A termination for operational reasons is a difficult situation for employees. Not only does one lose their job, but it often comes with financial concerns and the uncertain search for new employment. One way to mitigate this challenging situation is through severance pay. But what exactly is severance pay, and how is it calculated?

What alternatives are there to termination for operational reasons? In this article, we will explore these questions in detail and provide tips on how to best handle such a situation. Let’s find out together what options exist and how you can best assert your rights.

I. Introduction

What is termination for operational reasons?

A termination for operational reasons is a dismissal that occurs for reasons not related to the employee's personal situation. This means that the reason for the termination lies in the operational circumstances of the employer, such as economic difficulties, the closure of the business, restructuring, or changes in the production process.

According to Paragraph 1 of the Dismissal Protection Act (KSchG), the employer has the right to issue a termination for operational reasons if they can demonstrate and prove that urgent operational requirements necessitate the termination of the employment relationship. A termination for operational reasons can be issued to both the employee and the employer.

Reasons for termination for operational reasons

- Economic reasons: These may include a decline in revenue, losses, overcapacity in the business, relocation of production facilities, rationalization measures, mergers, or company insolvency.

- Technical reasons: This includes the introduction of new production methods, modernization of production facilities, or changes in the product range.

- Organizational reasons: This may involve the restructuring of the company, the merging of departments, or changes in areas of responsibility.

These fundamentally differ from terminations due to misconduct but are still categorized under the same family of regular terminations.

II. Severance Pay in the Case of Termination for Operational Reasons

Severance Pay in Terminations for Operational Reasons

Severance pay is compensation that an employer pays to an employee when the employment relationship is terminated. It can be paid in cases of both regular and extraordinary termination and is intended to help the employee mitigate the financial losses incurred due to losing their job.

According to Paragraph 1a of the Dismissal Protection Act (KSchG), an employee is entitled to severance pay in certain cases when the employment relationship ends due to operational reasons. This applies particularly if the employee has been employed for longer than six months and no significant reason for the termination exists. There is no entitlement to severance pay if the employee resigned voluntarily or if the employment relationship ended through a mutual agreement.

The amount of severance pay depends on the employee’s net salary and their duration of employment. There is no fixed sum or uniform calculation method applicable to all employees. However, certain general rules are typically used as a basis for calculating severance pay, such as the number of years of service, the employee's age, and the amount of the last salary.

It is important to note that entitlement to severance pay is not automatic, and employees may need to file a claim to enforce their entitlement. While there is no legal obligation for severance pay, it is common for both parties to reach a severance agreement that outlines the amount and conditions of the severance. Additionally, severance pay is not considered the same as social security compensation and is not deducted from such entitlements.

How Do I Calculate Severance Pay?

There is no fixed method or prescribed formula for calculating severance pay in the case of a termination for operational reasons. However, certain general rules are typically used as the basis for calculation, such as the number of years of service, the employee's age, and the amount of the last salary.

One factor in calculating severance pay is the employee's net salary. It is generally assumed that an employee will receive severance pay amounting to one to three months' salary. The longer the period of employment, the higher the severance pay tends to be. The employee's age is also a factor in calculating severance, as older employees typically receive higher severance since it may be more challenging for them to find new employment.

However, other factors can influence the amount of severance, such as the salary during the notice period, the employee’s likelihood of finding a new job, or the duration of unemployment. The circumstances of the termination, for example, whether it was arbitrary or unjustified, can also play a role in determining the severance amount.

A termination for operational reasons is a difficult situation for employees. Not only does one lose their job, but financial concerns and the uncertain search for new employment often follow. Severance pay is one way to ease this difficult situation. But what exactly is severance pay, and how is it calculated?

It’s important to note that severance pay is not an automatic entitlement, and employees may need to file a claim to assert their rights. Even though there is no legal obligation, it is common for both parties to agree on a severance arrangement that determines the amount and conditions. In some cases, especially with terminations for operational reasons, a settlement can be reached in court to agree on the severance amount. In this case, a judge will consider the circumstances of the case and make a decision. It is crucial to stay well-informed and seek legal advice to ensure the severance pay is fair and appropriate.

Severance pay is not the same as social security compensation and is not deducted from it. Severance pay is a form of compensation that can be paid in addition to other benefits such as unemployment benefits.

There is no universal calculation method for severance pay, and it varies depending on the individual case. While there is no legally prescribed amount, it is common for severance pay to range between 1-3 months' salary. It is important to seek information and legal counsel to ensure the severance is fair and just.

Legal Basis for Terminations for Operational Reasons & Severance Pay

The legal basis for terminations for operational reasons and severance pay in Germany is mainly found in the Protection Against Dismissal Act (KSchG). This law outlines the conditions for a lawful termination for operational reasons and also governs the entitlement to severance pay.

According to Paragraph 1 of the KSchG, an employer may issue a termination for operational reasons if urgent operational requirements make it necessary to terminate the employment relationship. These requirements must be objectively verifiable and must not be based on any misconduct on the part of the employee. The employer is also obligated to first attempt to continue the employment relationship through operational modifications or changes to the employment contract.

Paragraph 1a of the KSchG states that an employee who becomes unemployed due to a termination for operational reasons is entitled to severance pay if they have been employed for at least six months and there is no significant reason for the dismissal, such as gross misconduct or company insolvency.

While there is no legal rule for the exact amount of severance, it is commonly assumed that severance pay will range between one to three months' salary. It is important to note that there is no legally fixed method for calculating severance, and the amount is determined based on the specific circumstances of each case. It should also be noted that the right to severance is not automatic and may require a lawsuit to be enforced.

“If the employer terminates due to urgent operational requirements under § 1 paragraph 2 sentence 1 and the employee does not file a lawsuit within the period specified in § 4 sentence 1 to determine that the employment relationship was not terminated by the dismissal, the employee is entitled to severance pay at the end of the notice period.”

Special Regulations for Older Employees in Cases of Termination for Operational Reasons

There are special legal provisions regarding the amount of severance for older employees, which can be claimed in cases of termination for operational reasons. These regulations are designed to support older employees, who have been with the company for a longer period, and who may need a higher severance to mitigate the negative impact of termination.

If an employee is 50 years or older and has worked for the company for at least 15 years, they are entitled to severance pay equivalent to 15 months' earnings. If the employee is 55 years or older and has worked for the company for at least 20 years, they are entitled to severance pay equivalent to 18 months' earnings. However, this increased severance does not apply if the employee is 65 years or older at the time of termination.

What Rights Do Employees Have in the Event of Termination for Operational Reasons, and How Can They Contest It?

Employees have the right to severance pay in the case of termination for operational reasons if they do not contest the termination in court within a certain period. They also have the right to seek support from a works council or union to help assert their rights.

Employees can also contest the termination by filing a lawsuit to establish that the employment relationship was not legally terminated. This can result in either the continuation of the employment or the negotiation of a higher severance payment.

Employees can also challenge the termination by arguing that it was unlawful, for example, if it was discriminatory or arbitrary. In some cases, there may also be a violation of the works council’s participation rights. In such cases, the termination can be reviewed in court. An employee can argue that the termination was unnecessary, as there were alternative solutions that could have protected the employer’s interests, such as transferring the employee to another department or reducing working hours. Additionally, employees can argue that they were not properly informed about the reasons for the termination or were not given enough time to prepare for it.

What Are Average Severance Amounts?

There is no legally fixed method for calculating severance, and the amount of severance can vary from case to case. However, certain general rules are often used as a basis for calculation, such as the number of years of service, the employee's age, and the amount of the last salary.

In practice, it is common for employees to receive severance pay amounting to one to three months' salary. The longer the period of employment, the higher the severance pay is usually. The employee's age also plays a role in calculating severance, as older employees generally receive higher severance since it may be more difficult for them to find new employment. However, there are also cases where severance amounts can be higher or lower, depending on the individual circumstances.

Studies, such as one conducted by the German Institute for Economic Research in 2020, have shown average severance payments of 11.9 months' salary for employees with long periods of employment. However, it is important to note that these are only average values and should not be considered binding.

It is essential to stress that there is no universal rule for severance amounts, and it is crucial to seek information and legal advice to ensure the severance is fair and just.

What Severance Amount Is Possible in the Event of Termination for Operational Reasons?

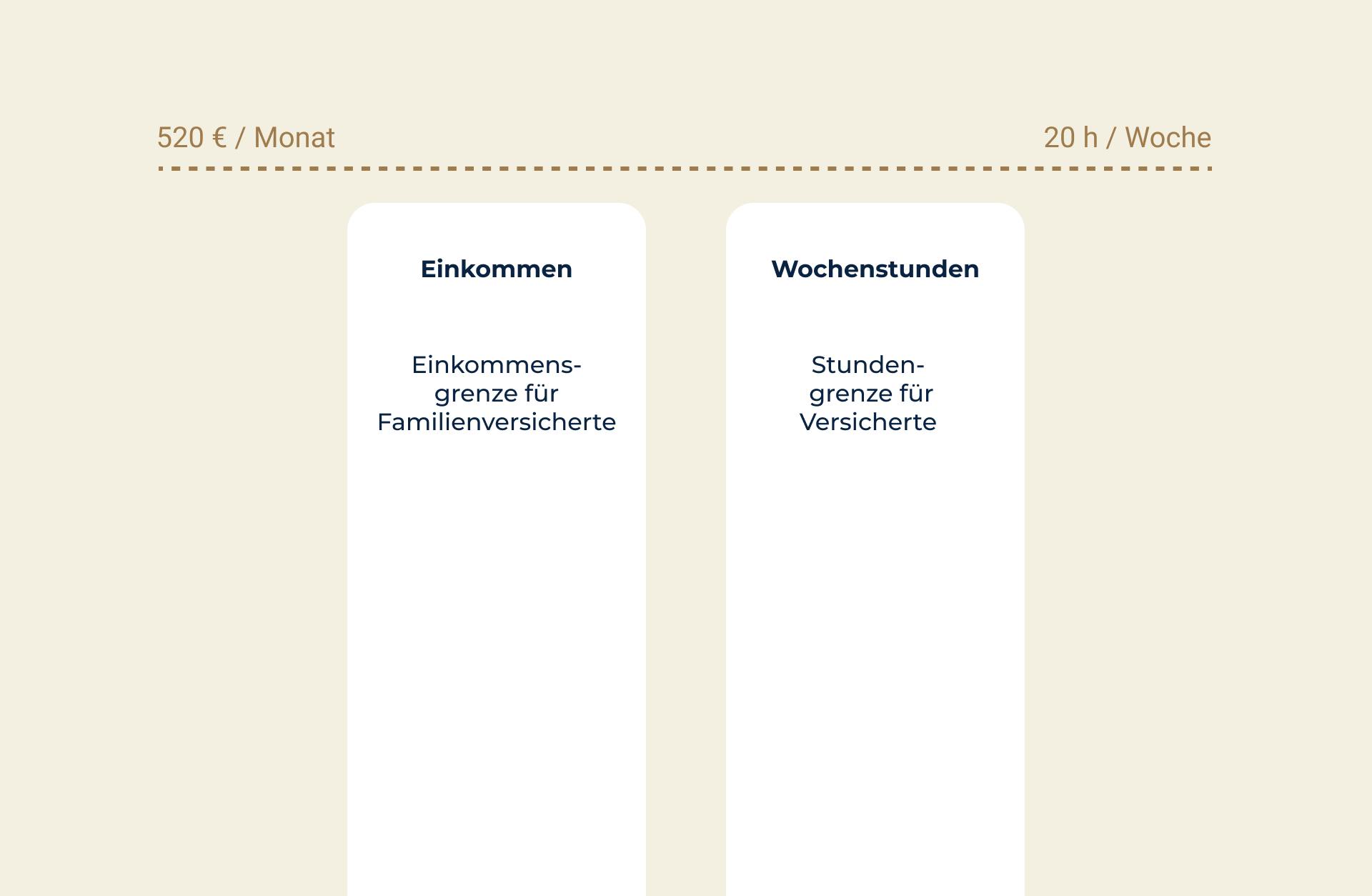

The severance pay in the event of termination is compensation intended to mitigate the negative impact of termination on the employee. Although the amount of severance depends on various factors, such as the duration of employment, the quality of performance, and the employee’s social and personal circumstances, there is still a statutory minimum for severance in cases of termination for operational reasons.

According to § 1a KSchG (Dismissal Protection Act), the minimum severance amount in cases of termination for operational reasons is 0.5 gross monthly earnings per year of employment. This standard severance serves as a guideline for employers and employees to agree on an appropriate severance amount.

This standard severance serves as a guideline for employers and employees to agree on an appropriate severance amount.

The monthly earnings used to calculate severance include salary and potential fringe benefits, such as company cars or housing, whose usage value must be included in the severance amount. Employment durations of 6 months or more can be rounded up to a full year. For example, an employment period of 1 year and 7 months would be counted as 2 years.

What Factors Influence Severance?

Several factors can influence the amount of severance in cases of termination for operational reasons. One important factor is the employee's net salary, as this is typically the basis for calculating severance. A longer period of employment can also result in a higher severance payment.

The employee's age also plays a role in calculating severance, as older employees usually receive higher severance since it may be more difficult for them to find new employment.

Another factor is the employee’s earnings during the notice period, also known as "garden leave." An employee who continues to work and receive their salary during the notice period typically has a claim to lower severance than one who is dismissed and does not receive pay during this time.

Other factors that can influence severance include the employee’s likelihood of finding new work, the duration of unemployment, and the circumstances of the termination, such as whether it was arbitrary or unjustified.

Is Severance Mandatory in the Case of Termination for Operational Reasons?

Severance is not automatically mandatory when an employment relationship is terminated for operational reasons. It is a voluntary benefit provided by the employer to mitigate the negative impact of termination on the employee.

In many cases, severance is agreed upon to end the employment relationship amicably. If a severance agreement has been reached, the employer is obligated to pay it unless otherwise stipulated in the employment contract or a legal regulation.

There are, however, cases where severance is not agreed upon, for example, when the employee resigns voluntarily or when there is an extraordinary termination for significant cause. In such cases, there is no entitlement to severance.

Severance Entitlement: What Are My Rights?

The entitlement to severance in the case of termination for operational reasons is regulated by law in Germany and is primarily found in the Protection Against Dismissal Act (KSchG). According to Paragraph 1a of the KSchG, an employee who becomes unemployed due to a termination for operational reasons is entitled to severance if they have been employed for at least six months and there is no significant reason for the dismissal, such as gross misconduct or company insolvency.

There is no legal regulation for the amount of severance, but it is commonly assumed that employees are entitled to severance of one to three months' salary. These amounts are not binding, and the severance amount depends on the individual circumstances of each case.

An entitlement to severance presupposes that the termination for operational reasons was lawful. A termination for operational reasons is only lawful if urgent operational requirements necessitate the termination of the employment relationship, and the employer has first attempted to continue the relationship through operational modifications or changes to the employment contract.

There are also cases where no severance entitlement exists, such as when the employee was terminated for misconduct or when the company has become insolvent and has no means to pay severance. There are also cases where an employee may be entitled to a higher severance due to special circumstances, such as illness, but this depends on individual circumstances and applicable laws.

It is essential to seek legal advice in cases of termination for operational reasons to ensure the severance entitlement is claimed and that the severance is fair and just. Employee representatives and unions can also be helpful in such cases. In any event, it is crucial to stay well-informed about the applicable rules and rights in cases of termination for operational reasons to assert one’s rights and ensure a fair severance.

Severance Payment

The payment of severance in cases of termination for operational reasons is an important aspect for employees, as it often represents the only compensation for losing their job. In Germany, there is no legal regulation for the payment of severance; instead, the rules are found in employment contracts or social plans.

In many cases, severance is paid as a lump sum, but sometimes it is paid in installments. If severance is paid in installments, the employee should ensure that the installments are fixed and that the employer actually makes the payments.

In some cases, the severance may also be subject to conditions. For example, the employer may make the severance payment contingent on the signing of a confidentiality agreement or a commitment by the employee not to contact competitors. These conditions should be carefully reviewed and discussed with a lawyer to ensure they are legally binding and enforceable.

It is important to note that severance is usually not taxable unless it is a severance paid as a result of deliberate misconduct, such as theft or fraud. However, it is always advisable to seek information about the tax implications of severance and the proper procedure for payment.

Taxes on Severance Pay in the Case of Termination for Operational Reasons

Severance pay in the case of termination for operational reasons is considered taxable income and is therefore subject to full taxation. Since severance pay falls under income tax, the employer is responsible for calculating and deducting the taxes. This means the employer must issue a payslip when paying the severance, determine the amount of income tax to be withheld, and remit it to the relevant tax office.

There are no longer any tax exemptions for severance payments. However, under certain circumstances, it is possible to apply the "fifth rule" for taxation. This rule allows the severance to be spread over five years for tax purposes, potentially resulting in tax savings.

III. Negotiating Severance Pay

Tips for Successful Negotiations

Negotiating severance pay in cases of termination for operational reasons can be a stressful and difficult situation for employees. To negotiate successfully, it is important to be well-prepared and know your rights and interests. Here are some tips that can help with negotiations:

- Know your rights and the relevant laws. Understand the requirements for a termination for operational reasons and the type of severance you are entitled to.

- Gather evidence of your performance and contributions to the company. This can be in the form of work certificates, project reports, or references.

- Seek support from employee representatives or unions, who can help you strengthen your position and assist you during negotiations.

- Consult a lawyer, who can help you assert your rights and negotiate severance payments.

- Focus on facts and figures during negotiations and avoid personal attacks or blame.

- Be willing to compromise and meet certain requirements of the company, as long as your main concerns are addressed.

- Consider accepting the employer’s offer and asking for alternatives, such as additional training, a work reference, or a recommendation letter.

- Remember that negotiations are a process and that it is normal for there to be several rounds of offers and counteroffers before an agreement is reached.

Possible Points of Negotiation

When negotiating severance pay for a termination due to operational reasons, there are several factors to consider. Some of these points include:

- Amount of severance pay: The goal is to secure a severance payment that adequately compensates the employee for their financial losses.

- Payment terms: This involves deciding whether the severance will be paid in a lump sum or in installments, and under what conditions.

- Work reference: A high-quality work reference can be crucial for the employee in their search for a new job.

- Garden leave: An agreement may be reached for the employee to continue being paid during the notice period, which provides financial security during the transition.

- Training programs: The employee might request a training agreement to better prepare for the job market.

- Employer obligations: This could include the employer agreeing not to provide negative references or withholding information about the termination.

- Conditions and deadlines: Ensure that the terms and deadlines in the employer’s offer are legal and feasible.

- Termination agreement: Both parties may agree to a termination contract where the notice period is waived, possibly in exchange for an increased severance payment.

- Social plan: As part of negotiations, a social plan can be discussed, which outlines severance pay and job search support for employees.

- Future opportunities: The employee can also explore options for continued employment within the company, potentially in a different role.

Not all of these points will be relevant in every case, and negotiations can vary significantly. It's important for employees to be clear about their goals and flexible in negotiations. A clear and realistic negotiation strategy can help secure a fair severance package and the best possible terms.

Role of the Works Council

Role of the Works Council

The works council is an important resource for employees facing terminations due to operational reasons and negotiating severance pay. The works council has several duties and powers as outlined in the Works Constitution Act (BetrVG).

The works council’s primary role is to represent the interests of employees, which includes supporting them in severance negotiations by advising them on their rights and the requirements for termination.

The works council must be informed and consulted about planned terminations and the reasons for them. It has the right to express its opinion.

In certain cases, the works council has the right to veto a termination if it believes the termination is not operationally justified or goes against the interests of employees.

The works council may have the right to approve severance agreements and thus participate in severance negotiations.

The works council can negotiate a social plan that sets out the terms for severance pay and job search support. This plan must be agreed upon by both the employer and the works council and can be part of the severance discussions.

The works council acts independently and in the interests of employees, making it advisable to seek its support during severance negotiations.

IV. Alternatives to Termination for Operational Reasons

Options for Employers

For employers, there are various options when it comes to terminations due to operational reasons and severance pay. One of the first options is avoiding layoffs by considering alternatives such as restructuring the company or relocating jobs.

Another option for employers is the use of termination agreements, where both employer and employee come to a mutual agreement. This type of contract can allow the notice period to be waived in exchange for a higher severance payment.

Another possibility is offering training programs to employees, giving them the opportunity to better qualify themselves for the job market.

Employers can also negotiate a social plan with the works council, which sets out provisions for severance payments and support in finding new employment. Such a social plan must be jointly agreed upon by the employer and the works council and can be part of the negotiations.

Employers must comply with the legal requirements for operational terminations and ensure that severance agreements are legally sound. This can be ensured through external legal consultation.

Alternatives for Employees

For employees who have received a termination due to operational reasons, there are alternative options they can consider. One option is to file a dismissal protection lawsuit, in which the labor court reviews whether the termination was justified. In this case, employees have the chance to demonstrate their case, and the court may even order reinstatement if it finds the termination unjustified.

Another alternative could be to enter into negotiations with the employer to secure a severance package. This process can be supported by the works council or external legal advice.

Employees can also enhance their skills and experience by focusing on the job market and searching for new employment. This can be done through training programs aimed at increasing their chances of securing a new position.

A further alternative is the possibility of joining forces with other affected employees to collectively challenge the operational termination and potentially negotiate for higher severance payments.

It’s important to note that each employee’s situation is unique, so there is no one-size-fits-all solution. Therefore, it is advisable to be well-informed about one’s rights and options and to carefully evaluate them before making any decisions.

Advantages and Disadvantages of the Alternatives

A dismissal protection lawsuit has both advantages and disadvantages for employees. One advantage is that the labor court can review the dismissal and potentially order reinstatement. This can be a good alternative for employees who feel wronged or want to keep their job. However, it's important to note that such a lawsuit can be time-consuming and costly, and in some cases, it may be unsuccessful.

Negotiating severance with the employer can be a quicker and more cost-efficient solution than a lawsuit. There is the possibility of obtaining a higher severance payment than through a dismissal protection lawsuit. However, negotiations can be difficult, and employees may not receive what they had hoped for.

Training programs can help employees improve their skills and experience, positioning themselves better in the job market. A drawback, however, is that it requires time and costs, and there is no guarantee of finding a new job.

Another alternative could be joining forces with other affected employees. The advantage here is mutual support and the ability to collectively fight for higher severance payments. A disadvantage could be that it may be difficult to find other employees to join, and the chances of success vary for each individual case.

It should be noted that each alternative has its own advantages and disadvantages, and each employee’s circumstances are unique. Therefore, it is recommended to be well-informed about one's rights and options and to carefully weigh them before deciding on an alternative.

V. Conclusion

3 Tips for Employers Regarding Severance Pay

- Seek legal advice: Employers should consult a lawyer or labor law expert to ensure that severance agreements are legally sound and meet all legal requirements.

- Transparent communication: It is important for employers to communicate openly and transparently with affected employees about the reasons for the termination due to operational reasons and the severance amount. This can help avoid misunderstandings and dissatisfaction.

- Realistic expectations: Employers should have realistic expectations regarding the severance amount and be aware that factors such as the employee’s length of service, age, and salary during the notice period can influence the amount.

5 Tips for Employees Regarding Severance Pay

- Know your rights: It is crucial for employees to be clear about their rights and options before making any decisions about severance. This can be done by reading employment contracts, laws, and regulations, as well as seeking advice from experts like lawyers or works council members.

- Stick to the facts: When entering into severance negotiations, employees should focus on facts and figures. This can strengthen their arguments and increase the chances of obtaining a higher severance.

- Be prepared to negotiate: Employees should be ready to negotiate both the amount of severance and other conditions. This can help them secure a higher severance and better terms.

- Seek support: Employees can seek help from their works council, union, or external legal advice to assist with negotiations and ensure their rights are protected.

- Consider all options: Employees should carefully consider all available options, including a dismissal protection lawsuit, training programs, and searching for a new job. They should weigh their choices carefully to decide which solution is best for their situation.

5 Additional Thoughts on Severance in Terminations for Operational Reasons

- Severance payments can be a valuable financial aid for employees who have lost their jobs, especially if they face difficulties finding a new one quickly. However, it's important to recognize that severance is typically not mandatory, and the amount can vary from case to case.

- Employers should understand that severance negotiations can be challenging for both sides, and open, transparent communication is essential to avoid misunderstandings and dissatisfaction.

- A termination due to operational reasons can be a stressful and difficult experience for employees. It's important to take time to fully understand your rights and options before choosing an alternative.

- If an employee is involved in an unjustified termination case, a labor law attorney can be a valuable resource. They can help clarify the employee’s legal claims and work towards the best possible outcome for the individual.

- In Germany and many other countries, there are legal minimum standards regarding severance, but other factors can vary from case to case and influence the severance amount. Therefore, it’s essential for both employees and employers to engage with these matters and stay well-informed.

A related article on termination is the ordinary termination and extraordinary termination.

More articles:

Working Student Contract Notice Period