to answer many of their questions independently. This helps avoid frequent and costly consultations with legal professionals.

- 5. Efficient Use of Allowances:The platform also provides information on optimizing tax allowances to minimize gift tax. Reducing the tax burden can indirectly lower the overall cost of the gift..

By using Beglaubigt.de to prepare a gift agreement, users can access a cost-efficient alternative to traditional contract drafting.

Pre-Planning and Preparation: How Can Parties Minimize Notary Costs?

Careful preparation can help reduce notary fees when creating gift agreements. Here are some tips to help minimize costs:

Research:

Learn about the legal requirements and formalities of a gift agreement in advance. This enables you to clearly communicate your wishes and expectations to the notary, reducing the time and effort spent on consultation.

Use Templates: Make use of legally secure contract templates, such as those offered by Beglaubigt.de’s document creator. By providing the notary with a well-structured contract draft, you can save both time and money.

Prepare Documents: Ensure all necessary documents and information are readily available for the gift agreement. This includes items like land registry extracts, ID documents, or proof of the value of the gift. Proper preparation reduces delays and additional costs.

Alternatives to Notarial Certification: Are There Situations Where a Notary Is Not Mandatory?

In certain situations, a visit to the notary is not mandatory, as the law does not require notarial certification for every type of contract. A prominent example is gifts of movable objects or cash.

For such transactions, notarial certification is not required, provided the gift is made without conditions or special terms. However, it is important to note that notarial certification offers significant advantages, particularly in terms of legal certainty and evidentiary value.

Notarial certification helps ensure that both parties are fully informed about their rights and obligations, and it helps prevent future disputes. Therefore, it is especially recommended for complex or high-value gifts.

Careful preparation and the use of legally compliant contract templates can help minimize the need for notarial involvement and the associated costs.

By using such templates, the process can be made more efficient, which can particularly lead to cost savings in standardized contract arrangements.

Who Pays the Costs in a Gift Transaction?

In a gift transaction, several costs typically arise, and the responsibility for these costs is usually shared between the involved parties.

The key cost components in a gift transaction primarily include notary fees, taxes, and potentially valuation costs to determine the value of the gifted asset.

The notary fees for certifying a gift agreement are based on the value of the gifted item and are regulated by the Court and Notary Costs Act (GNotKG). These fees typically increase with the value of the gift.

These costs are typically borne by the donor, unless explicitly agreed otherwise.

The gift tax, which is determined by the relationship between the parties and the value of the gift, is usually paid by the recipient.

German tax law provides allowances that vary based on the relationship and are outlined in § 16 of the Inheritance and Gift Tax Act (ErbStG).

If the value of the gift exceeds these allowances, gift tax is due, with the exact tax rate depending on the relationship and the value of the gift, as specified in §§ 19 and 20 ErbStG.

Can a gift be made without a notary?

A gift can generally be made without involving a notary, provided that it does not involve assets for which notarial certification is legally required, such as real estate or shares in a limited liability company (GmbH) in Germany.

For movable property or cash, a gift without notarial certification is possible and legally valid, as long as the essential components of a gift — the intent to give and the transfer of the gifted item — are present.

For example, a grandmother could give her granddaughter a savings account with a significant amount upon her reaching adulthood.

As long as the grandmother has the clear intention to gift the savings account and physically transfers it to the granddaughter, a valid gift is made. Notarial certification would not be required in this case but is recommended for larger assets to address tax issues or for documentation purposes.

Who bears the fees for notarial certification?

When a gift agreement is notarized, notary fees arise, which are generally shared by both the donor and the recipient. However, it is also possible to include specific cost-sharing arrangements in the contract, such as having the donor or the recipient cover all notary costs

Who is responsible for paying the tax?

In the case of a real estate gift, property transfer tax is usually payable, and the recipient is responsible for this payment. However, there are often tax exemptions or reductions for gifts within the family, such as between spouses or in direct lines (parents, children). It's advisable to research potential tax exemptions beforehand.

Who pays the costs for land registry changes?

The costs for updating the land registry following a real estate gift are typically borne by the recipient. As with notary fees, the contract can also include a specific arrangement on how these costs will be shared.

Overall, the parties involved in a gift agreement should agree in advance on how to divide the costs and include this in the contract.

Which is better: Gift or Transfer of Ownership?

Gift: What are the advantages and disadvantages of this form of asset transfer?

A gift is the gratuitous transfer of assets, such as real estate or money, from one person to another. The advantages of gifting include:

- Tax Allowances:

Depending on the relationship between the parties and the value of the gift, tax allowances can be used. These allowances can be renewed every ten years, allowing for significant tax benefits. - Early Asset Transfer:

Gifting enables the transfer of assets during one's lifetime, allowing for early inheritance planning and reducing the size of the estate for future heirs. - Donor Protection: The gift agreement can include provisions such as a lifetime right of residence or usufruct rights, ensuring the donor is financially and physically secure even after transferring the asset.

Disadvantages:

- Irrevocability: A gift is generally irrevocable and can only be undone under specific legal conditions (e.g., gross ingratitude by the recipient).

- Property Transfer Tax: When gifting real estate, property transfer tax may be incurred, which the recipient is typically responsible for paying.

Transfer of Ownership: What Are the Advantages and Disadvantages of This Form of Asset Transfer?

A transfer of ownership is a transaction involving compensation, where the recipient provides something in return, such as a purchase price. The advantages of transferring ownership include:

- Flexibility:

The value of the compensation can be agreed upon individually, giving both parties more flexibility in structuring the asset transfer to suit their needs. - Right to Reclaim:

Unlike a gift, a transfer of ownership allows for reclaiming the asset in cases of non-payment or breach of contract.

Disadvantages:

- Tax Burden:

A transfer of ownership can trigger additional taxes, such as income tax or gift tax, depending on how the compensation is assessed, in addition to the property transfer tax (Grunderwerbsteuer). - No Tax Allowances:

Unlike with a gift, tax-free allowances cannot be utilized in a transfer of ownership, which can increase the tax burden for both parties.

The decision between a gift and a transfer of ownership depends on the individual circumstances and goals of the parties involved. A gift offers the advantage of tax allowances, while a transfer of ownership provides more contractual security. It is advisable to seek comprehensive legal and tax advice before making a decision to ensure the best outcome for your specific situation.

Gift Agreement for a Car – What Should Be Considered?

Form of the Gift Agreement: Is Notarial Certification Required?

Unlike gifting real estate, gifting a car does not require notarial certification. However, a written gift agreement is highly recommended to clearly document the transfer and the conditions of the gift, helping to prevent potential disputes.

Vehicle Transfer and Ownership Transfer: How is the Car Transferred?

To transfer a car, there must be an agreement between the donor and the recipient and the physical handover of the vehicle. This includes handing over the registration certificate part I (Fahrzeugschein) and the registration certificate part II (Fahrzeugbrief). Additionally, the gift agreement should document the handover of the car and the mutual agreement.

More on this topic can be found here: Gift Agreement for Car without Notary.

If you are looking for more information on guidelines for gift agreements: What to Consider in a Gift Agreement.

Re-registration of the Vehicle: What Steps Are Necessary?

After the gift, the car must be re-registered in the name of the new owner. The following documents are required:

- Registration certificate part I (Fahrzeugschein)

- Registration certificate part II (Fahrzeugbrief)

- Insurance confirmation (eVB number)

- ID card or passport of the new owner

- Written authorization, if the new owner cannot personally visit the registration office

The re-registration should be completed within a few days after the vehicle handover.

Tax Considerations: Are there tax-free allowances for gifting a car?

Yes, when gifting a car, tax-free allowances can be applied, similar to other types of gifts. These allowances vary based on the relationship between the donor and recipient and are valid for a period of ten years. It is advisable to check the relevant allowances and gift tax to account for any potential tax liabilities.

Overall, careful preparation and documentation of the car gift are recommended to avoid legal and tax consequences and to ensure a smooth vehicle transfer.

What does it cost to gift a house?

Notary Fees for Gifting a House: What Fees Are Involved?

The notary fees for certifying a gift agreement for a house are based on the value of the property and the fee schedule outlined in the Court and Notary Costs Act (GNotKG). According to § 97 GNotKG, the fees for notarizing a gift agreement depend on the transaction value (i.e., the property's value) and typically range between 0.5 and 2.0 fee units. Additional fees may apply for land registry entries, which are also based on the property value (§§ 36, 44 GNotKG).

For more information, refer to: Gifting a House Agreement

Property Transfer Tax on Gifting a House: When Is It Due?

In most cases, property transfer tax (Grunderwerbsteuer) does not apply when gifting a house, as such gifts are exempt from this tax under § 3 Nr. 2 of the Property Transfer Tax Act (GrEStG). However, the gift must be registered in the land registry to become legally effective, and land registry fees will apply.

Gift Tax for Gifting a House: How Is It Calculated?

The gift tax on gifting a house in Germany is calculated based on the market value (Verkehrswert) of the property and the relationship between the donor and the recipient, as well as the applicable allowances. These factors determine the potential gift tax liability.

- Market Value of the Property:

The first step is to determine the current market value of the property, which serves as the basis for calculating the gift tax. - Relationship and Allowances:

The tax-free allowance depends on the relationship between the donor and recipient. The closer the relationship, the higher the tax-free allowance.

The Legal Peculiarities of Gifts in Germany

Gift Promises and the Requirement of Notarial Certification

In Germany, gift law contains some interesting quirks. According to § 518 Abs. 1 of the German Civil Code (BGB), a gift promise must be notarized to be legally binding. However, this requirement contrasts with the actual gift itself, where notarial certification is not necessary, unless the gift involves real estate or land (as per § 311b Abs. 1 BGB).

A gift promise establishes the legal obligation of the donor, whereas the actual gift is completed when the item is handed over to the recipient.

The Revocation of Gifts

Another peculiarity in German gift law relates to the possibility of revoking a gift under certain conditions. According to § 528 BGB, a donor can reclaim a gift if, after the gift, they are unable to maintain their own reasonable standard of living or meet their ongoing obligations.

This is only possible if the revocation occurs within ten years of the gift being made. Similarly, a donor can revoke a gift if the recipient has committed an act of gross ingratitude (§ 530 BGB).

Liability of the Recipient

A significant but often overlooked legal nuance in German gift law is the liability of the recipient. According to § 528 Abs. 2 BGB, creditors of the donor have the right to challenge the gift if the donor becomes insolvent and the gift negatively affects the creditors' ability to be compensated.

This provision protects the interests of creditors and prevents debtors from transferring assets through gifts to close relatives or others, effectively placing the assets beyond the reach of their creditors.

5 Further Considerations on »Costs for a Gift Agreement at a Notary«

- Regional Differences in Notary Fees:

Depending on the federal state and local fee regulations, the costs for a gift agreement at a notary may vary. It is advisable to check the fee structure in the specific region to avoid unpleasant surprises. Notary costs in some regions may be higher or lower, so researching local fees is essential. - Notary Fees as Tax-Deductible Expenses:

In some cases, the notary fees for a gift agreement may be tax-deductible, depending on the individual's tax situation. Consulting with a tax advisor or contacting the relevant tax office can clarify whether these costs can be claimed as tax-deductible expenses in specific situations. - Gift Agreement and Gift Tax:

In addition to notary fees, the gift tax must also be considered. Gift tax is due if the value of the gift exceeds certain tax-free allowances. Advance planning and taking the gift tax into account can help prevent unexpected financial burdens. - Notary as Legal Advisor:

The notary is not only responsible for certifying the gift agreement but can also provide valuable legal advice. The notary can explain the legal consequences and offer helpful tips when drafting the contract. The cost of these advisory services is typically included in the notary fees for the gift agreement. - Comparing Notaries:

It can be worthwhile to compare the costs of different notaries to find a competitive offer. However, it's important to keep in mind that the quality of advice and the experience of the notary are crucial factors. A smooth process and thorough consultation can be more valuable in the long term than a minor cost saving.

Conclusion: Why Are the Costs for a Gift Agreement at the Notary a Good Investment?

In conclusion, the costs for a gift agreement at the notary are well-invested. Notarial certification provides legal certainty for the parties involved and ensures that the agreement complies with legal requirements. For gifts involving real estate or land, notarial certification is even mandatory under § 311b Abs. 1 BGB.

Another advantage of using a notary is the minimization of risks. The notary’s expert review helps avoid legal pitfalls, protecting both the donor and recipient from unforeseen issues and potential future disputes.

While the notary fees, which are based on the Notary Fees Act (GNotKG) and vary according to the value of the gift, may seem significant, they are a worthwhile investment. These costs help prevent legal disputes or problems with creditors, which could arise without proper documentation.

Overall, the notary fees for a gift agreement provide essential protection for both the donor and the recipient. They ensure the legality of the gift, reduce risks, and protect the parties from unpleasant surprises. Thus, the costs for a notary’s services are an investment that pays off in the long run.

More articles: