The certificate of inheritance procedure is a judicial process designed to determine the rightful heirs of a deceased person and to officially confirm their inheritance rights. The certificate of inheritance is an official document that proves both the existence of an inheritance and the entitlement of the heirs.

This document is particularly necessary when it comes to transferring real estate or applying for benefits that are linked to the heirs of a deceased person. The certificate of inheritance procedure can be initiated by anyone who has a legitimate interest in the inheritance, such as the heirs themselves, the deceased's creditors, or the tax office.

Certain proofs must be provided for the procedure, such as a death certificate or a will. In some cases, the certificate of inheritance procedure can be waived, such as in the case of smaller inheritances or when there is agreement among all parties involved. However, it is generally advisable to carry out the certificate of inheritance procedure to avoid legal uncertainties and to definitively establish the status of the heirs.

Certificate of Inheritance & Inheritance Procedures - Simply Explained

The certificate of inheritance procedure is a judicial process designed to identify the heirs of a deceased person and to certify their inheritance rights. An official document, referred to as a certificate of inheritance, is issued in this process. In this blog article, we aim to provide you with an overview of the certificate of inheritance procedure and answer the most important questions that arise in connection with the certificate of inheritance.

Three Questions You Should Ask Yourself:

What is a certificate of inheritance and what purpose does it serve?

A certificate of inheritance is an official document that confirms both the existence of an inheritance and the entitlement of the heir to take over this inheritance. This document is particularly important when it comes to the transfer of real estate or when benefits have to be applied for that are linked to the heirs of a deceased person. For example, a certificate of inheritance is required for the transfer of real estate to prove the heir's ownership status at the land registry. Also, when applying for benefits such as pensions or insurance claims that are due to the heirs of a deceased person, the certificate of inheritance serves as necessary proof of the heir's status.

"The certificate of inheritance is the only proof of heirship and has a high evidentiary value. It is therefore of great importance in creating legal certainty in connection with the inheritance." - Notary Zeiler, expert at Beglaubigt.de.

Who can apply for a certificate of inheritance?

The certificate of inheritance procedure can be applied for by anyone who has a legitimate interest in the inheritance. This includes, for example, the heirs themselves, creditors of the deceased person, or the tax office. Third parties who are in any way affected by the inheritance can also apply for a certificate of inheritance. For example, a co-heir who has to manage the estate jointly with other heirs can apply for a certificate of inheritance to certify their heir status.

What proofs are required for the certificate of inheritance procedure?

For the probate process, certain evidence is required, which can vary depending on the case. In any case, a death certificate proving the death of the deceased person is needed. If this is not available, a will containing the deceased person's last will and testament is also required. This will can either be handwritten or notarized. If no will is present, the statutory inheritance law applies, determining who the heirs of the deceased person are. In this case, evidence that shows the family relationships of the deceased person, such as birth certificates or marriage certificates, is required. Evidence of compulsory portion claims or other claims related to the inheritance may also be required.

What steps should be followed in the probate process?

Various steps must be taken in the probate process to ensure a smooth execution of the procedure. Here are some important steps in the probate process:

- Application for the probate certificate: The probate certificate is usually applied for at the competent probate court. The applicant must provide information about the deceased person and the possible heirs.

- Submission of documents: Various documents, such as a death certificate of the deceased and, if applicable, a will or an inheritance contract, must be attached to the application for the issuance of a probate certificate.

- Examination of the heir's status: The probate court examines during the process who qualifies as an heir and what shares of the estate the individual heirs are entitled to.

- Court decision: If all requirements are met, the court decides on the issuance of the probate certificate. The probate certificate is then handed to the heirs.

- Use of the probate certificate: The probate certificate serves as proof of heir status and is needed, for example, to transfer bank accounts to the heirs' names or to transfer real estate.

How long does the probate process usually take?

The duration of the probate process depends on various factors, such as the complexity of the case and the availability of evidence. Typically, the probate process takes several months, but in some cases, it can take longer. It is possible that the procedure is temporarily suspended, for example, if additional evidence is needed or if a settlement with the parties involved is sought. In such cases, the duration of the probate process can be significantly extended. Therefore, it is important to be informed about the probate process, its associated deadlines, and costs beforehand to be accordingly prepared.

What costs can be expected in the probate process?

The probate process involves certain costs. These include court costs, which are usually borne by the applicant. These costs consist of various items, such as costs for the application, evidence collection, and court decision. In some cases, expert costs may also arise if the court appoints an expert to clarify the heir status.

The amount of court costs depends on the value of the estate. There are certain exemption limits above which court costs are incurred. These limits are specified in the court cost regulations and are regularly adjusted. At the time of research, the exemption limit for court costs was 150 Euros for an estate value of up to 20,000 Euros, 500 Euros for an estate value of up to 200,000 Euros, and 1,000 Euros for an estate value of up to 1 million Euros. For higher estate values, court costs are calculated based on the value of the estate.

In addition to court costs, additional expenses may incur in the probate process, such as fees for the authentication of documents or attorney's fees if one has been hired.

Notarial custody of the will at the probate court costs a flat fee of 75 EUR. Registration of the will with the central will register has cost 12.50 EUR since January 1, 2022.

The Certificate of Inheritance and Its Importance for the Heir

The Certificate of Inheritance is an official document that certifies the existence of an inheritance and the heir's right to inherit. There are various types of Certificates of Inheritance, such as the testamentary and the statutory certificate.

If you own real estate such as land, houses, or apartments and these are inherited or bequeathed without a notarial will or inheritance contract, your heirs will need a Certificate of Inheritance to transfer the property to them. This is because the land registry must verify the succession before a transfer can take place. Succession can only be proven by a Certificate of Inheritance or a notarized will or inheritance contract.

Even if a handwritten will exists, banks, insurance companies, and authorities may require the heirs to present a Certificate of Inheritance if the will is unclear or if it is not evident who inherits and in what proportion.

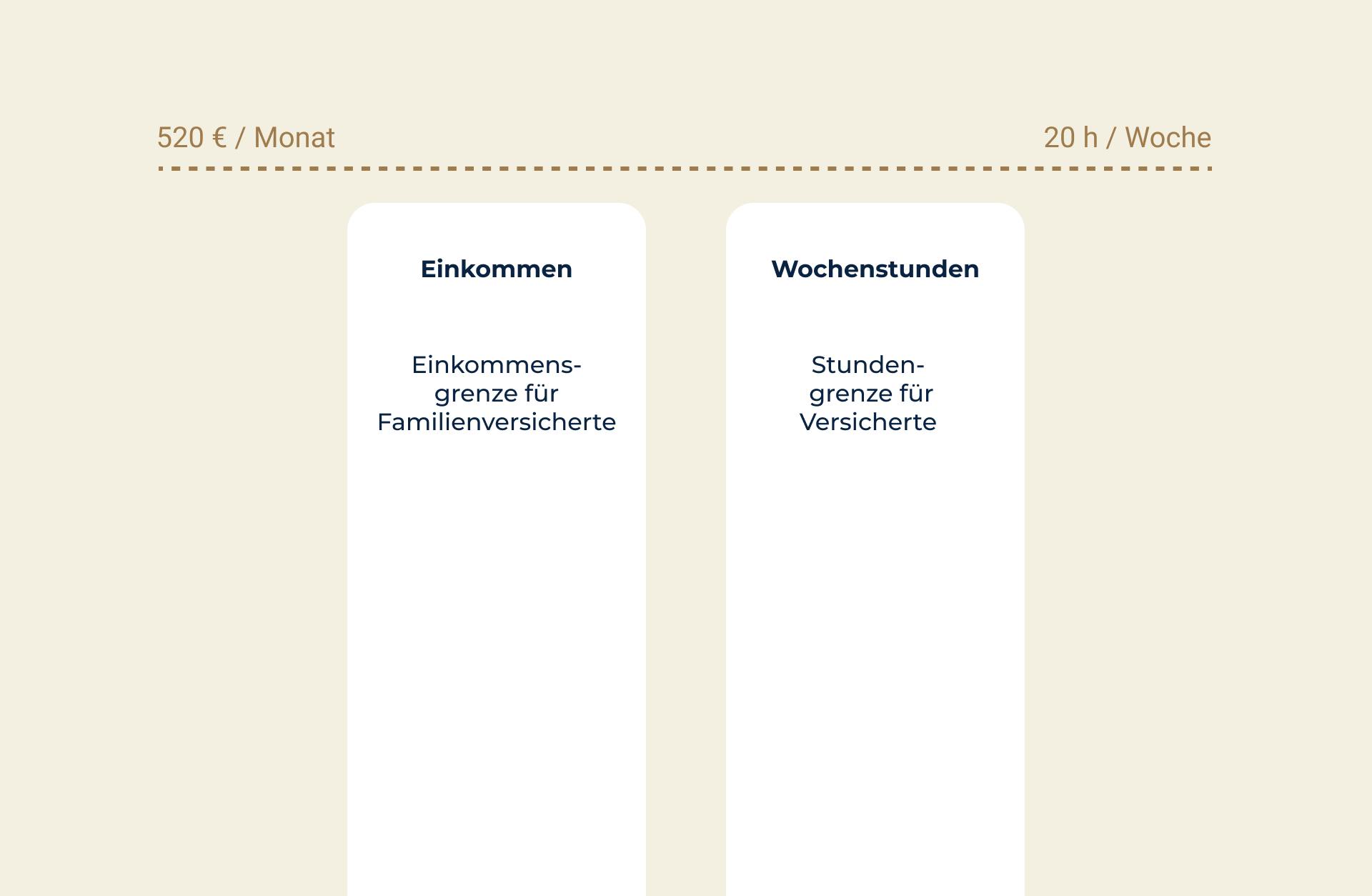

You can apply for a Certificate of Inheritance at the probate court in whose jurisdiction the deceased last resided. In your application, you need to make a sworn declaration that you are not aware of anything contradicting the accuracy of your statements. You can submit the application either at a notary’s office or the probate court. The application fee for a Certificate of Inheritance is uniformly 1.0 fee units according to KV 23300 in the Court and Notary Costs Act (GNotKG), regardless of where you file the application. The probate court additionally charges another 1.0 fee units according to KV 12210 for issuing the Certificate of Inheritance itself.

Compared to a notarial single will, the costs for a Certificate of Inheritance are twice as high. A notarial single will only incurs a fee of 1.0 according to KV 21200, whereas the application for a Certificate of Inheritance and the certificate itself each incur a fee of 1.0 according to KV 23300 and KV 12210 respectively. Therefore, a notarial single will is usually the more cost-effective option.

If there is a joint spousal will and the property is first inherited by the wife from the husband and then by the joint children, two Certificates of Inheritance are required - one after the husband's death and another after the wife's death. If both the husband and wife own property, two Certificates of Inheritance are also required. A joint spousal will incurs a fee of 2.0 according to KV 21100, while two Certificates of Inheritance each incur a fee of 2.0 according to KV 23300 and KV 12210 (totaling 4.0). In general, a notarized joint will or an inheritance contract is more cost-effective than two Certificates of Inheritance.

What is the difference between a testamentary and a statutory Certificate of Inheritance?

A Certificate of Inheritance is a public document that identifies a person as the lawful heir. There are two main types of Certificates of Inheritance: the statutory Certificate of Inheritance and the testamentary Certificate of Inheritance.

A statutory Certificate of Inheritance is issued when the deceased did not leave a will or when the will has been declared invalid. This certificate confirms who the statutory heirs of the deceased are and what share of the estate they receive.

The probate certificate, on the other hand, is issued if the deceased has left a valid will. This certificate indicates who is named as the heir in the will and what shares of the estate the heirs are entitled to.

The main difference between the two types of certificates lies in the legal basis: The statutory probate certificate is based on statutory succession, while the probate certificate is based on the last will of the deceased as set down in the will.

Why is the probate procedure important?

The probate procedure is important because it enables an official determination of heirship. It serves to clarify who is eligible to be an heir after a person’s death and what shares of the estate each heir is entitled to. Here are some reasons why the probate procedure is important:

- Legal certainty: The probate certificate is the only proof of heirship and has high evidential value. It therefore provides legal certainty in connection with inheritance.

- Protection against third-party claims: The probate certificate protects the heirs against third-party claims from those who might try to participate in the inheritance.

- Avoidance of disputes: If there are several potential heirs, the probate procedure can help to avoid disputes and find an amicable solution.

- Clarity about the estate: The probate procedure provides clarity about which assets belong to the estate and the value of the estate.

- Facilitation of estate settlement: The probate certificate facilitates the settlement of the estate by serving as proof of heirship and the shares in the estate.

What are the alternatives to the probate procedure?

There are some alternatives to the probate procedure that can be considered depending on the circumstances of the individual case. Here are some options:

- Testamentary execution: If the deceased has directed a testamentary execution, the estate is managed by the executor. In this case, no probate certificate is necessary.

- Joint account: If the deceased had a joint account with a spouse or another person, the account automatically transfers to the survivor. In this case, no probate certificate is necessary.

- Power of attorney: If the deceased had granted a power of attorney during their lifetime, the agent can manage and close the account after the deceased's death. However, the power of attorney generally expires upon the death of the account holder.

- Low-value estate: If the estate contains only low-value assets, the probate certificate can be waived. Instead, an affidavit can be provided stating who the heir is and which assets belong to the estate.

It is important to note that the above-mentioned alternatives are not applicable in all cases and that the decision as to which alternative is best depends on the individual circumstances. It is therefore advisable to seek advice from an experienced lawyer or notary to ensure that all legal steps are carried out correctly and lawfully.

What should be considered when applying for a probate certificate?

When applying for a certificate of inheritance, there are some things to consider to ensure the process runs smoothly. This includes, for example, submitting the required documents, such as the will or birth certificate of the deceased person and the heirs. It is also important to be aware of the costs and deadlines associated with the certificate of inheritance process and, if necessary, seek professional help to prepare accordingly.

The certificate of inheritance process is an important process that serves to legally determine the status of heirs and give the heir the right to manage and dispose of the estate of the deceased person. There are various alternatives to the certificate of inheritance process that may be considered in certain cases, but they do not have the legal authority of a court-issued certificate of inheritance. When applying for a certificate of inheritance, one should pay attention to submitting the required documents, the costs, and deadlines, and seek professional help if necessary.

What is the procedure for a certificate of inheritance?

The certificate of inheritance process is a legal procedure to establish the status of heirs and consists of several steps. Here is a rough overview of the certificate of inheritance process:

- Application: The application for a certificate of inheritance must be submitted to the competent probate court. The applicant must prove the status of the heirs and submit the necessary documents.

- Determination of heirs: The probate court reviews the submitted documents and determines who qualifies as an heir of the deceased.

- Proclamation date: The probate court sets a date for the proclamation of the certificate of inheritance.

- Proclamation of the certificate of inheritance: On the proclamation date, the certificate of inheritance is proclaimed and handed over to the heirs.

- Possibilities of objection: Objections to the issuance of the certificate of inheritance can be filed within six weeks.

- Conclusive effect: If no objections are filed against the issuance of the certificate of inheritance or the objections are unsuccessful, the certificate of inheritance becomes conclusive.

How long does a certificate of inheritance process take?

The duration of a certificate of inheritance process depends on various factors, such as the complexity of the case, the number of heirs, the availability of documents, and the workload of the competent probate court. Generally, a certificate of inheritance process takes between two and six months but can also take longer.

Here are some factors that can influence the duration of the process:

- Availability of documents: The duration of the process also depends on how quickly the needed documents, such as birth certificates or death certificates, can be obtained.

- Number of heirs: If there are several heirs, this can lead to a longer process duration, as each heir must submit the necessary documents and evidence.

- Objections: If objections to the certificate of inheritance are filed, this can prolong the process.

- Workload of the court: The workload of the competent probate court can also influence the duration of the process.

What does the probate court review in a certificate of inheritance?

As part of the certificate of inheritance process, the probate court reviews the status of the heirs and determines who qualifies as an heir of the deceased. Various legal requirements must be met before the certificate of inheritance can be issued. Here are some of the main points the probate court reviews in a certificate of inheritance process:

- Requirements under inheritance law: The probate court examines whether the applicant is eligible as an heir according to inheritance law regulations. This includes checking if the deceased left a will or if the legal order of succession applies.

- Presence of other heirs: If there are multiple potential heirs, the probate court examines whether a community of heirs exists and which shares of the estate each heir receives.

- Identity of the heirs: The probate court verifies the identity of the applicant and, if applicable, of other heirs to ensure that they are the actual heirs.

- Existence of debts: The probate court checks whether the deceased left any debts and whether they need to be settled from the estate.

- Existence of wills and inheritance contracts: The probate court verifies if there is a will or inheritance contract and whether these documents are legally valid.

What is the certificate of inheritance procedure?

The certificate of inheritance procedure is a judicial process to determine the status of heirs. Its purpose is to establish who qualifies as an heir after a person's death and what shares of the estate the individual heirs are entitled to. The certificate of inheritance is an official document that certifies who is considered the heir of the deceased and what shares of the estate the individual heirs are entitled to.

The certificate of inheritance procedure is usually applied for and carried out at the competent probate court. Various legal conditions must be met for this. For example, the applicant must be able to prove that they qualify as an heir. This involves checking if the deceased left a will or if the legal order of succession applies. The identity of the applicant and, if applicable, other heirs is also verified.

When all conditions are met and the probate court determines who qualifies as an heir, the certificate of inheritance is issued and handed over to the heirs. The certificate of inheritance carries significant probative value and serves as evidence of the applicant's status as an heir.

Who is heard in the certificate of inheritance procedure?

There is no legal requirement specifying who must be heard in the certificate of inheritance procedure. However, typically those individuals who are relevant to the heir determination are heard.

Usually, those individuals who qualify as heirs or who might possibly claim parts of the estate are heard. These could be other relatives or creditors of the deceased, for instance.

Additionally, it may be necessary to involve experts, such as appraisers, to clarify certain aspects of the procedure.

It is important to note that each case is unique, and the decision regarding who is heard is made by the competent probate court. Therefore, it is advisable to seek advice from an experienced lawyer or notary to ensure that all legal steps are correctly and lawfully carried out.

Who is allowed to close a bank account after the death?

After a person's death, a bank account can usually only be closed by a legitimate heir or an authorized representative. If the deceased left a will, the heir generally needs to apply for a certificate of inheritance to prove their heir status and to close the account. If no will exists and the legal order of succession applies, all heirs must act together to close the account.

If the deceased had granted a power of attorney during their lifetime, the authorized person can also close the account. However, the power of attorney usually expires upon the account holder's death. The authorized person is therefore only allowed to use and manage the account until the account holder's death.

What rights and obligations does the heir have after the issuance of the certificate of inheritance?

After the issuance of the certificate of inheritance, the heir has both rights and obligations in connection with the estate of the deceased. Here are some of the most important rights and obligations of the heir:

Rights:

- Access to the estate: The heir has the right to access the estate of the deceased and manage the assets that remain in the estate of the deceased.

- Ownership of estate items: The heir receives ownership of the estate items to which they are entitled according to the certificate of inheritance and can dispose of them freely.

- Payment of inheritance shares: The heir has the right to have their share of the estate paid out in the form of money or other assets.

- Community of heirs: If there are multiple heirs, they have the right to act as a community of heirs and jointly decide on the estate.

Obligations:

- Settlement of debts: The heir is obligated to settle the debts of the deceased from the estate.

- Settlement of the estate: The heir has the obligation to manage and settle the estate of the deceased, including the management of the assets, the payment of debts, and the distribution of the estate to the heirs.

- Management of the estate: The heir has the obligation to properly manage the estate of the deceased to ensure that the estate's assets are preserved and that the heirs receive their fair share.

- Tax return: The heir has the obligation to file a tax return for the estate of the deceased and, if applicable, pay inheritance taxes.

What legal regulations apply to the certificate of inheritance?

The legal rules for the issuance of the certificate of inheritance are regulated in the German Civil Code (BGB). Here are some of the most important legal rules regarding the certificate of inheritance:

- Heir status: The certificate of inheritance is only issued to persons who are entitled as heirs of the deceased.

- Application: The certificate of inheritance is issued upon application by the heir to the competent probate court.

- Application eligibility: Those eligible to apply are the heirs as well as those who have a legitimate interest in proving heir status.

- Submission of documents: Certain documents usually need to be submitted with the application, such as the applicant's ID card, proof of the existence of an inheritance right, and possibly a will.

- Procedure: The procedure for issuing the certificate of inheritance is usually a judicial process and is subject to the corresponding rules of the Code of Civil Procedure.

- Effect of the certificate of inheritance: The certificate of inheritance has a high probative value and is considered proof of the applicant's heir status.

- Contest: The certificate of inheritance can be contested if the applicant is not actually entitled to inherit or if the will on which the certificate of inheritance is based is invalid.

Who benefits from term life insurance?

A term life insurance policy can be beneficial for certain groups of people, especially for those who have financial obligations that would be unmet in the event of their death. Here are some examples:

- Families with children: If you have a family that is financially dependent on you, a term life insurance policy is a good option to ensure that your family is financially secure in the event of your death.

- Mortgage holders: If you own a house and have a mortgage, you can take out a term life insurance policy to ensure that your family is able to continue making mortgage payments in the event of your death.

- Self-employed or business owners: If you work as a self-employed person or business owner and your family depends on your income, a term life insurance policy is a good option to ensure that your business and family are financially secure in the event of your death.

- Couples without children: If you live in a partnership without children and are financially dependent on each other, a term life insurance policy can help ensure that the partner is financially secure in the event of your death.

When is a certificate of inheritance necessary and when can it be waived?

A certificate of inheritance is usually necessary when it comes to proving the status of heir, especially if the deceased did not leave a will or if the will is invalid. A certificate of inheritance is an official document that certifies who is considered the heir of the deceased and what shares of the estate the individual heirs are entitled to.

However, there are also cases in which a certificate of inheritance can be waived. Here are some examples:

- Agreement among the heirs: If all the heirs agree on who is considered the heir of the deceased and how the estate is to be divided, a certificate of inheritance can be waived.

- Small estate: If it is a small estate with low value assets, the competent probate court can waive the issuance of a certificate of inheritance.

- Existence of a will: If there is a valid will and an heir is named in it, this heir is usually recognized as the rightful heir without a certificate of inheritance.

Conclusion and advice on the inheritance certificate procedure

The inheritance certificate procedure is an important process that serves to determine the heirs of a deceased person and to certify their inheritance rights. The certificate of inheritance is an official document that proves the status of heir and gives the heir the right to manage and sell the estate of the deceased person.