beglaubigt.de

Liquidation GmbH: Conduct Online

We handle the liquidation of your GmbH. Complete process handling, deregistrations, and notary appointments – mostly digital, straightforward, and efficient.

REQUEST NOW

Beglaubigt.de: Your companion through the digital liquidation of a GmbH

Europe's first digital notary, Beglaubigt.de, is revolutionizing the notary profession in the digital age. With us, the liquidation of your GmbH is not only transparent and efficient but also conveniently possible from home.

Why is the liquidation of a GmbH important?

The dissolution of a GmbH, often initiated by a shareholder resolution under § 60 GmbHG, is a structured process. Various legal steps must be followed:

- A 3/4 majority resolution of the shareholders is required for dissolution under § 48 GmbHG.

- After the dissolution resolution, the managing director loses their representation authority, and the liquidators take action in accordance with § 66 Abs. 1 GmbHG.

- The liquidators have various duties, including handling ongoing business and distributing assets to the shareholders according to § 72 GmbHG.

How does the liquidation of a GmbH proceed? How Beglaubigt.de supports you

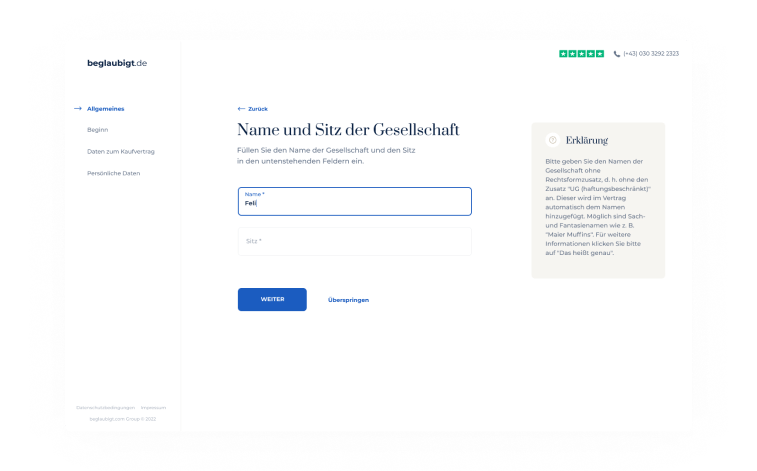

Submit a request: Through our platform, you provide all relevant information about the GmbH.

- Process coordination: We review your information and plan the entire liquidation process. With over 1,000 liquidations per year, we have optimized all processes for you, taking over the tedious work.

- Notary appointment: Under § 65 Abs. 1 GmbHG, we assist in finding the right notary and coordinating the required appointment.

- Digital deregistrations: After successful liquidation, we handle digital deregistrations to ensure legal security.

- Federal Gazette publication: According to § 73 Abs. 1 GmbHG, the liquidation is announced, and creditors are invited to file claims.

At the end of the liquidation process, the GmbH is deleted from the commercial register (see commercial register application). The company's books and records must still be kept for ten years.

With Beglaubigt.de, the complex task of GmbH liquidation according to GmbHG requirements becomes a seamless, stress-free process. Start with us now in a new digital age of GmbH liquidation.

Our advantages at a glance

Efficient handling

With Beglaubigt.de, liquidations can be efficiently carried out through digital procedures.

Digital process assistance

We have optimized the liquidation process of a GmbH and digitalized the service.

Transparent costs

Transparent breakdown according to the Notary Costs Act (GNotKG).

Die Liquidation einer GmbH in Deutschland regelt sich nach verschiedenen gesetzlichen Bestimmungen, insbesondere nach dem Gesetz betreffend die Gesellschaften mit beschränkter Haftung (GmbHG).

Nachfolgend eine detaillierte Betrachtung der gesetzlichen Grundlagen und der wesentlichen Schritte, die im Rahmen einer Liquidation beachtet werden sollten:

Liquidation GmbH Legal Foundations

- GmbHG: The Act on Limited Liability Companies (GmbHG) is the main law that governs the formation, management, and liquidation of GmbHs.

- Commercial Code (HGB): Some provisions from the HGB, particularly those regarding annual financial statements, are also relevant during liquidation.

- Insolvency Code (InsO): If the GmbH is insolvent, the liquidation is carried out according to the provisions of the Insolvency Code.

Key Steps:

The dissolution, liquidation, and deletion of a GmbH are processes that are both extensive and legally demanding. It is essential to carry out each step correctly and on time to avoid legal complications.

1. Dissolution: Shareholders' Resolution

The first step in the liquidation process of a GmbH is the resolution for dissolution by the shareholders' meeting.

It is crucial that this step is carried out formally and correctly, as it forms the basis for all subsequent actions. According to § 60 GmbHG, the appointment of a liquidator is required for the dissolution of the GmbH.

If the articles of association do not contain any differing provisions, the adoption of this resolution requires a qualified majority of three-quarters of the votes cast, as stipulated in § 60 Abs. 1 No. 2 GmbHG.

In the case of a company with a fixed term, the need for a dissolution resolution under § 60 Abs. 1 No. 1 GmbHG is waived, as the GmbH is automatically dissolved after the period specified in the articles of association has expired.

However, the initiation of dissolution does not mean the immediate deletion of the company from the commercial register. Rather, it marks the beginning of the process in which the GmbH winds down its business activities. Further legal steps are required to complete the liquidation process and fully dissolve the company.

2. Liquidation: Appointment of the Liquidator

Typically, managing directors who are in office at the time of dissolution automatically become liquidators of the company, also known as "born liquidators," according to § 66 Abs. 1 GmbHG. The articles of association may also designate alternative or additional individuals for this role.

If this is the case, they too become liquidators without requiring a separate appointment. Additionally, it is possible to appoint specific liquidators through a resolution of the shareholders' meeting.

It is important to note that such appointed liquidators must assure the register court that no legal obstacles prevent their appointment, in accordance with § 66 Abs. 4 GmbHG in conjunction with § 6 Abs. 2 Sentence 2 No. 2 & No. 3 and Sentence 3 GmbHG.

3. Registration of the Dissolution in the Commercial Register and Public Announcement

When a company is dissolved by a shareholders' resolution, this must be entered in the commercial register in notarized form. In most cases, the responsibility for the registration lies with the liquidators of the company (§ 78 GmbHG), as managing directors lose their authority to represent the company upon dissolution.

The competent register court is located in the same district as the company's headquarters. For companies with branches, registration is only required at the main court. The reason for the dissolution (usually the shareholders' resolution) should be clearly stated in the registration.

Furthermore, the liquidators must publish the dissolution of the GmbH in the so-called "company bulletins." A mandatory place for publication is the Federal Gazette in accordance with § 12 Sentence 1 GmbHG.

Other publication outlets are only permitted if explicitly mentioned in the articles of association (§ 12 Sentence 2 GmbHG). The main purpose of these announcements is to inform creditors of the dissolution. With this publication, the so-called waiting period (Sperrfrist) begins in accordance with § 73 Abs. 1 GmbHG.

4. Registration of the Liquidators

In addition to the dissolution of the company, it is also necessary to register the appointed liquidators in the commercial register, as stipulated in § 67 GmbHG. The initial liquidators and their authorization to represent the company are registered by the managing directors.

Any changes in the liquidators' appointments or in their authorization to represent the company must be submitted for registration by the current liquidators. However, the so-called "born liquidators" (as mentioned earlier) do not need to be registered separately, according to § 66 Abs. 1 GmbHG.

If the registration does not explicitly mention liquidators, the managing directors are automatically registered as the liquidators. Nonetheless, it is advisable to explicitly state in the dissolution registration that the former managing directors will act as the liquidators, to avoid any confusion.

Individuals who are designated as liquidators either in the articles of association or appointed by the shareholders' meeting must be registered separately in the commercial register.

5. Preparation of Final Financial Statements During Liquidation

At the start of the liquidation, the liquidators are required to prepare an opening balance sheet along with an accompanying report. At the end of each financial year during the liquidation, an annual financial statement and a corresponding management report must be submitted.

The accounting and financial reporting obligations remain in place throughout the liquidation period. This means that the publication of financial statements in the Federal Gazette is still required.

During the liquidation phase, the final accounting documents of the former operational company, the opening balance sheet of the liquidation with the accompanying report, the financial documents for each liquidation financial year, and the final liquidation balance sheet must be published. The obligation for disclosure only ends with the final deletion of the company from the commercial register.

6. Waiting Year, Deletion Application at the Commercial Register, and Supplemental Liquidation

After settling or securing the company’s debts and following the end of a so-called waiting year ("Sperrjahr"), which begins with the creditor notification in the Federal Gazette as mentioned in point 3, the remaining assets (including the necessary capital for share capital) can be distributed to the shareholders under certain conditions.

During this waiting year, no distribution of assets to the shareholders is permitted. After this period, the capital retention requirement under § 30 GmbHG is lifted.

It is important to note that the waiting year is not an absolute deadline. Even after its end, claims can still be made against the company. However, previously unknown creditors can only be satisfied from the company’s assets after the waiting year if any assets remain.

If the assets have already been distributed, their claims will not be met. Once the liquidation is completed and the final accounting has been done, the liquidators must formally register the end of the liquidation with the commercial register in notarized form (§ 74 Abs. 1 Sentence 1 GmbHG in conjunction with § 12 HGB). With the entry of the liquidation’s conclusion and the deletion from the commercial register, the company is fully dissolved. The completely wound-up company no longer exists.

It is important to ensure that the financial resources required for the commercial register entries, as well as funds for the storage of company documents for ten years, are available.

These documents must be handed over to either a shareholder or a third party (§ 74 Abs. 2 GmbHG). If it is discovered after the company has been deleted that there are still assets remaining or that further settlement actions are necessary, a supplementary liquidation must be carried out.

In this case, the company re-enters the liquidation process. To become operational again, the appointment of an additional liquidator is required, either by request or by the commercial court.

The entire process of dissolving a company consists of the phases of dissolution, liquidation, and finally deletion from the commercial register.

It is a complex procedure that requires detailed knowledge and careful attention to legal requirements. We make the process as efficient as possible and handle all the important steps for you. We manage the entire procedure for companies, ensuring that each step is carried out on time and in compliance with legal requirements.

Process of Liquidating a GmbH with Beglaubigt.de:

Beglaubigt.de revolutionizes how GmbH liquidations are conducted:

- Digital Document Upload: Instead of a physical visit, company documents can be uploaded securely and easily.

- Online Consultation: The individual situation of the GmbH is analyzed via a live video connection, and corresponding steps are proposed.

- Digital Process Handling: After successful consultation and planning, the entire liquidation process is digitally coordinated. This includes organizing notary appointments and required deregistrations.

Advantages of Digital GmbH Liquidation with Beglaubigt.de:

- Time Efficiency: The entire liquidation process can be completed from home or the office, avoiding unnecessary trips and wait times.

- Speed: Thanks to digital handling, delays are minimized. Everything from the initial consultation to the final deregistration in the commercial register is done at an accelerated pace.

Transparent Cost Structure and Package Options:

- Beglaubigt.de offers a clear and transparent pricing structure. Depending on the size and complexity of the GmbH, users can choose from various packages with different services and price structures.

GmbH Liquidation Checklist

Liquidating a GmbH can be a challenge. However, with Beglaubigt.de, this process becomes clear, structured, and efficient. Thanks to digital expertise and a close network of partners, many traditional hurdles are minimized.

The following checklist outlines the optimized liquidation process with Beglaubigt.de:

Preparation:

- Analysis of the company's situation using digital tools.

- Document preparation: IDs, shareholder lists, resolutions.

Resolution:

- Support in preparing and conducting digital shareholder meetings.

- Creation and documentation of the digital dissolution resolution.

Notification and Registration:

- Electronic registration of dissolution in the commercial register.

- Automated announcement of the liquidation.

Handling of Business:

- Digital upload and review of the liquidation opening balance.

- Online coordination with liquidators.

- Digital handling of ongoing business and liabilities.

- Support in asset disposal via platform partners.

Completion of Liquidation:

- Review of the final liquidation balance through the platform.

- Support in distributing the remaining assets.

- Automated deletion request at the commercial register.

Other Considerations:

- Online help and advice on tax implications.

- Creation of a digital final documentation.

Through the integration of digital tools and processes, Beglaubigt.de offers a thoughtful and time-efficient approach to GmbH liquidations.

What happens to the share capital during liquidation?

During the liquidation of a GmbH, the share capital — the capital contributed when the company was founded — plays a significant role. It forms the financial foundation of the company and is central to the liquidation process.

- Asset Distribution: According to § 72 of the GmbH Act, the primary goal of liquidation is to distribute the company's assets to the shareholders. However, this distribution can only occur after all company liabilities have been settled. In this context, the share capital is treated as part of the company's assets.

- Creditor Satisfaction: A key step before distributing assets to shareholders is the full satisfaction of the company's creditors. This means that all available company assets, including the share capital, are used to settle all debts. If the available assets are insufficient to cover all liabilities, the share capital may be fully depleted.

- Distribution to Shareholders: After all creditors have been satisfied, the remaining assets, including any remaining share capital, can be distributed to the shareholders. This distribution is done according to the proportions laid out in the company's articles of association. Therefore, if there are assets left after satisfying the creditors, shareholders will receive a portion of the remaining company assets, including the share capital, based on their ownership stake.

Beglaubigt.de and the Liquidation Process:

Liquidation, especially in the context of share capital, can be complex. But Beglaubigt.de simplifies this process:

- Transparent Overview: Through a digital platform, you can access the current status of your liquidation at any time, allowing you to track the distribution and use of share capital seamlessly.

- Process Optimization: Beglaubigt.de handles everything for you, from coordinating with notaries to completing all necessary steps—from the initial inquiry to the final distribution of assets.

- Legal Security: Supported by digital technologies and legal expertise, Beglaubigt.de ensures that the liquidation is conducted in full compliance with applicable legal requirements, particularly regarding share capital.

Submit a Request on beglaubigt.de

Upload Documents

Process Handling

Automatic Entry of the Liquidation and Deregistrations

Liquidation GmbH – Conduct Online & Directly

With Beglaubigt.de, the liquidation of your GmbH becomes a seamless and digital process. Our platform allows you to complete the dissolution and settlement entirely remotely and in compliance with all legal requirements. We coordinate and guide you digitally to ensure that the entire process is structured, efficient, and tailored precisely to your needs.

Liquidation GmbH & Co. KG

The GmbH & Co. KG is a hybrid structure combining elements of both a GmbH and a limited partnership (KG), with characteristics from both legal forms. Due to this dual structure, specific considerations must be taken into account during the liquidation process. Below is a general overview of the liquidation process for a GmbH & Co. KG:

- Basic Structure of a GmbH & Co. KG:

In a GmbH & Co. KG, the GmbH acts as the general partner (Komplementär) with unlimited liability, while the co-partners (Kommanditisten) are only liable up to their capital contributions. This has significant implications for the liquidation process, as the GmbH is primarily responsible for the liabilities.

2. Dissolution Resolution:

As with any company, a resolution to dissolve the GmbH & Co. KG must be passed, usually during a shareholders' meeting. Both the interests of the GmbH and those of the limited partners (Kommanditisten) should be considered.

3. Liquidation and Liability:

The liquidation follows the same procedure as that of a KG, with the GmbH, as the general partner, managing the winding up of the business and settling any outstanding claims. If there are liabilities that the GmbH cannot cover, the limited partners may be called upon, up to their capital contributions.

4. VDistribution of Assets:

After settling all liabilities, the remaining assets are distributed. First, the limited partners (Kommanditisten) receive their capital contributions back. Any remaining surplus or loss is divided according to the terms laid out in the partnership agreement.

5. Deregistration from the Commercial Register:

Both the GmbH & Co. KG and the GmbH as the general partner must be removed from the commercial register. Often, two separate deregistration procedures are required.

6. Tax Considerations:

The liquidation of a GmbH & Co. KG has tax implications for both the company and its shareholders. Hidden reserves may be uncovered, or tax-relevant capital gains or losses may arise.

Liquidation GmbH Duration: How Beglaubigt.de Speeds Up the Process

The liquidation of a GmbH is generally a complex process that can take several months or even years, depending on the circumstances. The liquidation process typically unfolds in several phases:

- Resolution and Announcement: Shareholders must pass a resolution to dissolve the company, which is then published in the commercial register. This can take several weeks.

- Business Wind-Up: The liquidators continue or terminate ongoing business activities, depending on what is most economically viable. Settling the business and paying off liabilities is often the most time-consuming part, potentially taking months or even years, depending on the complexity of the GmbH.

- Final Distribution and Deregistration: After all liabilities are settled, the remaining assets are distributed to shareholders. Finally, the GmbH is deregistered from the commercial register. This step can also take several weeks.

How Beglaubigt.de Speeds Up the Process beschleunigen?

Experience Matters: With over 1,000 clients who have gone through the liquidation process with Beglaubigt.de, the team knows exactly what challenges may arise and how to efficiently address them.

Optimized Procedures: By constantly improving internal processes based on experiences from many clients, Beglaubigt.de ensures that each phase of the liquidation proceeds as quickly as possible.

Fast Notary Appointments: A frequently underestimated time factor is waiting for notary appointments. Thanks to close collaboration with notaries, Beglaubigt.de can organize appointments very quickly, avoiding unnecessary delays.

In summary, thanks to Beglaubigt.de's experience and optimized processes, the liquidation of a GmbH can be handled significantly faster and more efficiently than through conventional methods. It is a combination of expertise, proven procedures, and the right network that makes the difference.

Liquidation GmbH & Co. KG

With Beglaubigt.de, the liquidation of your GmbH becomes a straightforward and digital process. Simply submit the necessary documents online and have them reviewed and guided by our experts.

Without the usual paperwork and long waiting times, we guide you through the legal requirements of the liquidation process. Our specialists are always available to ensure a smooth procedure. A modern service that perfectly combines efficiency and security.

Liquidation of a GmbH Tax Implications

The liquidation of a GmbH has various tax implications that can affect both the company and its shareholders. The relevant tax regulations in the German Income Tax Act (EStG), the Corporation Tax Act (KStG), and the Trade Tax Act (GewStG) must be considered.

1. Tax Implications for the GmbH:

Liquidation Balance Sheet: At the start of the liquidation process, a so-called liquidation opening balance sheet must be prepared. This is a special form of balance sheet that marks the beginning of the liquidation phase and serves as the basis for tax assessment.

Liquidation Gains: During liquidation, hidden reserves (the difference between book value and market value) may be revealed, which must be recorded as liquidation gains for tax purposes. These gains are subject to corporation tax and potentially trade tax.

Loss Carryforwards: Existing tax loss carryforwards of the GmbH can generally be offset against liquidation gains, provided certain conditions are met.

2. Tax Implications for the Shareholders:

Income Tax Treatment: The distribution of liquidation proceeds to shareholders is considered a sale or disposition of their company shares for income tax purposes. This can result in capital gains or losses, which are generally classified as income from capital investments and subject to capital gains tax.

Exemption Amount: Under certain conditions, part of the capital gain may be tax-free. There is an exemption amount available, but specific requirements must be met to qualify.

Return of Contributions: If contributions that were previously paid into the equity of the GmbH are returned to shareholders as part of the liquidation, these payments are generally tax-neutral.

GmbH Liquidation Notary Near Me

If you prefer a notary appointment near you for the GmbH liquidation process, you can easily find and schedule an appointment with one of our partner notaries via beglaubigt.de. Selected locations include:

GmbH Liquidation Costs: How much does it cost to liquidate a GmbH?

Liquidating a GmbH incurs various costs that depend on factors like the size and complexity of the GmbH, the number of assets, liabilities, and other specific circumstances. Here's a detailed overview of potential cost points:

- Notary and Court Fees

Each resolution to liquidate the GmbH must be notarized and recorded in the commercial register. The notarization of such a resolution can cost between €150 and €500 depending on the effort involved. Additionally, registration fees for the commercial register range from around €100 to €200 depending on the federal state. - Liquidator Fees

In complex liquidation situations, hiring an external liquidator may be advisable. The costs for this vary depending on the tasks and experience of the liquidator. For example, an external liquidator may charge between €100 and €500 per hour based on their expertise. For flat-rate billing, costs could range from €2,000 to €5,000 depending on the complexity. - Tax Consultancy Fees

Tax-related issues often arise during the liquidation process, requiring the expertise of a tax advisor. The cost for such consultation is typically between €80 and €250 per hour, depending on the complexity of the tax questions. - Other Costs

Additional costs may arise from the announcement of the liquidation in the electronic Federal Gazette, generally ranging from €20 to €100. Additionally, companies should account for the costs of settling outstanding liabilities and final fees for the removal of the GmbH from the commercial register.

How can beglaubigt.de help?

While liquidation costs vary depending on several factors, beglaubigt.de offers a standardized and transparent solution.

With our platform, you can manage the entire liquidation process clearly and efficiently, with all costs clearly outlined and no hidden fees. This not only provides financial planning certainty but also ensures a smooth and reliable liquidation process.

How to Liquidate a GmbH: Advantages of beglaubigt.de

- Standardized Processes: At beglaubigt.de, we rely on tried and tested standardized procedures that make the liquidation process efficient and transparent.

- Complete Process Support and Management: We guide you from start to finish, ensuring no important steps are missed.

- Expert Knowledge: Our expertise allows us to know exactly what steps and documents are required for your GmbH liquidation.

- Clear Steps: Each step of the liquidation process is clearly communicated so that you always stay informed and know what’s coming next.

- Transparent Costs: There are no hidden fees with us. We ensure that all costs are clear and transparent from the outset.

- Fast Notary Appointments: Thanks to our close collaboration with a network of notaries, we can arrange short-notice appointments, significantly reducing the liquidation timeline.

The Technology Behind beglaubigt.de and Its Security Measures

Beglaubigt.de uses advanced technologies to ensure that the process of digital GmbH liquidation is both seamless and secure:

- Encryption: All transmitted data is protected by end-to-end encryption to prevent any interference or data leaks.

- Two-Factor Authentication: This additional security layer ensures that only the authorized user can access their data.

Liquidation of a GmbH

Easily Conduct Online

The liquidation of a GmbH, in accordance with applicable legal regulations, requires careful execution and dissolution of the company. At liqui-gmbh.de, we thoroughly assess your liquidation needs, provide digital process support, and prepare everything for a legally compliant and efficient liquidation of your GmbH.

Frequently Asked Questions from Our Users