Gift Agreement for a Car Without a Notary: Explained in 3 Simple Steps

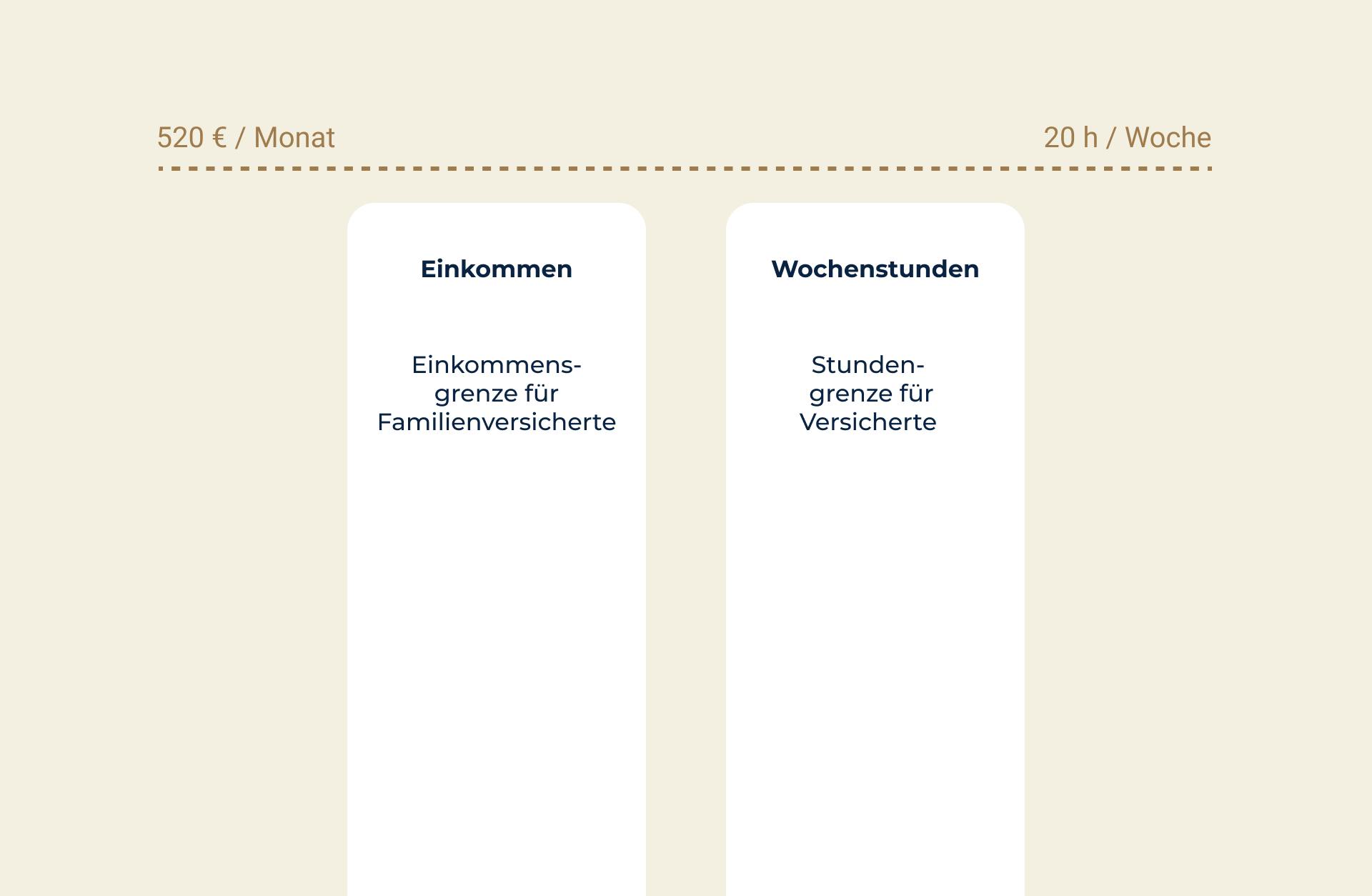

Background and Importance of Gift Agreements for Car Transfers

Why a Gift Agreement is Important

A gift agreement for a car is essential to establish clear legal terms and avoid potential disputes. This contract documents the gift and ensures both parties (the donor and the recipient) are aware of their rights and responsibilities.

Overview of the Process Without a Notary

It is possible to complete a gift agreement for a car without the involvement of a notary. Here are the steps to follow:

New: Use our online tool to create a gift agreement: Create a Gift Agreement Online

Step 1: Preparing the Gift Agreement

Legal Requirements for a Car Gift Agreement Without a Notary

To ensure the validity of a car gift agreement without a notary, certain legal requirements must be met:

- Written Form: Although a verbal agreement is possible, it is recommended to document the gift in writing to provide evidence in case of disputes.

- Mutual Consent: Both parties (donor and recipient) must agree to the car gift and express their consent in the agreement.

- Clear Identification of the Car: The car must be clearly identified in the agreement with details such as the manufacturer, model, Vehicle Identification Number (VIN), first registration date, and possibly the current license plate number.

- Transfer and Acceptance: The donor must transfer the car to the recipient, and the recipient must accept the gift. This should be noted in the agreement.

- Legal Capacity of Both Parties: Both parties must be adults and mentally capable.

- Signatures: Both parties should sign the agreement to finalize it.

New: Download customizable gift agreement templates in PDF or Word format from Beglaubigt.de: https://beglaubigt.de/schenkungsvertrag

Step 2: Collecting Required Information and Documents

What Information and Documents Are Needed?

For a car gift agreement without a notary, the following information and documents are required:

Information for the Gift Agreement:

- Full name, address, and birthdate of the donor.

- Full name, address, and birthdate of the recipient.

- Car details: Manufacturer, model, Vehicle Identification Number (VIN), first registration date, current license plate, and any special agreements or conditions.

- Date of the gift and the transfer of the car.

Vehicle Documents:

- Vehicle registration certificate part II (Fahrzeugbrief): Contains key information about the car and the current owner. This is needed for re-registration.

- Vehicle registration certificate part I (Fahrzeugschein): Also required for re-registration and includes information about the car and owner.

Personal Documents:

- Valid ID card or passport for both the donor and the recipient.

Insurance Confirmation (eVB Number):

- The recipient will need an electronic insurance confirmation (eVB number) to re-register and insure the vehicle in their name.

The gift agreement must be signed by both parties (donor and recipient). After collecting all the necessary information and documents, the car can be re-registered and transferred to the recipient.

Although no notary is required, it may be helpful in some cases to seek legal advice to ensure that the contract is correct and complete.

For more details on what to consider in a gift agreement: What to Consider in a Gift Agreement.

Legal Foundations and Requirements for a Car Gift Agreement

Several legal foundations and requirements must be fulfilled for a gift agreement to be valid and legally binding. Here are the key aspects:

- Agreement (Mutual Consent):

Both parties, the donor and the recipient, must agree on the gift. This agreement is documented through a written contract that is signed by both parties. - Transfer and Ownership:

The gift is a transfer of ownership according to § 929 BGB (German Civil Code). The vehicle must be physically handed over from the donor to the recipient, and the recipient must accept the vehicle. The transfer and ownership change should be clearly stated in the gift agreement. - Specificity of the Vehicle:

The vehicle must be clearly identified in the contract, for example by including details such as the manufacturer, model, Vehicle Identification Number (VIN), and first registration date. - Valid Parties:

Both parties must be legally competent, meaning they must be adults and of sound mind. Minors can only enter into a gift agreement with the consent of their legal guardians (usually parents). - No Legal Obstacles:

The gift must not violate any laws or moral standards. If it does, the gift agreement would be considered void. - Vehicle Registration:

The recipient must re-register the vehicle in their name at the local registration office. For this, they will need the gift agreement, vehicle documents, a valid ID, and proof of insurance. - Gift Tax:

In Germany, gifts are subject to gift tax. However, there are tax-free allowances that apply within a ten-year period. As long as the value of the gift does not exceed these allowances, the gift is tax-free.

How to create a car gift contract without a notary?

A car gift contract can be created without a notary by following these steps:

- Gather Information: Ensure you have all the necessary details for the contract, including the personal information of the donor and the recipient, as well as the vehicle details (manufacturer, model, Vehicle Identification Number (VIN), date of first registration, current license plate).

- Draft the Contract: Write a formal gift contract that includes the key elements:

- a. Title: Give the document a clear title, such as "Car Gift Contract."

- b. Parties: Identify the donor and the recipient with their full names, addresses, and dates of birth.

- c. Vehicle Details: Provide a detailed description of the vehicle, including manufacturer, model, VIN, date of first registration, and current license plate.

- d. Transfer and Ownership: Specify the date of the vehicle transfer and any conditions related to the transfer of ownership.

- e. Date of the Gift: Indicate the date the contract is signed and the gift becomes effective.

- f. Signatures: Have both parties (donor and recipient) sign the contract.

- Vehicle Documents: The donor should hand over the vehicle's registration documents (Zulassungsbescheinigung Teil II and Teil I, or registration certificate part II and part I) to the recipient.

- Vehicle Registration: The recipient must re-register the vehicle in their name at the appropriate vehicle registration office. For this, they will need the gift contract, the vehicle documents, a valid ID (passport or ID card), and proof of insurance.

Car Gift Agreement Without a Notary: PDF & Word Template

GIFT AGREEMENT FOR A MOTOR VEHICLE

Between:

Donor:

First Name Last Name

Street Address

Postal Code City

Date of Birth

and

Recipient:

First Name Last Name

Street Address

Postal Code City

Date of Birth

the following gift agreement is made:

§1 Object of the Gift

The donor transfers the following motor vehicle to the recipient:

Manufacturer:

Model:

Vehicle Identification Number (VIN):

First Registration Date:

Current License Plate:

§2 Transfer and Ownership

(1) The donor agrees to transfer the vehicle to the recipient at their own cost and risk.

(2) The recipient accepts the gift and the ownership transfer of the vehicle.

§3 Registration

The recipient agrees to re-register the vehicle in their name at the responsible registration office immediately after the transfer.

§4 Warranty

The donor provides no warranty for any material or legal defects of the vehicle. The gift is made on an "as-is" basis.

§5 Severability Clause

If any provision of this contract is invalid or unenforceable or becomes invalid or unenforceable after the contract is made, the validity of the rest of the contract remains unaffected. The invalid or unenforceable provision shall be replaced by a valid and enforceable provision that comes as close as possible to the economic intent of the parties.

§6 Additional Agreements

(1) Amendments and supplements to this contract require written form. This also applies to the cancellation of the written form requirement.

(2) No side agreements have been made.

Location, Date

Signature Donor Signature Recipient

Can a Car Gift Agreement Without a Notary Be Customized?

Yes, a car gift agreementgift agreement without a notary can be individually tailored as long as it meets legal requirements. You can adjust the contract to fit your specific needs and circumstances by including special agreements or conditions between the parties (donor and recipient).

Some examples of possible customizations include:

1. Vehicle Handover Arrangements: You can specify the time and place of the handover or include agreements about who will cover the costs associated with the transfer.

Insurance Provisions: Clarify whether the donor will continue the car insurance until the vehicle is re-registered or if the recipient must secure new insurance.

Repairs and Maintenance: You can include terms that specify any repairs or maintenance that must be completed before the car is handed over.

While customizing the gift agreement, it's essential to ensure the changes are legally valid and comply with applicable laws. If you're unsure about the legality of your modifications, it's a good idea to consult a lawyer or notary for advice.

Is a Car Gift Agreement Without a Notary Valid?

Yes, a car gift agreement without notarization is valid under German law, specifically according to the German Civil Code (BGB). While § 518 Abs. 1 BGB generally requires a gift promise to be notarized for validity, there are practical exceptions for gifts of movable property, such as vehicles.

For a car gift, notarization is not required. A written contract signed by both parties (donor and recipient) is sufficient. The contract should include the following:

- Details of the Donor and Recipient: Full names and addresses of both parties.

- Vehicle Description: Clear details about the car, including make, model, Vehicle Identification Number (VIN), and, if applicable, the license plate number.

- Transfer Date: The date when the vehicle is handed over and ownership is transferred.

- Gift Declaration: A clear statement that the vehicle is being transferred without payment.

- Signatures: Both parties must provide handwritten signatures.

It is also advisable to document the handover of the vehicle, including the transfer of important papers such as the registration certificate part II (Fahrzeugbrief) and part I (Fahrzeugschein), along with the keys. An handover protocol recording the car’s condition at the time of transfer can be useful.

Additional Considerations: Even though a notarized contract is not required for a car gift, involving a legal expert can be beneficial. A lawyer or notary can review the agreement, ensuring all legal requirements are met and both parties fully understand their rights and obligations.

Step 2: Signing the Car Gift Agreement

Car Gift Agreement Without a Notary: What to Keep in Mind When Signing?

When signing a car gift agreement without a notary, there are several important points to ensure the contract is legally valid and accurate:

- Complete and Correct Information:

Before signing, check that the contract includes all relevant details, such as: Full names and addresses of both the donor and the recipient. Vehicle details: Manufacturer, model, Vehicle Identification Number (VIN), first registration date, and current license plate.Terms of the vehicle transfer and ownership change. - Clarity and Understanding:

Ensure the agreement is clearly written and easily understood by both parties. Each party should fully comprehend the terms and conditions of the gift. - Mutual Consent:

Both the donor and the recipient must agree to the contract’s terms. Make sure there are no unresolved questions or uncertainties. Mutual Consent:

Both the donor and the recipient must agree to the contract’s terms. Make sure there are no unresolved questions or uncertainties. - Signatures: The agreement should be signed by both parties. Ensure the signatures are legible and that both parties use their full legal names.

- Date: Add the date of signing to document when the gift becomes official.

- Witnesses:

Although witnesses are not legally required for signing a car gift agreement, it can be beneficial to have one or two independent witnesses. This can help support the validity of the contract in case of future disputes. - Document Storage:

Both the donor and the recipient should keep a copy of the signed agreement. This provides proof of the terms and conditions of the gift and helps protect their rights and obligations.

Can I Gift a Car Tax-Free?

Yes, in principle, you can gift a car tax-free. In Germany, gifts are subject to gift tax, but there are tax-free allowances for gifts within certain family relationships, which apply over a ten-year period.

The tax-free allowances are as follows:

- Spouses and civil partners: €500,000

- Children and stepchildren: €400,000

- Grandchildren: €200,000

- Parents and grandparents (gifts to them): €100,000

- Siblings, nieces, nephews, uncles, aunts, in-laws, and non-registered partners: €20,000

As long as the value of the gifted car does not exceed the respective tax-free allowance for the recipient, the gift remains tax-free. If the allowance is exceeded, gift tax must be paid on the excess amount. The tax rate depends on the relationship and the value of the gift.

For more details on property-related gifts, you can refer to relevant articles like Schenkungsvertrag Immobilie.

Can My Father Gift Me His Car?

Yes, your father can gift you his car. To ensure the gift is legally valid, the following steps should be followed:

- Create a Gift Agreement:

A written gift agreement should be prepared, outlining the details of the gift, including the car’s details and the personal information of the father (donor) and the child (recipient). Both parties must sign the agreement. - Transfer of Vehicle Documents:

Your father will hand over the vehicle registration certificate part II (Fahrzeugbrief) and part I (Fahrzeugschein). These documents are necessary for re-registering the vehicle. - Re-Registration:

The child must re-register the car in their name at the relevant vehicle registration office. This requires the gift agreement, vehicle documents, a valid ID or passport, and proof of insurance. After the re-registration, the child will receive new vehicle documents and, possibly, new license plates. - Handover of the Vehicle:

After re-registration, the car can be officially handed over. It’s advisable to prepare a written confirmation of the handover to avoid any misunderstandings or disputes.

Since this is a gift from father to child, the tax-free allowance for gift tax applies. The allowance for gifts from parents to children is €400,000 over a ten-year period. As long as the car's value does not exceed this amount, the gift is tax-free.

Can You Simply Gift a Car?

Yes, you can gift a car, but there are a few steps to follow to ensure the transfer is legally correct. Here's a summary of the key steps:

- Create a Gift Agreement:

Draft a written gift agreement detailing the specifics of the gift, including car details and the personal information of both the donor and the recipient. Both parties need to sign the agreement. - Transfer Vehicle Documents:

Hand over the vehicle registration certificate part II (Fahrzeugbrief) and part I (Fahrzeugschein) to the recipient. These documents are required to re-register the car. - Re-Register the Vehicle:

The recipient must re-register the car in their name at the relevant registration office. They will need the gift agreement, vehicle documents, a valid ID or passport, and an insurance confirmation. After the re-registration, the recipient will receive new vehicle documents and possibly new license plates. - Hand Over the Car:

After re-registration, the car can be officially handed over to the recipient. It's a good idea to create a written confirmation of the handover to avoid any misunderstandings or disputes.

While gifting a car is relatively straightforward, it's essential to meet all legal and bureaucratic requirements to avoid future issues.

Step 3: Re-Registering the Vehicle and Handover

What Documents Are Needed for the Registration Office?

To re-register a gifted car in the new owner's name at the registration office, the following documents are required:

- Gift Agreement: The written gift agreement signed by both the donor and recipient, documenting the details of the gift and the car.

- Vehicle Documents: Vehicle registration certificate part I (Fahrzeugschein)Vehicle registration certificate part II (Fahrzeugbrief)

- ID or Passport: A valid ID card or passport of the recipient to verify their identity.

- Electronic Insurance Confirmation (eVB):

The recipient needs an eVB number (electronic insurance confirmation) to prove the car is insured. This can usually be requested from the insurance provider online or by phone. - Vehicle Inspection Reports: Current reports from the main inspection (HU) and emissions test (AU) are required if the car is older than three years.

- Power of Attorney (if applicable):

If the recipient can't appear in person at the registration office, a written power of attorney is needed to authorize someone else to complete the re-registration. The authorized person will also need a valid ID or passport. - SEPA Direct Debit Mandate:

A completed and signed SEPA direct debit mandate for vehicle tax, allowing the tax authority to withdraw the car tax from the recipient's account.

Car Gift Agreement Without a Notary: How Can I Re-Register the Vehicle?

Re-registering a gifted vehicle without the involvement of a notary requires following certain steps to meet all legal and administrative requirements. Here's how to proceed:

- Ensure Insurance Coverage:

Before starting the re-registration process, you must obtain car liability insurance (Kfz-Haftpflichtversicherung), which is legally required in Germany. Request an electronic insurance confirmation (eVB number) from your insurance provider. This number is essential for the re-registration. - Gather Required Documents:

Make sure to collect the following documents for a smooth re-registration process: Gift Agreement: Signed by both donor and recipient. - Schedule an Appointment with the Registration Office:

Contact your local registration office (Zulassungsstelle) to schedule an appointment. This can often be done online or by phone. Scheduling an appointment in advance helps reduce waiting times and makes the process more efficient. - Complete the Re-Registration:

On the day of the appointment, visit the registration office with all required documents. After the documents are checked, the vehicle will be officially registered in your name, and you will receive the updated vehicle registration certificate part I (Fahrzeugschein) with your details. Fees will apply, and the exact amount may vary depending on the office.. - Attach New License Plates:

If a new license plate is required, have it printed beforehand and attach it to the vehicle after registration. The plates must comply with legal standards and be properly mounted.

It’s important to note that the requirements and process for vehicle re-registration can vary by state and registration office. Be sure to check with your specific office beforehand to ensure you're following their particular guidelines. With proper preparation and adherence to the steps outlined above, the re-registration process can be completed efficiently and without legal complications.

Gift Agreement for a Car: How to Gift a Vehicle?

Gifting a car involves several steps to ensure the process is smooth and legally compliant. Here are the steps to gift a vehicle:

- Create a Gift Agreement:

Draft a written gift agreement that includes the necessary information, such as:Personal details of the donor and recipientVehicle details: Manufacturer, model, Vehicle Identification Number (VIN), first registration date, current license plateTerms of transfer and ownership

Both parties must sign the agreement. - Hand Over Vehicle Documents:

The donor must provide the recipient with the vehicle registration certificate part I (Fahrzeugschein) and part II (Fahrzeugbrief). - Insurance:

The recipient should arrange for car insurance and obtain an electronic insurance confirmation (eVB number) from their insurance provider. - Re-Register the Vehicle:

The recipient must re-register the car in their name at the local registration office (Zulassungsstelle). The following documents are required:

- Gift agreement

- Vehicle documents (Zulassungsbescheinigung part I and II)

- A valid ID or passport for the recipient

- eVB number (electronic insurance confirmation)

- Proof of the latest vehicle inspection (HU) and emissions test (AU), if applicable

- SEPA direct debit mandate for vehicle tax

- 5. Vehicle Handover:

After completing the formalities, the car can be officially handed over by the donor to the recipient.

1.Legal Requirements for a Car Gift Agreement

A gift agreement is a legally binding document that formalizes the transfer of an asset—such as a car—from one person (the donor) to another (the recipient) without compensation. While a notarized contract is not typically required for the validity of a car gift agreement, the following formal requirements must be met to ensure its legal enforceability:

Written Form:

Although not mandatory, it is highly recommended to put the agreement in writing to avoid misunderstandings and serve as evidence in case of disputes. The contract should include essential details such as:

- Vehicle information: Make, model, Vehicle Identification Number (VIN), registration number, etc.

Names and addresses of both the donor and recipient.

A clear statement that the vehicle is being transferred as a gift.

- Physical Transfer:

In addition to the written agreement, the vehicle must be physically handed over to the recipient. This step serves as further confirmation that both parties intend to complete the gift. - Mutual Consent:

Both the donor and the recipient must explicitly agree to the terms of the gift. This consent must be free from coercion, fraud, or significant misunderstanding. The agreement should reflect that both parties fully understand and accept the terms of the gift.

2.Tax Aspects of a Car Gift Agreement

When gifting a car, certain tax obligations may arise. The key points to consider are?

When gifting a car, certain tax obligations may arise depending on the legal jurisdiction. The following points are generally important to consider:

Gift Tax: In many countries, the gifting of assets, including cars, is subject to gift tax. The amount of tax and the requirement to pay depend on factors like the relationship between the giver and the receiver, the value of the car, and any tax-free allowances.

Car Valuation: To calculate the gift tax, a realistic valuation of the car is necessary. The current market value or a value set by authorities may be used.

Tax-Free Allowances: Many countries offer tax-free allowances that reduce the amount of gift tax owed. The exact amount of these allowances and the conditions for using them should be checked in advance.

Effects of Gifting a Car on Insurance and Registration

What needs to be considered regarding insurance and registration after gifting a car?

After transferring ownership of a vehicle through a gift, both the insurance and registration need to be updated:

- Insurance:

The new owner must insure the vehicle immediately. It's important to inform the insurance company about the ownership change to maintain coverage. The existing policy may sometimes be transferred to the new owner, or a new insurance policy may need to be taken out. - Registration:

The car must be re-registered in the new owner's name. The recipient needs to visit the local registration office with the gift agreement, vehicle registration certificate (part I and II), and a valid proof of insurance to complete the process.

More articles: