The question of whether leaving the church is financially worthwhile is one that concerns many people in Germany. Given the church tax levied on church members, this is a consideration that is not only based on financial considerations, but is also deeply rooted in personal beliefs and values.

In this article, we take a comprehensive look at this question, considering both the financial aspects and the emotional and spiritual factors that play a role in the decision to leave or remain in the church.

How high are church taxes in Germany?

Church tax in Germany is a significant financial contribution that church members must make. The amount of church tax varies depending on the federal state and denomination, but is generally based on a percentage of the church member's taxable income.

In this section, we discuss the basics of calculating church tax and highlight the differences between the federal states and denominations.

Calculation of church tax

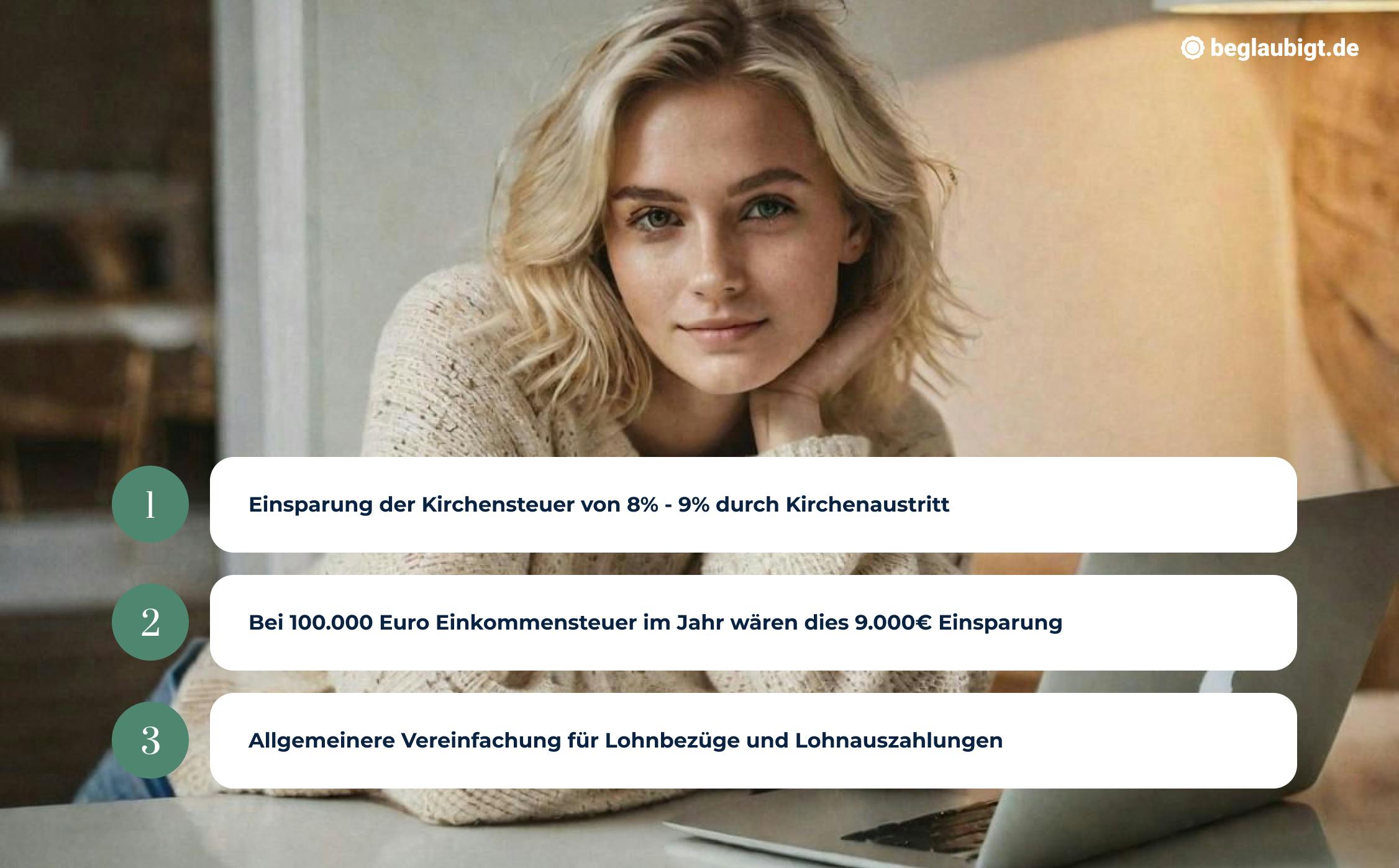

- Basics for calculating church tax and its amount: Church tax is calculated as a percentage of income tax and is around 8% to 9% of the income tax paid in most federal states. For example, if a church member pays $1,000 in income tax per year, the church tax would be an additional $90 at a rate of 9%.

- Differences between federal states and denominations: While the percentage of church tax is constant in most federal states, there are some exceptions and special features to note. In some federal states, such as Bavaria and Baden-Württemberg, a church tax of 8% is levied, while in most other federal states 9% is standard. In addition, there may be special regulations for certain denominations or in specific regions.

To give an example of how church tax is calculated, let's assume that a person has an average annual income that results in an income tax liability of €15,000. We will consider two scenarios: one in a federal state with a church tax rate of 9% and one with a rate of 8%.

Example of a federal state with a 9% church tax

- Income tax: €15,000

- Church tax rate: 9%

- Calculation of church tax: 15,000 euros * 9% = 1,350 euros

In this example, the church member would have to pay church tax of €1,350 in addition to income tax.

Example of a federal state with an 8% church tax

- Income tax: €15,000

- Church tax rate: 8%

- Calculation of church tax: 15,000 euros * 8% = 1,200 euros

In this scenario, the church tax that the member must pay is €1,200.

These examples illustrate how the amount of church tax depends directly on the income tax paid and the applicable church tax rate. Since church tax rates can vary between federal states, the actual church tax burden for individuals in different parts of Germany may differ.

If you decide to leave the church, you can easily initiate this process via our platform with express notary appointments: Leaving the church

Legal basis for leaving the church

- Laws and provisions governing church tax in Germany: The legal basis for the levying of church tax can be found in German tax law and in the specific church tax laws of the federal states. Among other things, these legal provisions stipulate who is liable for church tax, how the tax is calculated, and which types of income are subject to church tax.

- Current case law and examples: Over the years, there have been various court rulings dealing with church tax. These decisions often concern the details of church tax liability and calculation methods. For example, courts have clarified when income from capital assets is subject to church tax or how to deal with interfaith marriages.

Church tax represents a significant financial burden for many church members. Nevertheless, the decision to leave the church in order to avoid this burden is complex and should be made after considering all personal, spiritual, and financial factors.

Is it worth leaving the church with the help of a notary?

Although the process of leaving the church in Germany is typically handled directly by the relevant government agencies, such as the registry office or the local court, in certain situations it may be advisable or necessary to consult a notary.

In this section, we discuss the circumstances under which a notary can assist with leaving the church and the advantages this brings. By offering online booking of notaries via beglaubitet.de, we aim to simplify this process, which is often perceived as complex, and make it more transparent.

When is a notary helpful when leaving the church?

- Complex legal situations: In cases where the legal situation of a church member is complex—for example, for people who live abroad or have special financial circumstances—a notary can provide valuable legal advice.

- Preparation and certification of documents: A notary can not only prepare the necessary documents for leaving the church, but also certify them. This is particularly relevant if you wish to leave the church from abroad and the relevant documents must be sent to the competent authority in Germany in certified form.

- Advice on financial and legal consequences: A notary can provide information about the financial and legal consequences of leaving the church, particularly with regard to inheritance issues or the impact on existing legal agreements that require church membership.

Basic Law for the Federal Republic of Germany (GG): Article 140 GG in conjunction with Article 137(3) of the Weimar Constitution (WRV) guarantees the right to freedom of religion and the freedom to join or leave a religious community. These provisions form the fundamental legal basis for the possibility of leaving the church.

Advantages of using a notary for leaving the church

- Legal certainty: Using a notary ensures that all aspects of leaving the church are handled in a legally secure manner. This includes the correct preparation and submission of all necessary documents and ensuring that the withdrawal is carried out properly from a legal perspective.

- Time savings and convenience: For individuals who are abroad or unable to appear in person at the relevant authority, a notary can offer a time-saving and convenient alternative. Handling the matter through a notary can simplify and expedite the process.

- Individual consultation: Every case of leaving the church is unique, and individual circumstances may require specific advice. A notary can offer tailor-made solutions that are tailored to the personal situation of the person seeking advice.

Although it is not standard practice to use a notary when leaving the church in Germany, it can be very useful in certain cases. However, it is important to take the additional costs of notary services into account. The circumstances and advantages described above can serve as a guide when deciding whether a notary should be consulted in your specific case.

Platforms such as beglaubigt.de offer innovative ways to facilitate these legal steps. Through digital notary appointments, declarations of withdrawal can be submitted conveniently from home without having to go to the church office in person. This not only saves time, but also enables efficient processing while taking all legal aspects into account.

Other articles that may interest you on this topic:

- How does leaving the church work?

- What do I have to do if I want to leave the church?

- How much does it cost to leave the church?

Why should one remain in the church?

The decision to become or remain a member of a church is deeply rooted in personal beliefs, spiritual values, and the search for community. Despite the financial commitment in the form of church taxes, there are numerous reasons for remaining in the church.

Below, we highlight both the spiritual and social benefits and take a look at the financial and tax aspects associated with membership.

Spiritual and social benefits

- Community and social support: Church communities offer a strong network of social support and community. This includes not only religious activities, but also social events, educational opportunities, and aid projects. Members often find lifelong friendships and a sense of belonging here.

- Religious and spiritual significance: For many people, the church provides a space for spiritual development, reflection, and prayer. Participating in church services and rituals can provide a deep sense of fulfillment and purpose in life.

Church tax laws of the federal states: The specific details of leaving the church are regulated by the church tax laws of the individual federal states. These laws contain provisions on the formal requirements, deadlines, and fees for leaving the church. For example, Section 3 of the Church Tax Act of North Rhine-Westphalia regulates the collection of church tax and implicitly the conditions for leaving the tax-collecting religious community.

Financial and tax aspects

- Benefits of church services: Church members benefit from various services such as baptisms, weddings, and funerals. These services are often offered to members at a lower cost or even free of charge compared to non-members.

- Possibilities for tax deductibility of church taxes: Church tax is tax-deductible in Germany as a special expense. This can reduce the tax burden for church members under certain circumstances, which can be a financial incentive to remain a member.

- Working for a church-based employer: Some church-based employers require employees to belong to a Christian church. This can mean that leaving the church has a direct impact on your employability with these employers, and can even lead to the loss of your job.

The decision to remain in the church is not based solely on financial considerations. Spiritual fulfillment, a sense of community, and the accessibility of church services play an equally important role. In the next section, we will look at the financial costs of leaving the church in Bavaria to provide a detailed insight into the monetary aspects of this decision.

How much does it cost to leave the church in Bavaria?

The decision to leave the church can be based on various reasons, including financial considerations. In Bavaria, as in other federal states in Germany, leaving the church is a formal process that involves certain costs. These costs can vary depending on the federal state, and it is important to find out about the specific fees and procedures in Bavaria before leaving.

Fees and procedures for leaving the church

- Current legal situation and fee schedule: In Bavaria, an administrative fee is charged for leaving the church. This fee covers the costs of processing the application for withdrawal by the registry office or local court. The amount of the fee may vary, but is usually around 30 to 60 euros. It is important to inquire about the exact amount of the fee in advance at the responsible district court or registry office.

- Example of the withdrawal process: The withdrawal process in Bavaria usually requires a personal visit to the relevant district court or registry office. Applicants must present a valid identity card or passport. After paying the fee, the withdrawal is formally registered and the applicant receives a withdrawal certificate as proof.

The simplest solution, which is possible anywhere, is to go to a notary to deregister from the church. The notary plays a crucial role by certifying the process of leaving the church and thus making it legally binding. This step not only offers a convenient option, but also increased security and legal validity. You can quickly and easily book a notary appointment in your area via beglaubigt.de.

State-specific regulations: Each state has its own regulations governing withdrawal from the church. In Bavaria, for example, the "Law on Declaration of Withdrawal from Religious Communities under Public Law" may contain relevant provisions. These laws define how and where withdrawal must be declared (e.g., at which authorities) and what fees are incurred.

Comparison with other federal states

- Differences in exit fees and procedures: The costs and procedures for leaving the church can vary significantly between federal states. While Bavaria charges a moderate fee, other federal states may apply different rates. In addition, the procedure can be carried out online in some federal states, while in Bavaria it is necessary to appear in person. Alternatively, some federal states also offer the option of leaving the church digitally via platforms such as beglaubigt.de. Here you can make an appointment with a notary online and declare your withdrawal from the church from the comfort of your own home.

The decision to leave the church should not be taken lightly, and the associated costs are only one aspect of this decision. Nevertheless, it is important to find out about the specific requirements and fees in your own state to avoid unexpected surprises. In the following section, we will provide detailed instructions on how to leave the church in North Rhine-Westphalia in order to shed light on another important aspect of the decision-making process.

In the next section, we summarize some of the most important findings and offer an assessment of whether leaving the church is financially worthwhile. We also provide an outlook and recommendations for those who are looking for further information or are in the process of making this decision.

Financial analysis: Is leaving the church financially worthwhile?

The decision to leave the church is not only a matter of faith or personal conviction, but for many it is also a financial consideration. In order to make an informed decision, it is important to thoroughly analyze the short- and long-term financial implications of leaving the church. In this section, we examine the costs and savings associated with leaving the church and offer insights to help you make an informed choice.

Civil Code (BGB): Although the BGB does not contain a specific paragraph on leaving the church, the general provisions on leaving associations (Sections 39 ff. BGB) are applicable in a certain way, as they address the basic principles of voluntary membership in organizations and the possibility of leaving.

Comparison of costs and savings

- Short-term costs of leaving: The immediate costs of leaving the church include the exit fee, which varies depending on the state. In North Rhine-Westphalia, for example, this fee can be up to 30 euros. Although this is a one-time payment, it should be taken into account in financial considerations.

- Long-term savings through the elimination of church tax: The most significant financial savings result from the elimination of church tax. The amount of these savings depends on your income and the applicable church tax rate in your state. For many, leaving the church means a noticeable reduction in their annual tax burden.

Personal factors and decision-making aids

- Influence of income, marital status, and personal beliefs: The decision as to whether leaving the church is financially worthwhile depends heavily on personal factors. People with higher incomes who pay a higher church tax rate could realize greater savings. Marital status and personal beliefs also play an important role in this decision.

- Help with decision-making: A thorough analysis of your financial situation can be helpful. Consider your annual church tax burden in relation to the benefits you receive from church membership. It may also be useful to speak with a tax advisor to perform a detailed calculation of your potential savings.

The question "Is leaving the church financially worthwhile?" cannot be answered in general terms, as it depends on a variety of individual factors. While some people may realize significant financial benefits by leaving, for others the spiritual, social, and emotional aspects of church membership play a greater role. It is important to consider all these factors in your decision-making process and to make a choice that best suits your personal, financial, and spiritual needs.

How do I leave the church in North Rhine-Westphalia?

To leave the church, certain steps and formalities must be followed. The process of leaving the church may vary depending on the state. In North Rhine-Westphalia (NRW), there are specific steps and requirements that must be met in order to officially leave the church. This step-by-step guide is designed to help you understand and navigate the process of leaving the church in NRW.

Detailed step-by-step instructions

- Required documents and contact points: To leave the church, you must appear in person at the local district court or registry office in your district of residence. You will need a valid identity card or passport. In some cases, a current registration certificate may also be required. It is advisable to inquire in advance by telephone or online about the exact requirements and opening hours of the relevant office.

- Legal information about the withdrawal process: During the interview, you formally declare your withdrawal from the church. The competent authority records your withdrawal and issues a certificate of withdrawal. This certificate is an important document that you should keep in a safe place, as it officially confirms your withdrawal.

Or complete your withdrawal from the church with one of our partner notaries. This allows you to plan and book your withdrawal from the church conveniently and easily online. Our notary appointments in:

Administrative Procedure Acts of the Federal States (VwVfG): The general administrative procedure acts of the federal states may also be relevant to the procedure for leaving the church, particularly with regard to the issuance and effectiveness of administrative acts (in this case: certificates of withdrawal).

Financial considerations after leaving

- Changes to your tax burden: Once you have successfully left the church, you are no longer obliged to pay church tax. This leads to a direct reduction in your tax burden. You should submit your certificate of withdrawal to the tax office to ensure that the change is taken into account in your tax bracket.

- Long-term financial implications: In addition to the immediate savings resulting from the elimination of church tax, there are also long-term financial considerations. These include, among other things, foregoing church services at member rates. It is important to weigh these long-term implications against the short-term financial benefits.

Leaving the church is a personal decision that should be carefully considered. In addition to financial aspects, emotional, spiritual, and social considerations also play a role. The above instructions provide an overview of the formal process in North Rhine-Westphalia and are intended to serve as a guide to make leaving the church as easy as possible for you.

Conclusion: Is leaving the church financially worthwhile?

The question of whether leaving the church is financially worthwhile varies from person to person and depends on a variety of personal, spiritual, and financial factors. Our comprehensive look at the various aspects of leaving the church—from spiritual and social reasons to the costs of leaving in different states to the financial and tax consequences—has shown that this decision is much more than just a matter of crunching numbers.

Summary of key findings

- Spiritual and social considerations: For many people, belonging to a church community and the spiritual and social benefits that come with it play a decisive role. These intangible values must be carefully weighed when deciding whether to remain in the church or not.

- Costs and financial implications: The immediate costs of leaving the church are relatively low compared to the potential long-term savings from no longer having to pay church tax. However, the amount saved varies greatly depending on income and individual tax circumstances.

- Employment with church-run institutions: For employees of church-run institutions, leaving the church can have direct professional consequences. The decision should therefore be made taking into account the specific requirements and potential loss of benefits.

- Legal aspects: Leaving the church is a formal process that is subject to certain legal requirements. A thorough understanding of these regulations is essential to ensure that the process runs smoothly. Our partner notaries can help with this. Thanks to digital notary appointments, declarations of withdrawal can be submitted efficiently and transparently from home.

Final assessment

The decision for or against leaving the church cannot be reduced to financial considerations alone. Although leaving the church can lead to immediate financial relief, the spiritual, social, and professional consequences are equally important. Ultimately, each person must make this decision based on a holistic view of their personal situation.

For those seeking further information or assistance in the decision-making process, we recommend consulting with experts—whether in tax matters, legal issues, or spiritual guidance. This is the only way to ensure that the decision is well-considered and in line with one's own values and needs.