Introduction to the liquidation of a limited liability company (GmbH)

The liquidation of a limited liability company (GmbH) is a formal and legally binding process that aims to dissolve and terminate a limited liability company (GmbH). This process is usually initiated when the shareholders decide that the GmbH should or can no longer continue its business activities.

According to Section 60 of the Limited Liability Companies Act (GmbHG) , a limited liability company (GmbH) may be liquidated for various reasons, including:

- A reason specified in the articles of association.

- A resolution of the shareholders.

- A court ruling.

The liquidation of a limited liability company (GmbH) is not simply an administrative act. It requires careful planning and execution to ensure that all legal and financial obligations are fulfilled. Both legal requirements and court rulings play a decisive role in this process.

It is therefore essential to thoroughly familiarize yourself with the Liquidation GmbH process in order to avoid potential legal pitfalls and ensure that the process runs efficiently and smoothly.

Once again, the definition of liquidation of a limited liability company (GmbH):

Liquidation is the process by which the business of a limited liability company (GmbH) is terminated, its assets are realized, and the company is ultimately deleted from the commercial register. This occurs either because the term specified in the articles of association has expired, by resolution of the shareholders, or as a result of a court ruling.

How does the liquidation of a limited liability company work?

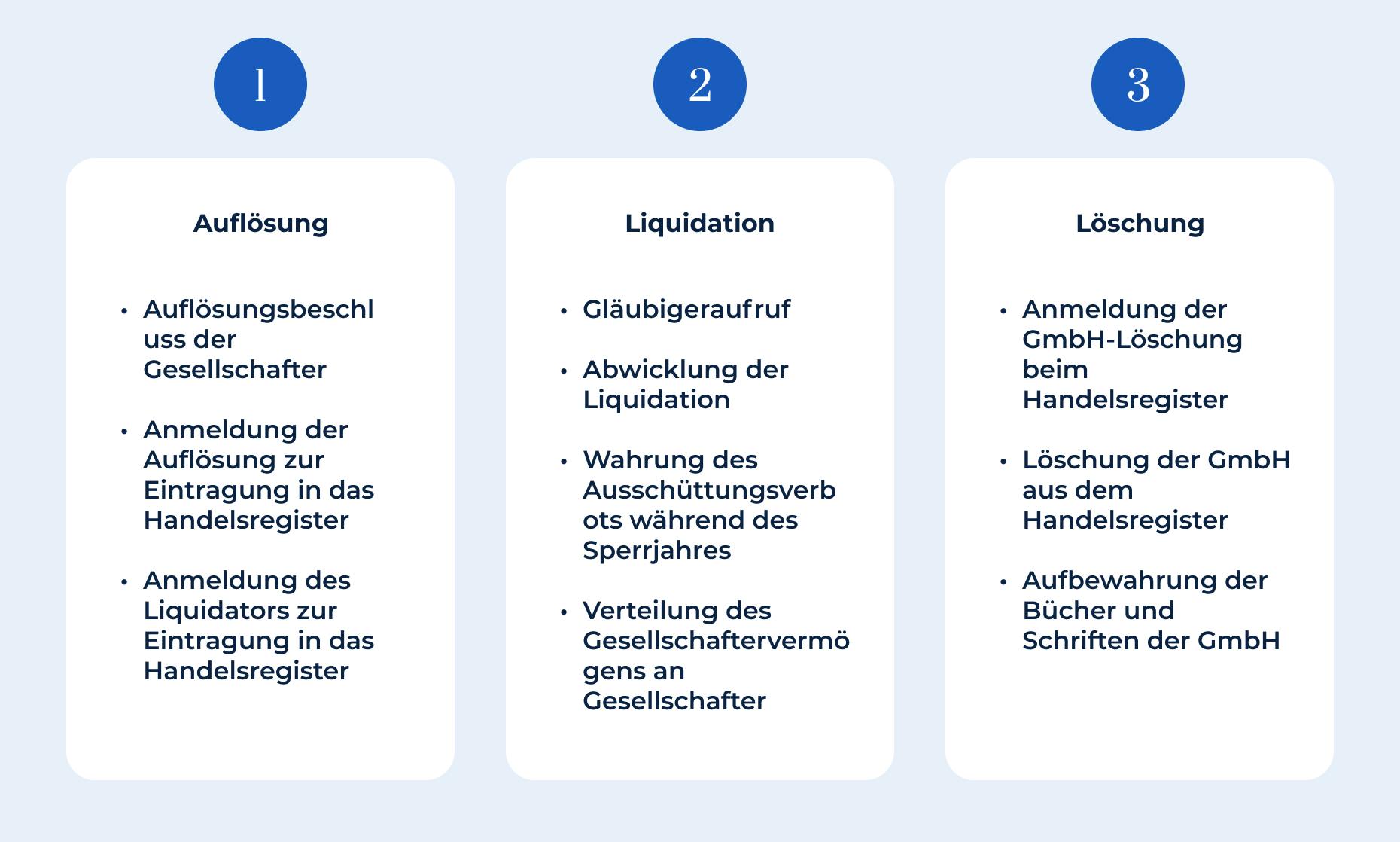

The liquidation process is rather complex and is divided into three main phases: dissolution, liquidation, and deletion:

Steps in the liquidation process:

- Resolution of the shareholders:

The first step in liquidating a limited liability company (GmbH) is a resolution by the shareholders. This resolution must be passed by a majority of at least three-quarters of the votes cast, unless the articles of association provide for a different majority (Section 60 (1) GmbHG). - Appointment of a liquidator:

Following the decision to dissolve the LLC, a liquidator is appointed. This can be either a shareholder or an external person. The liquidator is responsible for winding up the business and fulfilling the LLC's liabilities. - Announcement of liquidation:

The dissolution and appointment of the liquidator must be entered in the commercial register and announced in the Federal Gazette. This serves to give creditors and other parties involved the opportunity to register their claims. - Settlement of business and liabilities:

The liquidator is responsible for winding up the ongoing business of the limited liability company, realizing its assets, and settling its liabilities. In doing so, he must always act in the interests of the creditors. - Distribution of assets:

After all liabilities have been settled, the remaining assets of the GmbH are distributed among the shareholders. Distribution is usually based on the shareholders' capital shares. - Deletion from the commercial register:

Once liquidation and distribution of assets have been completed, the LLC is deleted from the commercial register. Upon deletion, the LLC is permanently dissolved.

This structured Liquidation GmbH process ensures that all legal and financial aspects are handled properly and that the company is dissolved in accordance with the law.

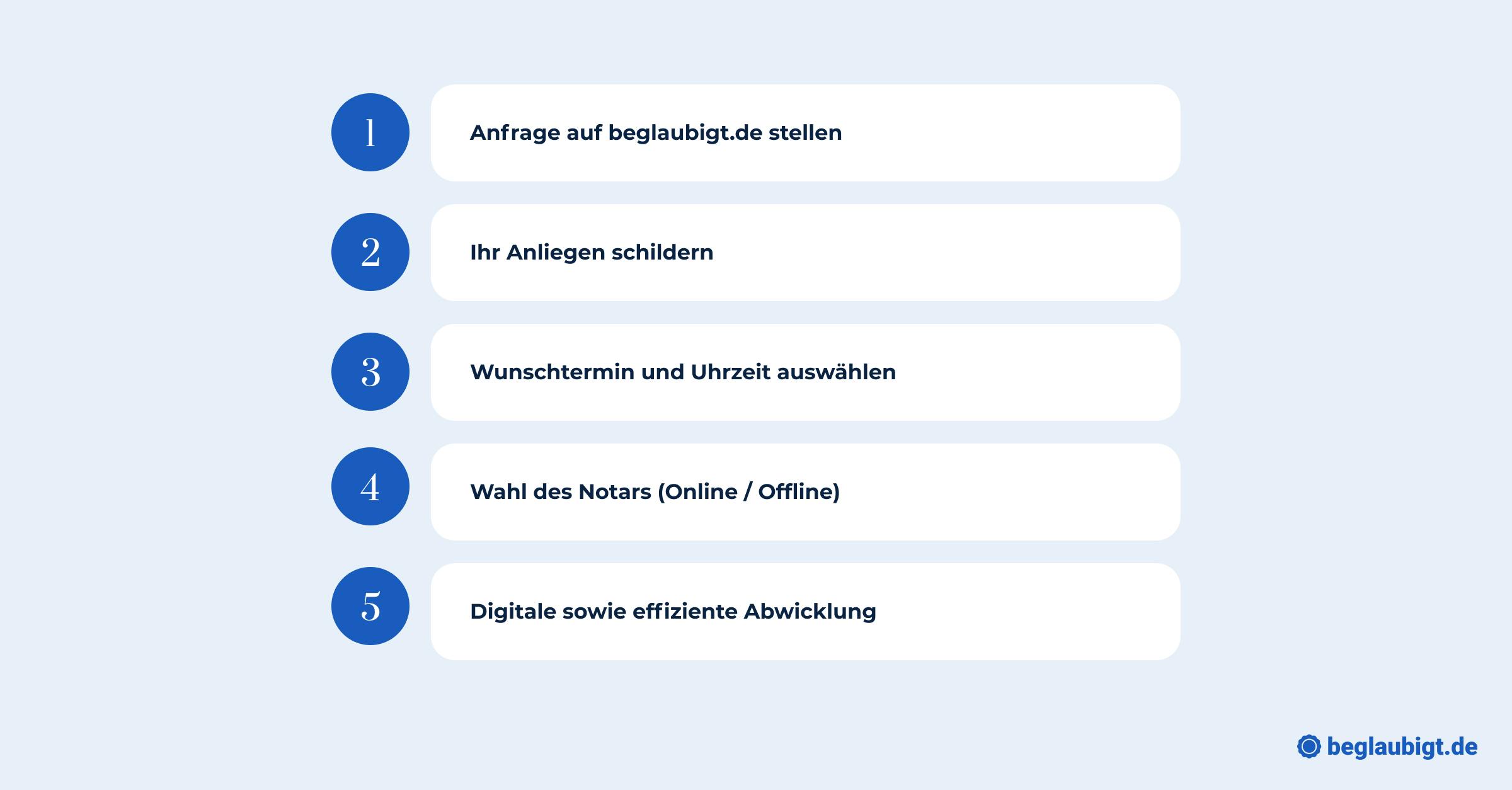

Beglaubigt.de has established itself as a trusted partner for entrepreneurs, especially when it comes to complex processes such as the liquidation of a limited liability company (GmbH).

The service package offered by Beglaubigt.de is specifically designed to handle the entire liquidation process from start to finish, allowing entrepreneurs to focus on other aspects of their business.

Beglaubigt.de offers a comprehensive service, from initial consultation and planning to the legally compliant preparation and management of all necessary documents, right through to final processing and deletion from the commercial register. More on this topic: Liquidation of a limited liability company (GmbH)

The team of experts at Beglaubigt.de understands the challenges and legal requirements associated with the liquidation of a limited liability company (GmbH) and ensures that every step is carried out correctly and efficiently.

How long does it take to liquidate a limited liability company (GmbH)?

The liquidation of a limited liability company (GmbH) is a comprehensive process whose duration depends on various factors. As a rule, however, it can be expected to take anywhere from several months to several years.

General duration of the liquidation process:

The average duration of the liquidation of a limited liability company (GmbH) is between 12 and 24 months. However, this period may vary depending on the individual circumstances of the GmbH.

A key factor influencing the duration is the so-called blocking period pursuant to Section 73 (1) GmbHG. This period is at least one year and serves to give creditors the opportunity to assert their claims against the GmbH.

Factors that can influence duration:

- Complexity of business:

The more complex the business structures and activities of a limited liability company (GmbH) are, the longer the liquidation process can take. For example, the liquidation of business assets or the termination of long-term contracts can take additional time. - Number of creditors and claims:

A large number of creditors and claims can prolong the liquidation process. Each creditor has the right to file their claims within the blocking period. The liquidator must review these claims and handle them accordingly. - Potential legal disputes:

Legal disputes, for example with creditors, business partners, or employees, can significantly delay the liquidation process. Court proceedings are often time-consuming and can hinder the completion of the liquidation.

Practical example: Liquidation of Muster GmbH

Muster GmbH, a medium-sized mechanical engineering company, has seen a steady decline in sales over the years. After several unsuccessful attempts to get the company back on track, the shareholders decide to liquidate the limited liability company.

1. Resolution:

At an extraordinary shareholders' meeting, 90% of the shareholders vote in favor of dissolving Muster-GmbH. The resolution is recorded in the minutes and liquidation proceedings are initiated.

2. Appointment of a liquidator:

The shareholders appoint Mr. Müller, the previous managing director, as liquidator. He is granted power of attorney to carry out all necessary steps for the liquidation.

3. Announcement:

Mr. Müller enters the dissolution of Muster-GmbH in the commercial register and publishes the liquidation in the Federal Gazette. This marks the start of the one-year blocking period for creditors.

4. Winding up the business:

Mr. Müller begins winding up the ongoing business. He terminates existing contracts, sells machinery and inventory, and settles outstanding invoices. In doing so, he discovers that Muster GmbH still has outstanding receivables from several customers. He sends reminders and, in some cases, engages a debt collection agency.

5. Creditors and claims:

During the blocking period, a total of 50 creditors come forward with claims totaling €500,000. Some claims are unjustified and are rejected by Mr. Müller. He reaches installment payment agreements with other creditors.

6. Legal disputes:

A supplier files a lawsuit against Muster GmbH for an allegedly unpaid invoice. The legal dispute drags on for several months and delays the liquidation. Finally, a settlement is reached.

7. Distribution of assets:

After deducting all costs and settling all liabilities, the remaining assets amount to €300,000. These will be distributed among the shareholders in accordance with their capital shares.

8. Deletion from the commercial register:

Two years after the start of liquidation, Muster-GmbH is finally deleted from the commercial register.

This practical example shows that the liquidation of a limited liability company (GmbH) is a complex process that is influenced by many factors. Legal disputes in particular can significantly delay the liquidation process. It underscores the importance of careful planning and execution.

What happens when a limited liability company (GmbH) is liquidated?

The liquidation of a limited liability company (GmbH) has a number of consequences, both legal and financial. These consequences affect not only the GmbH itself, but also its employees, business partners, and other stakeholders. It is therefore crucial to be aware of these consequences in advance and to prepare for them.

Legal and financial implications of liquidation:

Liquidation marks the beginning of the legal winding up of the GmbH. This means that all business activities must be discontinued and the GmbH can no longer participate in economic transactions. From a financial perspective, the assets of the GmbH must be liquidated in order to settle all liabilities.

Surpluses are then distributed to the shareholders. If the assets of the GmbH are insufficient to settle all debts, the shareholders may be held personally liable under certain circumstances.

Impact on employees, business partners, and stakeholders:

The liquidation of a limited liability company (GmbH) has a significant impact on the company's employees. Employment contracts must be terminated, and severance payments or other compensation may be due.

Business partners, especially suppliers and customers, must be informed of the liquidation, and existing contracts must be terminated or transferred as necessary. Stakeholders, such as investors or lenders, may suffer financial losses, especially if the LLC is unable to settle its liabilities in full.

Tax consequences and reporting requirements: The liquidation of a limited liability company (GmbH) also has tax implications. For example, any hidden reserves must be disclosed and taxed. In addition, certain tax reporting requirements must be observed. The GmbH must prepare a closing balance sheet and a final tax balance sheet and submit them to the tax office.

Under certain conditions, any tax losses can be offset against profits from previous years. It is therefore advisable to consult a tax advisor to ensure that all tax aspects of the liquidation are handled correctly.

What business can a limited liability company in liquidation still conduct?

The liquidation of a limited liability company (GmbH) marks the beginning of the process of winding up the company. During this phase, the GmbH has special obligations and restrictions. It is crucial to understand which transactions and activities are still permitted during liquidation and which are not.

1. Principle:

Once the decision to dissolve the company has been made and liquidation has begun, the limited liability company is generally no longer entitled to continue its previous business activities. The main purpose of liquidation is to terminate the company, wind up its business, settle its debts, and distribute the remaining assets to the shareholders.

2. Permissible transactions:

- Settlement of existing transactions: The GmbH may conclude existing transactions, i.e., it may fulfill contracts that were concluded prior to liquidation.

- Realization of assets: The liquidators may sell or otherwise realize the assets of the LLC in order to settle the company's liabilities.

- Settlement of liabilities: The GmbH must settle its debts and liabilities. This may include paying invoices, repaying loans, or fulfilling other financial obligations.

3. Prohibited transactions:

- New business transactions: The GmbH may not enter into any new business transactions or conclude any new contracts that are not directly related to the winding up of the company.

- Long-term obligations: The LLC should not enter into any further long-term obligations, as it is in the liquidation phase and its existence is limited in time.

4. Special caution:

It is important to note that transactions carried out during liquidation that do not contribute to the proper winding up of the LLC may have legal consequences. This may result in liability claims against the liquidators or even criminal consequences.

5. Name suffix:

During liquidation, the LLC must include the suffix "in liquidation" or "i.L." in its name. This serves to inform third parties that the company is in liquidation.

Liquidation of a limited liability company (GmbH): Practical tips and advice

The liquidation of a limited liability company (GmbH) is a complex and often challenging process. To make this process smooth and efficient, some practical tips and advice are helpful.

Important documents and records required for the liquidation process:

Accurate and complete documentation is crucial for the successful completion of the liquidation. Essential documents include:

- Articles of association of the limited liability company

- Resolutions of the shareholders' meeting

- Accounting records and balance sheets

- Contracts with business partners, suppliers, and customers

- Employee contracts and documentation

- Tax documents and certificates

Common mistakes and how to avoid them:

- Incomplete documentation: Ensure that all relevant documents are available and up to date.

- Failure to publish: The liquidation must be duly published in the commercial register and in the Federal Gazette.

- Failure to comply with the blocking period: The one-year blocking period for creditors must be observed in order to avoid legal consequences.

- Neglecting tax obligations: The tax aspects of liquidation are complex and require careful planning and execution.

Beglaubitet.de as a process consultant for the liquidation of your limited liability company

An essential aspect of liquidation is the legally compliant drafting and execution of all contracts and agreements.

Beglaubigt.de offers valuable support in this regard. This greatly simplifies and accelerates the entire liquidation process (see Liquidation GmbH).

Beglaubigt.de takes care of the entire process for entrepreneurs by providing a transparent and user-friendly platform that streamlines the entire liquidation process. With Beglaubigt.de, companies can be sure that all legal requirements are met and that they receive the best service.

More Articles:

Digitaler Notar Fuer Deutschland Online Gruendung Einer Gmbh Oder Ug