beglaubigt.de

Create a legally secure loan agreement

Quickly and easily create a legally reviewed loan agreement in .PDF format according to current standards. The template is free and fully customizable

Create PDF now

+10 Tausend

Verträge erstellt

100%

Anpassbare Vorlagen

2 Minuten

Bis zur Fertigstellung

4 Stunden

Zeiteinsparung

In collaboration with top-tier lawyers for legal security

All contract templates have been created by a team of experts and are continuously reviewed for their current relevance.

Our goal is to provide legally compliant and up-to-date contract templates in a simple and digital manner. If you have a special case, we are ready to address it."

Peter MendelRechtsanwalt und Fachanwalt

Peter MendelRechtsanwalt und Fachanwalt für Arbeitsrecht

Customizable loan agreement available for download as a PDF or Word document

After creation, you will receive the loan agreement in the chosen file format for download, so you can further edit or use it as needed. A secure, encrypted link also ensures continuous access, providing you with flexibility for future adjustments or desired changes.

Introduction to the loan agreement

1.1. "What is a loan agreement?

A loan agreement is a legally binding document that governs a financial transaction between two parties: the lender and the borrower. It plays a central role in many financial dealings and is therefore of great importance for both individuals and businesses.

The legal basis for the loan agreement in Germany is found in the Civil Code (BGB).

§488 Abs. 1 BGB specifies the essential features of a loan agreement:

Through the loan agreement, the lender is obligated to provide the borrower with an agreed amount of money or an agreed quantity of other fungible items. The borrower is required to pay the owed interest and to repay the provided loan upon maturity.

"A basic example of a loan agreement might look like this: A borrower takes out a loan of €20,000 from a bank to purchase a car. The repayment of the loan amount occurs in monthly installments over a set period, in this case, five years, plus a specified interest rate.

The loan agreement specifies the exact terms of this transaction, including the amount of the monthly installments, the interest rate, and the loan term.

Loan Agreement: Important Contents

Loan agreements are made both in business contexts and private settings. For loans granted by banks, a written agreement is mandatory due to extensive legal regulations.

In private settings, a written agreement is not always required but provides transparency and legal protection for both parties. Templates for such agreements are available online.

A loan agreement includes not only information about the loan amount or the type and value of the object loan but also details about other terms of the provision. These include:

- Duration of the contract

- Agreed interest rate

- Binding of the interest rate

- Total interest burden

- Purpose of the loan

- Repayment terms

- Provisions in case of late payment

- Additional costs (e.g., processing fees, account fees,

- setup fees for bank loans)

- Additional agreements (such as early repayment or deferral of payments)

- Collateral for the loan

- Disbursement terms

- Standard loan conditions

- Notes on the right of withdrawal

- Termination conditions

For added security, we recommend our loan agreement creator:

Loan agreement as PDF or WORD.

1.2. What is the difference between a loan and a credit?

In everyday language, the terms 'loan' and 'credit' are often used interchangeably. However, upon closer examination, especially from a legal and economic perspective, there are more differences between the two terms than one might think.

A loan is defined in §488 BGB and refers to a monetary or material benefit provided based on a contract for a specific period. The borrower commits to repaying not only the borrowed amount but also the agreed-upon interest.

A common example is mortgage financing. Suppose you want to build a house: you approach a bank, which provides you with a fixed amount of money. You then repay this amount over several years in fixed installments, including interest.

A credit, on the other hand, is a broad term encompassing various types of borrowing models. It acts as an umbrella term for many different financing options, from overdrafts to current account credits to consumer loans.

For example, an overdraft credit allows you to withdraw more money from your bank account than you currently have, up to a specified limit. Colloquially, this is often referred to as 'going into the red.

The central difference between a loan and credit lies in their nature and flexibility.

While a loan often represents a long-term, fixed commitment with clearly defined repayment rates and a fixed interest rate, a credit is more variable—both in terms of repayment conditions and interest rates.

It's like comparing a permanent, long-term employment contract with a flexible freelance contract in the job market. Both have their advantages and disadvantages and are suitable depending on the situation and needs."

2. What are the types of loan agreements

There are many different types of loan agreements that can be chosen based on the borrower's needs, the lender's conditions, and the specific requirements of the financial transaction. Here are some of the most common types of loan agreements:

- Annuity Loan: This is the most common type of loan, especially for mortgage financing. With an annuity loan, the monthly payment amount, which includes both interest and principal repayment, remains constant throughout the loan term. The interest portion decreases over time while the principal repayment portion increases.

- Repayment Loan: With a repayment loan, a constant principal repayment is agreed upon for the duration of the loan. Interest is calculated on the outstanding amount and thus decreases over time, reducing the overall burden.

- Bullet Loan: In a bullet loan, the repayment of the borrowed amount occurs in a lump sum at the end of the loan term. During the term, the borrower only pays interest. This type of loan is often combined with a life or pension insurance policy, which is used to repay the loan upon maturity.

- Fixed-Rate Loan: With a fixed-rate loan, the interest rate is set for the entire loan term. This protects the borrower from rising interest rates.

- Variable-Rate Loan: In contrast to a fixed-rate loan, the interest rate on a variable-rate loan is not fixed but tied to a reference rate, such as the Euribor. When interest rates decrease, the borrower can benefit from lower interest costs, but if rates increase, costs rise accordingly.

- Forward Loan: A forward loan is used for refinancing. The borrower secures current interest rates for a period up to five years in advance for the time after the expiration of the interest rate lock on their current loan.

Create a legally secure loan agreement as a PDF

With Beglaubigt.de, you can trust that your loan agreement includes all necessary content. The platform enables the creation of legally secure contracts that are customized and reviewed by professionals to meet your specific needs.

Private Loan Agreement: Why is its creation so important?

Creating a private loan agreement is crucial for several reasons:

- Clarity: It establishes the exact terms of the loan, ensuring that both parties understand their obligations and expectations.

- Legal Protection: It provides a basis for enforcing the agreed terms, offering legal recourse if disputes arise.

- Risk Minimization: It protects the lender from financial losses by clearly outlining the conditions and repayment terms.

- Compliance: It ensures adherence to legal requirements and regulations, avoiding potential legal issues.

Clarity: Without a written loan agreement, misunderstandings about the terms of the loan may occur. A loan agreement clearly and precisely defines the loan amount, interest rate, term, and repayment conditions. By formally documenting these terms, both parties ensure a clear understanding.

Legal Protection: A written loan agreement provides legal protection in case of disputes. It can serve as evidence of the agreed terms and assists in enforcing them. Without a written contract, proving the exact terms of the loan can be challenging.

Risk Minimization: A loan agreement protects the lender from financial risks. It specifies how and when the loan will be repaid and outlines what happens if repayment does not occur as agreed. This provides security for the lender and guards against potential financial losses.

Compliance with Legal Requirements: In certain cases, especially involving large sums of money, the law may require a written loan agreement. Such a contract ensures compliance with these legal requirements.

With the support of Beglaubigt.de, you can create a private loan agreement that meets these needs, helping you ensure clarity, legal protection, risk minimization, and compliance with legal requirements.

When is a loan agreement valid?

The validity of a loan agreement is subject to certain legal requirements. In Germany, the provisions of the Civil Code (BGB) apply. Here are the essential criteria that must be met for a loan agreement to be valid:

- Agreement on Essential Contract Components: According to § 488 BGB, the parties to the contract must agree at least on the loan amount and the obligation to repay.

- Contracting Parties: Both parties to the loan agreement, the lender and the borrower, must be legally capable. This means they must be at least 18 years old and fully legally competent to establish rights and obligations.

- Form of the Contract: Generally, there is no specific form required for the validity of a loan agreement, meaning it can also be concluded verbally. However, there are exceptions, such as consumer loan agreements, which must be concluded in writing according to § 492 BGB. Additionally, certain contractual agreements, such as a mortgage, may require notarization to be effective.

- No Violation of Public Morals or Order: A loan agreement is void if it violates public morals or public order. For example, agreements involving usurious interest rates are not valid.

- Compliance with Legal Disclosure Requirements: For consumer loans, the lender has specific disclosure obligations. They must inform the consumer in a timely manner before the contract is concluded about certain contract conditions, such as the annual percentage rate, the loan term, or the right of withdrawal.

- Failure to meet any of these requirements can lead to the invalidity of the loan agreement. Therefore, it is always advisable to proceed carefully when concluding a loan agreement and to seek legal advice if necessary.

When is a private loan agreement invalid?

Even private loan agreements are subject to certain legal criteria, and failure to meet these criteria can render the agreement invalid. Here are some common reasons why a private loan agreement might be invalid:

- Violation of Public Morals or Order: As with general validity criteria for loan agreements, a private loan agreement can also be invalid if it violates public morals or order. This can occur, for example, with usurious interest rates or immoral contract terms.

- Incomplete Contract: A private loan agreement may be invalid if it is incomplete and fails to clearly specify essential contract components such as the loan amount, term, interest rates, and repayment conditions.

- Lack of Legal Capacity: If one of the parties is not legally capable at the time of the contract's conclusion—such as being a minor or mentally unable to understand the contract's significance—the agreement can be invalid.

- Form Violations: In certain cases, the form of the contract can lead to invalidity. While a private loan agreement can generally be concluded informally, specific aspects may require a formal approach. For example, a guarantee declaration must be in writing according to § 766 BGB. Failure to adhere to this form renders the guarantee ineffective.

- Illegal Activity: A private loan agreement is also invalid if the money is used for illegal activities, such as drug trafficking or other criminal acts.

3. Examples of Loan Agreements

3.1. What is a loan agreement example?

A loan agreement typically outlines the terms between a lender, who provides a specific amount of money, and a borrower, who receives the money and is obligated to repay it by a certain date.

Here is a hypothetical example to illustrate the typical structure and elements of a loan agreement:

Loan Agreement Between Person A and Person B

In this hypothetical example, Person A, the lender, provides Person B, the borrower, with a loan of €10,000. The loan agreement might include the following terms:

- Loan Amount: The lender provides the borrower with a loan of €10,000.

- Term: The loan is granted starting August 1, 2023, and must be fully repaid by August 1, 2028.

- Interest Rate: The borrower must pay interest on the loan at an annual rate of 5%. Interest is calculated annually and due at the end of each year.

- Repayment: The loan is to be repaid in annual installments of €2,000. The first installment is due on August 1, 2024.

- Purpose of Loan: The loan is used for purchasing a car.

In practice, loan agreements can be more complex and include additional provisions, such as penalties for late payments, terms for early repayment, collateral for the loan, and other details.

For creating a legally sound loan agreement, it is advisable to use a professional platform like Beglaubigt.de, which specializes in creating legally secure contracts and helps ensure that all important aspects are covered.

4. Erstellung eines Darlehensvertrags

4.1. Private Loan Agreement Template: What Contents Should Be Included?

For a private loan agreement, it is crucial to document the terms in detail and accurately. Here are the key contents that should be included in a template for a private loan agreement:

- arties Involved: The full names and addresses of both the lender and the borrower should be listed.

- Loan Amount: The exact amount of the loan should be clearly specified. It is helpful to write the amount in both numbers and words to avoid misunderstandings.

- Purpose of the Loan: Although not always required, it can be useful to state the purpose of the loan.

- Loan Term: The start date and the date by which the loan must be fully repaid should be clearly defined.

- Interest Rate: If interest is charged on the loan, the interest rate should be specified. Additionally, it should be stated when and how often the interest is calculated and paid.

- Repayment Terms: The method of loan repayment should be described in detail. Will the loan be repaid in installments? If so, what is the amount of each installment and when are they due?

- Collateral: If collateral is provided for the loan, this should be documented in the agreement. The type of collateral and the conditions under which it can be claimed should be clearly defined.

- Special Repayments: It can be specified whether and under what conditions the borrower has the right to make additional payments beyond the agreed installments.

- Consequences of Default: It should be outlined what actions will be taken if the borrower defaults on their payments.

- Contract Modifications and Termination: A clause should be included that specifies how changes or termination of the contract will be handled.

- Final Provisions: Additional agreements can be made here, such as the choice of applicable law and jurisdiction.

- Signatures: The contract should be signed by both parties.

Legally Secure Loan Agreement:

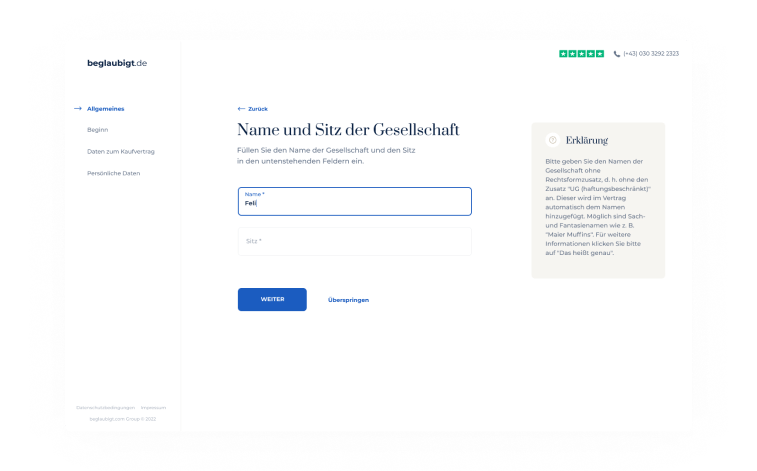

Easily Create Online

Beglaubigt.de helps you create a legally secure loan agreement with immediate validity. The user-friendly and intuitively designed document assistant captures all the necessary details to create a comprehensive yet straightforward loan agreement.

4.2Loan Agreement Template: What Might a Loan Agreement Look Like

Creating a loan agreement can be complex and time-consuming, especially when considering all legal aspects. In this context, Beglaubigt.de is an outstanding partner that allows you to quickly and easily create legally compliant contracts.

Beglaubigt.de's platform offers an intuitive document creator that can be used to create a loan agreement. Here are some of the advantages that make Beglaubigt.de a preferred partner for creating loan agreements:

User-Friendliness: The document creator is designed to be user-friendly, allowing you to create your contract in just a few steps.

Customizability: You have the option to tailor the loan agreement to your specific needs, ensuring that the contract meets the individual terms of the loan.

Legal Certainty: Beglaubigt.de has carefully designed all templates and the document creator to ensure compliance with current laws and regulations. This gives you confidence that your contract is legally compliant.

Time Savings: With Beglaubigt.de's document creator, you can create a loan agreement in a very short time. This saves you valuable time that you can use elsewhere.

Availability: After creating your loan agreement with Beglaubigt.de, you have immediate access to the document. You can download it as a PDF or Word document and use it right away.

Reliability: Thousands of users already rely on Beglaubigt.de for creating legally compliant contracts.

By using Beglaubigt.de's document creator for your loan agreement, you benefit from legal certainty, time savings, and user-friendliness. It is a reliable solution for anyone who needs to create a loan agreement.

Intuitive Questions Without Complexity

Shareable Link

Reviewed by Lawyers

Document Ready as PDF or Word

5. Legal Aspects of a Loan Agreement

5.1. What Legal Aspects Should Be Considered in a Loan Agreement?

Creating a loan agreement requires careful attention to various legal aspects to ensure compliance with laws and regulations. Here are some key legal considerations for a loan agreement:

1. Written Form: According to § 492 BGB, a loan agreement must generally be in writing. This means that the contract must be signed by both parties.

2. Clarity and Transparency: Under § 307 BGB, the terms of a loan agreement must be clear and understandable. Ambiguous or confusing clauses may be deemed invalid.

3. Interest Rates and Repayment: The agreement must clearly specify the interest rates and repayment terms, and these must be understandable to both parties.

4. Right of Withdrawal: For consumer loans, the borrower has a right of withdrawal. The contract must clearly state the withdrawal period and conditions.

5. Purpose of the Loan: In some cases, the purpose of the loan may be specified in the contract. This is particularly relevant if the loan is provided for a specific purpose.

6. Penalties for Default: The contract may include provisions for the consequences of default. These provisions must be fair and comply with legal standards.

7. Collateral: If collateral is required for the loan, it must be explicitly mentioned and described in the contr.

It is important to note that these are just some of the legal aspects to consider when drafting a loan agreement. The specific requirements may vary depending on the type of loan and the circumstances of the case. Therefore, it is advisable to use a platform like Beglaubigt.de, which specializes in creating legally secure contracts and helps ensure that all relevant legal aspects are covered.

When to Sign a Loan Agreement?

The signing of a loan agreement should only occur when both parties have fully understood and accepted all the terms of the contract. Here are some factors to consider before signing a loan agreement:

1. Understanding the Contract: Both parties should ensure they fully understand all the terms of the loan agreement. This includes interest rates, repayment schedules, any potential fees, and all other specific provisions of the contract.

2. Review of Terms: Before signing the loan agreement, verify that all agreed-upon terms are accurately reflected in the contract.

3. Legal Advice: In some cases, it may be advisable to consult a legal advisor before signing the contract. This is particularly relevant for more complex loan agreements involving large amounts or special conditions.

4. No Pressure: Never sign a loan agreement under pressure. Take the time you need to read and understand the contract thoroughly.

5. Retention of a Copy: After signing the loan agreement, both parties should retain a copy of the contract for their records.

6.The Document Creator from Beglaubigt.de

6.1. How the Document Creator from Beglaubigt.de Can Help in Creating Loan Agreements?

Using the document creator from Beglaubigt.de for creating loan agreements offers a variety of benefits. Here are some of the key points that make the platform an ideal choice for creating legally secure loan agreements:

1. legal Certainty: Beglaubigt.de uses the latest legal provisions and requirements to ensure that your loan agreements are always legally secure.

2. Time Savings: With Beglaubigt.de's document creator, you can create a professional and legally secure loan agreement in a short amount of time. You don’t have to start from scratch, saving you valuable time.

3. Customization: The platform allows you to personalize your loan agreement. You can add and adjust specific conditions to ensure that the contract meets your specific needs.

4. Clarity: The agreements created by Beglaubigt.de are clear and easy to understand. They avoid complicated legal jargon, helping to prevent misunderstandings and conflicts.

5. Availability: The platform is available 24/7, so you can access the document creator and create your loan agreement anytime and from anywhere.

6. Cost-Effectiveness: With Beglaubigt.de, you get a high-quality, legally secure loan agreement at a fair price, making the platform a cost-effective solution compared to hiring a lawyer.

7. Archiving: After creating your loan agreement, Beglaubigt.de also offers a secure and reliable archiving solution, so you always have access to your documents whenever you need them

With these and other benefits, Beglaubigt.de helps make the process of creating loan agreements as simple and straightforward as possible.

Frequently Asked Questions

by Our Users