What is the Commercial Register and what functions does it serve?

The commercial register is a publicly maintained directory that documents key information about merchants and commercial companies. It is managed by the relevant district courts.

Its primary function is to create legal certainty in business transactions by allowing third parties to access certain legally significant facts about registered companies.

This includes information such as the company name, registered office, capital, authorized representatives, and liability arrangements. The transparency provided by the commercial register fosters trust among business partners, customers, and investors.

Definition and Purpose of the Commercial Register

The commercial register is designed as an instrument of public authentication. It aims to provide a reliable source of information about the legal and organizational circumstances of commercial companies. By being entered into the commercial register, a company attains the status of a registered merchant, which comes with certain rights and obligations.

The purpose of the commercial register is thus multifaceted:

- Transparency: It provides a clear overview of the legal circumstances of registered companies.

- Legal Certainty: It establishes a reliable basis for business relationships and helps minimize risks and uncertainties in commercial transactions.

- Trust Building: By making information public and verifiable, it fosters trust in the business world.

New Service: We now offer commercial register registration via Beglaubigt: https://beglaubigt.de/handelsregisteranmeldung

Distinction between HRA and HRB

The commercial register is divided into two sections: Section A (HRA) and Section B (HRB).

- HRA (Handelsregister A): This section records sole proprietors and partnerships, such as general partnerships (OHG) and limited partnerships (KG). The HRA entry serves to disclose business relationships primarily based on personal liability of the entrepreneurs.

- HRB (Handelsregister B): This section is reserved for corporations such as limited liability companies (GmbH), public limited companies (AG), and entrepreneurial companies (UG – haftungsbeschränkt). HRB entries focus on companies where the liability of shareholders is limited to the company’s assets.

The distinction between HRA and HRB reflects fundamental differences in the structure and liability of business forms. It helps better assess the nature of a business relationship and the associated risks.

If you’d like to learn more about the commercial register, you may also be interested in this article: Commercial Register Registration Shareholders’ List.

Who is obligated to register in the commercial register?

The obligation to register in the commercial register applies to a variety of business forms and is detailed in the relevant legal provisions, particularly in the German Commercial Code (HGB). Registration in the commercial register is not just a formality but an essential legal requirement that ensures transparency and legal certainty in commercial transactions.

The duty to register in the commercial register depends on the legal form of the business. The following business forms are generally required to register:

- Sole proprietors: Any person operating a commercial business under their own name must register as a sole trader in the commercial register. Exempt from this rule are small businesses whose operations, by their nature and scope, do not require a business set up in a commercial manner.

- Partnerships: General partnerships (OHG) and limited partnerships (KG) must be registered in the commercial register, regardless of their business size. This obligation exists because, in these types of partnerships, at least some partners have unlimited personal liability.

- Corporations: For corporations, including limited liability companies (GmbH), public limited companies (AG), and entrepreneurial companies (UG – haftungsbeschränkt), registration in the commercial register is essential and is mandatorily required under the GmbHG, AktG, or specific UG provisions before these types of companies can begin their business activities. These companies only attain legal capacity through registration.

- Cooperatives: Cooperatives are also required to register in the commercial register, which establishes their legal capacity.

- Branches of foreign companies: If a foreign company operates a branch in Germany, it is also required to register that branch in the commercial register.

Relevant laws and sections

The legal basis for registration in the commercial register is primarily provided by the German Commercial Code (HGB). Key provisions include:

- § 1 HGB for sole proprietors, which establishes the requirement for a business to be organized in a commercial manner.

- §§ 106 ff. HGB for general partnerships (OHG), which regulate the registration obligations and legal consequences of registration.

- §§ 161 ff. HGB for limited partnerships (KG), which set similar regulations to those for the OHG.

- § 7 GmbHG for limited liability companies (GmbH), which specifies the registration process for the commercial register.

- § 36 AktG for public limited companies (AG), which outlines the requirements for registration in the commercial register.

These regulations ensure that businesses, depending on their legal form, are correctly registered in the commercial register. Registration not only fulfills legal requirements but also enhances trust in business relationships by making key information about the company publicly accessible.

You might also be interested in the following article: Asset-managing GmbH.

How can the registration for the commercial register be completed?

Registering with the commercial register is a key step during the formation phase of a company and requires careful preparation, as well as knowledge of the necessary steps and documents. This process can vary depending on the legal form of the company and the jurisdiction of the relevant district court. Below is a general overview of the registration procedure, taking into account both digital and traditional methods.

Step-by-step guide for registration

- Preparation of required documents:Depending on the legal form of the company, various documents must be prepared and made available. These generally include the company’s articles of association or bylaws, the list of shareholders, proof of appointment of managing directors or board members, and in the case of corporations, proof of the contribution of share or capital stock.

- Filling out the registration form: A specific form is needed for registration in the commercial register. This form can be submitted either online via the justice portal of the respective federal state or in paper form to the competent district court. The form requires detailed information about the company and its representatives.

- Notarial certification of documents: Before the registration is submitted to the commercial register, certain documents, particularly the signatures of those filing, must be certified by a notary. This ensures that all details are legally binding and authentic.

- Submission of the registration:The complete registration can now be submitted either digitally through the central commercial register portal or via post or in person to the relevant district court. Digital submission is preferred due to its efficiency and speed.

- Processing by the commercial register: After submission, the commercial register reviews the application. If necessary, the register may request additional information. Upon successful review, the entry is made, and the company is officially registered in the commercial register.

Digital vs. Traditional Registration Methods

In today’s digital business environment, entrepreneurs must decide whether to choose the digital or traditional route when registering their asset-managing GmbH in the commercial register. This decision is crucial, as it influences not only the administrative effort but also the speed and efficiency of the entire registration process.

- Digital Registration: The digital registration through the joint register portal of the federal states offers a fast and efficient way to enter the company into the commercial register. It allows you to complete all steps, from document preparation to submission, entirely online.

- Traditional Registration: The traditional registration requires the personal submission of documents to the district court or sending them by post. While this method may take more time, it remains an option in certain situations or for those who prefer a more personal approach.

The choice between digital and traditional registration depends on the specific needs and circumstances of the company. Regardless of the method chosen, registering with the commercial register is a critical step that formalizes the legal existence of the company and reinforces its credibility and transparency in business dealings.

If you're interested in conducting your company’s formation and registration digitally, you may also find the following article helpful: Notarization online.

When do I need to register in the commercial register?

The registration in the commercial register marks a significant step for companies in Germany and is associated with different timing and deadlines depending on the company’s form and structure.

This section provides an overview of the relevant times when commercial register registration should take place and outlines the legal frameworks that determine these deadlines.

Timing of Registration Obligation by Company Type:

- Sole proprietors: For sole proprietors, the obligation to register arises when the business requires a commercial organizational setup. This is typically determined by the size, revenue, and complexity of the business activities. Immediate registration is not always necessary, but it is advisable to complete it promptly to benefit from the advantages of merchant status.

- Partnerships (OHG, KG): For general partnerships (OHG) and limited partnerships (KG), registration in the commercial register is mandatory and is the legal basis for their existence as trading companies. The registration must be completed immediately after formation and before commencing business activities.

- Corporations (GmbH, AG, UG): For corporations such as GmbH, AG, and UG, registration in the commercial register is a constitutive (legal-forming) act that officially brings the company into legal existence. The registration must therefore be completed before any business activities begin.

Deadlines and Relevant Legal Provisions

The legal deadlines for registration in the commercial register are laid out in the specific laws that govern the various company forms. There are no uniform deadlines for all company types, but registrations should generally be made without unnecessary delay after the company’s formation or after reaching the registration threshold.

For corporations, particularly strict regulations apply. For example, the formation of a GmbH and its registration in the commercial register must occur “without undue delay,” as specified in § 7 (1) GmbHG, typically within a few weeks after signing the articles of association.

It is important to note that delays in registration can lead to not only legal but also financial consequences. For instance, the liability of managing directors or personally liable partners towards third parties can be extended if the company is not properly registered in the commercial register.

Thus, registration in the commercial register is not merely a formal requirement but a fundamental step that significantly impacts the legal and operational foundation of the company. Companies and founders should therefore carefully understand and adhere to the process and deadlines for commercial register registration to ensure a smooth start and operation of their business.

Looking for the right notary? We have partner notaries across Germany, for example in:

How much does a commercial register entry cost?

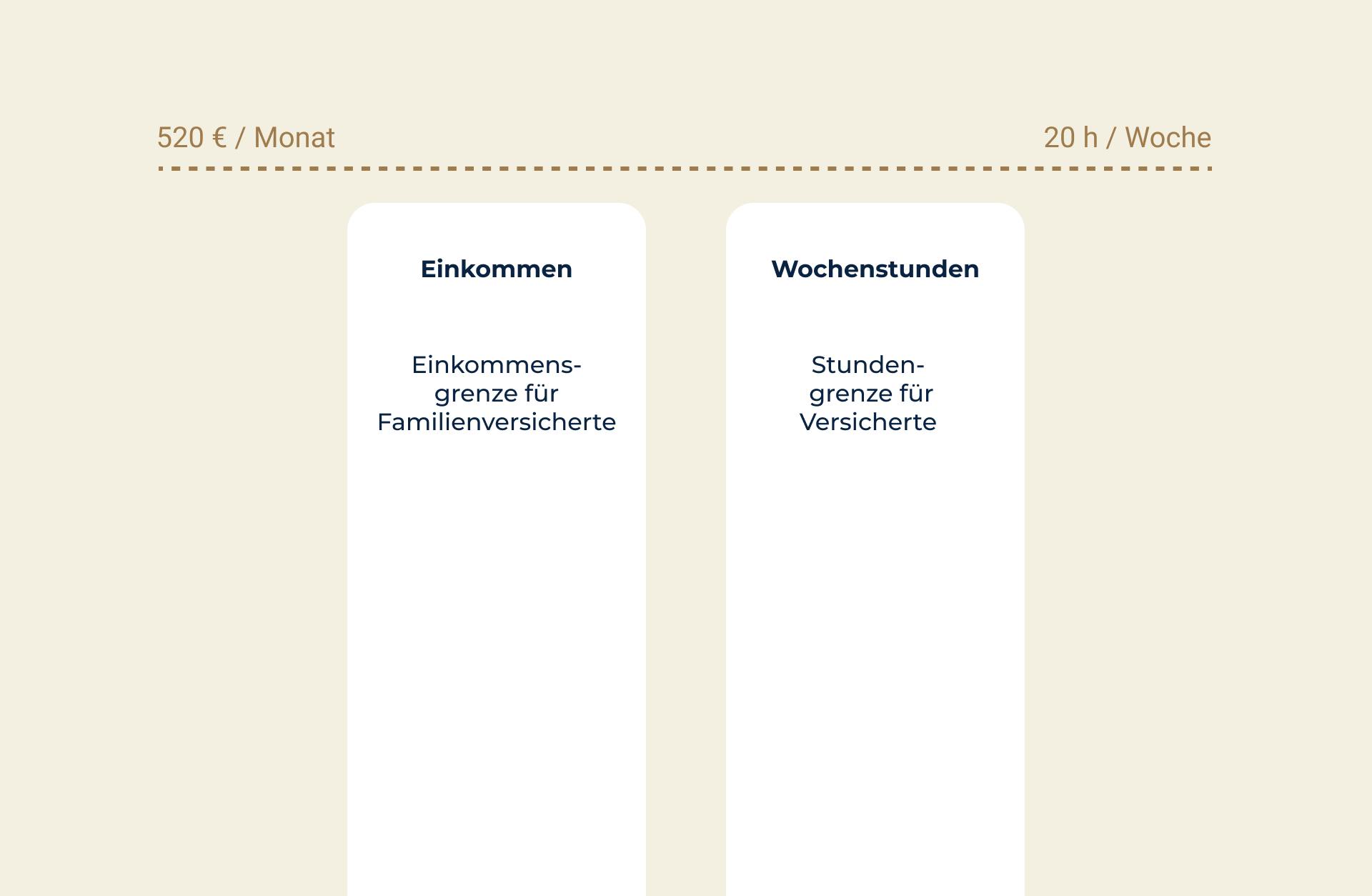

The costs for registering in the commercial register vary depending on the type of company and the scope of the registration. These costs consist of court fees and, in many cases, notary service fees. Below is a detailed breakdown of the typical cost factors and fees associated with a commercial register application.

- Court Fees

- The court fees for registration in the commercial register are determined by the Court Costs Act (GKG) and vary based on the legal form of the company and the company's capital. For example, the fees for registering a GmbH or AG are typically higher than those for sole proprietors or partnerships. The fees can also increase depending on the complexity of the registration and the amount of share capital.

- Notary Fees

- Notary fees are incurred for the certification of founding documents and the authentication of signatures. These are calculated based on the transaction value, which usually corresponds to the share or capital stock of the company, and are charged according to the Notary Fees Act (GNotKG). Notary fees can vary significantly, depending on how extensive the notarial services are.

Beispiele für Kosten unterschiedlicher Unternehmensformen

The costs for forming and registering a business in the commercial register can vary widely depending on the type of company. Here are some concrete examples of the costs associated with different types of companies such as sole proprietorships, partnerships, and corporations, providing entrepreneurs with a clearer understanding of the financial requirements tied to their specific business structure.

- Sole proprietorships: Registering a sole proprietorship is comparatively inexpensive since no significant share capital needs to be notarized. However, costs can still vary depending on the federal state and the scope of the registration.

- Partnerships (OHG, KG): For partnerships, there are not only court fees but also costs for notarizing the application. The total costs are usually higher than those for sole proprietorships but lower than for corporations.

- Corporations (GmbH, AG, UG): The costs for registering corporations are the highest. This is due to higher court fees, which result from the generally larger share capital, as well as the more extensive notarial services required for the formation.

It is important to note that actual costs can vary depending on the individual case. Additional costs may arise if, for example, changes need to be made to the commercial register or if special notarial documents are required.

Companies should therefore calculate the anticipated costs early on and include them in their financial planning. A detailed breakdown of fees and personalized advice can be obtained from the relevant chamber of commerce or a notary to avoid financial surprises.

Who must sign the commercial register application?

The signing of the commercial register application is a formal act that confirms the identity and authority of the persons submitting the registration. Depending on the legal form of the company, the requirements for who must sign the application vary.

This section explains the signing authority and the necessity of notarization for different types of companies.

Signing Authority by Company Type:

- Sole Proprietorships: the case of sole proprietorships, the owner of the business is authorized to sign. There are no further formal requirements regarding signing authority since the owner bears sole responsibility.

- Partnerships (OHG, KG): In partnerships, all personally liable partners must sign the commercial register application. In the case of limited partnerships (KG), only the general partners (Komplementäre) are required to sign, as limited partners (Kommanditisten) do not have the authority to represent the company.

- Corporations (GmbH, AG, UG): For corporations, the signatures of all managing directors (for GmbH and UG) or all board members (for AG) are required. These individuals must sign the application in the presence of a notary, who will authenticate the signatures.

Need for Notarization by a Notary

Notarization by a notary serves to verify the identity of the signers and the authenticity of their signatures. For corporations, notarization is mandatory for commercial register entries to ensure that the individuals signing the application have the legal authority to represent the company. This notarization provides additional legal security for the commercial register and for third parties conducting business with the company.

For sole proprietorships and partnerships, notarization of the signatures is not always required unless specific statements or documents explicitly call for such authentication. However, voluntary notarization can add clarity and security in these cases as well.

The proper signing and notarization of the commercial register application is a critical step in the company formation process. Mistakes or uncertainties in this area can lead to delays or even the rejection of the application. Companies should therefore be well aware of the requirements and consider consulting a notary to ensure that all formalities are correctly fulfilled.

If you're looking to quickly and easily find a notary for your commercial register application, beglaubigt.de can assist you. Feel free to contact us anytime if you have questions.

The Importance of Notarial Certification in Commercial Register Registration

Notarial certification plays a crucial role in commercial register registration, especially in the formation of corporations and other cases where the law mandates such certification. This formal confirmation not only verifies the authenticity of documents and the identity of the signatories but also ensures the legal correctness and completeness of the registration. Below, we provide a detailed explanation of the required documents and contracts for certification, as well as the role and responsibilities of the notary in the registration process.

Required Documents and Contracts for Notarization

Various documents and contracts must be notarized for registration in the commercial register. The exact list of required documents depends on the company's form and structure but typically includes:

- Articles of Association or Bylaws: In the case of corporations such as a GmbH, AG, or UG, the articles of association or bylaws must be notarized. These documents establish the company's basic principles, including its name, registered office, business purpose, and details about the share or capital stock.

- Founding Protocol: The founding protocol, prepared during the founding meeting, must also be notarized. It documents the shareholders' resolutions regarding the establishment of the company and the appointment of managing directors or board members.

- Signatures of Managing Directors or Board Members: The signatures of the individuals registering the company with the commercial register must typically be made in the presence of a notary and notarized.

- List of Shareholders: For GmbHs and other company forms that require the registration of shareholders in the commercial register, the list of shareholders must also be notarized.

Role and Responsibilities of the Notary in the Process

The notary plays a key role in the commercial register registration process and assumes several important responsibilities:

- Verification of Documents: The notary reviews the completeness and legal correctness of the documents presented for notarization. They ensure that all necessary details are included and meet legal requirements.

- Identity Verification and Signature Certification: The notary confirms the identity of the signatories and certifies their signatures. This guarantees that the individuals registering the company are indeed authorized to represent it.

- Consultation and Guidance: The notary advises the founding members or managing directors regarding the legal requirements and implications of the commercial register registration. They clarify the significance of the submitted documents and help avoid common mistakes and uncertainties.

- Submission of Documents: In some cases, the notary may also handle the electronic submission of notarized documents to the commercial register or assist the applicants in doing so.

Notarial certification is therefore an essential step to ensure the legal compliance and reliability of the commercial register registration. It not only provides legal certainty for the registering company but also protects the interests of third parties by ensuring the accuracy and dependability of the information entered into the commercial register.

If you wish to conduct your commercial register registration online, feel free to send us a request. We will be happy to assist you and connect you with one of our partner notaries.

Conclusion

Registering a company in the commercial register is a crucial step in the founding phase, which not only establishes legal validity but also opens the door to trustworthy business relationships.

This guide has highlighted the key aspects of commercial register registration, from the definition and functions of the commercial register, to the process steps and costs, and the vital role of notarial certification. For entrepreneurs and founders, it is essential to fully understand the requirements and steps involved in the registration process and to execute them correctly.

Mistakes or ambiguities in this process can not only cause delays but also lead to legal and financial consequences.

Careful preparation, the use of notarial services, and adherence to legal requirements are therefore critical to ensuring a smooth registration process.