What does a gift agreement mean?

A gift agreement is a legal document that regulates the voluntary, gratuitous transfer of assets or property from one person (the donor) to another person (the recipient).

The gift agreement is a form of contract law in which the donor provides a financial benefit from their assets without expecting anything in return.

Unlike other contracts, such as purchase agreements or exchanges, there is no consideration or obligation on the part of the recipient in the case of gifts.

A gift agreement should include certain elements to ensure it is legally binding and that both parties understand their rights and obligations.

These include the identification of the contracting parties, a precise description of the gift, the terms of transfer and ownership, the rights and obligations of both parties, and the signatures of the donor and recipient.

Key points summarized:

- Voluntary, gratuitous transfer of assets (donor to recipient)

- No consideration or obligation for the recipient

- Legal basis: German Civil Code (§§ 516-534 BGB)

Definition and Legal Basis of the Gift Agreement

A gift agreement is a legal arrangement between two parties, in which one person (the donor) transfers something from their assets to another person (the recipient) without compensation.

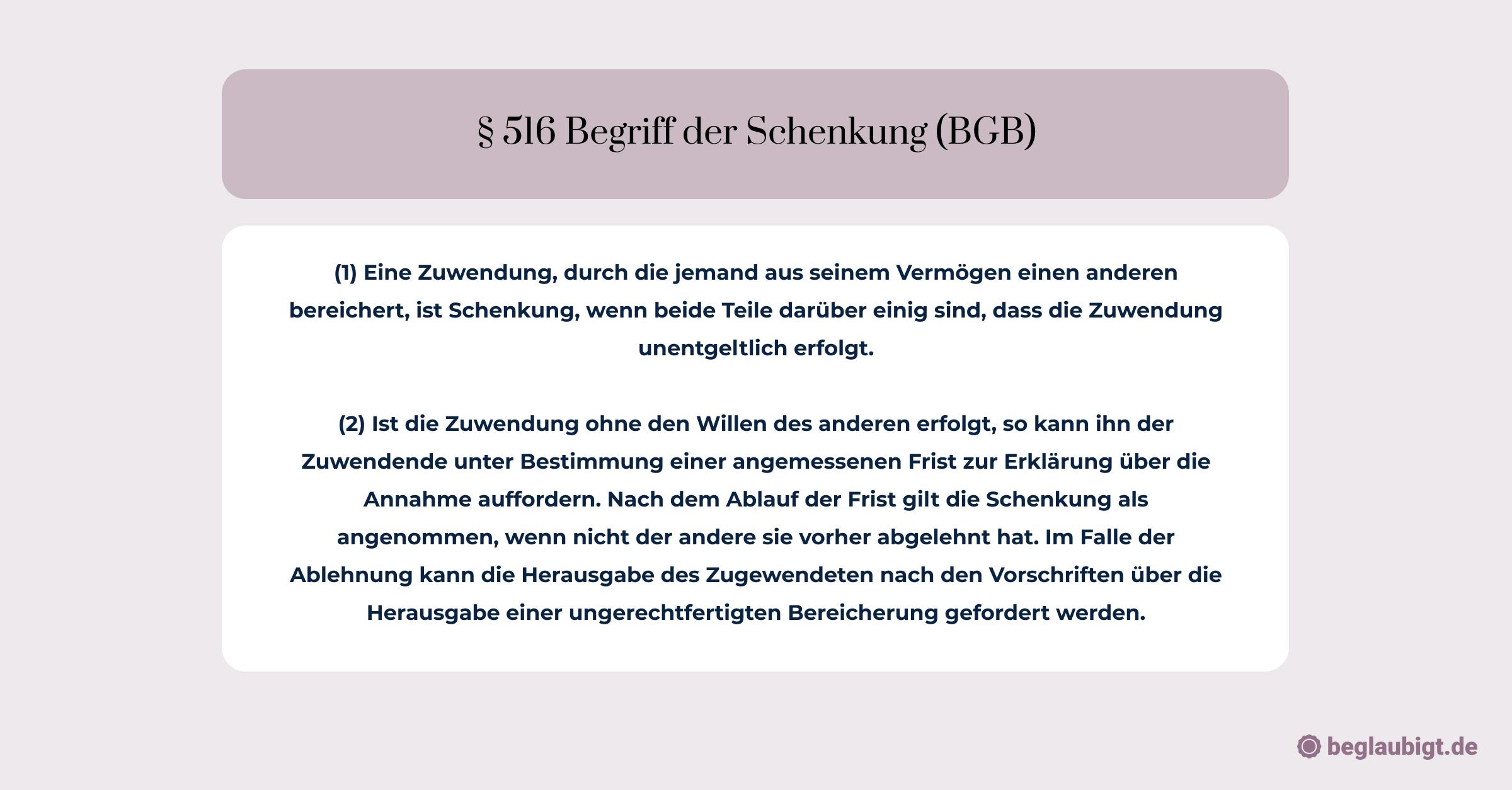

The legal basis for gift agreements is the German Civil Code (BGB), specifically §§ 516 to 534. Gifts are defined in § 516 (1) BGB as "a donation by which someone enriches another at their own expense."

Significance of the Gift Agreement in Practice

In practice, gift agreements can be used in various contexts, such as the transfer of real estate, money, or valuable items. They can be established between private individuals as well as between companies and non-profit organizations. Gift agreements are often of great importance, particularly for asset transfers within families, for tax savings, or for securing family wealth.

When drafting a gift agreement, it is crucial to observe the applicable formal requirements and legal regulations.

For example, the gift of real estate requires notarization according to § 311b (1) of the German Civil Code (BGB).

Additionally, a gift agreement should clearly and precisely define the involved parties, the assets being transferred, and any potential conditions or stipulations. A solid understanding of current legal frameworks and case law is essential to avoid legal pitfalls.

How is a Gift Agreement Formed?

A gift agreement is created through the mutual declarations of intent by the involved parties—the donor and the recipient. The gratuitous nature of the gift, as stipulated in § 516 (1) BGB, is a fundamental requirement.

Which formal requirements apply to the gift agreement?

The formal requirements for gift agreements are regulated in §§ 516 ff. of the German Civil Code (BGB) and vary depending on the type of asset being transferred:

- For the gift of movable items, such as furniture or jewelry, the "transfer through delivery" (*Traditio) usually suffices. In this case, the item is physically handed over to the recipient, and both parties declare their intent to gift the item.

- For the gift of real estate or similar property rights, notarization is required according to § 311b (1) BGB. This means that the gift agreement must be documented by a notary in a notarized deed and signed by both parties.

- For the gift of claims or other rights that are registered (e.g., stocks), in addition to the gift agreement, the necessary changes in the respective register must be made.

Why is the gratuitous nature a fundamental requirement for gift agreements?

Gratuitousness is a fundamental requirement for gift agreements because it distinguishes them from other contracts, such as purchase agreements. In a gift, the donor provides the recipient with a financial benefit without receiving anything in return.

This feature sets the gift apart from other legal transactions and is therefore a key characteristic of the gift agreement.

Traditio: Traditio is one of the simplest forms of property transfer for movable items and does not require notarization or other formal steps.

The donor and the recipient simply need to declare their intent to gift and physically hand over the item. The gift becomes legally binding through the handover and the simultaneous declaration of intent by both parties.

It is important to note that traditio is not sufficient for immovable property, such as real estate. In such cases, notarization and other formal requirements are necessary to make the gift legally binding.

Welche Inhalte sollten in einem Schenkungsvertrag enthalten sein?

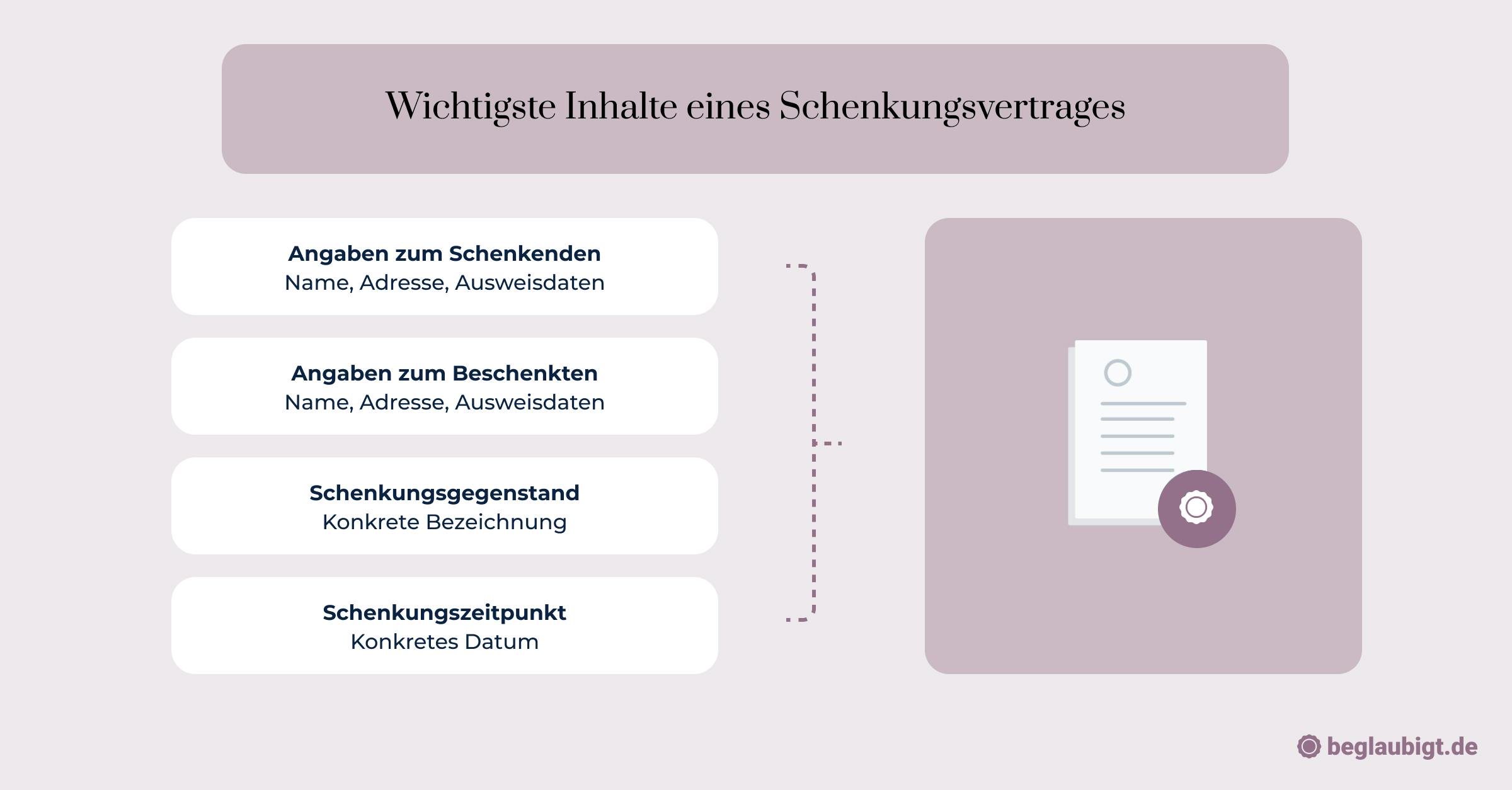

A gift agreement should include specific content to ensure it is legally valid and that both parties understand their rights and obligations. The following points should be included:

Here are the key elements that should be included in a gift agreement:

- Parties to the Agreement: Full names and addresses of the donor (Schenker) and the recipient (Beschenkter) should be stated.

- Gift Object: The agreement should contain a detailed description of the asset being gifted, including the type, condition, and value.

- Transfer and Ownership: The agreement should specify when and how the transfer and transfer of ownership of the asset will take place.

- Complete Gift: The contract should confirm that the gift is made unconditionally and without any compensation.

- Rights and Obligations: The rights and obligations of both parties should be clearly outlined, including responsibility for taxes, fees, or any other financial liabilities related to the gift.

- Liability Disclaimer: A clause should release the donor from any liability related to the gift or the use of the gifted asset.

- Gift Revocation: The agreement should define under what circumstances the gift can be reclaimed, such as in cases of fraud, deception, or breach of contract.

- Amendments and Additions: The contract should outline how any amendments or additions can be made, and what steps are necessary for them to become valid.

- Severability Clause: A severability clause should be included to ensure that the remaining provisions of the contract remain valid, even if one or more clauses are declared invalid or unenforceable.

- Applicable Law and Jurisdiction: The agreement should specify the governing law and the jurisdiction for resolving any disputes related to the contract.

- Signatures: The contract should be signed and dated by both parties—the donor and the recipient—to confirm its legal validity.

- Witnesses: While not always required, having witnesses sign the agreement can help confirm the authenticity of the signatures and the parties' consent to the agreement.

- Conditions of the Gift: If the gift is subject to specific conditions, they should be detailed in the agreement and accepted by both parties.

- Notarization: In some cases, it may be advisable or even required to notarize the gift agreement. This can enhance the legal validity of the contract and help prevent disputes over the gift.

- Contract Retention: Both parties should retain a copy of the signed gift agreement. This can serve as evidence of the gift in case of future disputes or as a reference when needed.

What information about the gift and the involved parties is required?

A gift agreement should first clearly and explicitly identify the involved parties, i.e., the donor and the recipient. This includes full names, addresses, and, if available, contact information. Additionally, it is important to describe the subject of the gift in detail.

For movable items, this may include an exact designation, such as the vehicle identification number for cars, or, in the case of real estate, the precise property designation. The value of the gift should also be stated.

What provisions for conditions, stipulations, and rights of revocation can be included in a gift agreement?

A gift agreement can also include conditions and stipulations that the recipient must fulfill in order to receive the gift. These conditions could involve fulfilling specific obligations or adhering to deadlines. It is important to clearly and understandably formulate these conditions and stipulations in the agreement.

Additionally, the donor's rights of revocation can be included in the gift agreement. A right of revocation may apply, for example, if the recipient does not meet their contractual obligations or if the donor's financial situation worsens after the fact. To avoid misunderstandings, the circumstances and conditions under which revocation rights can be exercised should be clearly described.

In summary, it is crucial that a gift agreement includes all relevant information and provisions to avoid legal disputes and ambiguities. Both parties should also be aware of the current legal situation, and legal advice may be necessary to create a legally secure gift agreement.

What types of gifts are there?

There are various types of gifts depending on the type of assets being transferred, the conditions of the gift, and the parties involved. Here are some common types of gifts with practical examples:

- Gift of Movable Items: This refers to the transfer of items that are not considered real estate, such as cars, jewelry, or furniture. Example: A father gifts his son a car for passing his driving test.

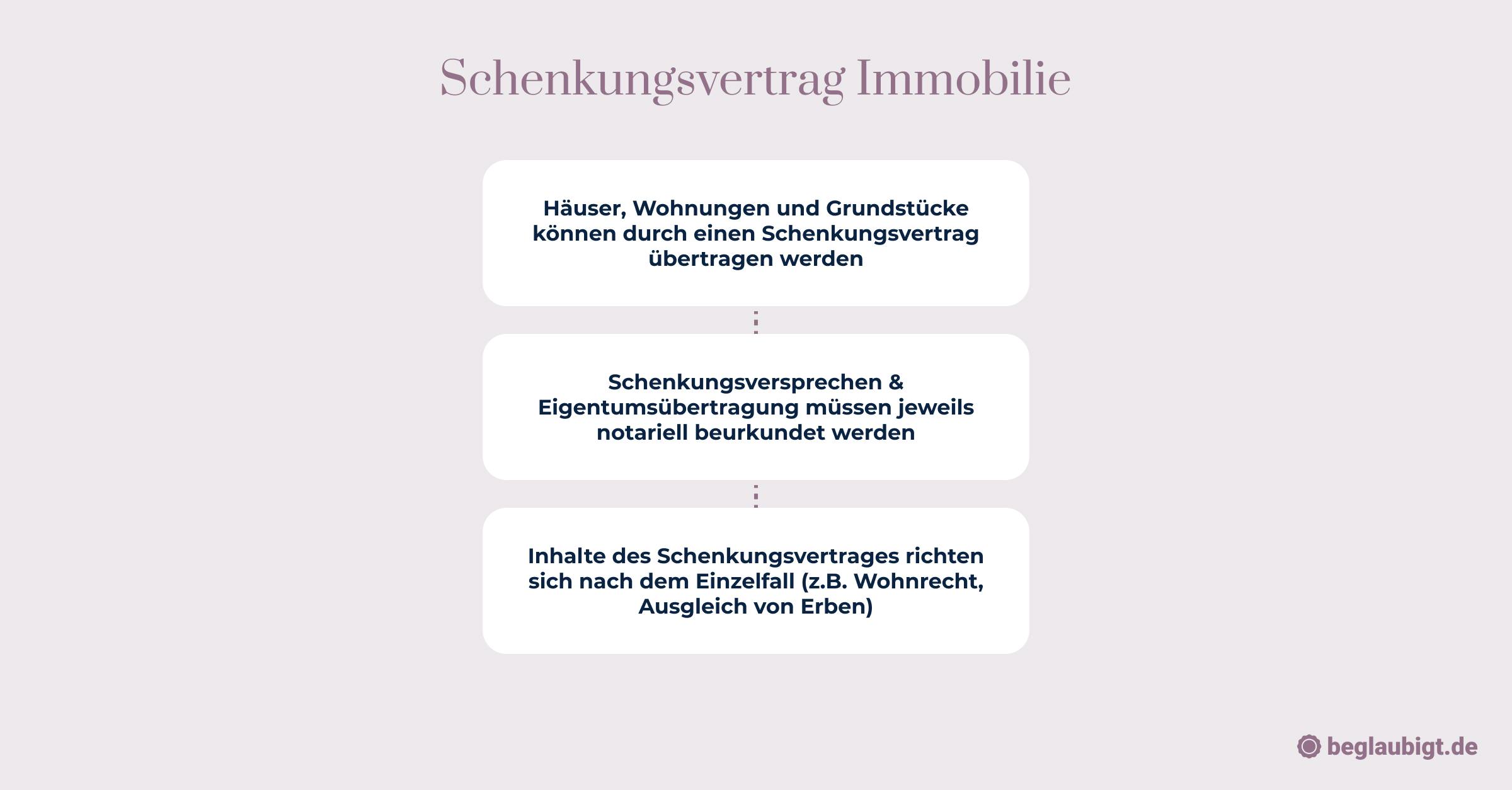

- Gift of Real Estate: In this case, the ownership of land or buildings is transferred from one person to another.Example: A mother transfers ownership of her house to her daughter to help her start a family.

- Monetary Gift: The transfer of money or cash equivalents from one person to another.Example: A grandfather gifts his granddaughter €10,000 to contribute to her wedding.

- Conditional Gift: These are gifts tied to certain conditions that the recipient must fulfill.Example: An uncle gifts his nephew a sum of money on the condition that it is used for his education.

- Gift with Right of Revocation: The donor reserves the right to reclaim the gift under certain circumstances, such as serious misconduct by the recipient.Example: A father gifts his son a piece of land but retains the right to take it back if the son fails to maintain it.

- Gift to a Charitable Organization: These are gifts made to charities or foundations and may offer tax benefits.Example: A person donates a sum of money to an animal shelter to support their work.

What is the distinction between direct and indirect gifts?

First, gifts can be divided into two basic categories: direct and indirect gifts. A direct gift involves the immediate transfer of the gifted item or asset from the donor to the recipient (e.g., handing over car keys). In contrast, an indirect gift occurs through a third party or the transfer of rights (e.g., a delivery service delivers the car, or the donor transfers stocks to the recipient).

What are Conditional and Obligation Gifts?

Another classification of gifts involves obligation gifts and conditional gifts:

- Obligation Gift: This type of gift comes with specific conditions that the recipient must meet. However, the gift remains valid even if the recipient fails to meet these conditions.Example: A donor gifts a property to the recipient but includes an obligation that the recipient must build a house on the land within five years.

- Conditional Gift: In contrast, a conditional gift only becomes valid once a specific condition is fulfilled. If the condition is not met, the gift does not occur.Example: A donor promises a sum of money to the recipient, but only on the condition that the recipient passes a certain exam. If the recipient fails, the gift does not take place.

When is a gift agreement useful?

A gift agreement can be useful in various situations. Here are some examples where a gift agreement is recommended:

- Asset transfer during one's lifetime: If someone wants to transfer part of their assets to the next generation or close individuals during their lifetime, a gift agreement can formalize and legally secure this transfer.

- Tax advantages: Gifts can be used to reduce or avoid inheritance taxes. In Germany, there are tax-free allowances for gifts that can be used every ten years. By making early gifts and utilizing these allowances, assets can be transferred to beneficiaries in a tax-efficient manner.

Securing family wealth: In some cases, a gift agreement can help secure family wealth in the long term by transferring assets to the next generation in a timely manner. For example, a family business can be passed on to a successor through a gift.

Real estate transfer: A gift agreement is especially useful when it comes to transferring real estate. A written contract can clearly outline the rights and obligations of the parties involved, ensuring the legal security of the transfer.

Protection during financial difficulties: If a person is experiencing financial difficulties or fears future financial problems, a gift agreement can be used to transfer assets to close individuals, protecting them from potential creditor claims.

Personal reasons: In some cases, a gift agreement may be useful for personal reasons, such as providing financial support to a loved one or as a gesture of appreciation and recognition.

Overall, a gift agreement is useful when an asset transfer without compensation is intended, and the parties involved want to clearly define their rights and obligations. A legally secure gift agreement can help avoid disputes and protect the interests of all parties involved.

In which cases can a gift agreement be used for asset transfer?

A gift agreement can serve as an organized means of transferring assets, particularly in the following situations:

- Transfer of real estate

- Handover of a business or shares

- Passing on securities or other valuable assets

A gift agreement legally secures the transfer, allowing for clear regulations regarding conditions and stipulations. This makes the transfer of assets smoother and helps prevent potential disputes between the parties involved. For example, the agreement could include a stipulation granting the donor a right of residence after gifting a property.

How can a gift agreement contribute to tax savings?

Another reason for using a gift agreement is to save on taxes. In Germany, gifts within certain tax-free allowances are exempt from taxes. These allowances depend on the degree of kinship between the donor and the recipient and can be utilized every ten years (§§ 16, 17 ErbStG). The allowances are structured as follows:

- Spouses/partners: €500,000

- Children and stepchildren: €400,000

- Grandchildren: €200,000

- Parents and grandparents (in the case of inheritance): €100,000

- Siblings, nieces, nephews, and other persons: €20,000

By strategically using gift agreements, assets can be transferred tax-free or at least in a tax-optimized manner. This is especially important for larger estates, such as the transfer of real estate or businesses. To avoid legal and tax pitfalls, it is advisable to consult an expert in such cases.

Which tax aspects should be considered in gift agreements?

When drafting a gift agreement, various tax aspects need to be considered, especially regarding gift tax. Here are some key points to keep in mind when planning a gift:

- Gift Tax:

In Germany, gifts are subject to gift tax. The tax is calculated based on the value of the assets being transferred. The tax rate depends on the degree of kinship between the donor and the recipient, as well as the value of the gift. - Tax-Free Allowances:

There are personal tax-free allowances that vary depending on the relationship between the donor and the recipient. These allowances can be used every ten years. For example, the allowance for gifts from parents to children is €400,000, and for spouses or registered partners, it is €500,000. Gifts up to these amounts are tax-free. - Tax Classes:

Gift tax is applied in different tax classes based on the relationship between the donor and the recipient. These tax classes determine the applicable tax rate. The closer the relationship, the lower the tax rate. - Real Estate Valuation:

For gifts involving real estate, it is crucial to correctly assess the value of the property to accurately calculate the gift tax. An overvaluation can lead to an unnecessarily high tax burden, while an undervaluation may cause legal issues. - Usufruct and Right of Residence:

If the donor retains a usufruct or right of residence, this can reduce the taxable value of the gift because the recipient does not receive full usage rights. This can result in lower gift tax. - Tax Planning Strategies:

To optimize gift tax, various planning strategies can be employed, such as making use of the available tax-free allowances, gifting assets that fall into a lower tax bracket, or dividing the gift into multiple installments over time.

How are tax allowances and rates regulated for gift tax?

Gift tax must be taken into account when making gifts, as it is levied according to the Inheritance and Gift Tax Act (ErbStG). As mentioned earlier, there are tax-free allowances based on the relationship between the donor and the recipient (§§ 16, 17 ErbStG).

If these allowances are exceeded, gift tax is applied. The tax rates vary depending on the degree of kinship and the value of the assets being transferred, and they are divided into three tax classes (§ 19 ErbStG):

- Tax Class I:Spouses, registered life partners, children, stepchildren, grandchildren, parents, and grandparents (for inheritance).

- Tax Class II:Siblings, nieces, nephews, stepparents, sons-in-law, daughters-in-law, parents-in-law, and divorced spouses.

- Tax Class III:All other persons.The tax rates range from 7% to 50% (§ 19 ErbStG), depending on the tax class and the value of the gifted assets. It's important to stay informed about current tax rates and allowances to properly estimate the tax consequences.

- The tax rates range from 7% to 50% (§ 19 ErbStG). It is important to stay informed about the current tax rates and allowances to assess the tax implications.

What tax optimization strategies are available?

To minimize or avoid gift tax, several strategies can be employed:

- Utilizing tax allowances: By making repeated gifts within the ten-year period, the tax-free allowance can be used multiple times.

- Gifts with conditions: The gift can be linked to certain conditions or obligations to reduce the taxable value, such as granting the donor a lifelong right of residence.

- Transfer of lower-value assets: Another option is to initially transfer assets of lower value to reduce the overall gift tax.

How can gift agreements be made legally secure?

To ensure gift agreements are legally secure, you can use the online tool beglaubigt.de. Beglaubigt.de is a legally compliant contract generator specializing in creating legally sound gift agreements and other types of contracts. The advantages of using beglaubigt.de include:

- User-friendly interface: The platform is easy to use, allowing you to create gift agreements tailored to your individual needs.

- Legally compliant templates: Beglaubigt.de provides legally reviewed templates that ensure the agreements comply with current legal standards.

- Up-to-date contracts: Contract templates are regularly updated to reflect changes in legislation and case law.

- Customizable options: Templates can be adapted to meet the specific needs and requirements of the parties involved.

- Time and cost savings: Creating gift agreements with beglaubigt.de saves time and costs compared to hiring a lawyer or notary.

By using beglaubigt.de, you can ensure that your gift agreement includes all the necessary provisions and legal requirements. This reduces the risk of disputes or misunderstandings regarding the gift and provides a solid foundation for a successful asset transfer.

What role does the revocation clause in a gift agreement play?

The revocation clause in a gift agreement plays an important role as it grants the donor the right to revoke the gift under certain conditions.

For instance, this clause can be invoked in cases of serious misconduct by the recipient or if the donor faces significant hardship, such as financial difficulties. It ensures that the donor has a legal mechanism to reclaim the gifted asset if certain agreed-upon conditions are not met or if unforeseen circumstances arise. This clause provides additional protection to the donor, making the agreement more flexible and secure.

The revocation clause should be clearly defined and established in the gift agreement to prevent misunderstandings and legal disputes.

Several court rulings highlight the importance of the revocation clause in gift agreements:

- BGH, Judgment of 19.02.2014, Az. IV ZR 159/13: The German Federal Court (BGH) ruled that a gift agreement can be revoked if the donor has a legitimate interest in reclaiming the gift due to serious misconduct by the recipient.

- OLG Munich, Decision of 16.05.2018, Az. 31 Wx 81/18: The Higher Regional Court of Munich clarified that a revocation clause in a gift agreement must not be too vague. The clause must specifically address the circumstances under which revocation is allowed to be legally effective.

- BGH, Judgment of 03.02.2010, Az. XII ZR 8/08: The BGH ruled that the forfeiture of the right to revoke a gift is subject to specific conditions. Merely doing nothing is not sufficient for the donor to forfeit their revocation right.

- These rulings demonstrate the critical role the revocation clause plays in protecting the donor's interests.

What are the reasons for revocation?

The revocation clause in a gift agreement is an essential component because it allows the gift to be undone under certain circumstances. Some possible reasons for revocation include:

Ingratitude of the recipient: If the recipient behaves with severe ingratitude towards the donor (e.g., through insults or criminal behavior), this can justify a revocation.

Failure to meet conditions: If the gift agreement includes specific conditions (e.g., the recipient must care for the donor in old age) and these conditions are not met, it may also justify revocation.

Change in life circumstances: In some cases, a significant change in the donor's life circumstances (e.g., financial hardship) can be grounds for revocation.

How to proceed with a revocation and what are the consequences?

A revocation of a gift agreement should generally be made in writing, outlining the reasons for the revocation. It is recommended to seek assistance from a lawyer or notary to ensure that the revocation is carried out correctly from a legal perspective.

In the case of a valid revocation, the recipient is obligated to return the gift. This means that the gifted asset or value must be transferred back to the donor. It is important to note that reversing the gift can be complex, especially when it involves real estate or other assets that are difficult to evaluate.

How can disputes related to gift agreements be resolved?

Disputes concerning gift agreements can be resolved in several ways. Here are some approaches that can help settle conflicts:

- Amicable Agreement: The involved parties should try to communicate directly and find a mutual agreement. Open and honest communication can help clear up misunderstandings and provide an opportunity to reach a compromise.

- Mediation: If the parties struggle to reach an agreement, a neutral mediator can be brought in. The mediator helps facilitate discussions and assists the parties in finding a common solution.

- Arbitration: An alternative to court proceedings is arbitration. The parties agree to appoint one or more arbitrators who make a binding decision regarding the dispute. This decision is usually final and can only be contested in exceptional cases.

- Court Proceedings: If all other approaches fail, the parties can turn to the court to resolve the dispute. The court will examine the situation and issue a binding decision for both parties. However, litigation can be time-consuming and costly.

- Legal Advice: Regardless of the conflict resolution approach, it is advisable to seek legal counsel. An experienced lawyer can assess the legal situation, suggest possible solutions, and support the parties throughout the process.

To avoid or resolve disputes related to gift agreements, it is crucial to carefully draft the contract and adhere to legal requirements. Open communication and addressing potential conflicts early on can help prevent costly and time-consuming legal disputes.

When are legal disputes necessary?

If out-of-court procedures such as mediation and arbitration do not lead to an agreement, the legal dispute remains the last resort. In this case, a trial is conducted before a competent court (in Germany, for example, before the district or regional court) and ultimately a judicial decision is made.

It is important to note that legal disputes are usually associated with high costs and a considerable amount of time. Therefore, this step should be carefully considered and only pursued after unsuccessful out-of-court procedures.

Who must prove the gift?

Burden of proof in gift claims

In legal disputes concerning gifts, the question often arises as to who bears the burden of proof for the existence and terms of a gift. Generally, the burden of proof lies with the claimant, meaning the person asserting a gift must provide the relevant evidence. This can be done, for example, through witness statements, written agreements, or other documentation.

The importance of gift contracts and notarial certifications

A written gift contract or notarial certification can serve as evidence of the existence of a gift. For valuable gifts, such as real estate, notarial certification is legally required (§ 518 BGB).

In such cases, the notarial document can be used as proof of the gift.

Burden of proof in the contestation of gifts

If a party seeks to contest a gift due to defects in will, such as deception or duress, the burden of proof also lies with that party. This means that the contesting person must demonstrate that the gift was made under the relevant circumstances, making it contestable.

What is not considered a gift?

Under German law, a gift is a voluntary, gratuitous transfer from one person to another, where the donor provides an asset advantage from their property without expecting any compensation. However, there are certain situations that do not qualify as gifts. Here are some examples:

- Mandatory payments: If a service is provided due to a legal obligation, e.g., maintenance payments or statutory inheritance claims, it is not considered a gift.

- Reciprocal contracts: Contracts where both parties provide services, such as sales contracts or exchanges, are not gifts because they are based on mutual consideration.

- Spending money or assets without creating a financial benefit: If money or assets are spent without the recipient gaining a financial advantage, it does not qualify as a gift. For example, paying off a third party’s debt is not considered a gift to that third party, as there is no shift in wealth in favor of the third party.

- Occasional gifts: Gifts made for a specific occasion or out of courtesy and of minor value are generally not considered gifts in the legal sense.

Some court rulings that clarify these distinctions include:

- Federal Court of Justice (BGH) ruling of 29.06.2005, case number IV ZR 34/04: In this case, it was established that a transfer made due to a moral duty or out of decency is not considered a gift.

- Federal Fiscal Court (BFH) ruling of 13.01.1999, case number X R 86/95: Here, the BFH clarified that expenses made to fulfill a legal obligation are not considered gifts.

Contracts with consideration

An essential characteristic of a gift is its gratuitous nature. Therefore, contracts where consideration is provided do not qualify as gifts. These contracts include:

- Purchase contract: In this case, a person acquires ownership of an item or a right in exchange for payment of the agreed purchase price (§ 433 BGB).

- Exchange contract: In an exchange contract, two services (items or rights) are exchanged against each other (§ 480 BGB).

Temporary transfers

Even when objects or rights are temporarily made available to another person, it does not constitute a gift, as these transfers are only temporary. Examples include:

- Loan for use: In a loan for use, an item is provided free of charge for a certain period of time. The item must be returned after the agreed loan period expires (§ 598 BGB).

- Rental agreement: In a rental contract, the landlord provides an item or a right (e.g., living space) to the tenant in exchange for payment of rent (§ 535 BGB). Unlike a gift, there is consideration in the form of rent, and the use is also time-limited.

In these cases, no gift is present, as either consideration is provided or the transfer is merely temporary in nature.

Is a gift required to be reported?

Reporting obligations to the tax office

A gift may need to be reported, depending on factors such as the value of the gift and the relationship between the donor and the recipient.

According to § 30 of the Inheritance and Gift Tax Act (ErbStG), gifts made during a person’s lifetime must be reported to the relevant tax office if gift tax is applicable.

Key points to consider:

- Tax exemptions: Depending on the relationship between the donor and recipient, certain tax-free allowances apply (§ 16 ErbStG). For example, the exemption for spouses and registered partners is €500,000, while for children and stepchildren it is €400,000.

- Reporting requirement: Both the donor and the recipient are obligated to report the gift to the relevant tax office within three months (§ 30 ErbStG) if the gift exceeds the respective tax-free allowance.

Reporting obligations for real estate gifts

In the case of real estate gifts, additional reporting obligations apply:

- Land registry change: A gift of real estate must be notarized, and the gift contract must be submitted to the land registry to register the transfer of ownership (§ 873 BGB, § 925 BGB).

- Real estate transfer tax: In some federal states, real estate transfer tax may be triggered under certain conditions when gifting property. It is advisable to consult with a lawyer or notary for guidance on this matter.

Die Meldepflichten bei Schenkungen sind abhängig von verschiedenen Faktoren, wie dem Wert der Schenkung und dem Verwandtschaftsgrad.

How does the tax office become aware of a gift?

The tax office can learn about a gift in several ways. Here are some of the most common methods through which gifts come to the attention of tax authorities:

- Gift report by the donor or recipient: In Germany, there is a reporting obligation for gifts under § 30 ErbStG. The donor or recipient must notify the relevant tax office of the gift within three months after becoming aware of it. The report should include details about the parties involved, the value of the gift, and, if applicable, the gift agreement.

- Notarial certification: If a gift agreement is notarized, the notary is required to report the gift to the relevant tax office.

- Banks and financial institutions: For larger monetary transfers or asset transfers, banks and financial institutions may be obligated to report these transactions to tax authorities.

- Report by third parties: In some cases, the tax office can learn about a gift through third parties, such as heirs, creditors, or other individuals affected by the gift.

- Review of tax returns: The tax office may come across suspicious asset movements or transactions indicating a gift during an audit or routine review of tax returns.

- Cooperation between tax authorities: Tax authorities often cooperate both nationally and internationally to exchange information about gifts and asset transfers. This can be particularly relevant for cross-border gifts.

Reporting obligations of the involved parties

In Germany, both the donor and the recipient are required to report a gift to the tax office within a period of three months (§ 30 ErbStG). This reporting obligation applies regardless of whether gift tax is due or not. The obligation to report also applies to gifts between close relatives and when utilizing tax-free allowances.

Notarial certification and its significance for the tax office

For certain gifts, such as the transfer of real estate, notarial certification is required. In these cases, the tax office automatically becomes aware of the gift, as the notary is obligated to report the transaction to the relevant tax office.

This allows the tax office to determine whether gift tax applies and, if necessary, request a gift tax declaration.

Proactive submission of the gift tax declaration by the recipient

It is advisable for the recipient to proactively submit a gift tax declaration to the tax office, even if no request has been made. This can help avoid potential back payments, interest, or even fines if the tax office later learns about the gift.

The gift tax declaration should include all relevant information, such as the personal details of the parties involved, the value of the gift, and, if applicable, the calculation of the gift tax.

What are the disadvantages of a gift?

Despite its advantages, a gift can also have some disadvantages. Here are a few potential drawbacks of making a gift:

- Irrevocability: A gift is generally irrevocable. Once the gift has been made, the donor cannot easily reclaim it, unless the gift contract includes a revocation clause under certain conditions.

- Loss of control: By making a gift, the donor relinquishes control over the transferred assets. This can be problematic, especially when it involves significant assets such as real estate or businesses.

- Tax consequences: Gifts may trigger gift tax if the tax-free allowances are exceeded. Donors and recipients should be aware of the possible tax implications and take them into account when planning the gift.

- Potential disputes: Gifts can lead to disagreements or conflicts within families or among friends, especially if the gift is perceived as unfair or disproportionate.

- Reclamation by social welfare authorities: In some cases, a gift may be reclaimed if the donor later requires social welfare assistance and the welfare agency demands the return of the gift to reduce welfare payments.

- Insolvency risk: If the recipient encounters financial difficulties and goes bankrupt, the gifted assets may be subject to seizure by creditors.

To minimize the potential disadvantages of a gift, it is important to carefully draft the gift contract and consider all relevant aspects such as tax implications, revocation clauses, and potential conflicts.

Practical examples of gift contracts

How does the gifting of real estate work?

The gifting of real estate is a common practical application of gift contracts. In a real estate gift, the donor transfers ownership rights to a plot of land or building to the recipient without compensation. Several special aspects must be considered:

- Notarial certification: According to § 311b BGB, the gift of real estate is only valid if the gift contract is notarized. This requirement ensures legal protection for the parties involved and provides legal certainty.

- Entry in the land register: After the notarization, the transfer of ownership must be registered in the land register to complete the gift legally. Typically, the involvement of a notary is required for this process.

- Real estate transfer tax: In most cases, real estate transfer tax is not charged for gifts of real estate between relatives, provided the gift tax allowances are observed. Otherwise, both real estate transfer tax and gift tax may apply.

How does the gifting of money work?

Another frequent example of gift contracts is the gifting of monetary amounts. In this case, the donor transfers a sum of money to the recipient without compensation. Several points should be considered when gifting money:

- Formal requirements: Unlike real estate gifts, the gifting of money is not subject to specific formal requirements. However, it may still be advisable to draft a written contract to avoid misunderstandings and disputes.

- Gift tax: The gifting of money may be subject to gift tax. The amount of tax depends on the relationship between the parties and the sum of money involved. However, there are tax exemptions, up to which no gift tax is payable (e.g., €500,000 for children and €400,000 for spouses).

- Conditions and stipulations: Even when gifting money, conditions and stipulations can be agreed upon, such as using the money for specific purposes (e.g., education or home construction). A clearly formulated agreement in the gift contract can provide clarity and legal security in such cases.

5 Tips for Gift Contracts

- Seek expert advice: Before drafting or accepting a gift contract, it is advisable to consult with a lawyer or notary. These experts can help you avoid potential legal pitfalls and ensure that the contract complies with current laws and regulations.

- Create a written agreement: Even if a gift can often be made informally, it is recommended to draft a written agreement. This helps to avoid misunderstandings and clearly outlines the conditions of the gift. For certain types of gifts, such as real estate, notarized certification is legally required (§ 518 BGB).

- Consider tax implications: Gifts may trigger gift tax if they exceed certain allowances. Make sure to inform yourself in advance about applicable allowances and tax rates to avoid any unpleasant surprises. It is also important to comply with reporting obligations to the tax office.

- Include a revocation clause in the contract: To allow for the possibility of undoing the gift if necessary, consider including a revocation clause in the gift contract. This provision allows the gift to be revoked under certain conditions, such as in the case of gross ingratitude from the recipient.

- Ensure all parties' consent: For gifts involving multiple people, such as in family matters, it is important to secure the consent of all parties involved. Open communication and transparency can help resolve potential disputes and disagreements in advance, ensuring harmony among the parties.

Conclusion: Gift Contracts Explained

Importance of legally sound gift contracts

A well-thought-out and legally secure gift contract is essential to avoid potential legal and tax issues. A comprehensive understanding of different types of gifts, reporting obligations, burden of proof, and tax considerations is crucial.

Using Beglaubigt.de for creating gift contracts

The platform Beglaubigt.de offers an easy way to create and manage gift contracts online. By collaborating with experts and following legal requirements, you can ensure that your gift contract meets current standards and is legally sound.

In summary, it is essential to consider all relevant aspects when drafting gift contracts and to maintain transparent communication with all parties involved. This helps ensure a smooth process and prevents potential disputes or misunderstandings in the future.