How can you transfer a property to someone else without compensation and still be legally protected? A gift agreement for real estate is the answer.

In diesem Artikel werden wir die rechtlichen Grundlagen von Schenkungsverträgen im Immobilienbereich untersuchen, relevante Gesetze und Rechtssprechungen betrachten und den Unterschied zwischen Überschreibung und Schenkung herausarbeiten.

Additionally, we address the costs and fees associated with the gifting of real estate, and explain the role of the notary in drafting and validating gift agreements.

Finally, we introduce you to the document creator from Beglaubigt.de, which helps you quickly and easily create legally secure gift agreements for real estate as a PDF or Word document.

Gift Agreement for Real Estate: Introduction

What is a gift agreement for real estate and why is it relevant?

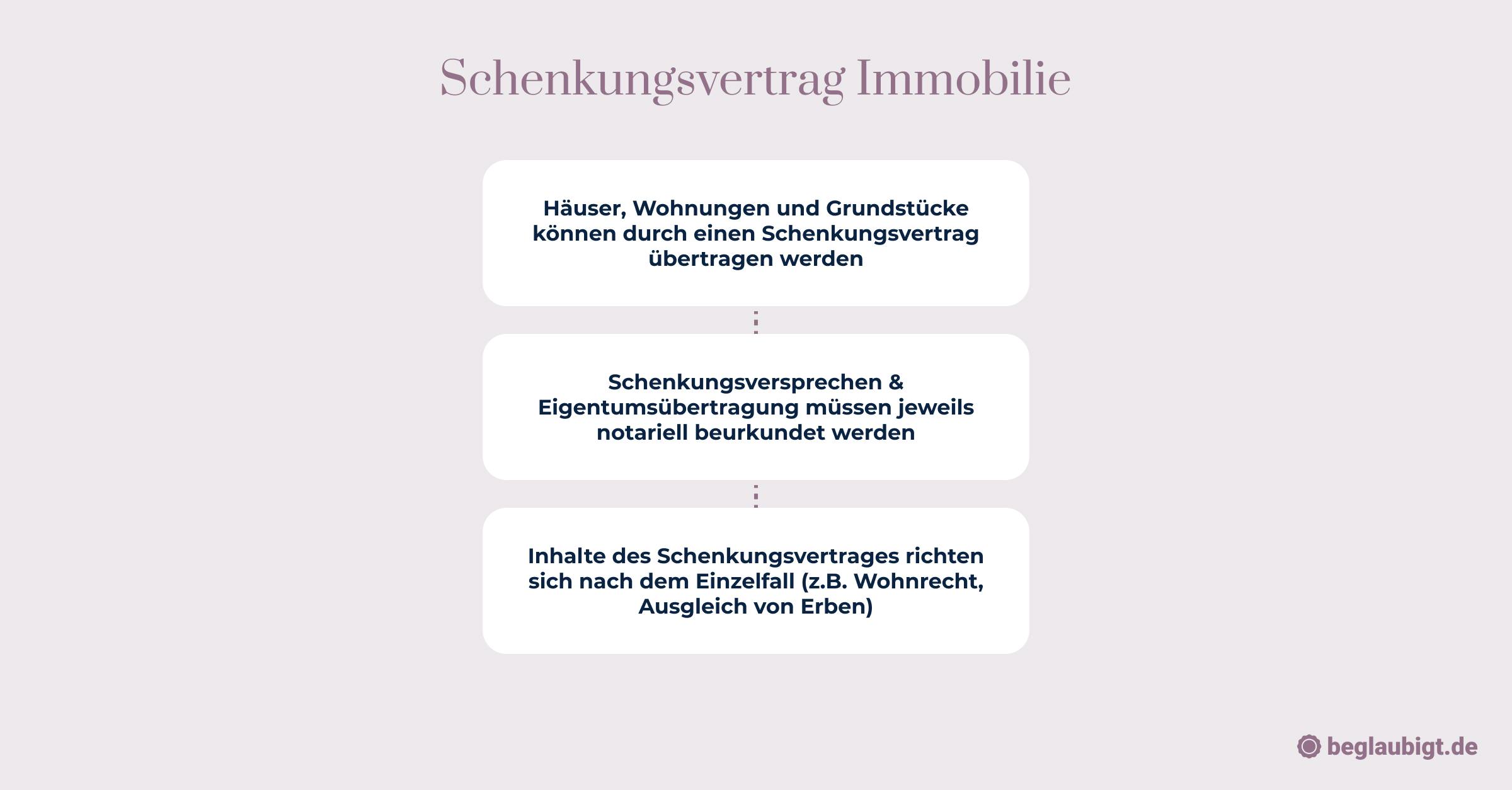

A gift agreement for real estate is a legal contract that governs the gratuitous transfer of ownership of a property from one person, the donor, to another person, the donee. It is relevant because it provides a way to transfer assets in a tax-advantaged manner while ensuring that both parties clearly understand their rights and obligations.

According to § 516 (1) BGB, a gift is defined as

"ein Vertrag, durch den jemand aus seinem Vermögen einen anderen auf dessen Kosten bereichert."

In the case of real estate, gifting is governed by §§ 873 and 925 BGB, which state that the gifting of a plot of land or an apartment is only effective if it is done through a notarially certified contract and the agreement on the transfer of ownership (cessation) is also notarized.

What are the benefits of a gift agreement for real estate?

A gift agreement for real estate offers a number of advantages for both donors and donees. Here are some of the main benefits:

- Tax Benefits: By gifting real estate, donors and donees can benefit from tax advantages. Gift tax exemptions, which vary depending on the degree of kinship (§§ 16, 17 ErbStG), allow assets to be transferred within the family in a tax-beneficial manner. This can help reduce the inheritance tax burden for heirs.

- Wealth Transfer During Lifetime: Gifting real estate allows the donor to transfer assets to the next generation or other beneficiaries during their lifetime. This can help prevent conflicts within a family and provide financial security to the donee.

- Legal Certainty: A legally valid gift agreement ensures clarity and security in the transfer of ownership. Both donor and donee are protected from potential conflicts or misunderstandings.

- Customization Options: A gift agreement for real estate can be tailored to the individual needs and wishes of the donor and donee. For example, rights of retraction or conditions for the donee can be stipulated in the contract.

- Prevention of Compulsory Share Claims: Gifting real estate can help reduce or prevent compulsory share claims by heirs if the gift agreement is designed accordingly.

- Relieving the Community of Heirs: Gifting real estate during one's lifetime can relieve the future community of heirs by already distributing the assets and avoiding complex inheritance disputes.

- Asset Protection: In certain cases, gifting a property can help protect assets from third-party claims, for example, in cases of insolvency or financial difficulties.

Property Gift Agreement: Legal Foundations

What legal regulations are decisive for property gift agreements?

Various legal regulations in Germany are decisive for property gift agreements. The most important laws and regulations related to property gift agreements are:

Civil Code (BGB):

- § 516 BGB (Gift): Defines the gift as a contract through which someone enriches another at their expense from their own assets.

- § 873 BGB (Transfer of a Property): Governs the transfer of a property and emphasizes that it requires an agreement (Auflassung) and entry into the land register.

- § 925 BGB (Form of Auflassung): Specifies that the Auflassung of a property or an apartment must be notarized.

- § 530 BGB (Right of the Donor to Reclaim in Case of Impoverishment): Stipulates that the donor can reclaim the gift under certain circumstances if they become impoverished.

Inheritance and Gift Tax Act (ErbStG):

- §§ 1-2 ErbStG (Tax Liability): Define the tax liability for inheritances and gifts.

- §§ 7-12 ErbStG (Valuation of Assets): Lay out the valuation rules for taxable assets.

- §§ 16-17 ErbStG (Tax Exemptions): Govern the tax exemptions for gift tax, which vary depending on the degree of relationship between the donor and the recipient.

- § 19 ErbStG (Tax Rates): Determines the tax rates for gift tax.

Real Estate Transfer Tax Act (GrEStG):

- § 3 No. 2 GrEStG (Exemption from Real Estate Transfer Tax): Gifts of properties are generally exempt from real estate transfer tax as long as they occur within certain degrees of kinship.

Land Register Ordinance (GBO):

- § 13 GBO (Entry in the Land Register): Governs the entry of rights and changes in the land register, including the entry of a property gift.

What role do the land register and notary play in property gift agreements?

The land register and notary play a central role in property gift agreements in Germany to ensure legal certainty and transparency for both parties. Here are the key functions of the land register and notary in this context:

Notary:

Certification of the Gift Agreement: In accordance with § 925 BGB, notarization is required for the Auflassung (agreement on the transfer of ownership) of a property. Therefore, a gift agreement for a property must be notarized to be legally effective.

Legal Advice: The notary informs and advises both parties (donor and recipient) on the legal consequences and requirements of the gift agreement to ensure that they understand the significance of their decision.

Verification of Identity and Legal Capacity: The notary verifies the identity of the involved parties and ensures that they are legally capable (i.e., of legal age and competent).

Land Registry Application: After notarizing the gift contract, the notary applies for the registration of the transfer of ownership in the land registry.

Land Registry:

Legal Certainty: The land registry serves legal certainty in real estate transactions by disclosing the ownership status, rights, and encumbrances on properties and apartments.

Registration of Transfer of Ownership: In the case of a gift of real estate, the transfer of ownership must be registered in the land registry. This registration takes place following the notary's application and the submission of the notarized gift contract.

Protection Against Double Transfers: The registration of the transfer of ownership in the land registry ensures that the property is not simultaneously transferred to multiple persons.

Protection of Good Faith Acquisition: The registration of the gift in the land registry protects the recipient in the case of a good faith acquisition. This means that the recipient is considered the rightful owner of the property if they act in good faith without knowledge of any defects in the gift contract or the registration.

Real Estate Gift Contract: Examples of Jurisprudence

Which court rulings illustrate the significance of gift contracts in the real estate sector?

BGH, Judgment of November 29, 2002, File No. V ZR 100/02

This case dealt with the question of whether a gift under a suspensive condition is valid. The Federal Court of Justice decided that a gift under a suspensive condition is permissible and that the condition of third-party consent does not affect the validity of the gift.

BGH, Judgment of October 19, 2018, File No. V ZR 143/17

This judgment concerned the question of reclaiming a gifted property due to gross ingratitude. The Federal Court of Justice decided that the donor can reclaim the property if the recipient is guilty of gross ingratitude and the reclaiming was stipulated in the gift contract. The BGH emphasized that reclamation can also occur due to insults, defamations, or physical violence against the donor or their relatives.

OLG Hamm, Judgment of November 17, 2016, File No. 10 U 31/16

This case concerned the validity of a gift contract for a property that had not yet been fully paid off. The Higher Regional Court of Hamm decided that a partially paid-off property can also be the subject of a gift contract as long as the remaining liabilities are taken into account in the contract and the recipient undertakes to assume them.

Real Estate Gift Contract: Typical Clauses and Their Significance

What is the difference between conveyance and gift?

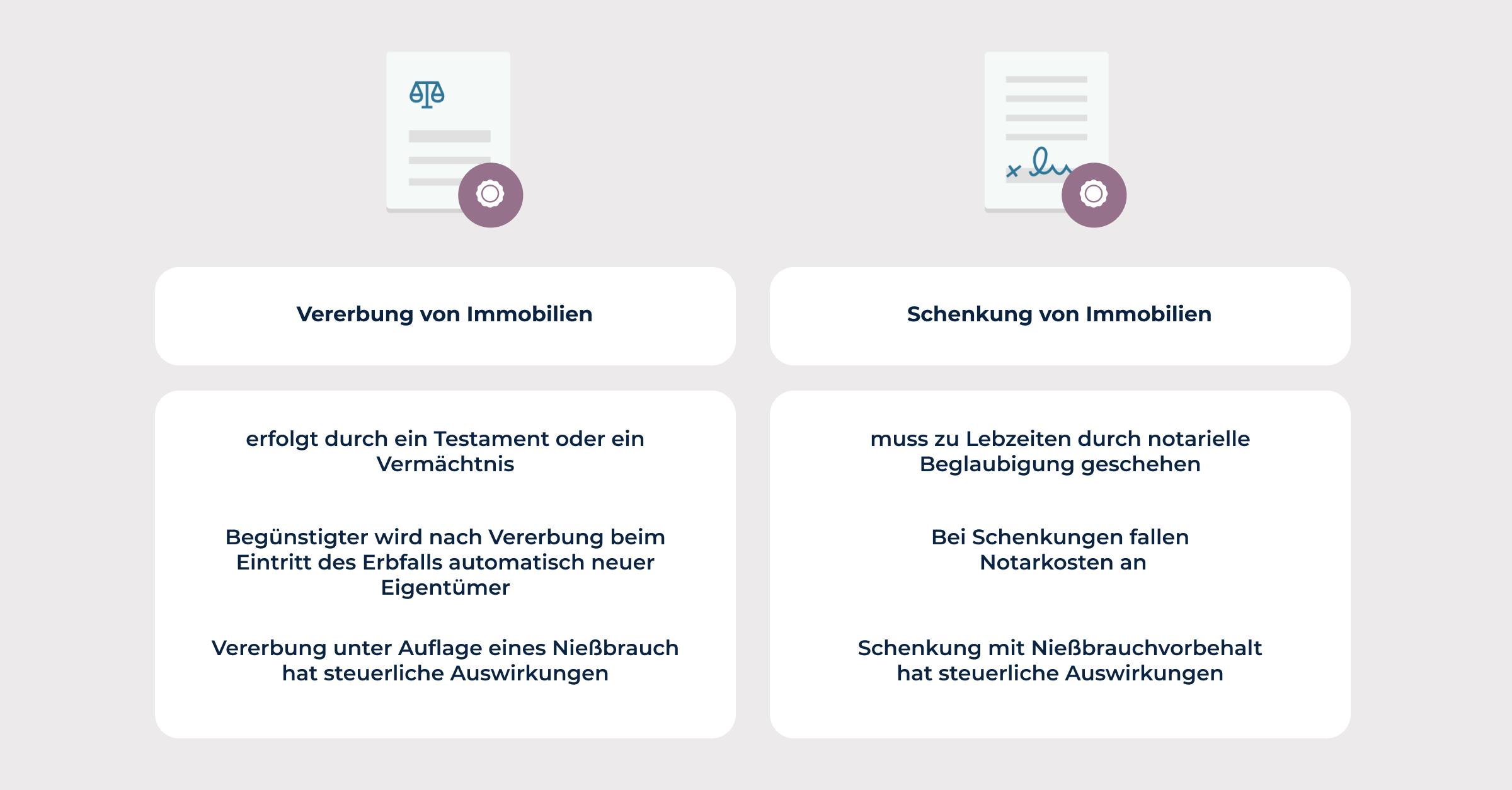

The terms conveyance and gift refer to the transfer of ownership of property, but there are important differences between the two. Here are the main differences:

Conveyance: Conveyance is a general term that refers to the transfer of ownership of a property from one person to another.

This can occur through various legal transactions, such as purchase, gift, inheritance, or exchange. In a conveyance, the ownership of the property changes hands, usually for consideration (e.g., payment of the purchase price).

Gift: The gift is a special form of transfer in which ownership of a property is transferred free of charge, that is, without consideration, from one person (donor) to another person (donee). The gift is made out of the voluntary and selfless motivation of the donor and is regulated in § 516 BGB.

Here are some further differences between transfer and gift:

- Consideration: In a transfer within the framework of a purchase contract, consideration (purchase price) is usually expected, whereas in a gift, no consideration is requested.

- Tax aspects: In a transfer within the framework of a purchase contract, real estate transfer tax is incurred, whereas in a gift, gift tax may be incurred depending on the value of the property and the degree of relationship between the donor and the donee.

- Contract design: Purchase contracts and gift contracts differ in their design and legal requirements. While notarization is required for both types of contracts, special regulations (e.g., reservation of revocation or right of reclamation) are possible in the case of gift contracts to protect the donor from unforeseen events.

- Risks and liability: In a gift, the donor is generally not liable for defects in the property unless he has fraudulently concealed them. In a transfer within the framework of a purchase contract, the buyer has statutory warranty claims for defects unless they have been contractually excluded.

Gift contract property: Costs and fees

What costs are incurred in the gift of a property?

Various costs may be incurred in the gift of a property, which are relevant for both the donor and the donee. Here are the main costs with examples:

- Notary costs: The notarization of the gift contract by a notary is required by law. The notary costs are based on the fee schedule for notaries (GNotKG) and depend on the value of the property. For example, for a property worth 300,000 euros, a notary fee of about 1,000 to 1,500 euros could be incurred.

- Land registry costs: Fees for the re-registration of the property in the land registry are charged by the competent land registry office. The costs depend on the value of the property and amount to approximately 300 to 400 euros for a property worth 300,000 euros.

- Gift tax: Depending on the value of the property and the degree of relationship between the donor and the donee, gift tax may be incurred. Allowances apply for gifts between relatives (e.g., 500,000 euros for children, 400,000 euros for spouses). If the value of the property exceeds these allowances, gift tax is due. The tax rates range from 7% to 50%, depending on the degree of relationship.

- Appraiser or expert costs: To determine the value of the property for gift tax or notary and land registry costs, it may be necessary to hire an appraiser or expert. This can lead to additional costs of about 1,000 to 2,000 euros, depending on the size and complexity of the property.

- Anwaltskosten: Wenn Sie einen Anwalt zur Beratung oder Unterstützung bei der Schenkung hinzuziehen, fallen Anwaltskosten an. Diese können je nach Umfang der Tätigkeit und dem Wert der Immobilie variieren. Für eine Erstberatung könnten beispielsweise 250 bis 500 Euro anfallen, während die Begleitung während des gesamten Prozesses höhere Kosten verursachen kann.

Wie hoch sind die Notarkosten bei Schenkung?

Die Notarkosten bei einer Schenkung richten sich nach dem Wert der Immobilie und der Gebührenordnung für Notare (GNotKG). Sie setzen sich aus verschiedenen Gebührenpositionen zusammen. Hier ist ein Beispiel für die Berechnung der Notarkosten bei einer Immobilie mit einem Wert von 300.000 Euro:

- Beurkundungsgebühr: Die Beurkundungsgebühr wird für das notarielle Schenkungsversprechen und die notarielle Annahmeerklärung fällig. Sie richtet sich nach der Gebührentabelle des GNotKG und beträgt für eine Immobilie im Wert von 300.000 Euro 1,0 Gebührensatz (§ 36 Abs. 2 GNotKG) x 1,0 Geschäftswert (§ 34 GNotKG) x 689 Euro (§ 44 Abs. 1 GNotKG) = 689 Euro.

- Beglaubigungsgebühr: Die Beglaubigungsgebühr wird für die Beglaubigung von Unterschriften und Handzeichen erhoben. Sie beträgt 20 Euro pro Unterschrift bzw. Handzeichen (§ 39 GNotKG) x 2 (Schenker und Beschenkter) = 40 Euro.

- Vollzugskosten: Die Vollzugskosten werden für die Durchführung der Umschreibung im Grundbuch erhoben. Diese Kosten betragen 0,5 Gebührensatz (§ 36 Abs. 2 GNotKG) x 1,0 Geschäftswert (§ 34 GNotKG) x 689 Euro (§ 44 Abs. 1 GNotKG) = 344,50 Euro.

- Auslagen: Die Auslagen umfassen Kosten für Post- und Telekommunikationsdienstleistungen, Schreibauslagen und Ablichtungen. Sie können je nach Aufwand variieren, beispielsweise 50 bis 100 Euro.

In diesem Beispiel belaufen sich die Notarkosten für die Schenkung einer Immobilie im Wert von 300.000 Euro auf insgesamt etwa 1.123,50 Euro (689 Euro + 40 Euro + 344,50 Euro + 50 Euro). Die tatsächlichen Kosten können je nach Umfang der Dienstleistungen des Notars und den individuellen Gegebenheiten variieren.

Schenkungsvertrag Immobilie: Gültigkeit und Notwendigkeit eines Notars

Ist ein Schenkungsvertrag einer Immobilie ohne Notar gültig?

In Deutschland ist ein Schenkungsvertrag einer Immobilie ohne Notar nicht gültig.

Gemäß § 925 BGB ist für die Übertragung des Eigentums an einer Immobilie die notarielle Beurkundung der Auflassung (Einigung über die Eigentumsübertragung) erforderlich.

Ohne eine notarielle Beurkundung ist der Schenkungsvertrag einer Immobilie rechtlich unwirksam, und die Eigentumsübertragung kann nicht vollzogen werden.

Es ist wichtig zu beachten, dass der Notar nicht nur für die Beurkundung des Schenkungsvertrags zuständig ist, sondern auch für die rechtliche Beratung und Aufklärung der beteiligten Parteien. Der Notar stellt sicher, dass Schenker und Beschenkter die rechtlichen Konsequenzen des Schenkungsvertrags verstehen und die gesetzlichen Vorgaben eingehalten werden.

Zudem ist der Notar nach der Beurkundung des Schenkungsvertrags für die Einreichung des Antrags auf Eintragung der Eigentumsübertragung im Grundbuch zuständig. Diese Eintragung ist notwendig, um die Eigentumsübertragung rechtlich abzusichern und Rechtssicherheit für beide Parteien zu gewährleisten.

Was ist bei einer Schenkung von Immobilien zu beachten?

Bei einer Schenkung von Immobilien sind mehrere Aspekte zu beachten, um sicherzustellen, dass der Prozess reibungslos und rechtlich einwandfrei abläuft. Hier sind einige Punkte, die bei einer Schenkung von Immobilien zu berücksichtigen sind:

- Notarielle Beurkundung: Ein Schenkungsvertrag für Immobilien muss notariell beurkundet werden, um rechtskräftig zu sein. Vereinbaren Sie einen Termin mit einem Notar, um den Schenkungsvertrag zu erstellen und beurkunden zu lassen.

- Land Register Entry: After the notarization of the gift contract, it is necessary to register the gift in the land register. The notary will usually submit the land register application for you.

- Gift Tax: Inform yourself about possible gift taxes that may be incurred on the gift of the property. Depending on the degree of kinship between the donor and the recipient, there are different allowances that can be used every ten years.

- Supplementary Claims for Compulsory Portion: Keep in mind that a gift can affect the statutory compulsory portion of heirs. To avoid conflicts, you should consider possible supplementary claims for compulsory portions and make appropriate arrangements in the gift contract.

- Rights of Reclamation: Consider whether you want to anchor rights of reclamation in the gift contract so that you can reclaim the property in certain cases (e.g., insolvency of the recipient, divorce, or death).

- Usufruct or Right of Residence: If the donor wants to continue to benefit from the property, a usufruct right or right of residence can be agreed upon in the gift contract.

- Gift with Conditions: A conditional gift allows the donor to reclaim the property if they later need it themselves. This should be regulated in the gift contract.

- Legally Secure Gift Contract: Use Beglaubigt.de's document creator to create a legally secure gift contract for real estate, tailored to your individual needs.

By considering these aspects when gifting real estate, you can ensure that the process runs smoothly and legal problems are avoided.

Gift Contract Real Estate: Disadvantages of a Gift

What are the disadvantages of gifting real estate?

Gifting real estate can also bring disadvantages for both the donor and the recipient in certain cases. Here are some possible disadvantages:

Gift Tax: Depending on the degree of kinship between the donor and the recipient and the value of the property, gift taxes may apply. However, there are allowances that vary depending on the degree of kinship. If the value of the property exceeds the respective allowance, gift tax is due.

Right of Reclamation by the Donor: In certain cases, such as gross ingratitude by the recipient or a financial emergency of the donor, the donor can reverse the gift. This can lead to legal disputes and uncertainties.

Supplementary Claims for Compulsory Portion: If the donor dies and the property was gifted within the last ten years before death, statutory heirs may have supplementary claims for compulsory portions. As a result, the recipient may be required to compensate the compulsory portion.

Liability for Obligations: If the property carries debts or other liabilities, the recipient may be held liable for them. It is important to clearly specify in the gift contract which liabilities pass to the recipient and which are borne by the donor.

Right of Residence or Usufruct: If the donor reserves a right of residence or usufruct on the property, this can restrict the recipient in the use of the property or place a financial burden on them.

Protection against termination in rented real estate: If the gifted property is rented, the legal termination protection regulations for the tenant apply. The recipient can only dispose of the property to a limited extent in such cases.

How can the disadvantages of a real estate gift be avoided or minimized?

The disadvantages of gifting real estate can be minimized or avoided through careful planning and preparation. Here are some ways to address the disadvantages of gifting real estate:

- Reclamation Claims: To ensure that the donor can reclaim the property in certain situations (e.g., insolvency of the recipient, divorce, or death), a right of reclamation can be agreed upon in the gift contract.

- Gift Tax: Before gifting, check whether tax exemptions for gift tax can be claimed. The exemptions depend on the degree of kinship between the donor and the recipient and can be claimed again every ten years.

- Compulsory Portion Supplement Claims: To avoid possible compulsory portion supplement claims from heirs, the donor can link the lifetime gift with a condition that the recipient acknowledges the compulsory portion supplement claim and waives further claims.

- Usufruct or Right of Residence: To ensure that the donor can continue to benefit from the property, a right of usufruct or residence can be agreed upon in the gift contract. This ensures that the donor retains the right to use the property or benefit from rental income.

- Conditional Gift: A conditional gift allows the donor to reclaim the property if they need it later. This can be stipulated in the gift contract to ensure the donor is protected in case of need.

- Legal Advice: In case of uncertainties or complex issues, it is advisable to consult a lawyer or notary to minimize potential disadvantages and risks of the gift.

- Security in the Gift Contract: By including careful and comprehensive provisions in the gift contract, potential disadvantages can be avoided or minimized. Use the document creator from Beglaubigt.de to create a legally secure gift contract for real estate that is tailored to your individual needs.

Real Estate Gift Contract: Valuation of the Property:

Who determines the value of a property in a gift?

When gifting a property, it is necessary to determine the value of the property. This value is relevant for the calculation of gift tax and helps to correctly utilize the exemption for gift tax. The determination of the property's value in a gift usually involves several steps:

- Estimation by an Independent Expert: It is advisable to commission an independent expert, such as a property appraiser, to determine the value of the property. This expert provides an appraisal that determines the market value of the property based on various factors such as location, size, year of construction, equipment, and condition.

- Tax Office: The tax office can accept the value of the property determined by the expert or make its own assessment. Usually, the tax office follows the market value determined in the appraisal, but it can also apply the so-called simplified income capitalization method, especially if no appraisal is available. In this method, the standard land value, type of building, and year of construction are used to determine the value of the property.

- Agreement between Donor and Donee: The donor and donee can agree on a specific value of the property. However, this agreement should be based on a realistic valuation and documented in the gift contract. Otherwise, the tax office may conduct its own valuation for the gift tax and potentially set higher taxes.

How does the tax office assess a property in a gift?

To avoid or minimize the disadvantages of gifting a property, it is crucial that the donor and donee carefully plan and seek advice from a specialized lawyer or notary.

One way to reduce the gift tax is to use the gift tax allowances, which vary depending on the degree of kinship. Gifts can be repeated at certain intervals to fully utilize the allowances multiple times.

It is also advisable to clarify the conditions for a possible reclaim of the property in the gift contract and to put them in writing to avoid future legal disputes.

Um Pflichtteilsergänzungsansprüche auszuschließen, sollten Schenkende erwägen, die Schenkung mehr als zehn Jahre vor ihrem Tod durchzuführen. Nach Ablauf dieser Frist entfallen in der Regel Pflichtteilsergänzungsansprüche.

The liability for debts should also be clearly regulated in the gift contract by specifying which debts are transferred to the donee and which are borne by the donor. A thorough examination of the property and its financial obligations can help avoid unexpected liabilities.

Another aspect to consider when planning a property gift is the right of residence or usufruct. The donor and donee should specify the conditions for this in the gift contract and consider alternatives such as temporary residence rights or rental agreements if they seem more appropriate.

Finally, donors and donees should inform themselves about the legal tenant protection regulations and plan accordingly, especially if the donee intends to use the property themselves. In this case, it is important to know the legal reasons and deadlines for termination.

Property Gift Contract: Reporting to the Tax Office

How does the tax office learn about a gift?

The tax office usually learns about a property gift in two ways:

- Notary: The notarization of a property gift by a notary is legally required (§ 311b Abs. 1 BGB). After notarizing the gift contract, the notary informs the land registry to register the transfer of ownership. In this context, the notary is also obligated to report the gift to the relevant tax office (§ 18 GrEStG). For this purpose, the notary sends a copy of the gift contract to the tax office.

- Self-Reporting by the Parties: The donor and donee are also required to report the gift to the relevant tax office. This reporting obligation is regulated in § 30 ErbStG. The parties have a period of three months after concluding the gift contract to do so. Late reporting may result in late fees or even fines.

After the tax office becomes aware of the gift, it checks whether gift tax is due. The tax office considers the value of the property, the degree of kinship between the donor and the recipient, as well as the applicable allowances and tax rates. If gift tax is due, the tax office issues a corresponding tax assessment notice, setting the amount of the gift tax.

What tax aspects need to be considered when gifting real estate?

When gifting real estate, various tax aspects need to be considered to avoid unexpected tax burdens or penalties. The most important tax aspects are:

Gift tax: A gift of real estate is subject to gift tax. This tax depends on the degree of kinship between the donor and the recipient, as well as the value of the property. The closer the relationship, the higher the allowances and the lower the tax rates (§§ 16, 19 ErbStG).

Allowances: For gift tax, allowances apply, which vary according to the degree of kinship (§ 16 ErbStG). For example, the allowance for spouses and registered partners is 500,000 euros, while for children it is 400,000 euros and for grandchildren, it is 200,000 euros. The allowances can be used again every ten years.

Tax rates: Gift tax is levied in different tax classes, which are determined by the degree of kinship (§ 15 ErbStG). The tax rates vary according to the tax class and the value of the property, ranging from 7% to 50% (§ 19 ErbStG).

Valuation of the property: The value of the property is crucial for the calculation of the gift tax. The value should be determined by an independent appraiser to create a realistic basis for the tax calculation. The tax office can acknowledge the determined value or make its own valuation.

Reporting obligation: The donor and recipient are obliged to report the gift to the relevant tax office within three months after the gift contract is concluded (§ 30 ErbStG). Non-compliance with this deadline can result in late fees or fines.

Speculative tax: If the recipient sells the property within ten years of the gift, the so-called speculative tax may be due. This is an income tax on the profit from the sale of the property if less than ten years have elapsed between acquisition and sale (§ 23 Abs. 1 Nr. 1 EStG).

To avoid possible tax disadvantages when gifting real estate, it is advisable to seek advice from a tax consultant or specialist lawyer. Careful planning and compliance with legal requirements can help minimize unexpected tax burdens.

Real estate gift contract: The document creator from Beglaubigt.de

How does the document creator from Beglaubigt.de help in creating a legally secure gift contract for real estate?

The document creator from Beglaubigt.de is a helpful online tool that facilitates the creation of a legally secure gift contract for real estate. Here are some advantages and features of the document creator:

- Templates and customization: Beglaubigt.de offers prefabricated contract templates created by experts that meet current legal requirements. These templates can be individually customized to meet the needs and requirements of the parties involved.

- Easy Handling: The user interface of the document creator is user-friendly and intuitive. This allows even people without legal expertise to create a legally compliant gift deed for real estate.

- Up-to-date: Beglaubigt.de ensures that the contract templates are always up-to-date and comply with the current laws, paragraphs, and jurisdiction.

- Time and Cost Savings: Using Beglaubigt.de's document creator saves time and costs compared to having a lawyer draft a contract. Users can generate a legally compliant gift deed as a PDF or Word file in a short amount of time.

- Data Protection: Beglaubigt.de places great importance on protecting the personal data of its users. The data is handled securely and confidentially and is not shared with third parties without the users' consent.

- Notes and Information: The document creator from Beglaubigt.de offers additional notes and explanations regarding the individual contract clauses to provide users with a better understanding of the legal aspects.

How does the generation of PDF and Word documents work with the document creator?

The document creator from Beglaubigt.de allows for the easy and fast generation of PDF and Word documents for real estate gift deeds. Here is a step-by-step guide on how to use the document creator:

- Select Template: Choose the appropriate template for the real estate gift deed on the Beglaubigt.de website. This template has been created by experts and complies with current legal requirements.

- Customize Template: Adapt the template to the individual needs and requirements of the parties involved. Enter all the necessary information in the designated fields, such as personal data of the donor and the donee, information about the property, possible conditions or stipulations, and other relevant information.

- Review and Adjust: Carefully review the entered information and the created contract clauses. Ensure that all details are correct and complete and adjust the contract clauses if necessary.

- Document Generation: After all the information has been entered and reviewed, click the button to generate the contract document. The document creator will then create a legally compliant gift deed document in the desired format (PDF or Word).

- Download: Once the document has been generated, it will be available for download. You can download the PDF or Word document to your computer or another storage medium.

- Notarial Certification: Please note that the real estate gift deed must be notarized to be legally binding. After creating the document with Beglaubigt.de's document creator, schedule an appointment with a notary to have the gift deed notarized.

The generation of PDF and Word documents with Beglaubigt.de's document creator is uncomplicated and time-saving.