What do I need to do to leave the church?

Making the decision to leave the church is the first step in a process that involves legal, personal, and financial considerations.

To navigate this process, it is helpful to prepare systematically and keep in mind the role of the notary, who can provide essential support in certain aspects of leaving the church.

The traditional step to leaving the church

In order to leave the church, you must follow certain steps. These vary slightly depending on the federal state, but the basic structure of the process remains the same throughout Germany. Here is a general step-by-step guide to help you through the process:

- Check your church membership: Before you start the withdrawal process, make sure that you are officially a member of the church. This may seem obvious, but it is important because your church membership has tax implications in Germany. You can check your membership on your income tax statement or by contacting your church directly.

- Gather the necessary documents: To deregister, you will usually need a valid ID card or passport. Some authorities also require a birth certificate or baptismal certificate. Check with the relevant authority in advance to find out which documents are required.

- Find the right office: You can leave the church at a government office, which is usually the registry office in most states. But in some states, like Berlin and North Rhine-Westphalia, you have to go to the local court. The exact office varies, so check ahead of time.

- Submit your declaration of withdrawal: Visit the relevant authority in person to submit your declaration of withdrawal. Some federal states allow you to declare your withdrawal in writing or even online, but this is rather the exception. During your visit, you will be asked to fill out a form or submit a written declaration.

- Paying fees: An administrative fee is charged for leaving the church, the amount of which varies depending on the state (between approximately $20 and $60). Make sure you know the exact fee in advance and have it ready for your appointment.

- Receive confirmation: After submitting your declaration of withdrawal and paying the fee, you will receive a certificate of withdrawal. Keep this document in a safe place, as it serves as official proof of your withdrawal from the church and must be presented to your employer, for example, in order to stop church tax payments.

- Inform your employer: Inform your employer that you have left the church by giving them a copy of your certificate of withdrawal. This is necessary so that church tax can be deducted from your salary.

The fastest way to leave the church via beglaubigt.de

Beglaubigt.de can play a very special role in this process. Beglaubigt.de is probably the fastest provider for leaving the church, as we offer express appointments in the largest cities, thus avoiding the usual 3-4 week waiting period.

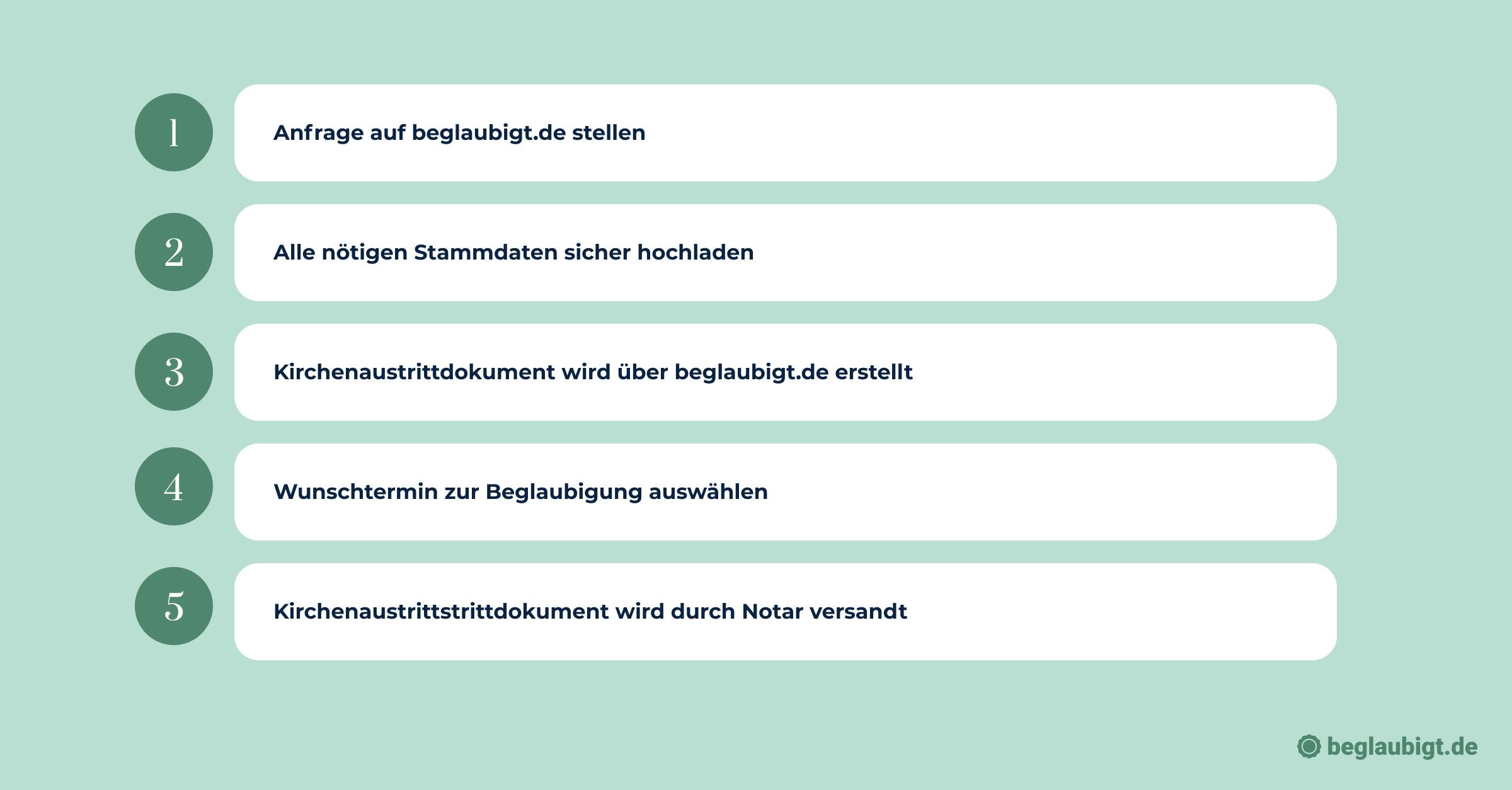

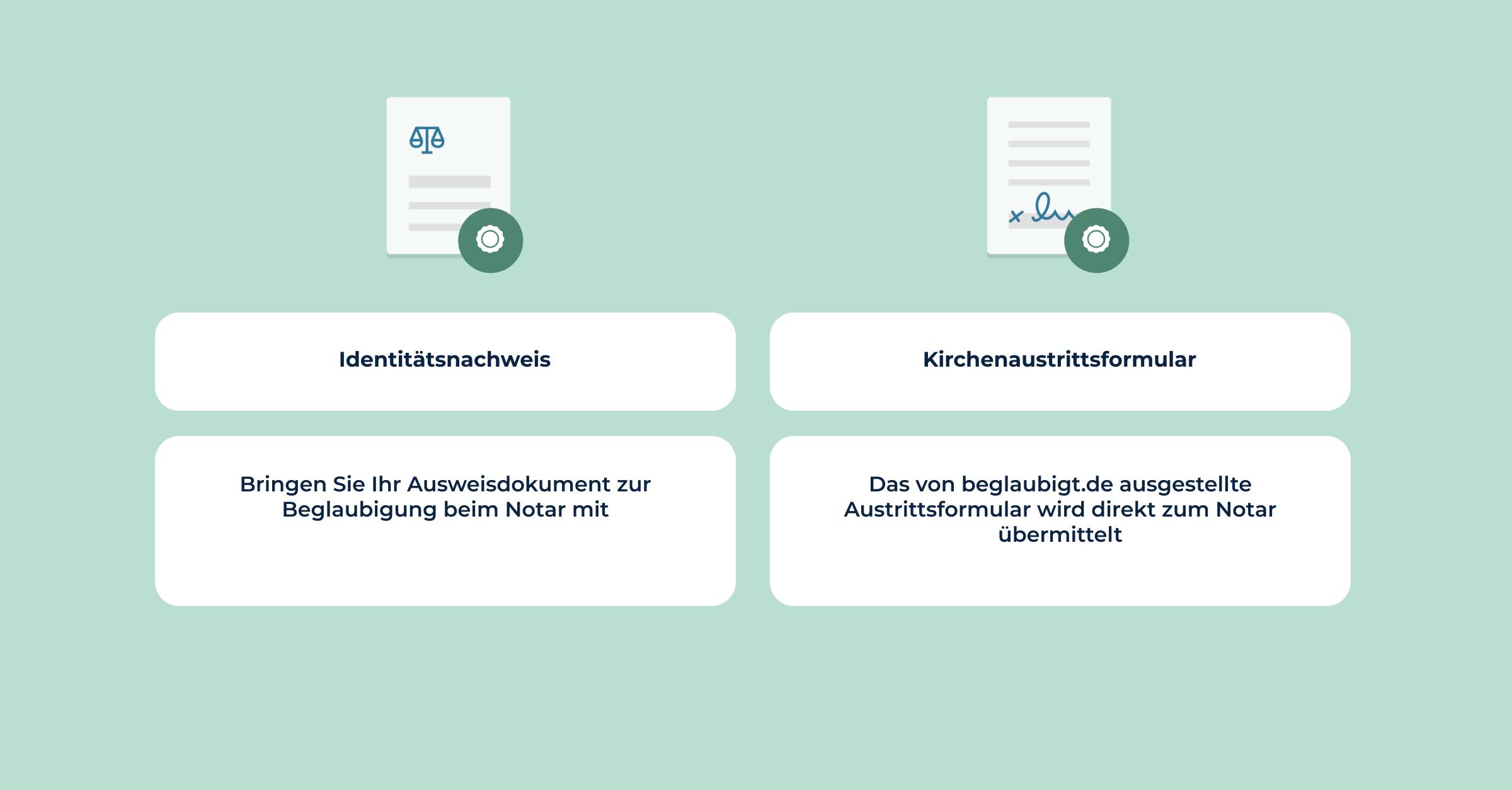

The process on beglaubigt.de is as follows:

If you are considering leaving the church digitally, we are happy to assist you: https://start.beglaubigt.de/anfrage

Questions to be clarified in advance for leaving the church

Before you begin the process of leaving the church, you should be clear about your motives and answer the following questions for yourself:

- What are my reasons for leaving the church?

- Am I aware of the consequences of my resignation, particularly with regard to church services and ceremonies?

- How will leaving the church affect my church tax?

Documents required for leaving the church

To leave the church, you will usually need the following documents:

- Identity card or passport

- Baptism certificate or membership certificate from your church (not always required, but helpful)

- Declaration of withdrawal (the form varies depending on the state)

Authorities and institutions responsible for leaving the church

In Germany, leaving the church is usually done at the registry office or district court of your place of residence. However, the exact jurisdiction may vary depending on the federal state. Please check the website of your city or district in advance for specific requirements.

The role of the notary in leaving the church

The role of the notary in leaving the church may not be obvious at first glance, as most people leave the church directly through government agencies such as the registry office or local court. However, there are situations and circumstances in which notarial services can be not only helpful but necessary.

Notaries offer an additional level of security thanks to their expertise in legal documentation processes and ensure the correct and legally compliant handling of documents that may be relevant in the course of leaving the church. In this section of the article, we take a detailed look at the cases in which the support of a notary is appropriate or necessary when leaving the church.

Notarization of documents - In most cases, notarization of documents is not required to leave the church. However, there are exceptions, especially if you live abroad or need to submit additional legal documents. In these cases, a notary can confirm the authenticity of your signature and documents, which simplifies and speeds up the process.

Legal advice from a notary - The decision to leave the church can raise not only emotional but also legal questions. A notary can be a valuable resource in this context:

- Advice on the legal consequences of your withdrawal, particularly with regard to marriages, baptisms, and funerals within the church

- Clarification of questions regarding church tax and how leaving the church affects it

- Assistance in formulating and certifying a declaration of withdrawal, should this be necessary

In summary, the process of leaving the church in Germany is relatively straightforward, but may vary depending on individual circumstances and place of residence. In certain cases, it may be necessary or advisable to use the services of a notary to ensure that all legal requirements are met.

By clarifying relevant questions in advance and providing all necessary documents, the withdrawal process can be completed efficiently and without unforeseen obstacles.

If you would like to leave the church online with a notary, beglaubigt.de can help you make an appointment with a notary in your area in a simple and straightforward manner. If you have any questions about the process, please feel free to contact us or take a look at this article: Notarization online

How high are church taxes in Germany?

Church tax in Germany represents a financial obligation for members of certain religious communities, which is levied directly via income tax.

This section highlights the key aspects of church tax, including how it is calculated, the amount payable, and the differences between the federal states. It also explains the implications of leaving the church for church tax payments.

Calculation basis and amount - Church tax is calculated as a percentage of income tax and varies between 8% and 9% depending on the federal state. This means that the amount of church tax depends directly on taxable income and the respective tax rate. For example, a person who belongs to a religious community subject to church tax and lives in a federal state where the church tax rate is 9% pays an additional 9 cents in church tax for every euro of income tax.

Differences between federal states - While most federal states apply a church tax rate of 9%, there are exceptions such as Bavaria and Baden-Württemberg, where the rate is 8%. This regional variation affects the total amount of church tax paid by members of religious communities that levy church tax.

Effects of leaving the church on church tax - Leaving the church generally results in the immediate termination of church tax liability. However, the practical implementation of this regulation does not always take place immediately. The date from which church tax is no longer levied depends on the date of withdrawal and the processing by the relevant authorities. As a rule, the obligation to pay church tax ends from the month following withdrawal.

Legal basis - The legal basis for the collection of church tax and the consequences of leaving the church are laid down in the church tax laws of the federal states and in agreements between the state and the religious communities. These regulations ensure that church tax is levied fairly and uniformly as part of the German tax system and is adjusted accordingly when a person leaves the church.

By leaving the church, members of religious communities that levy church tax can thus experience significant financial relief, which can be a major motivation for taking this step. However, the decision should be carefully considered, as it can also have far-reaching personal and, in some circumstances, social consequences.

You may also be interested in this article: Is leaving the church financially worthwhile?

What are the advantages of leaving the church?

- Financial savings: The most obvious advantage is the savings on church tax, which in many countries is deducted directly from your salary or pension. Depending on your income and tax rate, these savings can be considerable.

- Personal conviction: Leaving the church allows individuals to act in accordance with their personal convictions, especially if they no longer identify with the teachings or practices of their church.

- Autonomy: Leaving the church can also be seen as a step toward personal autonomy, in which one makes a conscious decision about one's membership and the obligations that come with it.

- Social and ethical reasons: Some people leave the church because they disagree with certain attitudes or actions that they consider socially or ethically problematic.

If you would like to read more about the disadvantages, we recommend our article: Leaving the church: disadvantages

How do I leave the church in Saxony?

Leaving the church in Saxony follows a specific procedure that differs in some respects from the withdrawal processes in other federal states. In this section, we will look at the special regulations and procedures that apply in Saxony and discuss the role of the notary in this process.

Competent authorities and contact points - In Saxony, the registry office of the place of residence is responsible for leaving the church. This differs from the practice in some other federal states, where in some cases the local court is responsible for leaving the church. People who wish to leave the church should therefore first contact their local registry office to obtain information about the necessary documents, opening hours, and possible appointments.

Differences from the general procedure in Germany - The procedure in Saxony is characterized by its straightforward processing. After presenting a valid identity card or passport and paying an administrative fee, the withdrawal from the church is formally recorded. The fee for withdrawing from the church in Saxony is around 26 euros, but may vary slightly depending on the registry office.

Notarial aspects of leaving the church in Saxony - Normally, no notarial certification is required to leave the church in Saxony. The process is handled directly by the registry office, and the declaration of withdrawal does not require any further form of certification. However, there are exceptions, particularly if additional documents must be submitted or if the withdrawal is made from abroad. In such situations, notarization may be necessary or at least helpful to ensure the authenticity and legal validity of the documents.

Special information for Saxony - For people who wish to leave the church in Saxony, it is advisable to obtain detailed information in advance and, if necessary, consult a notary for advice. Although notarization is not normally required, a notary can provide valuable support, for example in preparing the necessary documents or answering legal questions about leaving the church. The expertise of a notary can be an important resource, especially in complex cases or when there are uncertainties.

You can find out more about the process of leaving the church in this article: What do I have to do if I want to leave the church?

Can you leave the church online in Hamburg?

In today's digital world, many people are looking for ways to complete formal processes online – including leaving the church. Hamburg has taken innovative steps in this regard to offer its citizens this option.

This section explains how online church withdrawal works in Hamburg, which official platforms can be used for this purpose, and which legal requirements must be observed. It also discusses the role of the notary in the context of online withdrawals, particularly with regard to digital signatures and identity checks.

Digital options for leaving the church in Hamburg

In Hamburg, citizens can apply to leave the church via the city's online portal. This service is a convenient and time-saving alternative to visiting an official office in person.

Users can enter the required data and submit the necessary documents digitally via the platform. After submitting the application, a processing fee is payable, which can be paid online.

Legal framework for online resignations

The option to leave the church online is subject to strict legal requirements. These are intended to ensure that the process complies with both data protection regulations and the verification of the applicant's identity. In Hamburg, the online church withdrawal process has been designed to meet these legal requirements, for example by providing for secure identification and authentication of users.

The role of the notary in online church resignations

Although the process of leaving the church in Hamburg can be carried out online, notaries still play an important role, especially when it comes to securing legal aspects. In certain circumstances, for example, if additional documents need to be certified or in the case of Germans living abroad leaving the church, the involvement of a notary may be necessary.

Notaries are also able to verify digital signatures and perform identity checks, which provides an additional layer of security.

Future prospects and current debates

The introduction of online church resignation in Hamburg has sparked a debate about the digitization of formal and legal processes in Germany. While some praise its efficiency and user-friendliness, others express concerns about data protection and security.

The role of notaries in this digital transition continues to be debated, with emphasis placed on the need to combine traditional procedures with modern technologies in order to ensure legal certainty and trustworthiness.

Overall, online church withdrawal in Hamburg offers citizens a progressive way to take this personal step in an uncomplicated and efficient manner. The involvement of notaries in the process, especially when a digital signature and identity verification are required, shows that there is a need for professional legal support even in digitized procedures.

If you would like to complete your withdrawal from the church online as far as possible, it is advisable to use a notary. We would be happy to arrange an online appointment with one of our partner notaries for you. Simply send us a brief request with a few details. We work with notaries throughout Germany, for example in:

Fazit

The decision to leave the church is a personal one that is influenced by various factors, including ideological beliefs, financial considerations, or the desire for a change in personal affiliation. In this article, we have taken an in-depth look at the various aspects of leaving the church in Germany, from the necessary steps and documents to the financial implications in the form of church taxes, specific procedures in federal states such as Saxony, and digital options in Hamburg.

The introduction of online procedures for leaving the church, as seen in Hamburg, also demonstrates efforts to modernize administrative processes in Germany and offer citizens a simpler, more time-saving option for such declarations. The role of the notary is adapting to these developments by offering digital services such as identity verification and verification of digital signatures.

In summary, leaving the church in Germany is a well-structured process, but one that requires careful preparation and, in certain cases, professional support. The decision to take this step should therefore not be rushed, but made after thorough consideration and, ideally, with the advice of experts such as notaries. Ultimately, the process of leaving the church reflects the balance between individual rights, state processes, and adaptation to modern technologies that characterizes administrative action in Germany.